1.Bloomberg IPO Index Remains Sluggish

Aug 3, 2017

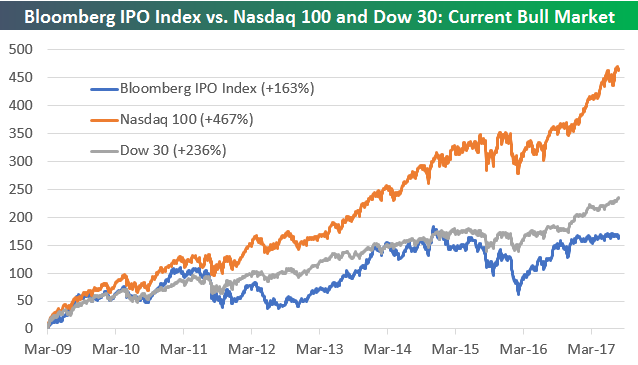

One index that hasn’t been participating in the market’s rally this year is the Bloomberg IPO Index, which is made up of companies that have IPOd within the past year. We just wanted to show you a quick chart to highlight the weakness for IPO stock performance.

Below is a chart comparing the performance of the Bloomberg IPO Index to the Nasdaq 100 and the Dow Jones Industrial Average since the bull market began back in March 2009. As shown, the Tech-heavy Nasdaq 100 is up by far the most at +467%, which might make you assume that IPOs would also be doing pretty well. But even the Dow 30 has outperformed the IPO Index and by quite a bit at that! Since the bull market began, the Dow is up 236% on a simple price return basis, while the IPO index brings up the rear in this group with a gain of just 163%. Over the past year, the IPO index has basically traded completely sideways.

https://www.bespokepremium.com/think-big-blog/bloomberg-ipo-index-remains-sluggish/

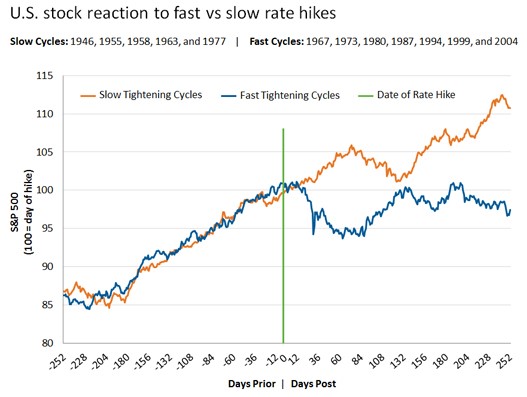

2.Interesting Chart on Fast vs. Slow Rising Rates and the Stock Market.

https://www.hartfordfunds.com/insights/nanette-abuhoff-jacobson/charts3Q17.html

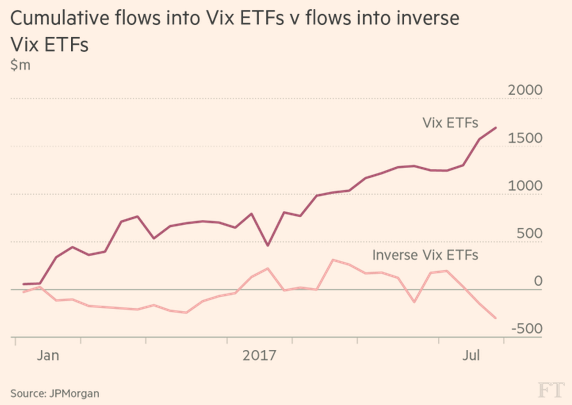

3.VIX Flows…More Cautious Behavior

Money last month poured into funds and securities that offer some protection against a sharp correction in the US stock market, the latest sign of cautious behaviour from both professional and retail investors in response to equities at record levels.

