1.Gas Prices Spike at Pump.

Unleaded Gas Chart….Still well below 2018 highs.

2.Seasonality in Gas Prices Begins….No Congestion for Gas Prices

Mar 26, 2019

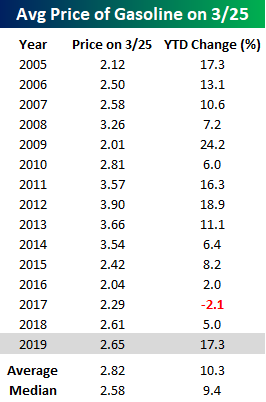

The road higher for gas prices has been as clear as can be of late as prices have been on a tear. According to AAA, the national average price of a gallon of gas has risen 17.3% YTD through 3/25. That’s a full seven percentage points above the average YTD gain for this time of year and the largest YTD increase through 3/25 since 2012. Even after the gains, though, the average price is only four cents higher now than it was a year ago. What’s ironic about this year’s gains in prices is that they are coming at a time when inflation is just about the last worry on anyone’s mind.

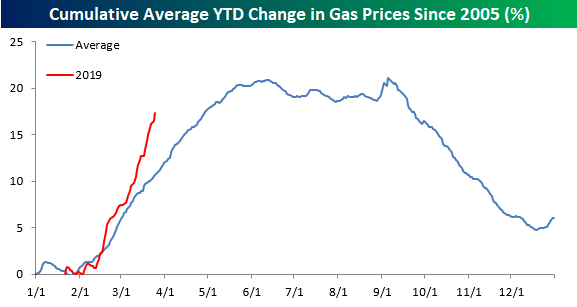

The chart below compares the change in gas prices this year to an annual composite chart of prices going back to 2005. While prices are higher this year, and the move has been much larger than normal, we would note that prices typically rise at this time of year. They also typically continue to rise right up until Memorial Day when the summer driving season kicks off. For most of the summer, prices then plateau and then start to rapidly decline heading into year-end.

One reason behind the much larger than average increase in gas prices this year is that lately, prices have barely gone down- not even for a day here and there. Check out the chart below. Over the last 42 calendar days, the national average price of gasoline hasn’t declined once. Going back to 2004, there have only been two other streaks that are longer (2009 and 2011), and if prices don’t decline today or tomorrow, the current streak will move into a tie for second.

https://www.bespokepremium.com/think-big-blog/no-congestion-for-gas-prices/

3.Reduction in Earnings Revisions Historically Not the End of Bull Market.

