1.Tranports…..CSX Big Day After Earnings.

Dow Jones Railroad Index 60% Rally off 2016 lows…50 day thru 200 day to upside on big volume. Not Recession like chart???

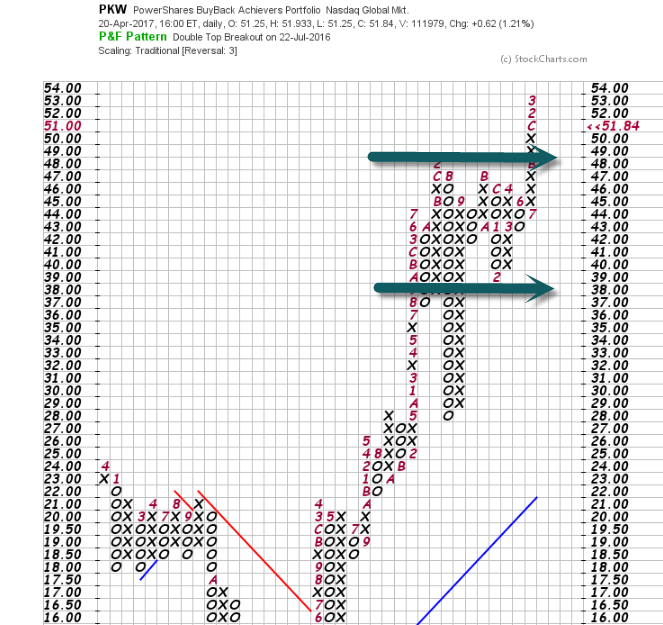

2.PKW-Buyback ETF…Buybacks Fuel for the Market—Consolidated then Rally to New High Again.

PKW ETF Chart.

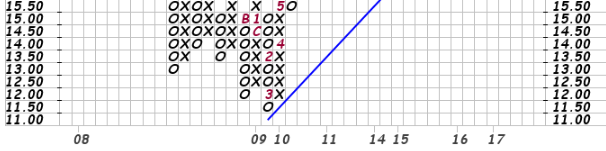

3.ETFs 25% Annual Growth Rate Since 2001—Now an ETF to Track ETFs.

The ETF Industry Exposure & Financial Services ETF (NYSE Arca: TETF), will begin trading today, April 20, 2017, providing investors with a single point of access to the companies driving and participating in the growth of the Exchange Traded Funds industry.

TETF will seek to track, before fees and expenses, the price and yield performance of the Toroso ETF Industry Index (the Index), which is designed to provide exposure to the publicly traded companies that derive revenue from the ETF industry. This includes ETF sponsors, index and data companies, trading and custody providers, liquidity providers, and exchanges.

ETFs and the industry have experienced significant growth over the past five years, as their assets have grown in the U.S. from $1.2 trillion to $2.7 trillion; the number of U.S. ETF sponsors has increased from 45 to 78; and the average ownership of U.S. equities by ETFs has more than tripled. 1

The Index, maintained by Solactive AG, is designed with four tiers of constituents:

- Tier 1, 50% of the Index’s exposure, is made up of companies with substantial participation in the ETF industry, providing direct financial impact to shareholders, including BlackRock, Charles Schwab, Invesco, State Street, WisdomTree, and more.

- Tier 2, 25% of the index’s exposure, is made up of companies with substantial participation in the ETF industry, providing indirect financial impact to shareholders, including KCG Holdings, NASDAQ, Intercontinental Exchange, Inc., and more.

- Tier 3, 15% of the Index’s exposure, is made up of those companies with moderate levels of participation in industry, including Bank of New York Mellon, US Bancorp, FactSet, Ameriprise Financial, and more.

