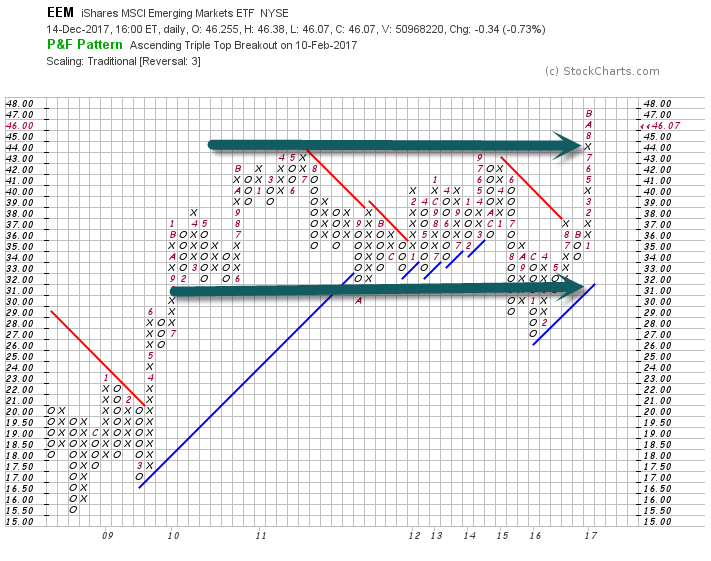

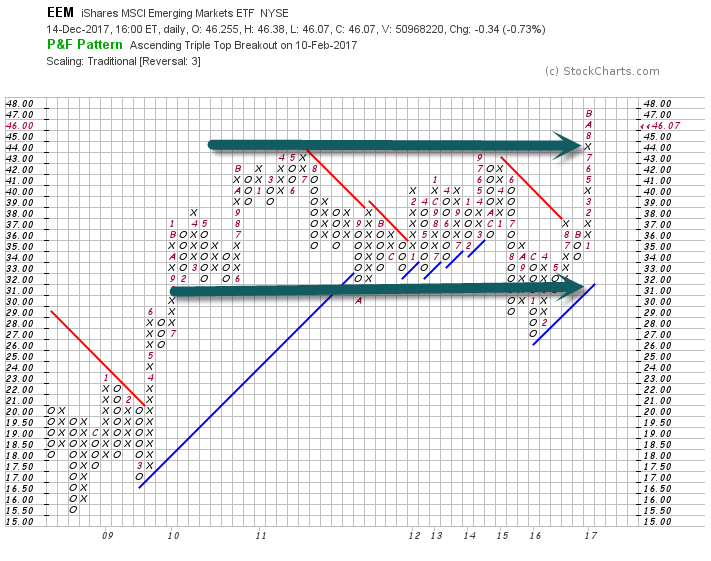

1.2017 Year of Emerging Markets Breakout

EEM ETF breaks out of 7 years sideways

Dec 11, 2017

The S&P 500 is up nearly 20% in 2017 after gaining 9.5% in 2016. The chart below highlights the annual price change of the S&P 500 since the current bull market began in 2009.

Contrarian investors might be prone to think that the market is likely to fall after a big up year, while momentum investors like to trade on strength one year turning into strength the next year. But if we look at the correlation between returns one year to the next, we find that there is none.

Below is a scatter chart showing the S&P 500’s move one year versus its move the next year. If the contrarian bet were true, you’d see a trend-line in the scatter chart that goes from the upper left to the lower right. If the momentum bet were true, you’d see a trend-line that goes from the lower left to the upper right. In reality, the trend line is flat as a pancake, meaning market returns one year have no correlation with market returns the next.

https://twitter.com/JackDamn/status/939878437925347329

Found at www.abnormalreturns.com

It’s the end of the world as we know it

It’s the end of the world as we know it

It’s the end of the world as we know it and I feel fine

REM “IT’S THE END OF THE WORLD”

Key Takeaways