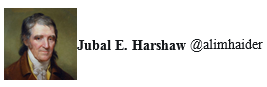

1.Another Reminder of How Tough it is to Time Markets…..Final 12 Months of Bull Account for One-Fifth of Gains.

Behind it all are facts of investing known well by anyone who sold after Brexit, the U.S. election, or five market corrections since 2009 that look just like this. One, it’s hard to see the end of things. Two, a lot of money is made at the top. Three, you miss any payoff in equities right now at grave risk to your career.

“It can be 6 or 8 percent costly, or even 10 percent costly” if you bail too soon, said John Augustine, chief investment officer for Huntington Private Bank in Columbus, Ohio, in an interview at Bloomberg’s New York headquarters. “That can mean a lot to folks in a 2 percent nominal world.”

It can actually mean more. A study by Bank of America Corp. on market peaks since 1937 shows that being uninvested in the last year of an advance meant foregoing one-fifth of the rally’s overall return. While every episode is different, that math translates into additional 470 points in the S&P 500, if the bull market goes on for another year.

Crash Course in Market Timing Shows Cost of Being Wrong at Tops

By Lu Wang

and Sarah Ponczek

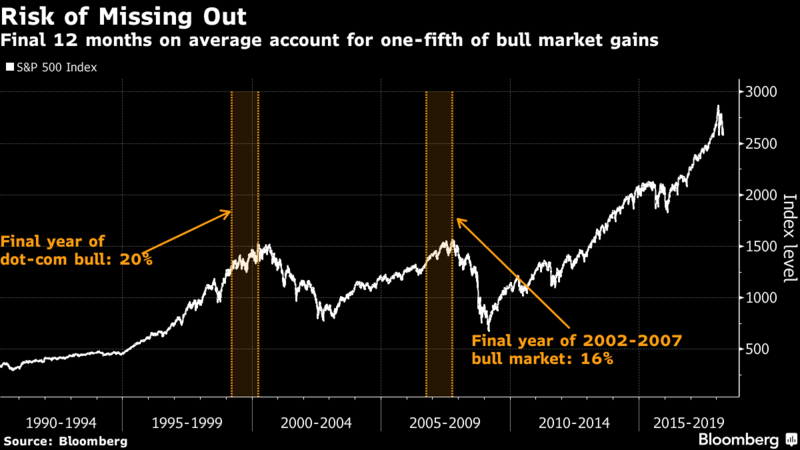

2.Spotify Seventh Biggest Internet IPO Ever.

At $27 billion, Spotify is the seventh-most-valuable internet company to go public in the U.S.

It’s up there with Google, if you don’t adjust for inflation.

Spotify’s public offering is not only notable because of its uncommon choice to list its shares directly on the stock market. The stock, which began trading today, also ranks among the most valuable internet companies to list in the U.S.

Its closing market value today was about $27 billion, according to Dealogic, putting it ahead of Twitter and Groupon, but behind Alibaba, Facebook, Snap and Google following their first trading days. That’s despite a stock price decline of about 11 percent today.

Spotify is also the most valuable tech IPO since Snap went public last year, closing its first day at nearly $29 billion. Spotify had the 25th-biggest first-day closing market cap out of companies in all sectors, according to Dealogic’s data, which goes back to 1995 and is not adjusted for inflation.

https://www.recode.net/2018/4/3/17193594/spotify-ipo-price-stock-wall-street-market