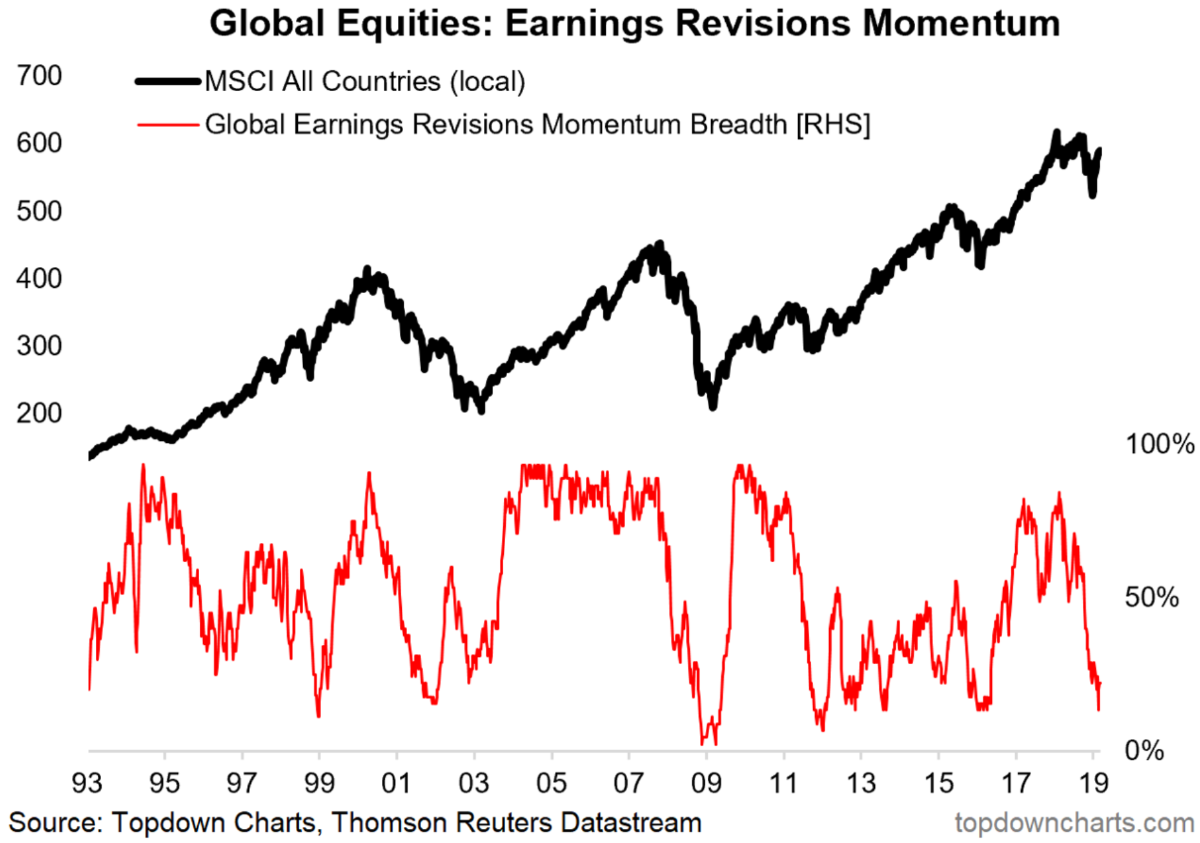

Global Equities – Earnings Revisions Momentum: I’ve seen a few charts floating around on global earnings revisions, and this is certainly something we track. As you might expect, we take a unique angle on this data – constructing a breadth indicator across 45 countries. As you can see with the chart there has indeed been a collapse in earnings revisions, but historically this has not necessarily been a bad thing, and indeed often times can actually be a contrarian bullish signal. (source)

4.Where developed market earnings may be headed-Blackrock

Written by Elga Bartsch, PhD

Elga explains what our new tracker of developed market earnings is telling us, and why our view on earnings is gloomier than the markets.

We have created a new tool for tracking developed market (DM) earnings. Our new earnings tracker leverages our existing suite of macro indicators, including our Growth and Inflation GPS, trade nowcast and additional inputs, as we write in our Macro and market perspectives Profit margins under pressure.

The chart below shows trailing 12-month earnings growth (based on EBITDA–earnings before interest tax depreciation and amortization) for the MSCI World and our new earnings tracker. Our earnings tracker suggests earnings growth should drop to zero year-on-year by the middle of the year–and points to some stagnation in DM earnings this year.

Most of the inputs into our tracker are pointing down. Our Growth GPS is ticking lower, while the proxy for unit labor costs has been rising as nominal wage growth has outstripped productivity. Yet the biggest driver of the G3 earnings retrenchment is our global trade tracker–DM earnings are sensitive to the global manufacturing and trade cycle.

What would it take for our earnings tracker to rise?

We would need to see a rebound in annualized global trade growth to about 3.5% from current levels near -5%. We believe this is possible. A very real upside risk to our outlook is that stimulus in China and Europe could spark an upturn in the global economy in the second half of the year. Any such rebound in global growth could more than offset the late-cycle drop in margins.

Our view is gloomier than the market’s. Our estimates for U.S. profit margins and nominal growth–implied by our Growth GPS–point to a 1% drop in national accounts data profits in 2019 and just below zero for S&P 500 pre-tax earnings. The calendar effects of 2018’s earnings acceleration mean that earnings growth near zero this year would require a few quarters of quarterly declines.

What earnings growth is priced in? The consensus S&P earnings growth forecast for 2019 is 4.4%: based on current price-to-earnings ratios and our estimate of the equity risk premium, we see the market is pricing in real earnings growth just below 3% (all according to March 2018 Thomson Reuters data).

We focus on the U.S. because it has led the current business cycle. There is evidence that through past cycles, the U.S. data have led DM profits and margin data too. And other countries don’t have the same detailed national accounts data.

Adding it up

Equity markets do not appear to be pricing in an earnings recession, and debt issued by highly leveraged companies could be particularly exposed. At face value, entering the late-cycle phase and an outright earnings recession appears a difficult backdrop for risk assets. Yet late-cycle stages and earnings recessions have historically been bullish for equities–as long as they don’t coincide with a full-blown recession.