- Tier 4, approximately 10% of the Index’s exposure, includes companies that are new or participating in a smaller way in the ETF industry relative to their overall focus, and includes such names as Morningstar, Eaton Vance, Goldman Sachs, Legg Mason, Citigroup, and more.

http://finance.yahoo.com/news/etf-industry-exposure-financial-services-130000910.html

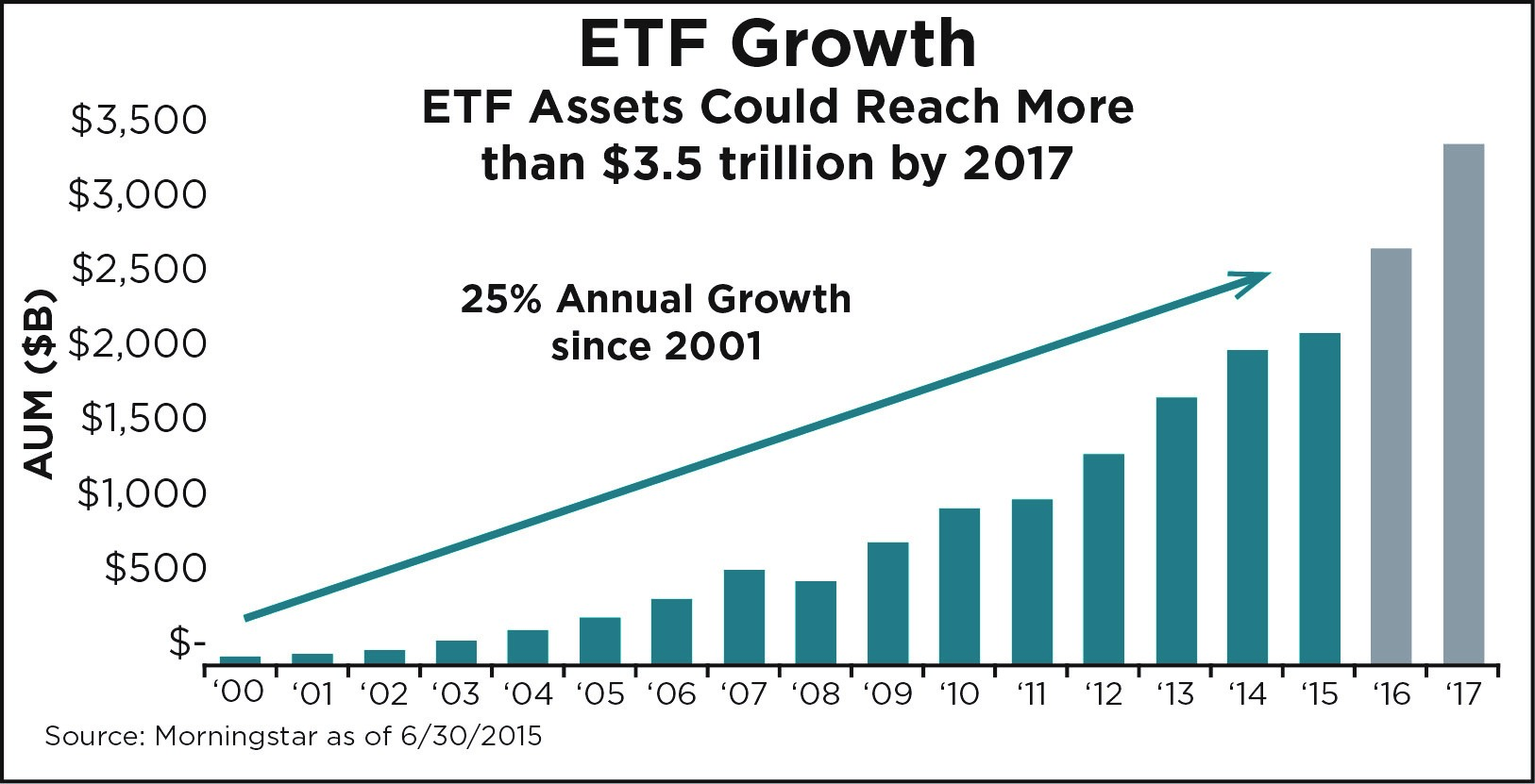

4.The Slowdown in Bank Lending Continues.

Less of an afterthought was a recent Wall Street Journal piece on business lending slowing — and how no one seems to know why. To quote that directly, “One of the great mysteries and biggest concerns is the slowing growth of bank lending.” Amongst the reasons they cited was 1) corporations issuing debt in the bond market at low rates to 2) pay down more expensive bank debt. Energy companies are specifically cited here, but that doesn’t explain the full dollar amount. There has been slowing in other lending such as mortgages, consumer loan and real estate, and, naturally, political uncertainty enters the fray.

