1.Bonds Gain $1.8Trillion in Value Q1

Holger Zschaepitz @Schuldensuehner Mar 30

Mad world. While Stocks have gained $9tn in mkt cap, global bonds have gained a whopping $1.8tn in value in Q1 2019 as cheap money from the central banks have inflated all assets. Part of this crazy world is that bonds in a volume of $11tn have negative yields.

https://twitter.com/Schuldensuehner

2.Why Goldman’s Clients Are Obsessing Over “The Jaws”

by Tyler Durden

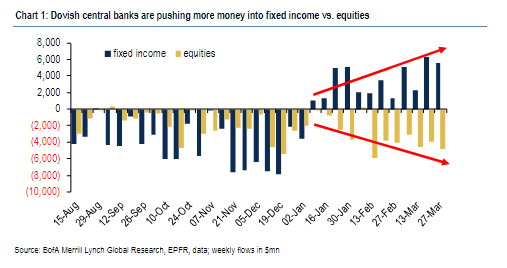

There have been two conflicting themes in the market so far in 2019: the first one has been the relentless selling by equity investors since the start of the new year despite the market’s remarkable surge in 2019, offset by buying of fixed income securities in a scramble to lock up yield ahead of potential rate cuts and/or QE by the Fed later in 2019 or in 2020 (most recently discussed here).

The second theme, which is closely tied to the first, has been the market’s so-called “jaws”, where stocks have moved sharply higher while yields have tumbled to multi-year lows, sparking investor confusion: is the bond market right in anticipating a period of acute deflation and/or recession, or is it wrong and stocks, which are less than 5% below their all-time highs, correct in their optimistic outlook.

As Goldman’s David Kostin writes, it is this decoupling that is dominating client discussions:

Ten-year US Treasury yields have plunged to 2.4%. From an investor perspective, stable equity prices coupled with falling interest rates means a wider earnings yield gap and implies a more attractive relative value for stocks assuming the economy does not fall into recession.

As Kostin recounts, one client told the chief Goldman equity strategist, that it all really “depends from which direction the jaws close – through higher rates or via lower equity prices.”

That’s the question that the bank tries to answer in its latest US Weekly Kickstart report.

https://www.zerohedge.com/news/2019-03-31/why-goldmans-clients-are-obsessing-over-jaws

3.Global PMI Longest Losing Streak Since 2007

Liz Ann Sonders-Schwab

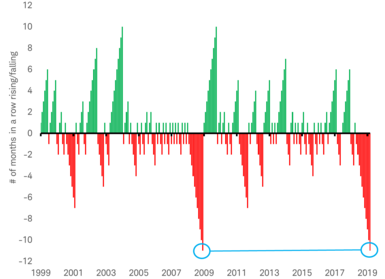

Growth concerns aren’t isolated to the United States; in fact, they appear to be exacerbated when looking past the border. Last week’s preliminary “flash” purchasing managers’ index (PMI) pointed to further economic weakness from many countries around the world. This makes it likely that the global manufacturing PMI will fall for the month of March to its lowest level in nearly three years when it is reported next week. March could be the 11th month in a row of declines for this indicator—a streak not seen since the last global recession in 2008.

Longest losing global PMI streak since Global Financial Crisis?

The weakening global economy is being highlighted by the inversion of the U.S. yield curve, with long-term bond yields continuing to fall. Over the past 50 years, U.S. yield curve inversions came about one year before each global recession. More significantly, they came close to the cyclical peak in international stocks, as measured by the MSCI EAFE Index.

https://www.schwab.com/resource-center/insights/content/market-perspective

4.What Happen When Futures Launched that Allowed Investors to Short Bitcoin.

That Didn’t Last Long: Cboe Bails on Bitcoin Futures Trading

by Wolf Richter • Mar 18, 2019 • 47 Comments • Email to a friend

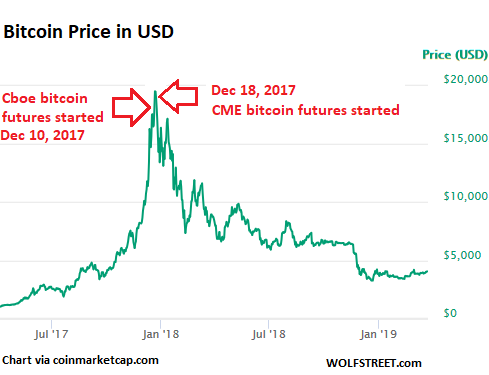

The incredibly impeccable timing of launching bitcoin futures at the very peak of the bubble.

When Cboe Global Markets – which owns the Chicago Board Options Exchange, BATS Global Markets, and others – started to let folks trade bitcoin futures contracts for the first time on December 10, 2017, it was greeted by deafening hoopla in the crypto community and in the crypto-bedazzled media. Within 24 hours bitcoin jumped by $2,000 to $17,382.

At the time, bitcoin was changing the world as we knew it, creating dreams by regular folks and their in-laws of becoming overnight billionaires or at least millionaires. Trading bitcoin futures contracts was just the next logical step in making bitcoin the mainstream millionaire-maker.

Then the Chicago Mercantile Exchange (CME) launched bitcoin futures on December 18, 2017. But on that day already the price of bitcoin had begun its epic collapse: When it comes to impeccable timing, few events can hold a candle to those two launch dates:

Futures trading can be used to bet on rising or falling prices, and this gave investors their first convenient chance to bet against the ludicrous run-up of bitcoin. Suddenly the bearish bets were the ones that made money.

https://wolfstreet.com/2019/03/18/didnt-last-long-cboe-bails-on-bitcoin-futures-trading/

5.2019 Line Up of Unicorns Set for IPOs….300 Total IPOs in Pipeline.

Large Raises Well Before IPOs

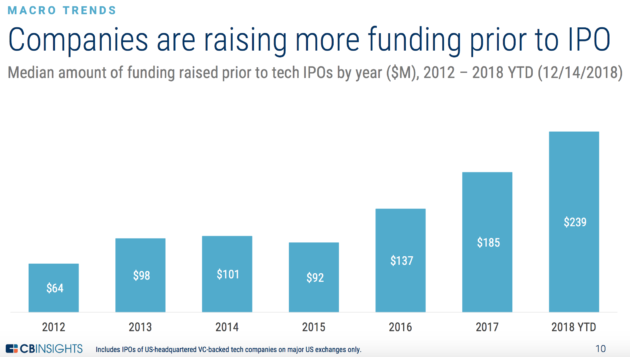

Over the past few years, many tech companies have held off on going public, opting instead to raise money from private investment firms that have plenty of cash to work with. CB Insights reported that the median time between first financing and public offering was 10.1 years for companies that had an IPO this year, up from 6.9 years in 2013. There were also nearly six times more $100 million-plus private financings than U.S. venture-backed tech IPOs in 2018.

6.Natural Gas Back to Lows.

Natural Gas Brief One Month Spike at End of 2018 But Back to Lows.

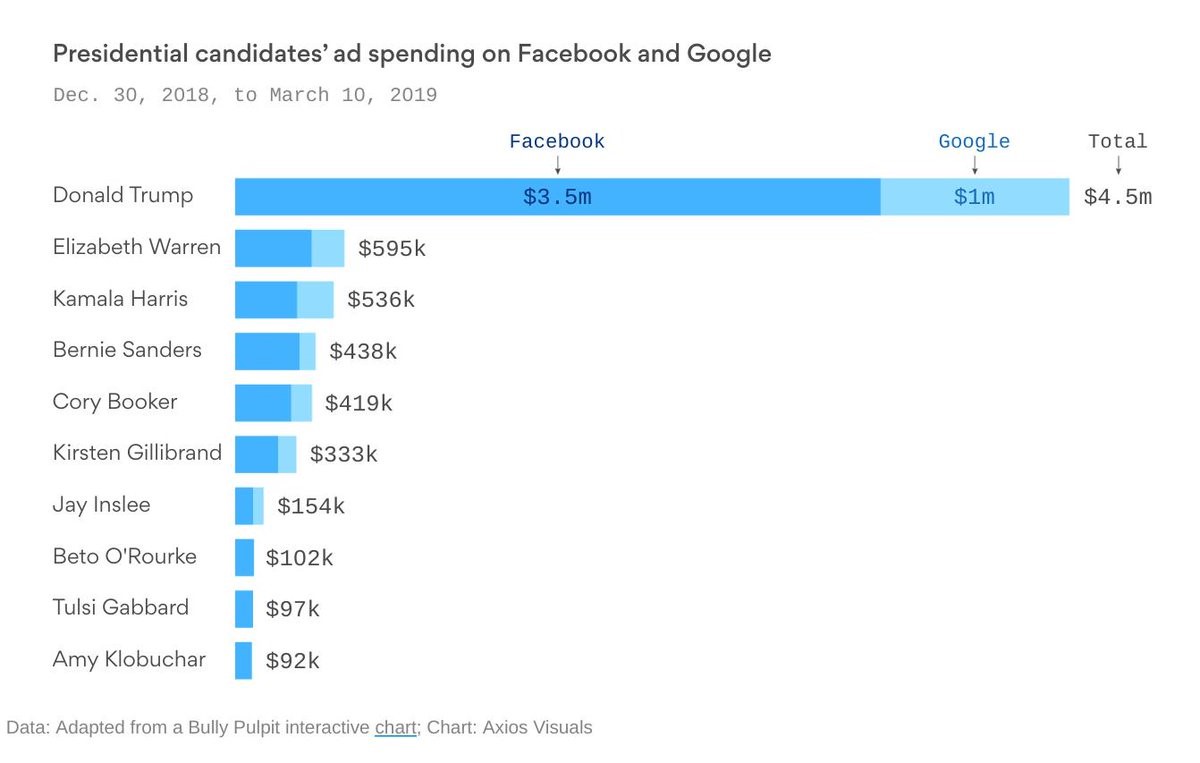

7. Trump Spending on Facebook

Found at Barry Ritholtz Blog

https://ritholtz.com/2019/03/10-sunday-reads-144/

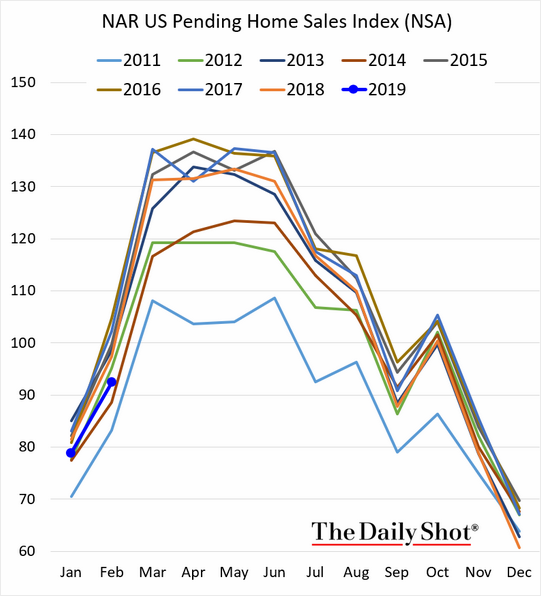

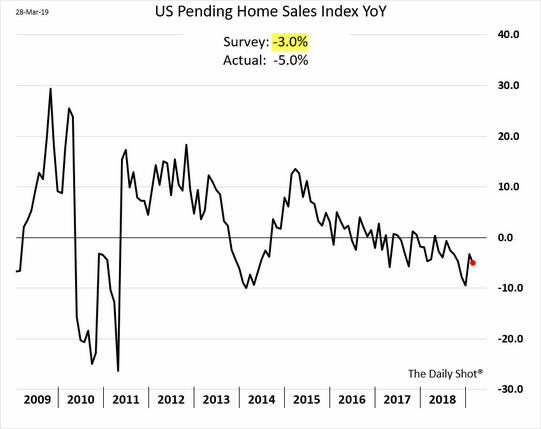

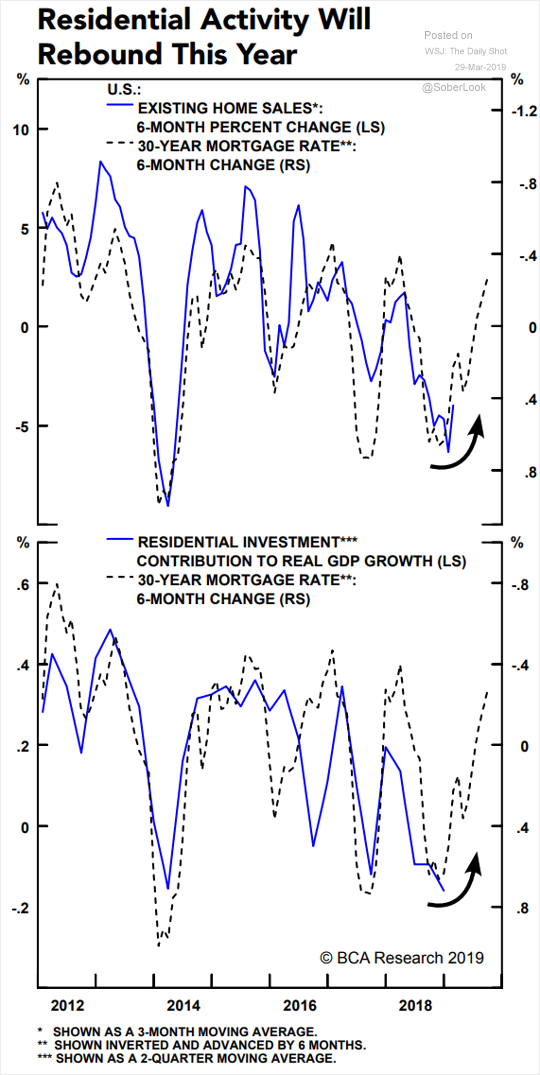

8.Pending Home Sales Break Thru 2012 Lows.

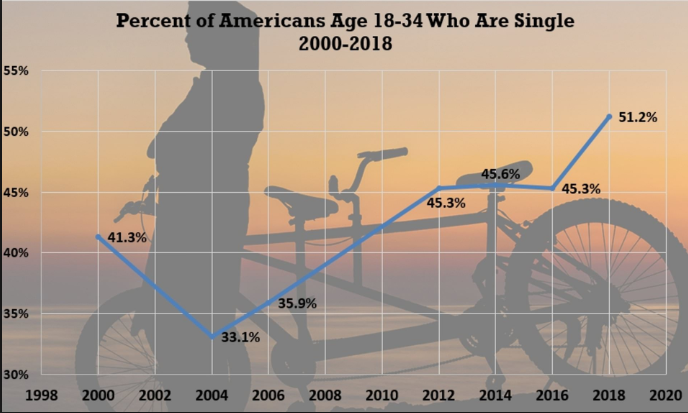

9. Most Singles Ever in U.S…One Big Factor for Home Buying.

10.Retailers Layoff 41,000 So Far in 2019….92% Increase.

“In the post-digital era, only the strong will survive. Darwin would love this,” said one retail analyst.

Shoppers enter a Payless Inc. store displaying a “Store Closing” sign in Shorewood, Illinois, on Feb. 20, 2019.Daniel Acker / Bloomberg via Getty Images file

March 29, 2019, 11:11 AM EDT

By Michael Cappetta

More than 41,000 people have lost their jobs in the retail industry so far this year — a 92 percent spike in layoffs since the same time last year, according to a new report.

And the layoffs continue to mount, with JCPenney announcing this week it would be closing 18 stores in addition to three previously announced closures, as part of a “standard annual review.”

Retail job cuts for January and February total 41,201, said research firm Challenger, Gray & Christmas in a new survey, including nationwide retailers such as Payless and Charlotte Russe.

“This is significant, and marks an acceleration of store closures and job cuts in the near term,” said Mark Hamrick, a senior economic analyst at Bankrate. “Retail is ground zero for seeing the shifts of change in our lives.”

Lifeway Christian Bookstores announced last week it would be closing the doors of all 170 brick and mortar stores, in a pivot to focusing on digital and e-commerce.

“The decision to close our local stores is a difficult one,” said Lifeway Chief Executive Officer Brad Waggoner. “While we had hoped to keep some stores open, current market projections show this is no longer a viable option.”

“In the post-digital era, only the strong will survive,” Ron Johnson, CEO of Enjoy, a retail technology company, told NBC News. “You need a great brand, a strong balance sheet, and a vision for experience that commences digitally. Darwin would love this.”

Johnson previously worked as head of retail for Apple and opened the first Apple Store and scaled it out to 1,200 locations. He then went on to serve as the CEO of JCPenney, but has no connection to this week’s store closure notice.