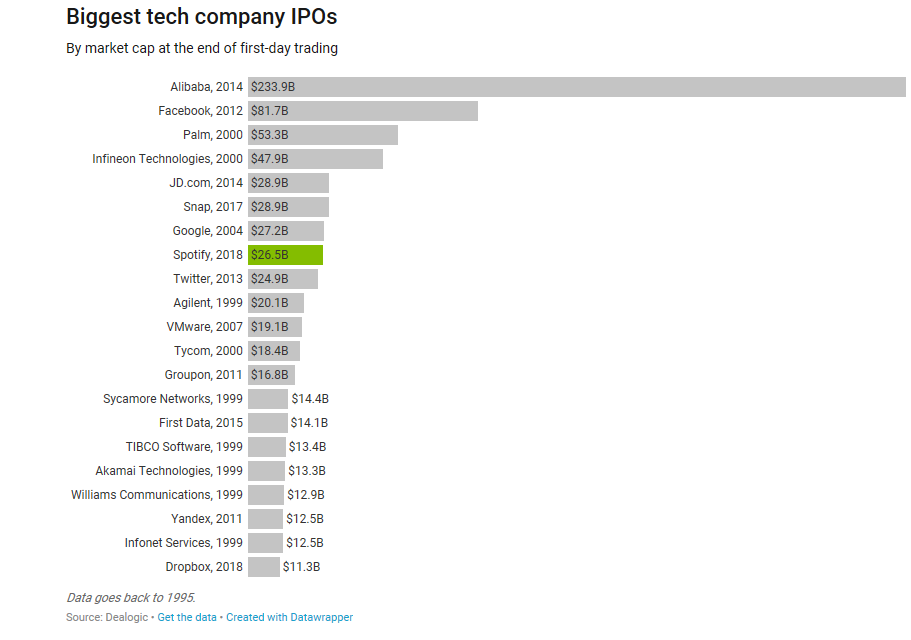

3.Amazing Narrow Band of Inflation for 20 Years.

The United States: US inflation has been staying within a relatively narrow band for over two decades. Deutsche Bank predicts that it will be moving toward the upper end of the range.

Source: Deutsche Bank Research

From the Daily Shot www.thedailyshot.com

4.Dollar Does Not Appreciate During Every FED Rate Hike Cycle.

Why We See the Dollar Continuing to Weaken

Global economic trends indicate continuing U.S dollar weakness over the next few years.

By Hemant Baijal & Turgut Kisinbay | March 06, 2018

Among the questions we are asked most often these days are: Why has the dollar depreciated while the U.S. Federal Reserve (Fed) has been in a tightening cycle since 2015? And will that dollar weakness persist as the Fed continues to hike and deliver interest rates that are among the highest in the developed markets? After all, interest-rate differentials are one of the key determinants of exchange rates.

We think that dollar weakness will continue over the next two to three years. There are a number of reasons why we believe that, but before we discuss them, let us begin by examining the Fed rate-hikes story.

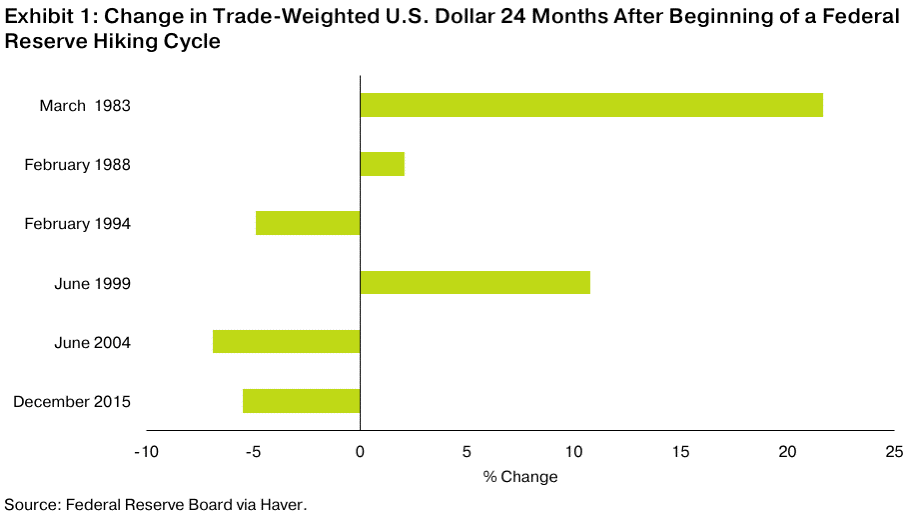

First, there is no iron-clad rule mandating that the dollar must appreciate every time the Fed is in a hiking cycle. Historical evidence clearly shows that the dollar has depreciated during some Fed hiking cycles and appreciated during others. Exhibit 1

It is important to keep in mind these three points:

- Exchange rate dynamics, just like any other asset price, are influenced by a host of factors, including economic growth differentials that result in capital flows, current account deficits, and long-term valuations. There is never a single determinant.