5.More Good Economic News from Europe….We saw big money flows to Euro stock markets in my piece yesterday….Still below 2015 highs.

Business activity in the eurozone hit a fresh six-year high in April, with the bloc’s flash composite PMI coming in at 56.7, compared to 56.4 in March. “France’s elections pose the highest near-term risk to the outlook, but in the lead-up to the vote the business mood has clearly been buoyant,” said Chris Williamson, chief business economist at IHS Markit. www.seekingalpha.com

Europe ETF….Stilll Below 2015 Highs…..50day still trading below 200day

Europe’s Leader-Germany Rallied Right to 2015 High now Paused.

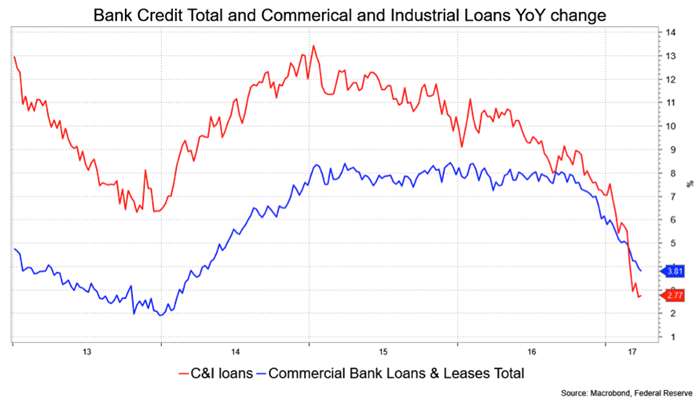

6.Bonds and Duration Risks

Opinion: Bonds now are more dangerous than you think

Investors are getting paid less to shoulder more interest-rate risk

Images/iStockphoto

By

JOHNCOUMARIANOS

Nobody buys bonds to get rich. You buy bonds to provide ballast against the volatile elements of your portfolio — like stocks. Traditionally this has meant sticking mostly to government and high quality corporate bonds — some boring but stable combination that tracks a benchmark index.

The problem is that according to a recent paper by Boston asset manager Grantham, Mayo, van Oterloo (GMO), the main Bloomberg Barclays U.S. Aggregate Index — and bond funds that track it — is riskier than it has been in a long time. That’s because bonds (essentially loans) have another risk separate from credit risk or the financial health of the borrower. That separate risk is duration or interest-rate risk. Measured in years, duration has to do with when bond holders or lender ultimately get their money back, and it tells a bondholder or a bond mutual fund owner how much their portfolio will fluctuate. A bond or a bond fund with a duration of five years, for example, will drop 5% if interest rates go up 1 percentage point.

Bonds that pay a high interest-rate suffer less in a rising-rate climate, because the bondholders (lenders) are getting more money back sooner,(with the ability to invest it at a higher rate, if rates rise. And this is the problem with the main bond index right now. Yields are so low that the index has greater duration, or interest-rate risk, now than ever before. That means rising rates will inflict more price declines on investors than they did in the past.

Professor Richard Thaler, an expert in behavioral economics, talked to MarketWatch about his ‘lazy’ investing strategy that allows investors to maximize their returns while doing very little.

According to GMO, the index sported a yield of more than 5% in 2008. Now it yields barely over 3%. That’s a big drop in yield and a correspondingly big increase in duration or interest rate risk. Duration has gone from around 3.5 years in 2008 to more than 5.5 years now.

If we compare yield to duration as a means of estimating what an investor is getting paid in relation to the duration risk an investor is taking, we see the metric was around 1.6 in 2008 — a 5.5% yield relative to a 3.5 year duration. Now, using data from the iShares Core U.S. Aggregate Bond ETF AGG, -0.16% , the yield-to-duration statistic is more like 0.42. Yield has plunged to 2.67%, and duration has grown to 5.67 years. That means bond investors are getting paid less for taking on more interest-rate risk.