https://www.blackrockblog.com/2019/03/22/developed-market-earnings/

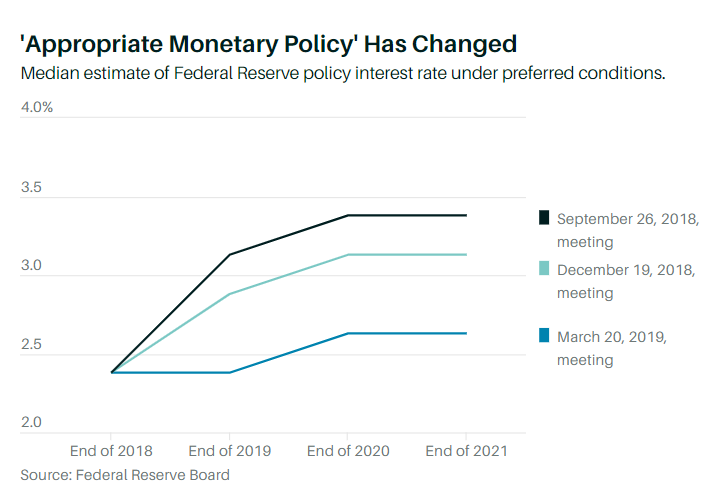

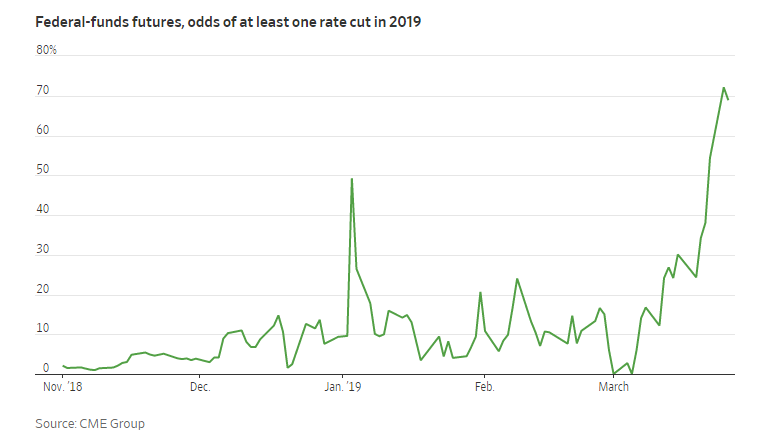

5.Sinking Estimates of Interest Rates.

The Fed Admits the Markets Were Right By Matthew C. Klein

https://www.barrons.com/articles/the-fed-admits-the-markets-were-right-51553283080?mod=hp_DAY_2

Global Bond Yields Slide to Fresh Lows Following ECB CommentsYields have slipped as central banks have signaled they are willing to hold rates low for significantly longer than expected

6.Watching 30 Year

Broke thru 2018 levels….Heading to 2017 levels that held 3x-see arrow on chart.

7.Drop in Rates Put Utilities Back in Lead.

XLU Utility ETF vs. S&P 500 1 year….Almost 10% Outperformance.