- Exchange rates represent a relative price. Both domestic and international factors matter for exchange rates.

- Markets are forward looking and discount future developments.

How do these three observations help us form our dollar outlook?

Good Full Read on Dollar

https://www.ofiglobal.com/institutional-investors/article/why-we-see-the-dollar-continuing-to-weaken?CMPID=spfilig#

5.S&P Has Been Positive 91% of Time Since 2013….Why Should We be Shocked by Some Volatility?

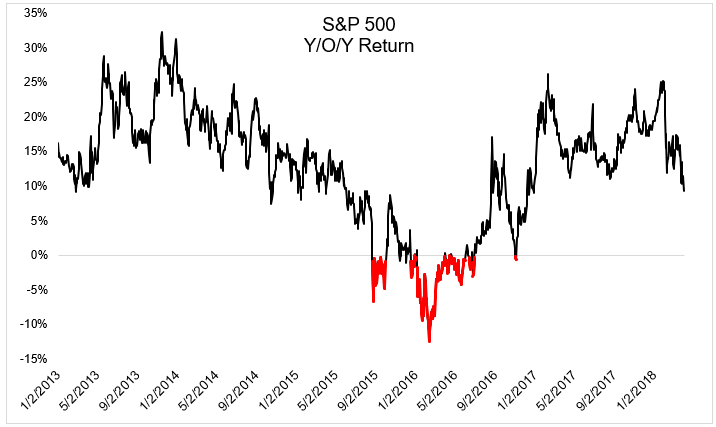

It’s never fun when stocks fall, but they’ve treated investors very kindly over the last few years. The S&P 500 has been positive 91% of the time year-over-year going back to 2013.

http://theirrelevantinvestor.com/2018/04/02/the-break/

6.Frontier Markets Big Outperformance in YTD…FRN Frontier Market ETF.

FRN +7.68% vs. S&P -2% EEM -1.25% (emerging markets)