| 2008 | 2017 | |

| Yield | 5.50% | 2.37% |

| Duration | 3.5 Years | 5.67 Years |

| Yield-to-Duration | 1.57 | 0.42 |

Source: GMO and iShares

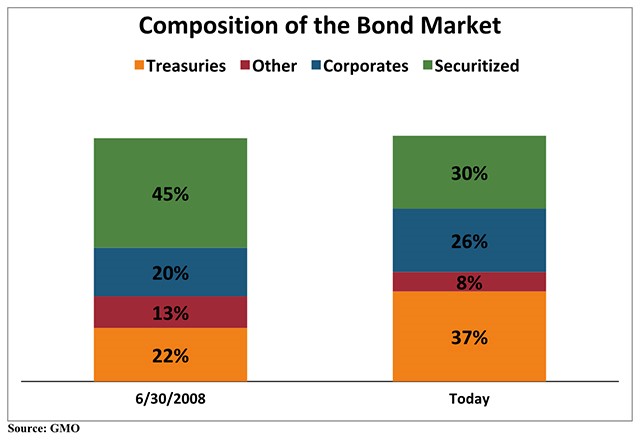

Besides the fact that yields are down and duration is up across the bond spectrum, more of the index is now composed of Treasurys, which always yield less than other bonds, owing to their safety. While Treasurys accounted for 22% of the benchmark bond index in the middle of 2008, they account for 37% of the index now.

Source: GMO

Investors uncomfortable with their bond portfolio’s duration can always opt for shorter-term bond funds. If you’re still in savings or accumulation mode, consider putting new money in some shorter-term funds. If you’re in retirement, consider moving some money into funds with lower duration. But understand that you might also lower your yield by doing so. Short-term bonds have lower durations but also lower yields. You can compensate for that by accepting more credit risk, but that comes with its problems too.

Overall, prepare for the fact that the shock-absorbing characteristic of your bonds may be compromised. Investors might just have to accept more volatile portfolios at this juncture.

http://www.marketwatch.com/story/bonds-now-are-more-dangerous-than-you-think-2017-04-21

7.Hardiness and Grit

Why are some people successful in achieving their goals in life?

Posted Apr 20, 2017

As a psychotherapist and researcher, I have long been interested in understanding why some people seem to be successful in achieving their goals in life and others struggle or fail. Why, for example, do some people who seem to be intelligent and talented not accomplish as much as others who appear to be less intelligent and/or minimally talented?

Source: El Nariz/Shutterstock

My doctoral dissertation was a research study of social work clinicians who had decided to become administrators in addition to or instead of continuing only as direct service providers of mental health services. In the course of my work I discovered the concept of the “hardy personality” (“hardiness”) which was developed by Suzanne C. Kobasa and Salvadore Maddi. They described this personality as demonstrating three essential components: commitment, control, and challenge.

Commitment refers to one’s ability to believe in the truth, importance, and interest value of who one is and what one is doing which results in a tendency to involve oneself fully in the many aspects of life, including work, family, and interpersonal relationships.

Control refers to the propensity to believe and act as if one can influence the course of events in his/her life. It involves the possession of a coping repertoire that enables such people to act effectively on their own and interpret and incorporate various life experiences, transforming these into something manageable and beneficial.

Challenge is based on the belief that change, rather than sameness or predictability, is the norm. These are people more likely to thrive under the circumstances of a new challenge or opportunity brought about by a new endeavor.

The clinician-turned-administrators in my study who scored high on the hardiness measures tended to have much more successful and less stressful transitions than those who were less “hardy.” My research investigated the various attributes and positive personality characteristics that promoted the more successful transitions. These included a record of high achievement, success, and professional advancement. High self-esteem, enjoying a challenge, being a risk-taker, being entrepreneurial, and being motivated and ambitious were listed as well.

Many successful transition-makers reported that they were not afraid to make mistakes, had good people skills, and tended not to be passive in their personal and professional lives. Hardy people are those who turn stressful life experiences into opportunities for personal and professional growth. The seek and value change, rather than finding ways to avoid it. They believe that change, rather than sameness or predictability, is the norm. The hardy person is also characterized by such qualities as resourcefulness, innovativeness, creativity, and as someone who can emerge victorious under conditions of stress and uncertainty.

