Top 10 will be off and on this week due to travel.

1.Story of Weekend…Yield Curve Inverted Friday.

The yield curve inverted — here are 5 things investors need to knowBy William Watts

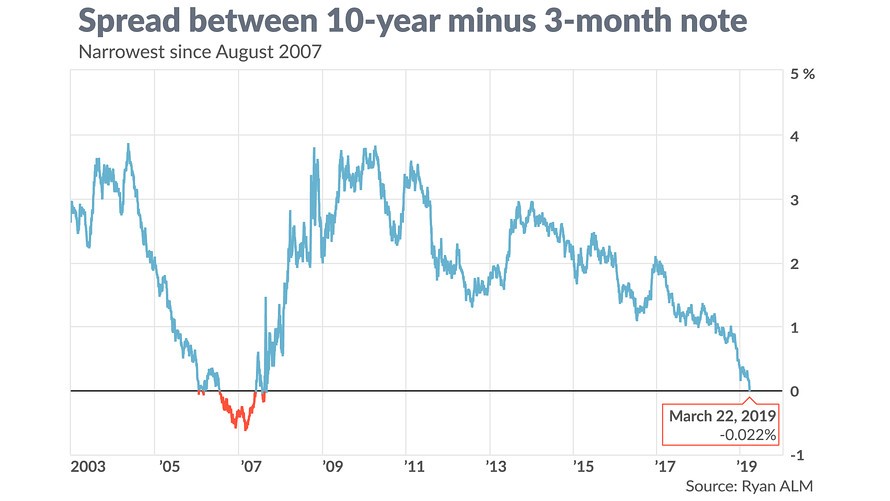

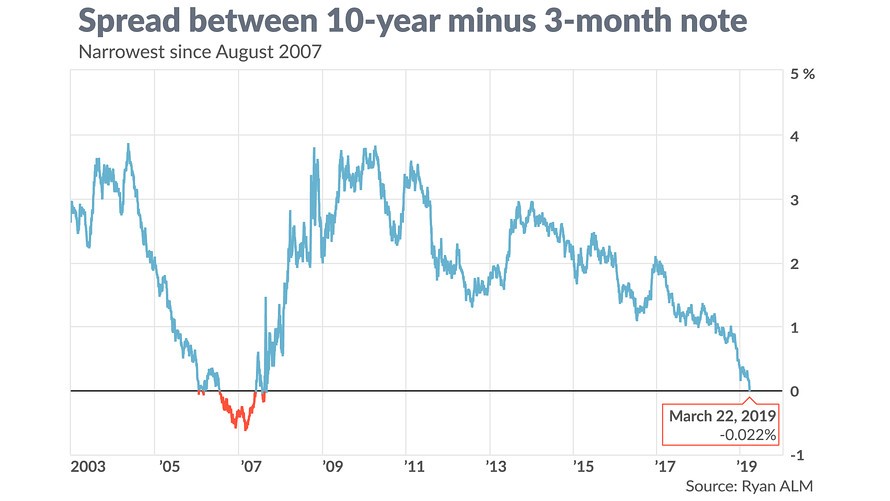

A closely watched measure of the yield curve briefly inverted Friday — with the yield on the 10-year Treasury note falling below the yield on the 3-month T-bill — and rattled the stock market by underlining investor worries over a potential recession.

But while that particular measure is indeed a reliable recession indicator, investors may be pushing the panic button prematurely. Here’s a look at what happened and what it might mean for financial markets.

What’s the yield curve?

The yield curve is a line plotting out yields across maturities. Typically, it slopes upward, with investors demanding more compensation to hold a note or bond for a longer period given the risk of inflation and other uncertainties. An inverted curve can be a source of concern for a variety of reasons: short-term rates could be running high because overly tight monetary policy is slowing the economy, or it could be that investor worries about future economic growth are stoking demand for safe, long-term Treasurys, pushing down long-term rates, note economists at the San Francisco Fed, who have led research into the relationship between the curve and the economy.

They noted in an August research paper that, historically, the causation “may have well gone both ways” and that “great caution is therefore warranted in interpreting the predictive evidence.”

What just happened?

The yield curve has been flattening for some time. On Friday, a global bond rally in the wake of weak eurozone economic data pulled down yields. The 10-year Treasury note yield TMUBMUSD10Y, +0.00% fell as low as 2.42% and remains off nearly 9 basis points at 2.45%, falling below the three-month T-bill yield at 2.455%.

Why does it matter?

The 3-month/10-year version that is the most reliable signal of future recession, according to researchers at the San Francisco Fed. Inversions of that spread have preceded each of the past seven recessions, including the 2007-2009 contraction, according to the Cleveland Fed. They say it’s offered only two false positives — an inversion in late 1966 and a “very flat” curve in late 1998.

Is recession imminent?

A recession isn’t a certainty. Some economists have argued that the aftermath of quantitative easing measures that saw global central banks snap up government bonds may have robbed inversions of their reliability as a predictor. Since so many Treasurys are held by central banks, the yield can no longer be seen as market-driven, economist Ryan Sweet of Moody’s Analytics, recently told MarketWatch’s Rex Nutting.

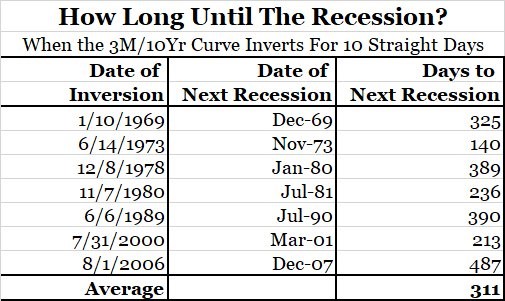

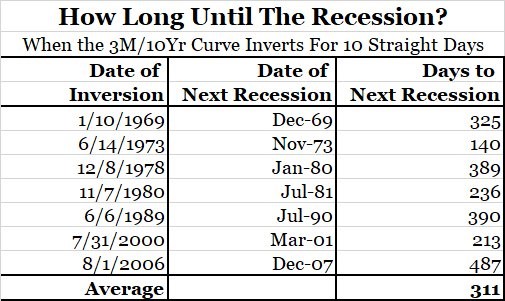

Meanwhile, recessions in the past have typically came around a year after an inversion occurred. Data from Bianco Research shows that the 3-month/10-year curve has inverted for 10 straight days six or more times in the last 50 years, with a recession following, on average, 311 days later

Replying to @alexandrascaggs

Per @biancoresearch the 10-year/3-month curve has inverted for 10 consecutive days or more 6 times in the last 50 years. On each of those occasions a recession has followed (on average 311 days later).

Bianco Research@biancoresearch

https://www.marketwatch.com/story/the-yield-curve-inverted-here-are-5-things-investors-need-to-know-2019-03-22?mod=mw_theo_homepage

Continue reading →