1.Ford and GM have Two of the Lowest P/E’s in S&P…..TSLA +41% YTD vs. F-GM Negative…..TSLA Trading at 271x Earnings.

Ford has the fifth-lowest price/earnings ratio in the S&P 500. The absolute lowest belongs to rival General Motors, which at $34, trades for under six times projected 2017 earnings. Barron’s has written favorably on GM, including in an article earlier this year (“GM Shares Could Drive 35% Higher,” Feb. 18), when GM traded around $37.

http://www.barrons.com/articles/ford-shares-are-too-cheap-1492229293

TSLA vs. U.S. Carmakers.

www.yahoofinance.com

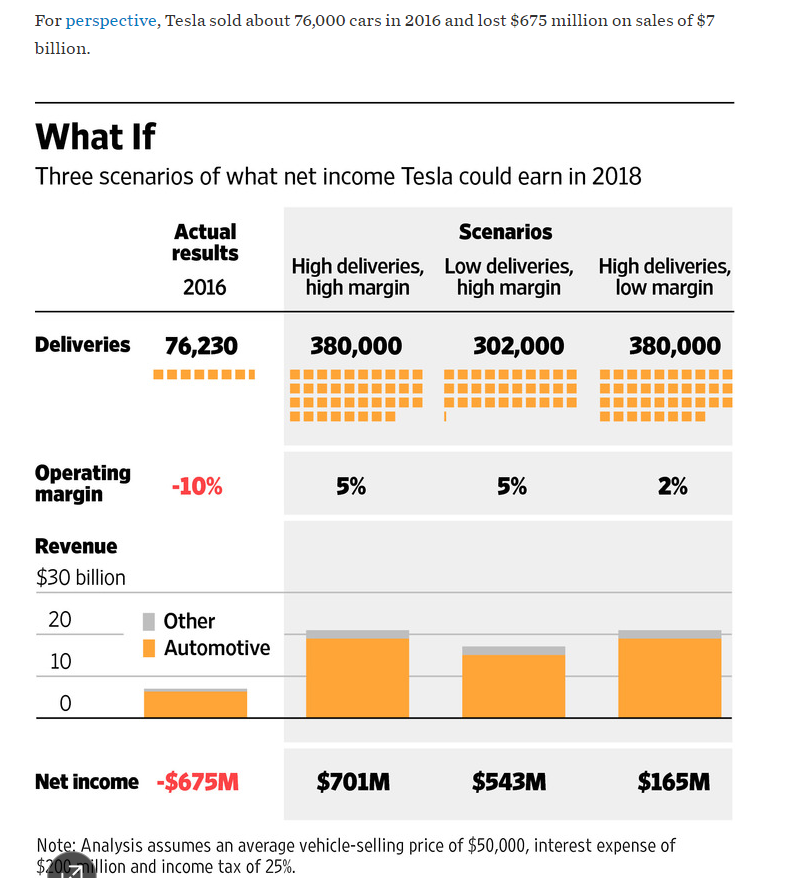

TSLA Lost $675 million in 2016

Read Full Story at WSJ

https://www.wsj.com/articles/what-is-tesla-really-worth-1492365561?tesla=y

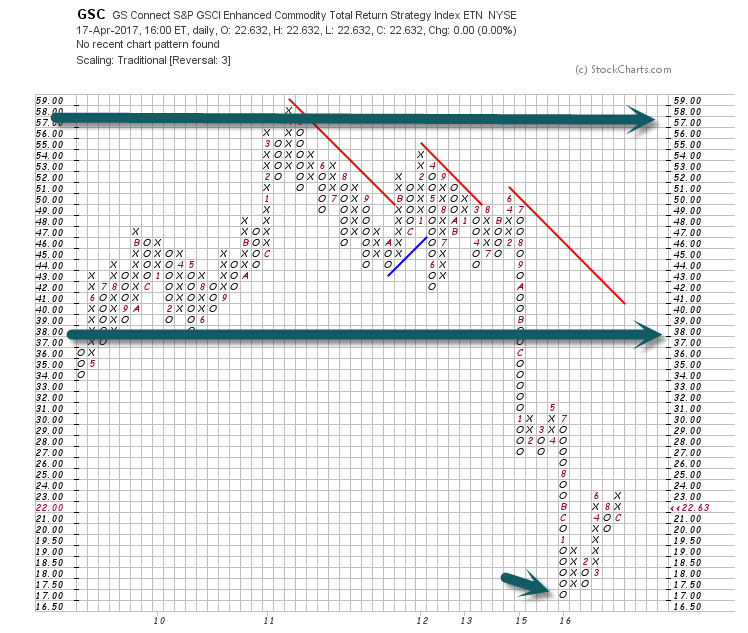

2.S&P Commodity Index -70% at Low…Bounced +28% in 2016. Asset Under Management in Commodities +41%

GSCI commodity index…Interesting real implosion happen in 2015

www.stockcharts.com

www.stockcharts.com