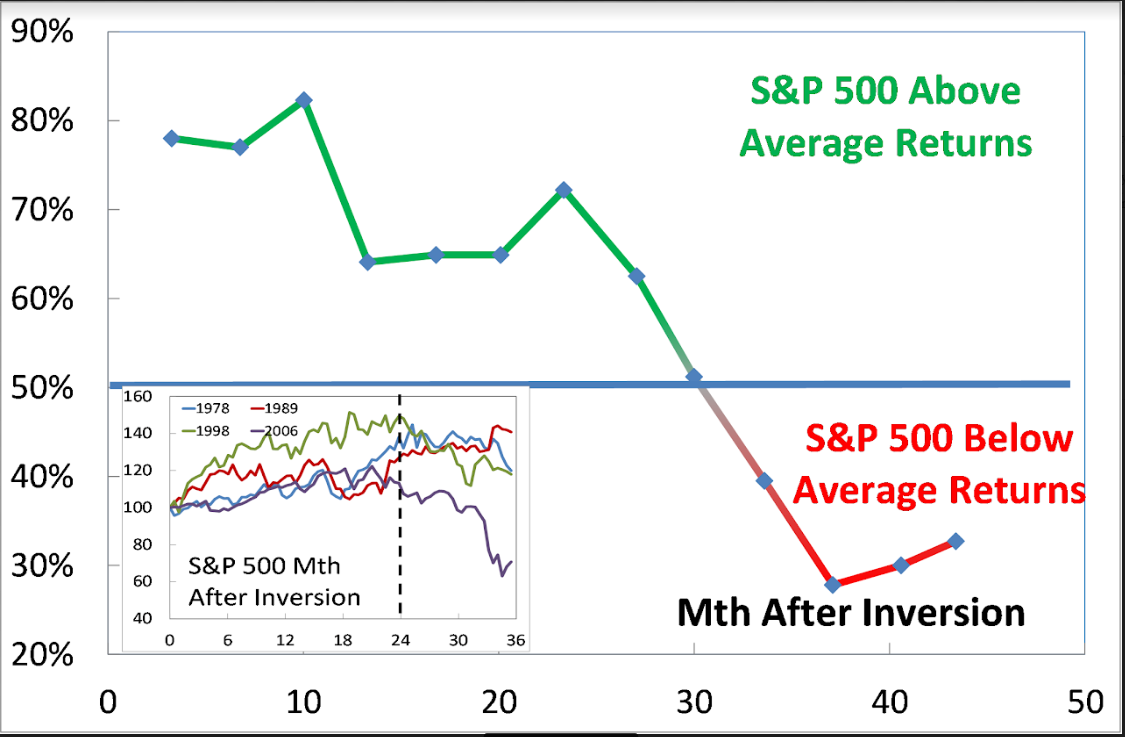

8.More on Yield Curve Inversion.

Stock market often produces strongest returns after yield curve inverts: JPM’s Kolanovic

William Watts

One of Wall Street’s top quantitative analysts was the latest to weigh in on the inversion of the yield curve, reminding investors Tuesday that the phenomenon, while viewed as a reliable recession indicator, also tends to signal a period of strong returns for the stock market.

“Historically, equity markets tended to produce some of the strongest returns in the months and quarters following an inversion. Only after [around] 30 months does the S&P 500 return drop below average,” said Marko Kolanovic, global head of macro quantitative and derivatives research at J.P. Morgan, in a Tuesday note (see chart below).

Stocks sold off sharply on Friday after the yield curve inverted. Or more specifically, a sensitive measure of the yield curve — the spread between the yield on the 3-month Treasury bill TMUBMUSD03M, -0.22% and the 10-year Treasury note TMUBMUSD10Y, -0.22% — turned negative.

The yield curve typically slopes upward. An inverted curve is often viewed as a sign investors see slower growth ahead, warranting lower rates. Moreover, inversions of the yield curve have proven to be a reliable recession indicator, preceding contractions by a year or more. Researchers at the San Francisco Fed say the 3-month/10-year curve is the most reliable indicator, while Cleveland Fed researchers note that inversions of that measure have preceded the past seven recessions with only two false positives — an inversion in late 1966 and a very flat curve in late 1998.

But while the curve’s move into inversion territory appeared to spark selling, market watchers have also issued numerous reminders that such moves typically don’t spell immediate doom for equity markets. In a Monday note, Tony Dwyer, chief U.S. markets strategist at Canaccord Genuity, noted that while an inversion is a recession predictor, “it is a better buy signal than pointing to a time to get sustainably defensive.”

In his note, Kolanovic looked at the path markets took after the first instances of a 10-year-3-month inversion in 1978, 1989, 1998 and 2006. He acknowledged that it’s impossible to derive reliable statistics from such a small sample, but said he believed the inversions showed a strong similarity because they are a “result of a specific setup of monetary policy and the economic cycle, and hence are likely to produce a similar response by investors and central bankers.”

Here’s his outline of that response:

|

Kolanovic said the current inversion is similar to past episodes in that Fed rate hikes and a growth slowdown have been key drivers of the inversion. Sticking to script, the Fed has stopped hiking and now plans to put its balance-sheet runoff on hold.

But he also noted differences. These include the pressure on the 10-year Treasury yield from zero or negative yields outside the U.S., particularly Germany and Japan. Also, China is a key driver of the global economic cycle, which means monetary and fiscal policy decisions by Beijing are likely to have more influence on the cycle than the Fed, he said.

He also noted that knowledge of the pattern around inversions is well known, which means it could “play out quicker or slower this time, but the time frame should be in quarters or years (rather than months).

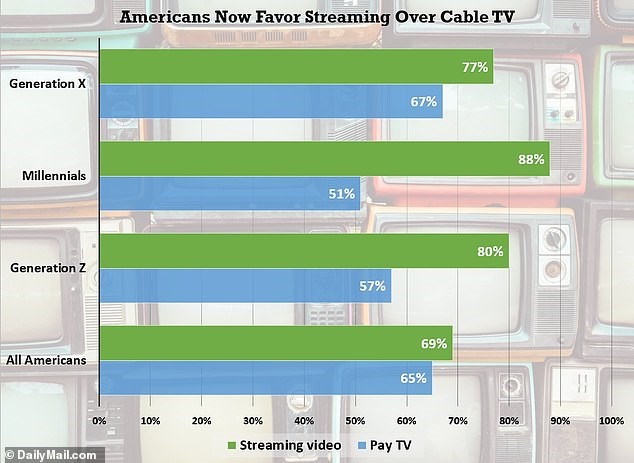

9.Watch this: More Americans now pay for streaming video content than cable television

survey finds

- Some 69% of Americans subscribe to at least one video streaming service, slightly more than the 65% who pay for cable TV, according to a new survey

- The average consumer pays for three streaming services, and Millennials were the generation most likely to use streaming, with 88% subscribing to at least one

- However, many Americans are frustrated with available content options – 47% had to pay for multiple subscriptions to see everything they want to watch

10.“If Time is Money, Money Can Also Buy Happier Time.”