Preparation for the risk of upset comes as market activity slows for the summer and in advance of possible central bank action in September, when policymakers may announce plans to remove crisis-era monetary policy measures. In the four weeks to July 28, retail investors pushed $445m into exchange traded funds tied to the VIX

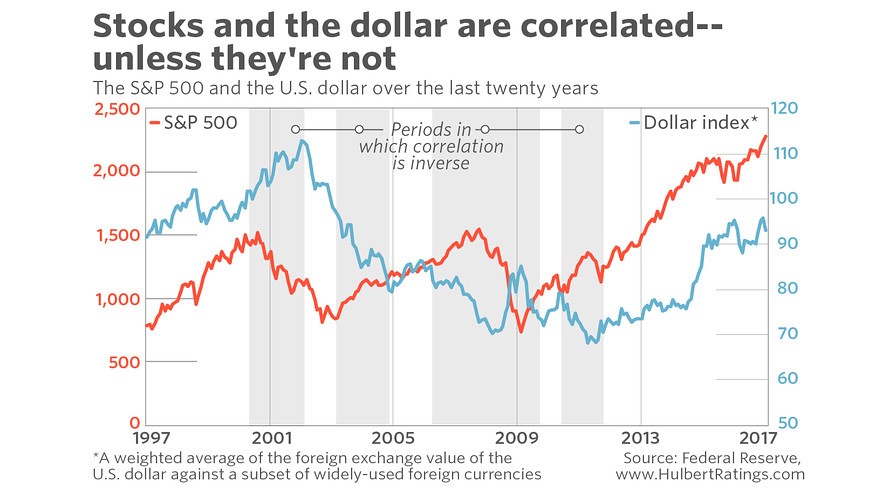

Spectacular as this example is, it is not the only time when the stock market’s correlation to the dollar has been the opposite of what we’ve seen recently. This is well-illustrated in the above chart: The shaded boxes show periods in which, like this year, the dollar-stocks correlation has been inverse. Notice that these shaded boxes cover only about half the time, and that in the other half the correlation is positive rather than inverse.

In other words, sometimes a falling dollar appears to be good for stocks, but other times when it is bad. The same goes for a rising dollar. Good luck translating these historical precedents into a stock market trading rule.

None of this means that you shouldn’t care — as a matter of public policy — about the dollar’s foreign exchange value. But when it comes to stock market investing, there are many more important factors on which it would be better for you to focus.

For more information, including descriptions of the Hulbert Sentiment Indices, go to The Hulbert Financial Digest or email mark@hulbertratings.com .

http://www.marketwatch.com/story/what-the-plunging-dollar-really-means-for-stocks-2017-08-04

4.Commodity/Energy Currencies Spike as Dollar Weakens

Canadian Dollar..50day thru 200day.

FXA Aussie Dollar…50 day thru 200day.

New Zealand Dollar Same

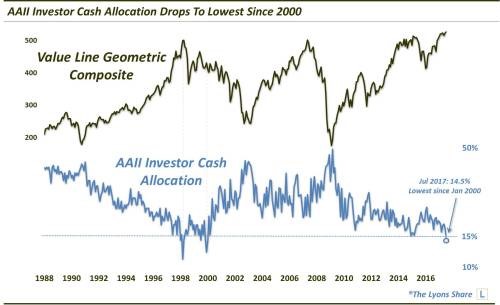

5.Cash Allocation at 2000 Lows …Tough to Interpret this Data with Cash Paying Zero and Money Still Flowing to Fixed Income.

Specifically, the July 2017 reading of investor cash came in at 14.5%. This was the lowest level in the survey since January 2000. In fact, the only lower readings in the survey’s history back to 1987 occurred in January-April 1998, July 1999 and November 1999-January 2000.

Is now the time to freak out about this low cash position? Probably not. Remember, market conditions have to be ripe for these secular, or cyclical, types of issues to unleash their ramifications. Given the close proximity of most market averages to all-time highs, we don’t think we’re at that point yet.

That said, this is certainly a counterpoint to the “cash on the sidelines” argument. That just doesn’t appear to be accurate. So while a crash, or even a major market top, may not be imminent, background market conditions are not at all favorable for a further, prolonged advance.

http://jlfmi.tumblr.com/post/163727098390/are-investors-running-out-of-cash

Found at www.abnormalreturns.com

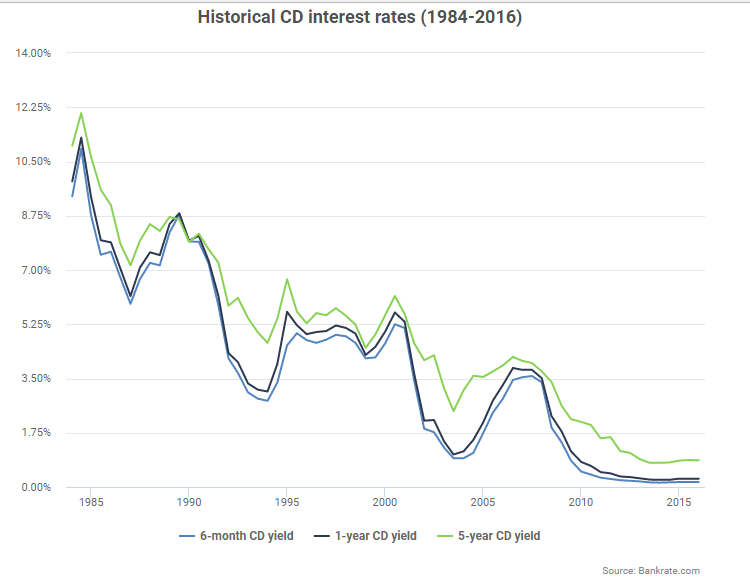

6.Historical CD Interest Rates – 1984-2016….In 2000 a 6 Month CD Paid 5%

DENISE MAZZUCCO

This chart shows the national average CD rates on 6-month CD yields, 1-year CD yields and 5-year CD yields since 1984, according to Bankrate’s weekly survey on interest rates.

http://www.bankrate.com/banking/cds/historical-cd-interest-rates-1984-2016/

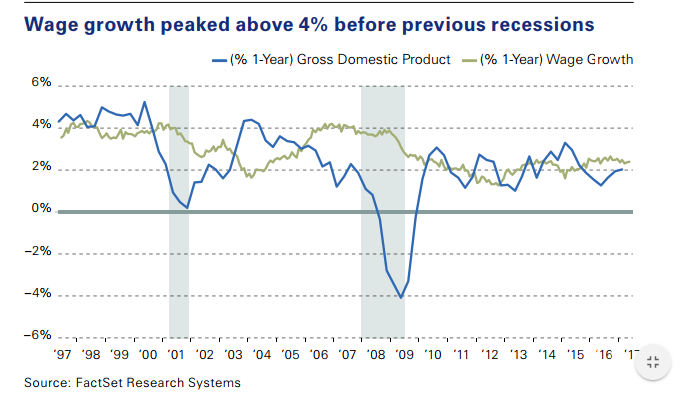

7.Wage Growth Not Yet Near Previous Peaks.

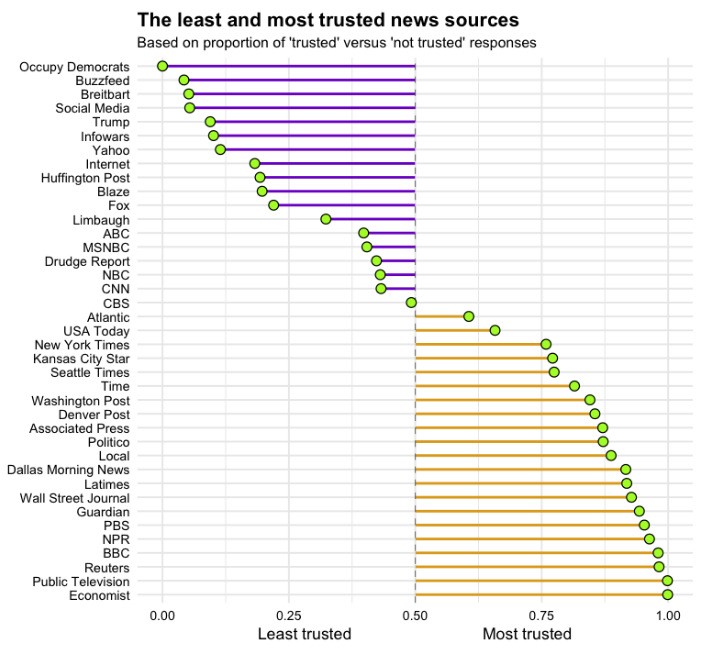

8.Read of the Day….The Least and Most Trusted News Sources in America

Which news sources are the most trustworthy?

This seems like a simple question – but in the “fake news” era, things haven’t been so straightforward. As a result, the public’s level of trust in mass media has fallen to a low of just 32%.

EXAMINING THE TRUST SPECTRUM

A new survey by the Trusting News Project helps shed more light on the state of trust in media, revealing the attitudes of 8,728 people in the United States. Administered through 28 media outlets around the country, the survey asked respondents how trusting they are of the media, whether they financially support news organizations, and which outlets are the most (and least) trustworthy.

Here are results to the question about trustworthiness of specific news sources:

Before we dive into the results, it’s worth noting that respondents were self-selected and tend to skew to the liberal side of the political spectrum. More on this later in the post, but keep it in mind.

http://www.visualcapitalist.com/least-most-trusted-news-sources/

9.Psychological Obstacles Every Entrepreneur Faces… and How To Overcome Them

You’re an entrepreneur – an individual who doesn’t let fear become a paralyzing factor. Daunting odds and discouraging investors don’t stop you from achieving your dream. You are an Alpha in a sea of people warning you to never break the status quo.

You have values, talents, and gifts to offer the world.

There are seemingly unconquerable obstacles that come complimentary with the life of an entrepreneur – but you already know that, and it doesn’t scare you off. That’s why you’re here.

But depending on the stage of your business ventures, some of these obstacles and mental barriers may arise. Don’t panic. You’re still the entrepreneur you know yourself to be. These obstacles are all things we as humans struggle with in creating something of value in such a competitive, busy world. Focus on e-commerce, we walk through these common obstacles and how to ensure they’re merely speed bumps on the way to your success.

1.“Where Do I Start?”

If you’ve already embarked on the long, arduous process of deciding the type of business you’re looking to get into (fashion, drop-shipping, kitchen goods, etc.), then congratulations! You’ve gone further than 90% of the entrepreneurial population.

Now comes the even harder part – actually taking that first step to turning your idea into a tangible business. It may be that you don’t have enough knowledge of your market, or maybe you aren’t familiar with the technical aspects of creating and maintaining an e-commerce store.

In these cases, you’ve lucked out. In the age of the Internet, there isn’t much information you can’t access.

Maybe it’s a decisive issue; you can’t make up your mind on whether you’re ready and motivated enough to take the plunge. Don’t worry, this is common. But, you can’t let it push your aspirations to the side.

One of the most important qualities a successful entrepreneur can have is a sense of urgency.

Whether that urgency arises after a traumatic incident like a divorce or being fired from your job, you can’t ever lose it if you want your business to continue growing. There’s a world of hungry people out there – make sure you never become a full one. Motivation comes in many shapes and forms. Whether it’s exercise, meditation, keeping your finances to a minimum to induce that hunger, etc., just make sure it’s dependable and sustainable for you.

2. Marginal Benefits

While the entrepreneurial legends devoted every waking moment to their businesses, that isn’t always possible for us. You may have a family to support. A degree you’re still earning. Your business model could be slow in the initial stages and you may not have the financial cushion to take huge risks.

Whatever the case, if you have to start your business on the side, you have to make sure you’re allotting enough time and effort for it to thrive. This means taking a highly disciplined, highly methodical look at your decision making in regards to time management.

You have marginal benefits that come along with making decisions, and you also have costs. Our natural psychology typically leads us to take action and make decisions when the marginal benefits outweigh the costs. Take for example, your living space. Every day it gets a little bit dirtier with dust, water bottles, little pieces of trash, dishes, etc. We could take five minutes out of each day for basic cleaning, but you don’t. You usually wait – wait for the grime to significantly show, the bottles to pile up, and the sink to get full before we start cleaning – and then it takes us two hours to finish.

This happens because, at first, we don’t see the benefit of fixing small inconveniences worth the time in the long run. The marginal benefit isn’t worth the cost. Yet, when it gets unbearable, the brain decides our quality of living is worth taking the extra hours out of the day to clean it all up. The marginal benefit outweighs the cost.

What does this have to do with your e-commerce site?

As an entrepreneur, it’s crucial you reevaluate this natural decision-making process. Your business needs to thrive, and there are a lot of little tasks that need to be done over a long period of time in order to build your venture into a successful, profitable business. Eventually, you should hire out other people to complete these small tasks so you can focus on big, money-making moves. But until then, it’s on your shoulders, and being the slightest bit lazy will compound into business-killing excess.

These things won’t show you any returns immediately, which is why it makes this one of the hardest psychological obstacles to push past in the e-commerce world. Things like choosing the proper products to sell online, setting up ads, publishing blog posts, (heck, building a blog!), developing social media channels, etc., all takes time, and provide hardly any instant gratification.

But, in the long run – if you do these things daily, and conquer this mental barrier – it’ll pay off and be the building blocks of your brand.

3. The False Productivity Façade

This is a super common problem that affects e-commerce entrepreneurs especially. This is when you feel like you’re doing something useful… but the action really does nothing to further your business goals.

The biggest culprit: tweaking your website. Customizing the layouts, rewriting the copy, adding new photos – you can spend TONS of time messing around and updating your website. But, is it really furthering your goals? In the beginning stages of your business: no.

Eventually, once you have a following of readers, website redesign can compound that audience and show them you are evolving with the times.

But as I said, in the beginning you have to simply get your website up and done. Try to move on without looking back… you’ve got plenty of other high-level tasks to do.

At the end of the day, it’s all about revenue. Is your site gaining traction in your niche? Are you getting visitors? Most importantly: are you getting sales? Just get your site up, interact with real people, and get them to make some real purchases.

4. Failure vs Momentum

It’s easy to stay motivated and productive when you finally see results. On the flip side, there’s nothing more discouraging than the massive amount of failure you first encounter when launching an e-commerce business.

Momentum is the good stuff, the kind of things that push you forward and make you want to keep hashing away at your work. Things like seeing a boost in traffic, ranking higher for your keywords in SEO, and being sought after as an influencer.

Failure is the drudgery that keeps e-commerce entrepreneurs from continuing their dream. And it’s rarely failure in the large sense, but small setbacks that make your work feel hopeless. This is the kind of stuff that causes most people to give up after a few months. Things like posting a really great article that drives no traffic and gets no exposure, or sending emails for guest posts and asking for product reviews only to get radio silence.

So, how can you cope with failure?

In the words of Craig Ballantyne, author of The Perfect Day Formula, “fail forwards.”

Also, consistency. In the face of denial, you’ve got to keep hammering away. One of the best ways to do this is by creating a written plan that details how you’re going to market your site: How many bloggers you’ll contact for product reviews, backlinks, guest posts, etc.

Marketing your e-commerce site ultimately comes down to a numbers game. The longer you stick it out, the more attention you bring, the higher your sales will be. Again, nothing builds more momentum than pure revenue.

Building a successful online platform and selling great products is a long and arduous road filled with more mental barriers than most people can handle.

But you’re an entrepreneur. It’s never going to be easy. That’s why you love it! And also why only a select few in this world are successful. Don’t let any of these psychological obstacles keep you from building your dream – because at the end of the day, those obstacles can’t stand up to your determination.

https://www.earlytorise.com/psychological-obstacles-every-entrepreneur-faces-overcome/