Commodity Investing is not for the faint of heart.

Commodities in Your Portfolio? It’s All Hogwash, Says Wall Street Dissenter

Campbell Harvey, a finance professor at Duke, is looking to upend conventional investing wisdom again

https://www.wsj.com/articles/commodities-in-your-portfolio-its-all-hogwash-says-wall-street-dissenter-1492206570?tesla=y

Academic paper by Cambell Harvey at Duke on commodity investing.

https://faculty.fuqua.duke.edu/~charvey/Research/Published_Papers/P124_Conquering_misperceptions_about.pdf

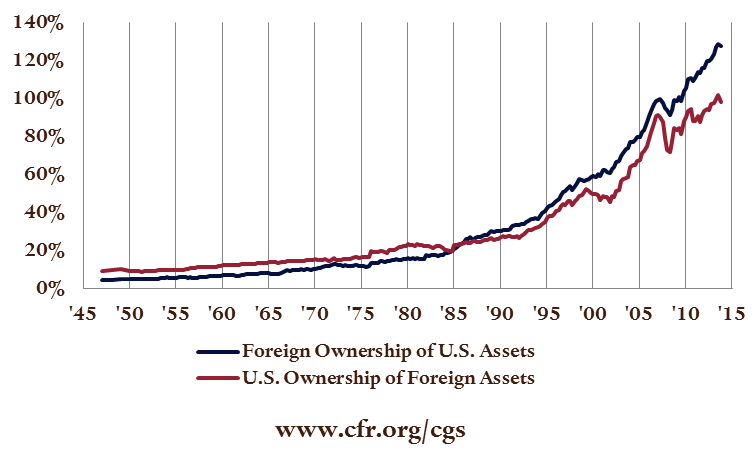

3.It’s a Global Economy, Populism or Not…..U.S. is 5% of Global Population. We have the Deepest, Most Liquid Bond Markets in World.

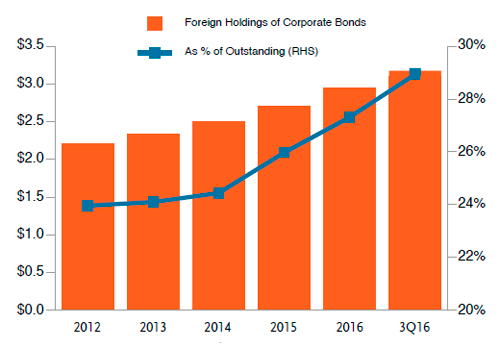

America’s need for foreign capital is equally significant. We are the world’s largest debtor nation. Borrowing money from overseas is as American as apple pie. Our foreign creditors now own roughly $6 trillion in U.S. Treasuries, $3.6 trillion in corporate bonds, and $5.7 trillion in U.S. equities.

This capital infusion helps finance the national debt, assists Americans in buying homes and autos, and supports capital investment in the private sector. It promotes growth and jobs—that’s why we do it.

http://www.barrons.com/articles/dont-give-up-on-globalization-1492231973

https://www.tcw.com/Insights/Monthly_Commentary/01-06-17_Year_End_Credit_Update

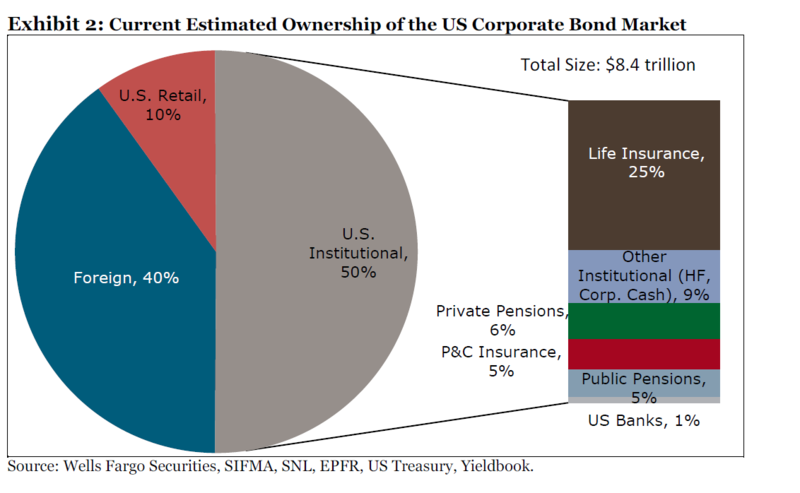

4.Interesting Breakdown of U.S. Ownership…25% Life Insurance.

https://www.bloomberg.com/news/articles/2016-08-25/there-s-basically-no-alternative-to-u-s-corporate-bonds-right-now

5.Since the Financial Crisis….FED Mortgage Backed Security Holdings went from Zero to $1.8 Trillion….Goal Now is “Treasury Only” Portfolio.

Given the Fed’s oft-stated objective to return to a “Treasuries only” portfolio in the future, the early phase of this process is likely to include a disproportionately greater amount of the $1.8 trillion of mortgage-backed securities in its portfolio that will not be reinvested or will be allowed to run off. In theory, that practice would put that asset class at a moderate disadvantage to Treasuries over the next 12 months or so. That risk would be mitigated to some degree by the continued health of the housing market over the next few quarters.

http://www.barrons.com/articles/bond-investors-dont-panic-as-fed-cuts-balance-sheet-1492229814

