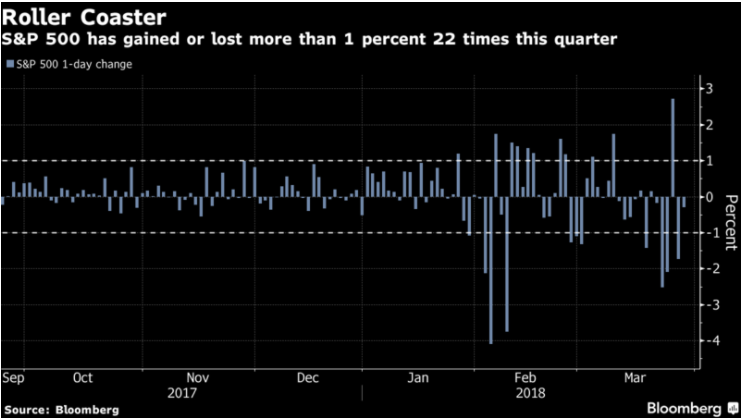

1.Slight Volatility Change 2018 vs. 2017…..S&P 22 1% Moves in First Quarter.

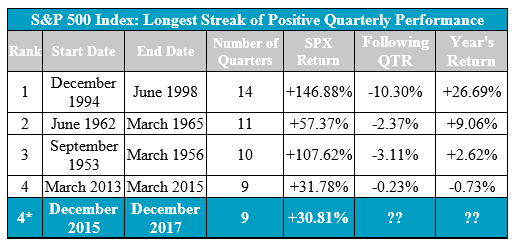

2.First Qt. Marks The First Time in 9 Quarters the S&P Index Finished Down…History of Streak Below

The first quarter of 2018 will mark first time in nine quarters the S&P 500 Index SPX will post a negative return. The SPX finished Q1 with a return of -1.22%. The streak of nine consecutive quarters began back in December 2015 and ended as we closed out 2017. Over that time frame the SPX was able to gain 30.81%. Looking back in history we can see this run ties the fourth longest quarterly streak in history from March 2013 to March 2015. During that time the SPX posted a similar return of +31.78%. The record from December 1994 to June 1998 remains in tact with 14 consecutive positive quarters, which was also the greatest return period for the SPX, up 146.88%. The other two instances were from June 1962 to March 1965 at 11 consecutive quarters and the stint from September 1953 to March 1956 at 10 consecutive quarters. Both of those times were able to produce strong performance numbers as well at 57.37% and 107.62% respectively. Use the table below as a reference point.

https://oxlive.dorseywright.com/research/bigwire

From Nasdaq Dorsey Wright

3.Can Investors Make Money in a U.S.-China Trade War?

Bernstein Blog

Shifting Trade Relationships

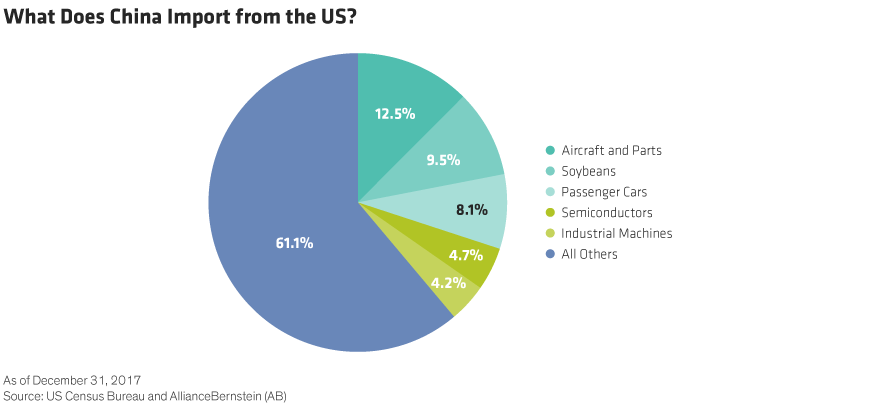

New trade barriers could spur a shift in traditional trading relationships. China would be likely to rethink its trade alliances in the region and get closer to partners in Southeast Asia, Latin America and the European Union (EU). In particular, China would seek new sources for products that it currently imports heavily from the US. Examples include aircraft and parts; pork, which is in plentiful supply across parts of Latin America and Asia; and soybeans (Display).

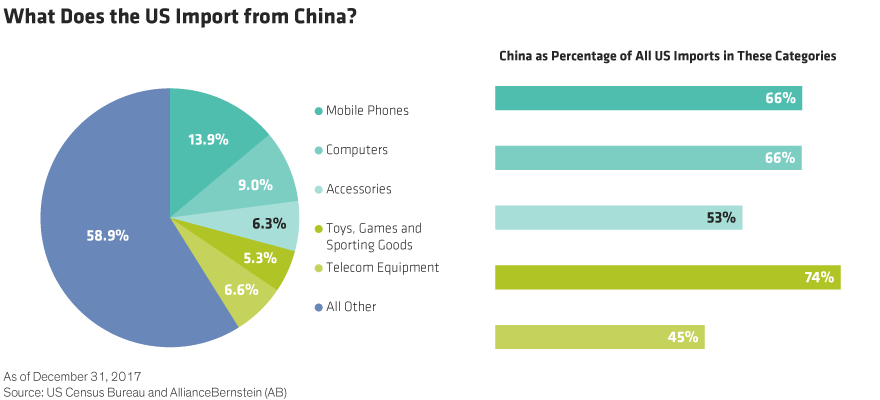

The US imports a wide variety of products from China (Display). A dramatic shift in the trading relationship would have the potential to redraw the supply chains that have become the backbone of the global technology industry—and vital for US manufacturers. For example, consider Apple’s manufacturing of the iPhone in China. Many components are produced in China by South Korean and Taiwanese companies, which could transport their operations elsewhere in the region.

https://blog.alliancebernstein.com/library/can-investors-make-money-in-a-us-china-trade-war?seg=66

4.Pot ETF 25% Off Highs.

Barrons Story on Pot Stock High Valuations.

Still, the price of Canada’s marijuana stocks might trigger vertigo. These companies trade for more than 100 times their 2017 sales, and several hundred times that year’s cash flows. Some have market values that are larger than estimated sales for Canada’s entire recreational

If Canada’s retail market can reach $9 billion in annual sales in a few years—as one bull estimates it will—that would yield only a couple of billion dollars in cash flow to wholesale producers like Canopy. So today’s investors are effectively paying 15 times the industry’s cash flow five years from now, a generous multiple. Moreover, there’s reason to believe these revenue forecasts are overly optimistic.

Most predictions fail to consider the dizzying price drops registered in states like Colorado and Washington after they legalized marijuana. In both states, supply gluts have pushed cannabis prices down more than 10% in each of the past two years.

Barrons Story-Marijuana Stocks Could Be a Buzzkill

By

Bill Alpert

https://www.barrons.com/articles/canada-pioneers-new-industry-in-marijuana-1522421400

MJ-American ETF -25% Off Highs

5.Homebuilders Trailing S&P On Sell Off. Will there be a Millenial Housing Bull?

XHB Homebuilder ETF -8% vs. S&P -2%

Homebuilder ETF Correction Territory….12% Off Highs.

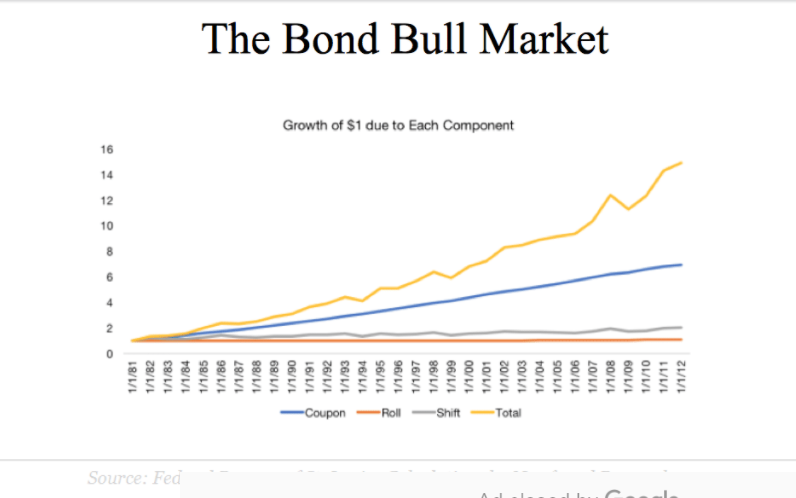

6.Even in Massive 35 Year Bond Bull Market Most of the Gains Come from the Coupon.