- Published on March 17, 2019

Gretchen Rubin

Interview: Ashley Whillans

Ashley Whillans is a Harvard Business School professor and behavioral scientist whose research explores the connection between how we spend time to how we experience happiness. Her recent Harvard Business Review series “Time Poor and Unhappy” looks at why we feel so starved for time today when, in fact, we have more discretionary hours than ever before.

I couldn’t wait to talk to Ashley about happiness, habits, and productivity.

Gretchen: What’s a simple activity or habit that consistently makes you happier, healthier, more productive, or more creative?

Ashley: My colleagues and I have conducted survey and experimental research with nearly 100,000 working adults from around the world. Across studies, we find that the happiest people prioritize time over money. People who are willing to give up money to gain more free time—such as by working fewer hours or paying to outsource disliked tasks—experience more fulfilling social relationships, more satisfying careers, and more joy. Overall, people who prioritize time over money live happier lives. Importantly, the benefits of choosing time over money emerge for the wealthy and less wealthy alike. Even spending as little as $40 to save time can significantly boost happiness and reduce stress. Our research suggests that even small actions—like savoring our meals, engaging in 30 minutes of exercise, or having a 5-minute conversation with a colleague (vs. focusing on work) can significantly shape happiness, more than most of us predict.

Gretchen: You’ve done fascinating research. What has surprised or intrigued you—or your readers—most?

Ashley: Over and over, I find that prioritizing time over money increases happiness. Despite this, most people continue striving to make more money. For example, in one survey, only 48 percent of respondents reported that they would rather have more time than more money. Even the majority of people who were most pressed for time—parents with full-time jobs and young children at home—shared this preference for money over time. In another study, the very wealthy (i.e., individuals with over 3 million dollars of liquid wealth sitting in the bank) did not always prioritize time over money either. These data suggest that a key challenge to reducing feelings of time stress and increasing happiness for a broad range of the population is psychological: most people erroneously believe that wealth will make our lives better. Research shows that once people make more than enough to meet their basic needs, additional money does not reliably promote greater happiness. Yet over and over, our choices do not reflect this reality.

Gretchen: Have you ever been hit by a lightning bolt, where you made a major change very suddenly, as a consequence of reading a book, a conversation with a friend, a milestone birthday, a health scare, etc.?

Ashley: As a happiness researcher, I should know better than to choose money over time. Yet, admittedly, like most people, I make these trade-offs suboptimally. I worked for an hour during my wedding reception and I can often be found typing on my laptop or taking work meetings in spa locker rooms. However, a recent experience solidified for me the importance of focusing on time over money. Two weeks ago, one of my closest friends from graduate school shared some devastating news: Her 32-year-old, fit, healthy partner was dying. Out of nowhere, her partner was diagnosed with terminal metastatic cancer. He was given three months to live. In her fundraising page my friend wrote, “We thought we had all the time in the world.” Today, my friend and her boyfriend ‘immediately-turned-husband’ are trying to savor every second of their time together before the inevitable. As a 30-year old myself, who has focused most of the last 10 years on my career (often at the expense of my sleep, my health, and my personal relationships), this experience was a wake-up call. None of us know how much time we have left, and we cannot take money with us. I have studied the importance of prioritizing time for years. And now, I have started truly trying to live this priority.

Gretchen: Is there a particular motto or saying that you’ve found very helpful? (e.g., I remind myself to “Be Gretchen.”)

Ashley: Benjamin Franklin wrote “Time is Money.” My personal mantra is a play on this familiar quote: “If Time is Money, Money Can Also Buy Happier Time.”

Gretchen: Has a book ever changed your life—if so, which one and why?

Ashley: The book that changed my life is Dan Gilbert’s Stumbling on Happiness. This book introduced me to the scientific study of well-being. Dan Gilbert argues that we often mispredict what will make us happy. His persuasive arguments and energetic, insightful and witty writing inspired me to become a social scientist. Specifically, this book solidified my interest in conducting research to learn how to successfully nudge all of us to spend our time and money in ways that are most likely to promote happiness.

https://www.linkedin.com/pulse/time-money-can-also-buy-happier-gretchen-rubin/

Found at Abnormal Returns Blog www.abnormalreturns.com