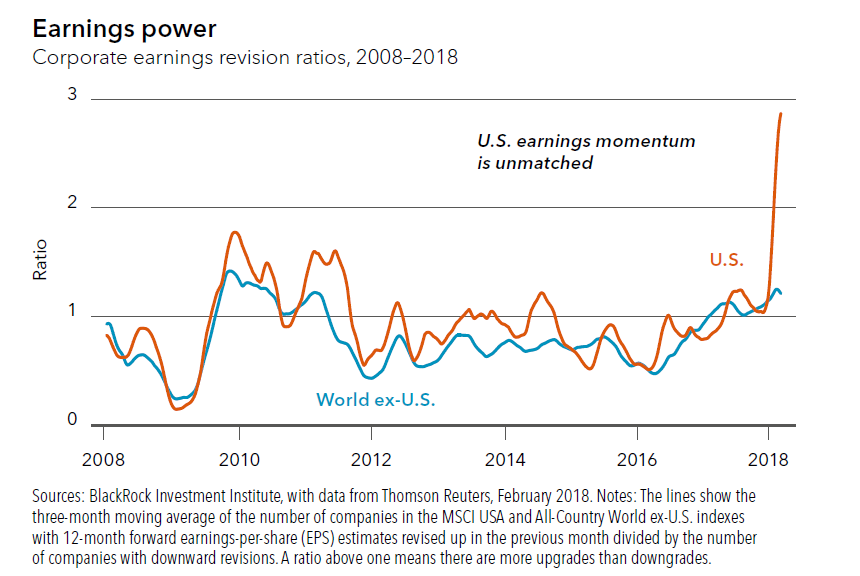

1.For the Bull to End …This Chart Would Need to Reverse.

https://www.blackrockblog.com/

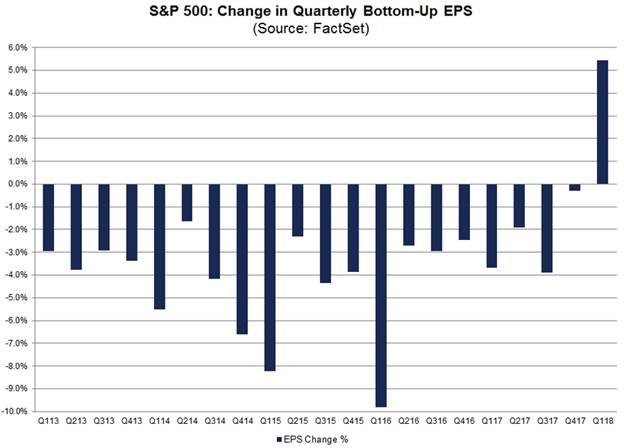

2.Earnings Season 2 Weeks Away….Analysts Have Marked Up Estimates at Record Rate

FactSet notes the first quarter of 2018 marked the largest increase in the bottom-up EPS estimate during a quarter since FactSet began tracking the quarterly bottom-up EPS estimate in Q2 2002 – Due to the recent price decline and anticipated gain of 18.6% in 2018 operating EPS, the S&P500 is now trading at a forward 12-month P/E of 16.6X, which is just slightly above the 16.4X average since 2000 (Sam Stovall)

From Dave Lutz at Jones.

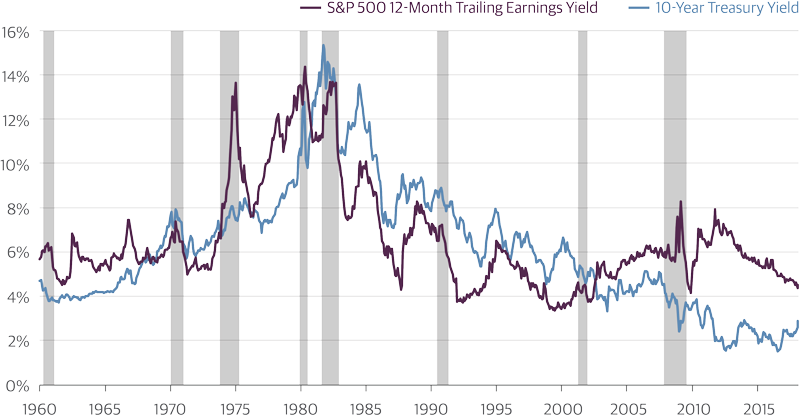

3.If Stocks Hit 20% Sell Off …The Market Would be at 14x.

Guggenheim

The reality today is that the economy is strong, interest rates are rising, and equities look fairly cheap. The Fed model right now would tell you the market multiple should be 34 times earnings. That is just fair value, not overvalued. And based on current earnings estimates for the S&P this year, the market multiple is closer to 17 times earnings. If stocks go down by 10 percent, the market multiple would drop to 15 times earnings. This would be getting into the realm of where value stocks trade. If there were a 20 percent selloff, you’re at a 14 times multiple. These market multiples don’t make sense. Markets do not price at 14 times earnings in an accelerating economic expansion with low inflation.

Stocks Are Cheap

Equity earnings yields* exceed still-low Treasury yields.

Source: Bloomberg, Guggenheim Investments. *Earnings yield equals the inverse of the price/earnings ratio. Data as of 2.16.2018.

4.Semiconductors are a Risk On Sub-Sector…12% Correction…China Passes Domestic Friendly Tax Laws to Compete.

SMH-Semiconductor Index

China cuts tax rates for chipmakers amid trade tensions

BEIJING (Reuters) – China’s finance ministry said on Friday it has introduced tax breaks for chipmakers made in the country, at a time when the government is seeking to reduce dependence on foreign semiconductors amid trade tensions with the United States over technology transfers.

: A researcher plants a semiconductor on an interface board during a research work to design and develop a semiconductor product in Beijing, China, February 29, 2016. REUTERS/Kim Kyung-Hoon

The move comes as the United States is considering imposing tariffs on $50 billion worth of Chinese exports, citing discriminatory trade practices in high-tech sectors, including semiconductors.

Chipmakers will be exempt from corporate taxes for two to five years followed by partial deductions, the ministry said in a notice posted on its website.

The exemptions cover a range of products, from very basic to cutting-edge chips, for use in computers, smartphones and other electronic devices.

The new rules are effective from Jan. 1, 2018.

China relies heavily on foreign semiconductors, which make up one of its largest import categories by value. It is seeking to overtake foreign rivals and become a top semiconductor producer by 2030, according to its own roadmap.

China’s ambitions have riled overseas regulators however, who have blocked several acquisition attempts by Chinese firms looking to speed up development through technology transfers.

U.S. President Donald Trump’s administration is requesting China purchase more semiconductors from the United States as part of a plan to avoid proposed tariffs and a potential trade war, Reuters reported on Tuesday.

According to Friday’s notice, companies producing high-end chips using 65 nanometer technology or smaller with an investment of over 15 billion yuan ($2.39 billion) will be exempt from corporate taxes for five years. Companies producing chips using 130 nanometer technology or smaller will be tax exempt for two years.

The new rules will mostly benefit China’s larger, older chipmakers which can promise higher investment and large-scale production.

China had 171 chip fabrication plants as of the end of 2016, accounting for roughly 14 percent of total global capacity, according to PwC, but produces less sophisticated chips than its foreign competitors.

The country has allocated extensive national funding to boost production. Last year leading chipmaker Tsinghua Unigroup Ltd signed deals with China Development Bank [CHDB.UL] and China’s national integrated circuit fund for financing of up to 150 billion yuan.

($1 = 6.2679 Chinese yuan renminbi)

5.FANG is Really FAAANGT—Add Alibaba and Tenecent-Both 10% Off Highs Following U.S. Cousins.

BABA Pullback

Tenecent pullback

6.With All the Success of Alternative Lending Since The Great Recession….IPOs Have Bombed.

Lending Club -86%

ONDK -79%

Greensky Files for IPO

https://www.wsj.com/articles/fintech-firm-greensky-files-confidentially-for-ipo-1522685450?mod=ITP_businessandfinance_0&tesla=y

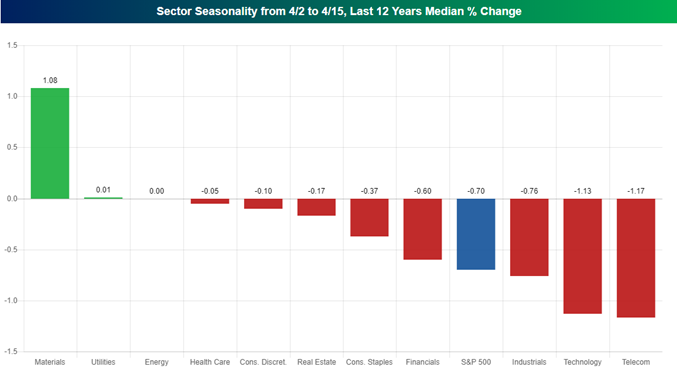

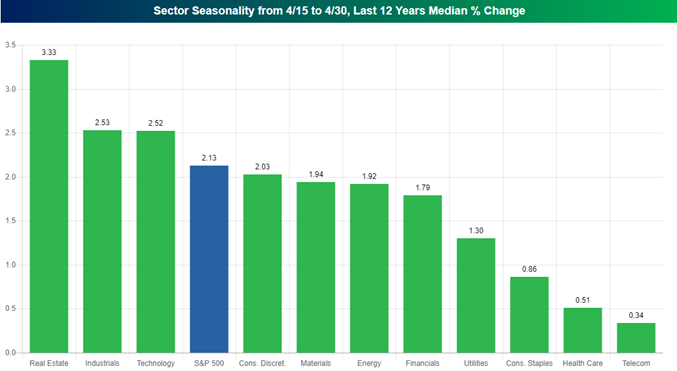

7.Bullish April Seasonality Not Until Second Half of Month

Apr 3, 2018

April has historically been one of the strongest months of the year for the stock market. Recently, though, the gains have all come in the second half of the month once Tax Day (April 15th) passes.

You can clearly identify this trend using our Stock Seasonality tool, which is available to Bespoke Premium and Bespoke Institutional clients.

We ran a screen to find the median change of S&P 500 sectors over the last 12 years from April 2nd through April 15th, which generated the chart below. As shown, the S&P 500 has seen a median decline of 0.70% during this time frame, while just two of eleven sectors have posted median gains.

When we run the same screen but look at the period from April 15th through April 30th, the chart below shows that the S&P 500 has seen a median change of +2.13%. All eleven sectors have posted median gains, and four sectors have gained more than 2% (Cons. Discret., Tech, Industrials, and Real Estate).

Clearly the back half of April has been much stronger than the front half in recent years.

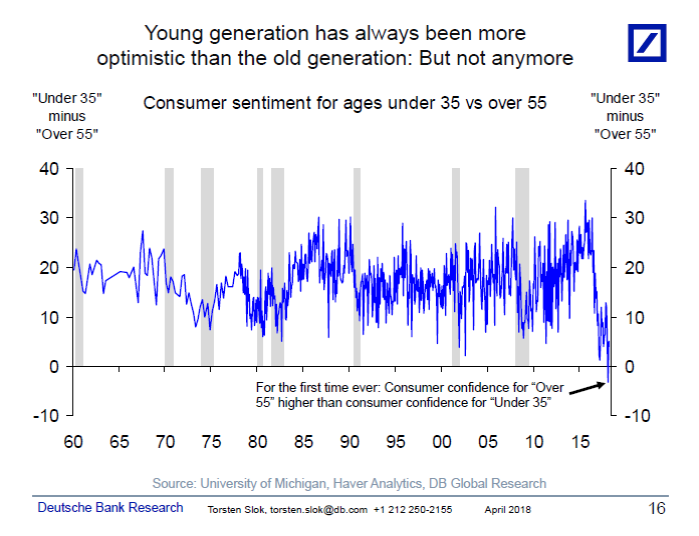

8.Gen Negative Y

My April chart book is here, happy to discuss, let your DB sales contact know.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

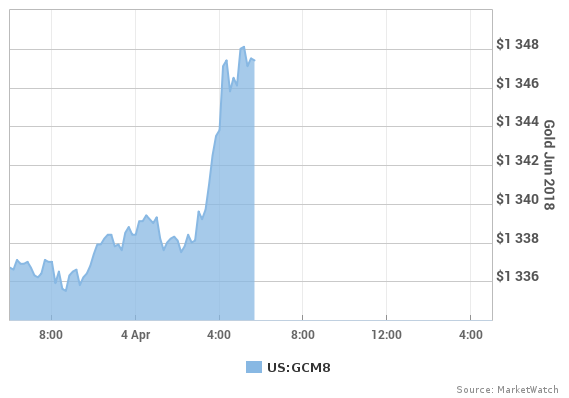

9.Two Safety Trades Jumping Pre-Market.

Gold

Traders take a shine to gold on Wednesday.

Rattled traders bid up haven assets, including gold futures. June gold GCM8, +0.77%climbed $10.30, or 0.8%, to $1,347.60 an ounce.

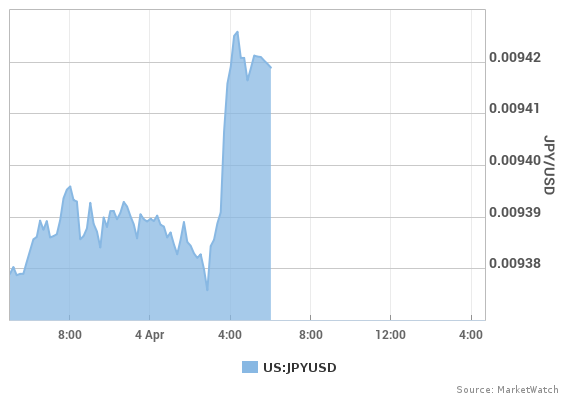

Yen also up on haven demand

The yen is jumping.

The Japanese yen — widely viewed as a safety play — also advanced Wednesday. The U.S. dollar USDJPY, -0.37% was buying 106.15 yen, down roughly 0.5% from 106.60 late Tuesday in New York.

10.Three Ways To Increase Your Portfolio’s Longevity

Posted March 26, 2018 by Anthony Isola

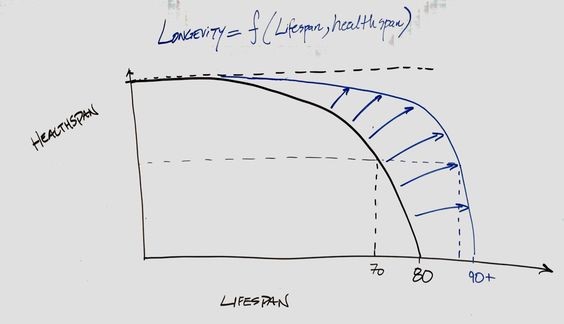

Concentrate on improving the lifespan and healthspan of your money. The same principles will exponentially increase the quality of your life.

Dr. Peter Attia has a clinical interest in human longevity.

How can we extend our lives without destroying quality? Living to 100, but relying on a feeding tube doesn’t cut it. Just like the markets, longevity is complex and nonlinear; fraught with millions of unpredictable variables. The best health and wealth habits are no match for a drunken driver.

Dr. Attia created this graph to display his objective.

He came up with three elements, which, in his words, he defines as:

- Brain — namely, how long can you preserve cognition (i.e., executive function, processing speed, short-term memory);

- Body — specifically, how long can you maintain muscle mass, functional movement and strength, flexibility, and freedom from pain; and

- Spirit — how robust is your social support network and your sense of purpose.

How does this relate to our retirement goals?

Think of lifespan as how long your money needs to last, based on your time frame. Healthspan is the return needed to achieve your goals.

Investors need to control their worst behavioral instincts; specifically, our amygdala; the part of the brain that regulates emotional responses. The best financial plan cannot withstand our emotional attraction to short-term events.

Selling your entire stock portfolio during a 10-15% typical yearly drawdown fits nicely into this category. This behavior is fatal to the longevity of retirement accounts.

Humans need to stay active in order to improve their healthspan. Weight lifting and stretching are two ways most can delay the aging process. Too much activity can also be damaging. There is no need to complete a weekly marathon to achieve the benefits of exercise.

The same goes for your portfolio. Periodically rebalancing a diversified global portfolio will do the job. Less is usually more for investors.

Sleep is a major ingredient for a healthy body and your investments.

This doesn’t mean you shouldn’t be active in other financial areas.

Consistent and increased annual savings will offset periods of market stagnation. Consistently monitoring taxes, insurance, budgeting, and debt management are good ways to be financially active.

Focusing on the difference between needs vs. wants is a great use of weekly energy.

Finally, studies have shown people with active and healthy social networks have a longer and healthier quality of life. Good friends and family are riches that no amount of money can purchase. Quality over quantity matters most.

Limiting caloric intake leads to increased longevity. Follow the same advice regarding your consumption of financial news. Avoid screaming media types who over exaggerate market noise to enrich themselves, not you. Few on Twitter or Facebook know you well enough to give sound financial advice.

Make friends with great books. They provide knowledge that will last decades, not a daily news cycle. Ignore co-workers who espouse “common” knowledge about money matters that is neither common nor knowledge.

Stay away from salespeople who push products. Find yourself a trusted fiduciary advisor to get you where you want to go. We can certainly help you with that.

Good health and lasting wealth have much in common.

Source: “How You Move Defines How You Live”, Peter Attia, MD