Yes, in a rising rate environment there would be a decline of principal for bond investors at first, but the higher yields on offer ultimately swamp that initial decline. In fact, when you look back at the source of investor returns in bonds since the inception of the bull market (early 1980’s), it turns out that almost all of the return came from the coupon or yield – and very little actually came from capital gains (bonds rising in price).

We threw in this slide via the St. Louis Fed and our friend Corey Hoffstein to illustrate the point:

Josh Brown Reformed Broker http://thereformedbroker.com/2018/03/29/you-oughta-know/

7.Entire Crypto Market Valuation Dropped $100 Billion Last Week….Regulation and a Futures Market to Short Changed Crypto Forever.

Bitcoin Drops From $7,900 to $6,600 as Cryptocurrency Market Takes a Beating

The valuation of the entire cryptocurrency market has declined to $253 billion, down $100 billion over the past week. The price of most major cryptocurrencies including bitcoin, Ethereum, Ripple, and Bitcoin Cash dropped by more than 13 percent throughout March 30.

Slump Continues

Over the past 24 hours, the price of bitcoin dropped from $7,900 to $6,600, recording a 12.6 percent decline in value. Ethereum, Ripple, and Bitcoin Cash all declined by more than 12 percent, as the market lost over $40 billion within a two-day span.

Both bitcoin and the cryptocurrency market have not seen these levels since early February, when the price of bitcoin dipped to $6,000. After reaching its bottom at $6,000, the price of bitcoin spiked to $12,000, reaching $14,000 in regions with substantial premiums, including South Korea and Hong Kong.

Although bitcoin has shown some resistance at the $6,600 mark, it has also demonstrated minimal signs of recovery. Volumes on most exchanges including Binance, Bitfinex, Bithumb, Bitflyer, and Upbit remain relatively low, but the volumes on futures markets are intensifying, as CCN previously reported.

Several analysts including Wall Street-based Fundstrat’s Tom Lee have stated that bitcoin is still on track to end the year at $20,000, especially if the market can initiate a mid-term recovery within the upcoming months.

Abra CEO Bill Barhydt stated that while the demand towards the cryptocurrency market has been non-existent from institutional investors and retailer traders in the west, that certainly has not been the case in Asia.

“There really is zero large-scale institutional money from the west in crypto right now. That is happening in Japan. Once a large sizable chunk of Western institutional money starts to come in — watch out,” said Barhydt.

Given the lack of volumes, it is likely that the cryptocurrency market could continue to fall in the next few days. However, if bitcoin fails to sustain its volumes and the price of the most dominant cryptocurrency in the market falls below the $6,000 mark, it could lead the market to another bear cycle.

Where Does the Market Go From Here?

Barhydt stated that hedge funds, institutional investors, and investment firms are still actively looking into the cryptocurrency market, and exploring ways to enter the market. He emphasized that hedge funds will likely see a window of opportunity to enter into the cryptocurrency market when the market stabilizes and extreme volatility of bitcoin and other major digital currencies subside.

“I talk to hedge funds, high net worth individuals, even commodity speculators. They look at the volatility in the crypto markets and they see it as a huge opportunity. Once that happens, all hell will break loose. Once the floodgates are opened, they’re opened.”

Featured image from Shutterstock.

https://www.ccn.com/bitcoin-drops-from-7900-to-6600-as-cryptocurrency-market-takes-a-beating/

From Techie 8 Daily Email techie8@techieinsights.com

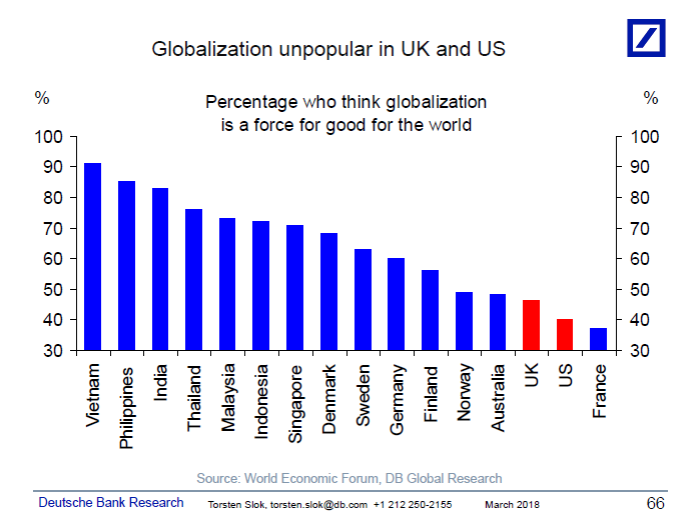

8.Where is Globalization Most Unpopular? Shockingly in the Freest of Markets? U.S. and U.K.

Torston Slok

Globalization is very unpopular among voters in the US, UK, and France, see chart below.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

9.Read of the Day….Venture capital’s stakes are getting much higher

Illustration: Axios / Lazaro Gamio

Tech startups aren’t the only ones in Silicon Valley that want to be unicorns. More and more VC firms are seeking to raise new funds of at least $1 billion, either for new flagships or growth-focused sidecars.

Why it matters: The last time we saw such a trend was during the dotcom era’s waning days.

Why this time it’s different:

- Startups are staying private longer, thus requiring more capital.

- VCs need deeper pockets to at least avoid major dilution. Even Sequoia Capital has seen its original Airbnb ownership fall from 20% to around 13%, per a source.

- SoftBank, even though none of these new funds is really seeking to compete with it.

- There has been intense valuation inflation for venerable tech stocks —yes, even compared to the bubble days — so private valuations are really just following their public market peers.

- There are viable markets for new tech product (i.e., the startups aren’t ahead of consumer and enterprise demand/willingness to try).

- Increased fund sizes in 2000-2002 were to write bigger checks for the same early-stage strategies, whereas this time it’s for complimentary strategies.

Why this time it’s the same:

- Per a longtime LP: “Never get confused. It’s almost always a fee grab.”

- Everyone is still judged on comparative returns, so individual funds won’t be exorcised for broad-based growth-stage carnage.

- Fund capital is widely available, in part, because of a reverse denominator effect.

- The business just looks so easy right now, which is why so many novices (and corporates) are pushing in.

- Overcapitalizing startups hasn’t become any smarter of an ROI strategy.

- Fund size tails will wag check size dogs, no matter how often VCs tell themselves they won’t.

Bottom line: We won’t know who’s right for at least five years, if not longer. But for now we do know that the stakes have become much, much higher.

10.The Top 6 Life-Dominating Lessons

by Joey Percia | Mar 27, 2018

Last Thursday I skipped town for a trip to Toronto for Craig Ballantyne’s Perfect Life Workshop.

… which was incredible! I highly recommend you go to one ASAP.

I was in town for less than 48 hours, yet was able to meet fantastic humans, forge relationships with badasses, and be reminded of life-dominating lessons.

That’s exactly what I want to share with you today—lessons that will allow you to conquer every single day.

I wouldn’t be surprised if you’ve heard these lessons before, but I’ll bet you need a refresher. There’s likely something you’ve been slacking on and need to revisit, right?

So, without further ado, here are my life-dominating lessons:

- Don’t be boring; being boring is a sin.

We’re bombarded with thousands of pieces of information and marketing messages every single day—dinging computers, vibrating phones, and push notifications for damn near everything.

The last thing you want to do is blend in. It’s critical that you’re able to stand out from all the noise.

But how?

Should you wear crazy clothes, light things on fire, and do obnoxious things just for the sake of being different?

Not so fast. Our society values entertainers, but backs away from too much crazy. It’s always been this way and it’s not changing any time soon. The best thing you can do is help your clients by offering them value in an entertaining and engaging way.

Think back to when you were in school. What made a good teacher a great teacher?

Was it better information? Or was it because they were able to convey the same message in an easy-to-understand way that was enjoyable, fun, and entertaining?

The entertaining teacher always won the day.

Use your personality, your skills, and your unique experiences to bring personality to your business and your life. People will love you for it.

- All tasks expand to their allotted time, so block out your time.

Parkinson’s law states that work expands to fill the time allotted for its completion.

As America’s great Uncle Abe Lincoln says, “Give me six hours to chop down a tree, and I will spend the first four sharpening the axe.”

Another high school example: How many times did you wait until the last minute to write a paper or complete a project?

If you’re like most people, you did it more than once. You forgot about the assignment for a few days until your teacher reminded you that your paper was due the next day.

The night before the deadline, you probably spent four hours procrastinating, an hour-and-a-half slowly getting your ideas together, then the next three hours with the pedal to the metal finishing your project.

The point is: If you don’t block out time for something, it likely won’t be accomplished.

Schedule out every single day for the important tasks that will move your business and personal life forward. Just be reasonable with how much time you set aside.

- It’s easy to give advice, but hard to follow. Learn to follow.

How many times have you listened to someone else’s business or personal struggles and easily helped them come up with a solution?

Countless times, I bet.

Often, the solutions you offer can easily be applied to solve your own problems. But it’s hard for us to see this for ourselves.

This phenomenon is something I call “Proximity Blindness.”

You’re too close to the decision-making process in your own life to be objective about right actions. Your biases, investments, and emotions often cripple you from making an easy decision that you know (objectively) will prove beneficial.

An outside eye from caring friends, coaches, and mentors who have been there is crucial to growth. Surround yourself with people who won’t hesitate to lend a helping hand or call you out when you screw up. And be willing to listen to their advice.

- These TWO self-sabotaging words can destroy you. NEVER use them.

“I know” is one of the most self-sabotaging phrases you’ll ever say.

By saying this, you tell your brain to ignore another person’s advice, checking it off as “received, but unheard.”

This has long been as habit of mine and is something I still have to work on. Sure, there are plenty of times where I’ve heard the advice before, but am I really implementing it the best way I can? Am I really doing it right? Is there ANYTHING new I can take away from what this person just told me?

Saying “I know” discounts it all.

Instead, be open and grateful for all feedback given to you. Think outside the box, and let others’ words remind you of how best to move forward.

- Take advantage of the potential others see in you.

Among the many works by celebrated author Neil Gaiman, there’s a personal story that stands out.

Neil spoke once about a casual conversation he had in the back of a room at a gathering of great people. He was speaking to another man named Neil.

The other Neil said to him, “I just look at all these people and I think, what the heck am I doing here? They’ve made amazing things. I just went where I was sent.”

This man felt like his work was nothing special. He knew all too well his own mistakes and counted himself just an ordinary man. But to the rest of the world, he was the great Neil Armstrong—the first man to set foot on the moon.

People see you differently than you see yourself.

In most cases, they see more value, potential, and opportunity in you than you see in yourself. Without others’ perspectives, it’s hard to get out of your own way.

Surrounding yourself with people who push you to grow is an essential part of success.

- Have difficult conversations. They’re important.

On a deep level, we’re all afraid to fail. And please, save me the “I’m not afraid of failure, that’s how I grow” lecture.

It’s not the act of failure in itself that haunts us; it’s what comes along with it: embarrassment, abandonment, mistrust, social exclusion, betrayal, powerlessness, etc.

The truth is, something in the past reframed this as a difficult conversation for us to have. We don’t talk about our failures with ease.

But if you continue to avoid the difficult conversations, you’re only cementing the fear. By facing the situation, you’re getting to the heart of that fear and learning its true nature—often an unfounded negative belief in your own ability. When you uncover the reality, then the fear disappears and you’re free to grow.

The truth is, if something is uncomfortable or awkward, it’s because you likely aren’t confident doing it. The only way to get better is to practice. Practice brings familiarity. Familiarity breeds confidence.

When it comes down to it, people who care less about failure, rejection, and others’ opinions will win.

But only you can decide what type of person you are going to be.

#

There you have it—the six lessons that help me dominate every single day. Life isn’t that hard; once you step back and put things in perspective (with the help and input of others), purpose and path become clear.

Comment below if this served as a reminder. How are you going to tackle your day using these life-changing lessons?

https://www.earlytorise.com/the-top-6-life-dominating-lessons/

Philadelphia Inquirer Names Matt Topley Top Influencer in Finance

Link to event.