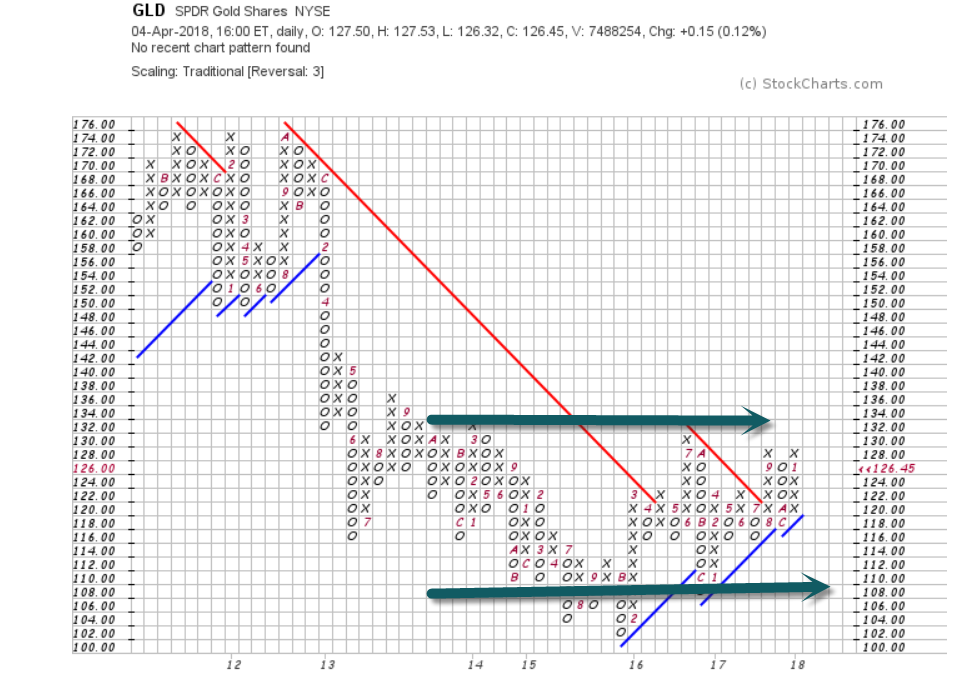

7.Gold Up for Year But Still in a Range.

GLD (gold etf)—5 Year Trading Range

8.Gas Price Comparison of 2000’s Going into Summer Driving Season.

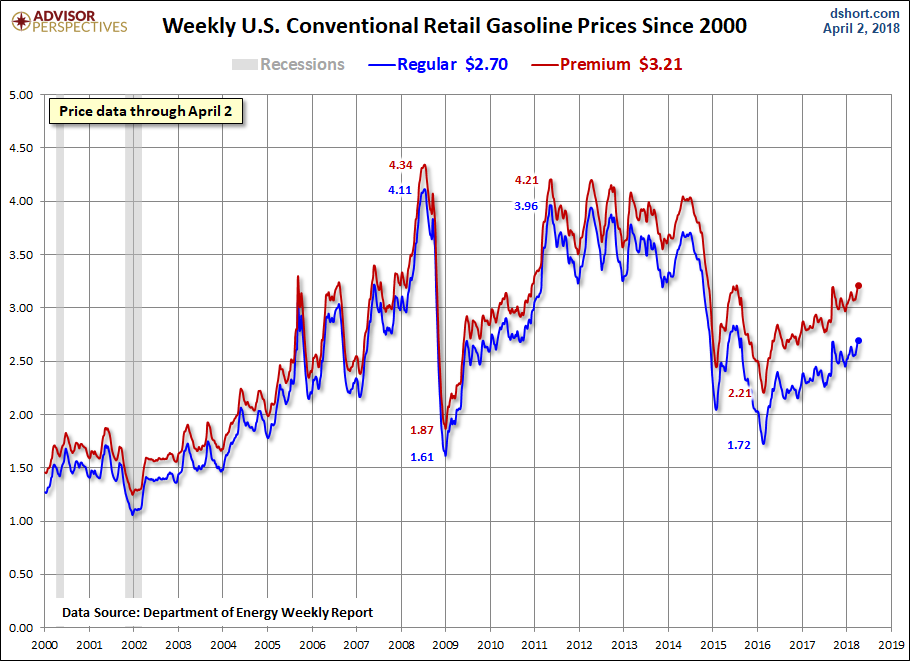

How far are we from the interim high prices of 2011 and the all-time highs of 2008? Here’s a visual answer.

