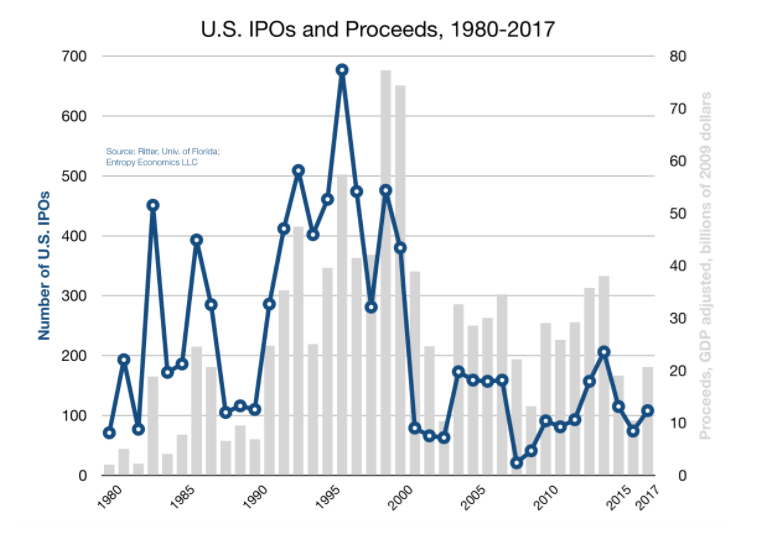

1.Dwindling Public Stock….In the Past 20 Years, U.S. Companies Purchased Back $3.6 Trillion More Than They Offered

Over the past two decades, U.S. companies bought back vastly more stock than they issued. On net, according to a new paper by Craig Doidge and colleagues, companies purchased $3.6 trillion more stock than they offered. Stock buybacks are a perfectly appropriate way to return value to shareholders, but the disparity is still surprising.

https://www.uschamberfoundation.org/blog/post/are-capital-markets-healthy-some-thoughts-corporate-concentration-and-dwindling-public

Found at Abnormal Returns Blog www.abnormalreturns.com