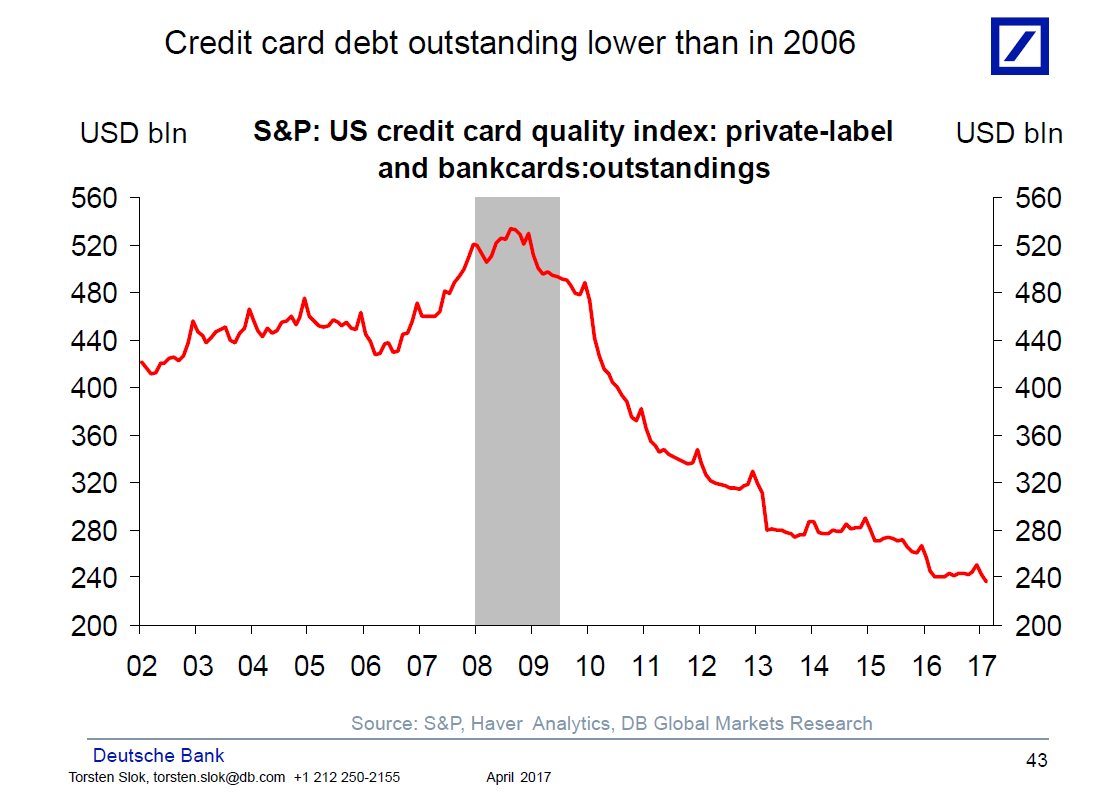

6.Hard to Believe Already But Subprime Mortgages Made Up 23.5% of Originations in 2006….Now 1.7%

Credit Card Debt Contraction Since 2006

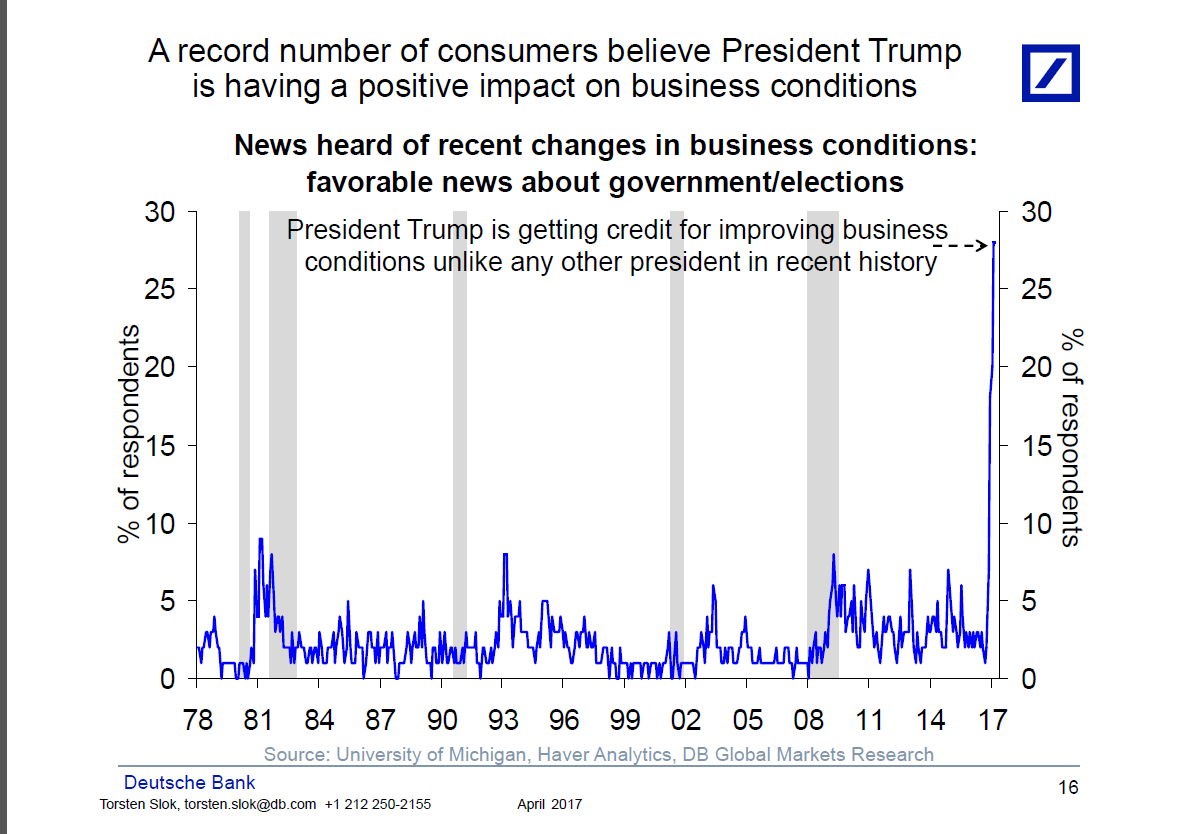

7.Check this Hockey Stick Spike from “Consumers Believing Trump will have Positive Impact on Business Conditions”

Torsten Slok Deutsche Bank has the Best Charts.

8.Vanguard is Buying $2B a Day in AAPL, MSFT and AMZN.

Vanguard Is Growing Faster Than Everybody Else Combined

By LANDON THOMAS Jr.APRIL 14, 2017

Continue reading the main storyShare This Page

A statue of the Vanguard founder, John C. Bogle, at the Vanguard headquarters in Malvern, Pa.CreditMark Makela for The New York Times

MALVERN, Pa. — The Vanguard trading floor is the epicenter of one of the great financial revolutions of modern times, yet it is a surprisingly relaxed place.

A few men and women gaze at Bloomberg terminals. There is a muted television or two and a view of verdant suburban Philadelphia. No one is barking orders to buy or sell stock. For a $4.2 trillion mutual fund giant that is still growing rapidly, it occupies a small fraction of the space of a typical Wall Street trading hub.

You can barely hear the quiet hum of money being invested — money in scarcely imaginable quantities, pouring into low-cost index mutual funds and exchange-traded funds (E.T.F.s) that track financial markets.

In the last three calendar years, investors sank $823 billion into Vanguard funds, the company says. The scale of that inflow becomes clear when it is compared with the rest of the mutual fund industry — more than 4,000 firms in total. All of them combined took in just a net $97 billion during that period, Morningstar data shows. Vanguard, in other words, scooped up about 8.5 times as much money as all of its competitors.

“Flows of this magnitude into one company are unprecedented,” said Alina Lamy, an expert on fund flows at Morningstar. “Since the crisis, investors have been saying, ‘I may not be able to control the market, but I can control how much I pay in mutual fund expenses.’ And when they look for quality funds with low fees, the first answer is Vanguard.”

The triumph of index fund investing means Vanguard’s traders funnel as much as $2 billion a day into stocks like Apple, Microsoft and Amazon, as well as thousands of smaller companies that the firm’s fleet of funds track. That is 20 times the amount that Vanguard was investing on a daily basis in 2009. It is manageable, in large part, because no stock-picking is involved: The money simply flows into index funds and E.T.F.s, and through February of this year, nine out of every 10 dollars invested in a United States mutual fund or E.T.F. was absorbed by Vanguard.

By any measure, these are staggering figures. Vanguard’s assets under management have skyrocketed to $4.2 trillion from $1 trillion seven years ago, according to the company. About $3 trillion of this is invested in passive index-based strategies, with the rest in funds that rely on an active approach to picking stocks and bonds.

More broadly, this deluge of money abandoning higher-price actively managed funds for Vanguard’s plain vanilla cut-rate vehicles has come as an existential shock to a mutual industry that has long been resistant to change.

What is being called the Vanguard effect was felt last month when the indexing giant’s rival, BlackRock, announced that it would revamp its stock-picking operations, promoting instead a process that relies more on computer-driven methodologies.

The effect within Vanguard has been no less profound. For decades, the firm has made the case that cheaper index funds will, over time, outperform more-expensive mutual funds that rely on brainy portfolio managers to pick stocks.

The main advocate of this doctrine was the founder, John C. Bogle, who retired in 1999 but runs a research operation on the Vanguard campus. For years, the firm has relied more on his simple message and the passion of his devotees than on fancy advertising campaigns to spread the word.

Read full story

9.Read of the Day…One Man’s Opinion on the Index Craze.

Is the Passive Indexing Craze the New Tulip Bulb Mania?

The rise of passive indexing plus the Fed’s monetary policies show all the signs of a bubble.

Don Schreiber Jr | Apr 17, 2017

The intense focus on passive versus active is setting investors up for another “tulip bulb” market mania event that could destroy more investor wealth and capital than the Financial Crisis.

To keep up with the constant feedback loop created by the news cycle, the mainstream media has reduced the concept of active investing to outperforming an index by the minute, hour, day, week, month, quarter, year and longer periods. They tout studies that show most managers don’t outperform passive indexes all the time, helping to drive investors to the conclusion they should only invest in passive, low-cost index products. The trend is well-confirmed with capital flows from active to passive, which is accelerating as the bull market has extended for years.

Active managers who benchmark against an index will typically have a goal of outperforming the benchmark over long periods of time, but beating an index over every conceivable time window is impossible and not a sustainable strategy. Some managers

focus on outperforming an index on a risk-adjusted return basis, while others are index agnostic with the goal to actively manage risk to capital to improve capital performance with the lowest risk possible over an investor’s lifetime. This more complex backdrop of active product goals does not neatly fit into the current active versus passive storyboard, so it is rarely discussed, but it is worth noting for the advisor community.

The Lurking Danger in Passive Indexing

Passive indexes generally outperform active during bull markets and especially when volatility is low and markets drift higher, as they have since 2009. The current bull market recovery has been supported by Fed monetary policy and has been carefully managed to create “Wealth Effect” spending by consumers. To promote spending, the Fed has intentionally created asset bubbles and managed markets to keep volatility low and asset prices high.

Naturally, passive products look good as markets move higher. They’re designed to replicate an index and, therefore, have a symmetrical return profile. Unfortunately, the same symmetry that investors like so much on the way up is what causes the most financial harm on the way down. In bear markets, passive products can fall just as much as the index, often as much as 50 percent or more, as we saw in 2000 and 2008. It’s time for investors and their advisors to pause long enough to remember those catastrophic losses.

Investors Beware of Increased Liquity-Trap Risk

We think the main reason for a potential liquidity trap is because access to financial information has been democratized over the last several years. The internet has allowed financial information and data to be instantly disseminated to retail investors. In turn, this has synchronized investor behavioral biases making markets more susceptible to major shifts in investor psychology. When investors down-shift — from the excessive optimism that exists now — to pessimism, the ensuing move to sell overpriced assets may cause another liquidity trap event. The concentration in passive index products points to the possibility that future bear market cycles will be faster developing, deeper and more damaging than previous cycles.

The Fed Has Become a Serious Risk Factor to the Bull Market

The Fed has a long history of raising rates too much and at the wrong time, and their most recent move is a classic policy misstep. The economy was growing at a 2.6 percent rate in 2015 when the Fed hiked them by 0.25 percent. They rationalized the hike by thinking the economy could handle a small rate increase after holding rates near zero for seven years. Unfortunately, the hike caused GDP to slow appreciably to 1.6 percent in 2016. 3 Still, under intense pressure to normalize, the Fed decided to increase rates again by another 0.25 percent in December of 2016. This time the hike was justified by the Fed, eyeing full employment statistics and a small uptick in wages.

Typically, it takes about six months for the Fed to see the full effects of a rate hike, so it was shocking to see them hike again in March. Let’s look at the facts surrounding the initial rate hikes:

· The economy is still weak and has posted the slowest growth rate in history during this recovery.

· The 2015 rate hike caused the economy to slow by 38 percent from 2.6 percent in 2015, to 1.6 percent in 2016.

· The economy is projected to slow again in 2017 with Q1 forecasts at just 1 percent GDP growth, and this is before the effects of the rate hikes have worked their way into the system

This is why it is so inconceivable that the Fed would put continued economic growth in jeopardy by hiking twice in three months. We see their shift in policy to be a major short-term risk factor to the current bull market trend. These rate hikes could torpedo the markets before the much-needed pro-growth policies get the chance to develop.

Is It Time to Hedge Your Fully Invested Bets?

Recently, we have become much more positive on the potential for the aging bull market to get a second wind because of the pro-growth tax and fiscal policy promised by the new administration. When you combine optimism and capital flows with positive earnings and revenue trends, it’s easy to be constructive in equity markets. But with consecutive Fed rate hikes and the potential for more increases in the future, a prudent investor needs to start hedging their bets.

We fear the dangerous combination of simplifying the active versus passive debate and an elongated bull market is creating one of the most crowded trades in history. And unfortunately, when markets finally correct, we believe the index trade will unwind causing investors to run for the exits. The resulting melee could cause another liquidity crisis even more severe than the 2008 Financial Crisis, which is why it’s imperative that advisors take a deep long look at their clients’ portfolio… before it’s too late.

Don Schreiber Jr. is Founder, CEO and co-portfolio manager at WBI Investments.

http://www.wealthmanagement.com/etfs/passive-indexing-craze-new-tulip-bulb-mania?NL=WM-27&Issue=WM-27_20170418_WM-27_351&sfvc4enews=42&cl=article_1_2&utm_rid=CPG09000007333628&utm_campaign=9161&utm_medium=email&elq2=8d021e99d7444dc78758aed3694d372c

10.Less Is More: 4 Things to Do When You Are Overwhelmed

POSTED ON MARCH 19, 2017 BY ARINA KATRYCHEVA | CATEGORIES: PRODUCTIVITY TIPS, SELF IMPROVEMENT

Nearly everyone complains about having too much to do at work nowadays. The reasons may vary from ambitions and overcommitting to just being unable to say no to extra work. However, the result is always the same: you end up at risk of not managing to do everything you had planned.

Experts say that overworking is not sustainable in the long term for both the employer and the employee: its consequences range from simple tiredness to exhaustion and emotional burnout. So, what can be done if you feel overworked?

Talk to your boss about your overwork

Easier said than done: none of us want to be considered a “no” person or “not a team player”. That’s why talking to a boss and admitting that the workload is too heavy is difficult even for the most hard-working employees.

However, if you are overwhelmed, it’s best to let your manager know: it doesn’t mean that you are lazy or uncommitted. A reasonable manager would appreciate your honesty and ability to adequately assess your personal resources. Being honest and giving a heads-up as early as possible is essential for achieving the desired changes.

A good way to let your boss know that you have too much on your plate is to come to them with actual solutions. Suggesting ways to optimize the workflow or redistribute workload shows initiative and responsibility. Speaking up when you feel you’re not handling the workload well is not about being lazy and difficult to work with. It’s about preventing your team from missing important deadlines and goals.

Focus on small tasks

A thousand mile journey begins with a single step. If there’s no way to reduce the workload and you’re feeling anxious about it, it might be a good idea not to concentrate on the big picture. Instead, focus on what’s right in front of you, doing work in chunks of smaller tasks – and your anxiety will gradually fade

When you’re not confident in your abilities, start anyway. Our negative thoughts are our worst enemy: they keep us from achieving more and contribute to our lack of confidence. Learn to ignore them and just get to work.

Learn to say no to extra work

No matter how hard-working we think we are, taking on every task available doesn’t mean being successful. Quite the opposite, in fact. And sometimes saying no is just as vital for the long-term progress of both your team and yourself. As questionable as it may sound, doing more does not always equal working better. Go ahead and ask yourself which one makes you feel better: accomplishing fewer tasks, but doing it really well, or wading through a massive list of assignments and ending up with below average results?

Don’t be a perfectionist. Many of us tend to judge ourselves too harshly, but perfectionism and our attempts to be as good as we “should” be only served to work against us, leading to negative thoughts, low self-esteem, and disappointment. You can be good enough without the extra work and being always busy.

And sure, sometimes overworking can feel rewarding. When we have a lot to do, we feel we’re needed, irreplaceable, in demand. However, the usual result is stress and exhaustion. To prevent this, we need to learn to evaluate our capacity and know exactly how much work we can handle.

Manage your tasks efficiently

When you find yourself feeling overwhelmed often, taking a look at what takes up most of your work time can be extremely valuable. One of the most efficient ways to do that is to visualize your tasks and record the time that you spend on them. And timesheet software can help you do that. See where your time goes, analyze the big picture, and see where you can (and should) improve.

Normally, a quick glance at the results of your time-track is enough to tell what work assignments consume most of your time. Think on the ways to increase your efficiency at work. Seek support from your team: think of delegating part of your work to your colleagues or redistributing it. Optimize your work process so that routine actions take less time, and set priorities so that the most important to-dos get done first.

Summary

Saying no to extra work and delegating part of your current responsibilities to your colleagues doesn’t paint you as not committed or unproductive. Remember: more input doesn’t necessarily mean more output. And if you do have a lot of work to do and it makes you feel anxious, just start anyway. Taking that first step will help you go the entire distance.