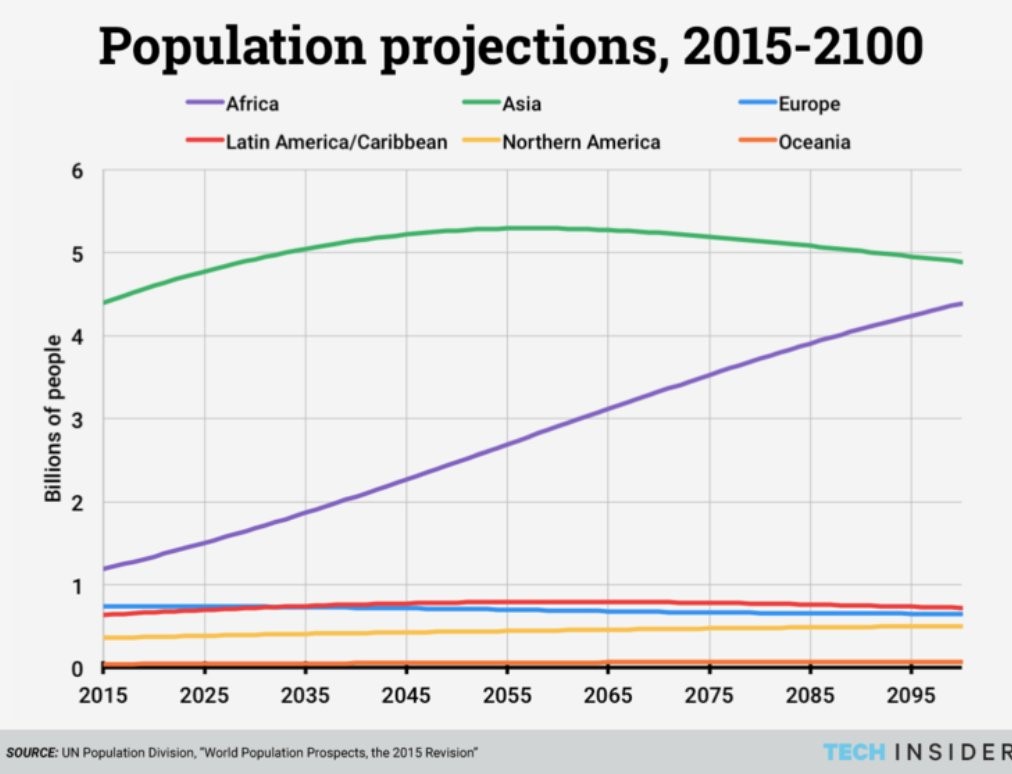

9.Population Projections 2015-2100

10.Wharton’s Adam Grant: How to receive criticism without being left crushed and unmotivated

10:45 AM ET Mon, 2 April 2018

But it’s also mission critical to your success and there are things you can do to make the experience of receiving criticism less painful.

That’s according to Adam Grant, an organizational psychologist and the author of “Originals,” and “Give and Take,” and co-author of “Option B” with Facebook executive Sheryl Sandberg. He’s also the host of “WorkLife with Adam Grant: A TED original podcast” and the top-rated professor at Wharton for six straight years.

“I don’t know very many people who enjoy getting criticized,” Grant tells CNBC Make It. “It’s something that we’re all terrified of, or that we at least know we’ve gotten defensive and it hasn’t gone well when other people have given us negative feedback.

“But if you look at the data, one of the biggest drivers of success, if you account for how motivated you are and you know how talented you are, is your ability to seek and use negative feedback,” says Grant. “Because that really determines how close to your potential you become.

Adam Grant

“If you never get criticized, then you never really get challenged to improve,” says Grant.

Dealing with criticism productively was the topic of the first episode of Grant’s new podcast, which launched in February.

For the episode, Grant talks to Ray Dalio, the billionaire founder of the hedge fund Bridgewater Associates, which currently has $160 billion in assets under management. Bridgewater Associates has a trademark policy of radical transparency. Everyone at the company speaks their minds.

David A. Grogan | CNBC

Ray Dalio speaking at the 2017 Delivering Alpha conference in New York on Sept. 12, 2017.

“One of the biggest tragedies of mankind is people holding in their opinions in their heads. And it’s such a tragedy,” says Dalio on the podcast. If people shared their ideas bad ones could be fixed and good ones could become better, which he calls “stress-testing” ideas. “They would so raise their probability of making a better decision,” he adds.

Dalio came to adopt the policy of radical transparency after a painful near-complete failure. Bridgewater Associates launched in 1975 and though Dalio did well initially, he got arrogant and made a bad bet. He nearly ruined the firm. But it also was a turning point for Dalio.