In her book Grit: The Power of Passion and Perseverance, author Angela Duckworth identifies a psychological trait she calls grit. The combination of passion, having an enduring interest in the job one is doing, and perseverance, being persistent and never giving up, are the two components that, in her view, help us better understand the psychology of achievement. She believes we have a tendency to overemphasize talent or natural ability and underemphasize the importance of zeal, determination, and motivation. We also tend to see intelligence as key in explaining success and achievement, which while true to some extent, is far from the only factor involved. She has studied why some individuals accomplish more than others who are of equal intelligence, and discovered that grit, unlike many traditional measures of performance, is not tied to intelligence and may explain why some very intelligent individuals do not consistently perform well over long periods.

Duckworth discussed the four psychological assets that gritty people have in common. These are interest, practice, purpose, and hope.

By interest she means that one must be passionate about something that interests them the most. The grittiest people have something they love to do.

Practice requires them to do things that interest them better than they did yesterday. They must be ready to improve on their skills, regardless of how excellent they currently perform. Challenging themselves to an exercise that exceeds their skill level leads to mastery.

Without purpose, one may not be able to carry on their interest for a long time. Hence it is essential to identify how their work is connected to their own well-being as well as the wellbeing of others.

Hope helps us see our ultimate concern through to the end. Grit loses when we are unable to get back up after a setback. But when we get back up, it prevails.

As can be seen, these concepts are both different and similar in certain ways. Both tend to value the importance of commitment and the positive management of challenges. They both address the issue that these traits are not necessarily inborn and can be developed under the right conditions. These researchers are also in agreement that the performance of certain behaviors can have a fundamental impact on an individual’s level of success. How then, if one is not particularly “hardy” or does not seem to go about accomplishing their goals with the qualities associated with “grit,” is it possible to become “hardier” and “grittier?”

Kobasa and Maddi believe that hardiness can be developed over time by emphasizing the need to help people develop better ways of coping with stress as well as helping them not to generate stress however possible. They both believe that the development of hardiness can be strengthened by child-rearing practices designed to help children see themselves and the world as interesting, worthwhile, and satisfying, thus preventing them from viewing themselves and the world as dull, meaningless, and frustrating. This difference may well result from the overall degree to which the interactions they had with their parents were supportive, facilitating satisfaction, and providing encouragement and acceptance.

Counseling for hardiness is the other way that the characteristics of commitment, control, and challenge can be learned and instilled, assuming that the unproductive behaviors of a “non-hardy” past can be broken. Cognitive-based therapies may be central in helping people become hardier, but it is a complex undertaking that requires a good deal of time and effort to achieve in a durable way. One might argue that any therapy has as an implicit objective to help the individual acquire the characteristics associated with hardiness as discussed above.

What about helping people to become “grittier?” Researcher Carol Dweck suggests that all of us possess either a fixed or a growth mindset. People with a growth mindset believe that they can improve their grades, learn new skills, and achieve their goals in general if they try hard enough. People with a fixed mindset do not think that they have the ability to improve and, as a result, are more inclined to give up whatever they are trying to accomplish when they face difficulty and get frustrated. This is consistent with our general understanding of the differences between optimists, who handle life’s challenges very differently than pessimists, who tend to be less happy, less accomplished, and suffer more.

Like the developers of ‘hardiness,’ Duckworth emphasizes the importance of child-rearing practices designed to foster interest, purpose, and hope in children that will support the likelihood of them becoming adults who will have a greater capacity to persevere and develop passion, i.e. become ‘grittier.’ Strong parental role models who demonstrate the characteristics associated with grit are vitally important to the developing child who will emulate his parents.

Here, too, any counseling or psychotherapy strives to help people acquire or strengthen ‘hardy’ or ‘gritty’ qualities. A focus on being better able to cope with stress, develop greater resilience, have a positive outlook, and develop or strengthen already existing qualities like passion and perseverance are most helpful in this effort.

One of the things I emphasize in my work with patients is to help develop the belief that one can learn to handle most of the difficult challenges and stressors that occur in everyday life. This includes coping with failure and doing whatever is possible to achieve success in its place. Working with this focus often shifts a person’s point of view about what might be possible for them which increases optimism and, therefore, the motivation to work toward change and achieve their therapeutic goals.

https://www.psychologytoday.com/blog/moments-matter/201704/hardiness-and-grit