“I was so broke that I had to borrow $4,000 from my dad to help pay for my family bills. And that was extremely painful — and it turned out to be terrific,” says Dalio during Grant’s podcast. “I was absolutely miserable. But it gave me the humility that I needed to deal with my audacity. It made me want to find the smartest people I could find who disagreed with me so that I could understand their perspectives.”

Not only did Dalio learn to seek out feedback himself, but it became a foundational tenet of his firm. Bridgewater Associates prides itself on being a “meritocracy.” Everyone is required (indeed, “require” is the word Bridgewater uses on its website in describing its culture) to be honest about their viewpoints — employees are expected to disagree openly.

Instinctively, people hear criticism, though, and they tend to become defensive.

“Psychologically I think the way it feels for most of us is it feels like we’re getting punched right in the stomach — somebody criticizes you and it can be so painful that it literally will activate a physiological pain response,” Grant tells CNBC Make It.

“Negative social feedback, the sense that you might be excluded or thought poorly of, actually influences your nervous system and so you know that can that can feel like you can’t breathe, like you’re you know sort of gasping for air, and in some cases it feels like you you’ve just been the victim of an attack and you don’t know if you can be successful moving forward.”

There are, however, things that you can do to make it less painful to receive negative feedback and make it more possible for you to hear criticism productively, according to Grant.

- Practice: The more often you receive criticism, the better you will get at it

“What I found so striking at Bridgewater is they give people constant practice, and it kind of reminded me of something that we we’ve been doing in psychology for decades, which is anytime somebody has a phobia you send them to exposure therapy,” says Grant.

First, new hires at Bridgewater watch other people being criticized, including the billionaire founder himself. Then they learn to be open to hearing criticism on small things, explains Grant. “This happens day in and day out, and over time it starts to become a little bit more familiar, a little bit more comfortable,” says Grant.

- Get in the habit of assessing your own response to negative feedback

At Bridgewater, part of your performance review is how well you respond to feedback, says Grant.

“In psychology we often talk about this in terms of giving yourself a second score,” says Grant. “Somebody might have just given me a D-minus, and I can’t control that. What I can control is saying, ‘I want to try to get an A-plus for how well I take that D-minus.’

“And this is something I’ve come to do now every time I get negative feedback,” Grant tells CNBC Make It. He tries to be honest with himself about whether he was open or defensive in receiving the feedback.

Publicly sharing the negative feedback you have received can be a way to keep yourself honest, says Grant. When he was teaching his first course as a professor, Grant says he got some pretty brutal comments from students about a month into the semester. His response was to gather all of the negative feedback and share it with the entire class, verbatim. Then they all discussed it and offered solutions.

“What I noticed was having that conversation on stage in front of dozens of students — it forced me to be open to the feedback, because I knew they were all gauging right in that moment whether I was willing to listen to them or whether I was just going to get all defensive,” says Grant.

“I don’t think that everyone should do that with every piece of feedback that they get, but I think sometimes there’s real value in actually taking the criticism you’ve gotten and sharing it with a group because then that group is going to hold you accountable for taking it seriously,” he says.

- Proactively trying to come up with the criticism you might receive

Often when we receive criticism, we go into an emotional, “fight or flight” response mode, says Grant, which is not a productive place to be in to hear advice constructively.

“I think the best way to avoid that is actually to prepare yourself by imagining what is the most negative feedback I could possibly get in this situation and then making a list of the harshest comments that you think will come across,” Grant tells CNBC Make it.

By doing so, it’s likely whatever negative feedback is you may get won’t be a surprise. “Most of us are much harder on ourselves than other people are on us, right? We beat ourselves up constantly,” says Grant.

“If you go through the exercise of imagining the worst case scenario, what the data show is that then that motivates you to prepare and get better and so you’re less likely to get that negative feedback at all. And then very often you’re able to come up with things that are much more devastating than what people really have to say to you.”

— Video by Andrea Kramar

See also: