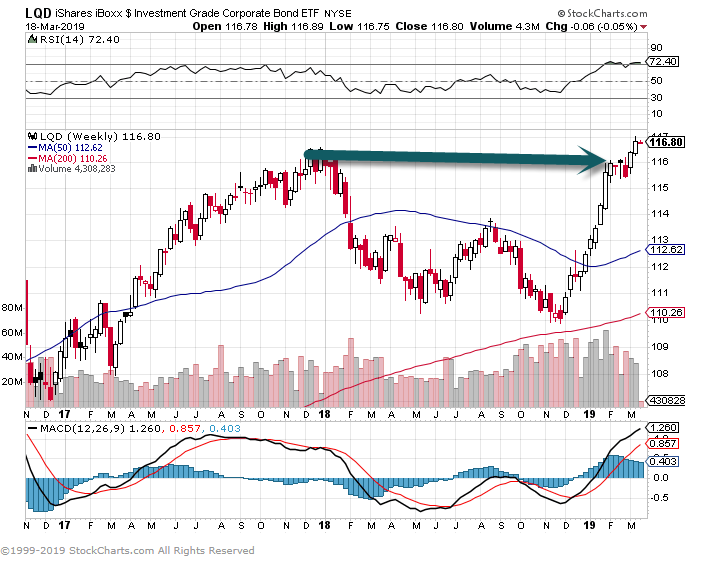

1.Some Asset Classes Hitting New Highs That Were Under Duress During FED Rate Raises.

3-7 Year Treasury

LQD-Investment Grade Bonds.

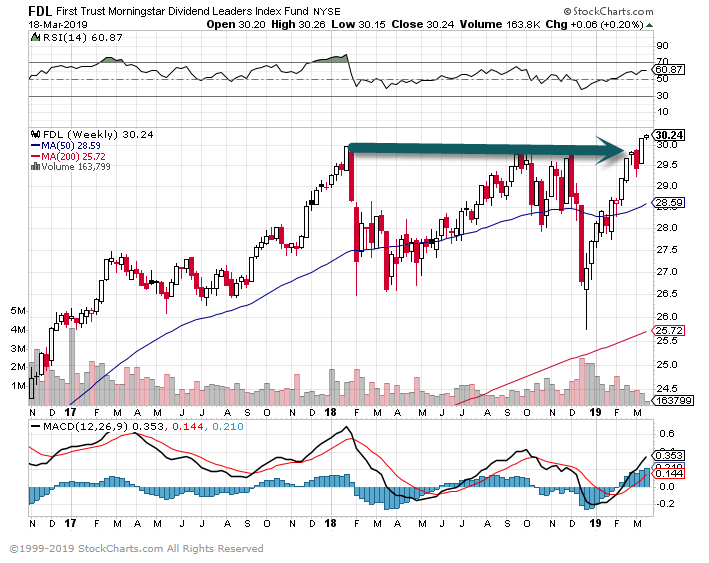

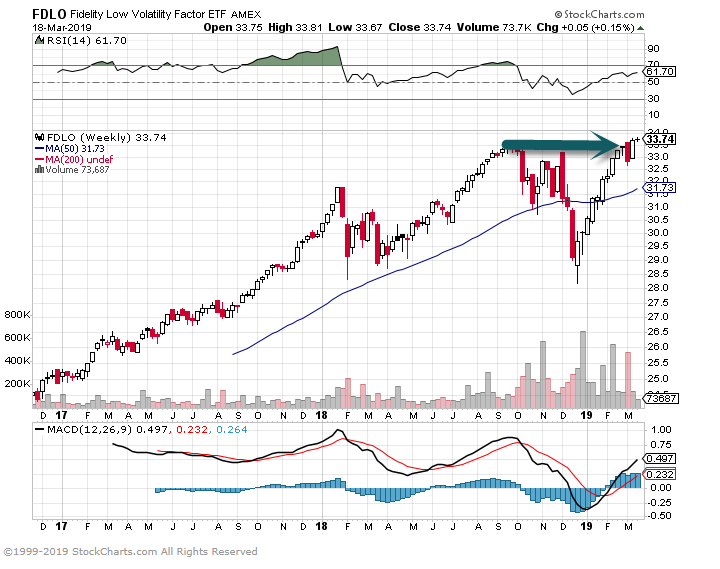

2.Equity New Highs…Dividend Leaders and Low Vol.

FDL-Dividend Leaders ETF New Highs.

Low Volatility ETF.

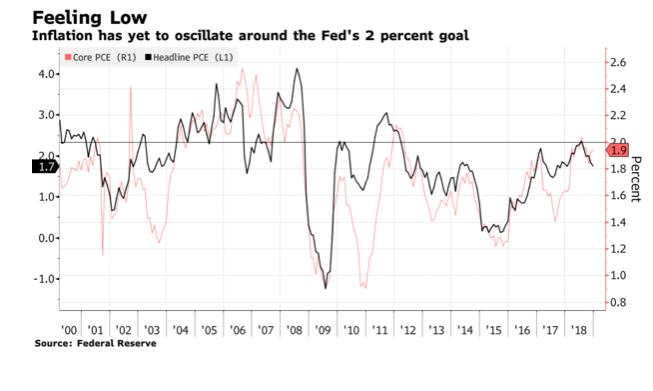

3.Inflation Has Yet to Oscillate Around the FED’s 2% Goal

Regardless, there’s a real chance that price gains come in below 2 percent again this year, making it less likely that the Fed will achieve its symmetric inflation goal on a sustained basis this economic cycle — potentially bad news for the central bank’s inflation-stabilizing credibility.

Rate-Hike Patience May Leave Fed in a Bind If Inflation Softens By Jeanna Smialek

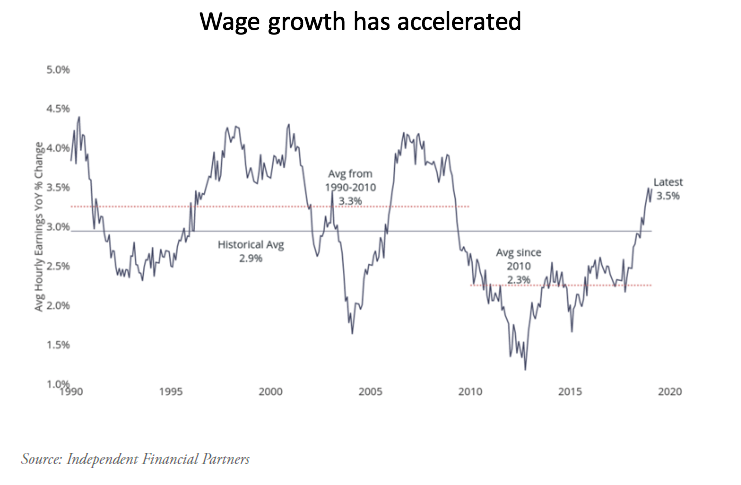

4.Historical Wage Growth.

For instance, one statistic that is showing consistent signs of “good” inflationary growth is that of wages. According to the Bureau of Labor Statistics, average hourly earnings are up 3.5% from a year ago. This is the fastest growth rate in earnings during this cycle, and well above the average annualized growth rate of 2.3%. Perhaps this data point is inflationary, but is it a problem if consumers are earning more money and is it something that the Federal Reserve should tighten the reins on? In our view, no, it is a healthy type of inflation. If it eventually leads to a broad uptick in prices for goods and services, then the Fed can tighten rates in response at that point in time, rather than trying to pre-empt it.

Tim Hussar Wharton Hill

https://www.whartonhillia.com/viewpoints/2019/3/15/viewpoints

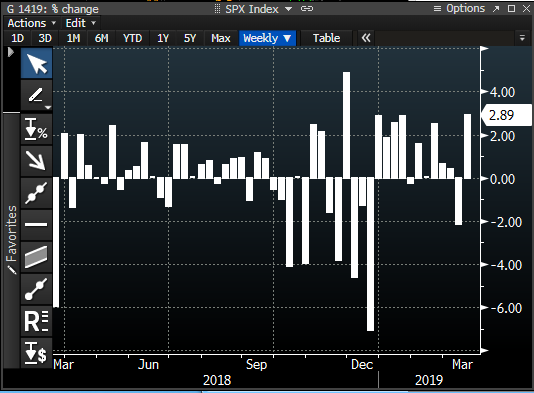

5. Last week the Spoos gained nearly 3%, their best week since last November, but The week after March’s option expiration week is bearish for DJIA, S&P 500 and NASDAQ. S&P 500 is weakest, down seven years straight, says AlmanacTrader

From Dave Lutz at Jones.

6.2017 82,250 Jobs Reshored Back to U.S.

Such “reshoring” by U.S. companies is on the rise. More jobs were gained through reshoring than lost to offshoring in 2016, for the first time since 1970, says the nonprofit Reshoring Initiative. In 2017, employers announced decisions to bring a record 82,250 jobs back, up from just 3,221 in 2010. Preliminary numbers for 2018 show that reshoring announcements slowed last year, to 53,420—possibly a result of “uncertainty from the trade wars, dysfunction in Washington, and the dollar being up a little bit,” says the nonprofit’s founder, Harry Moser. But he calls the trend powerful and persistent. “It’s not just a trickle here or there.”

How Investors Should Navigate Globalization’s Decline

By Avi Salzman andNicholas Jasinski

https://www.barrons.com/this_week?mod=BOL_HAMNAV

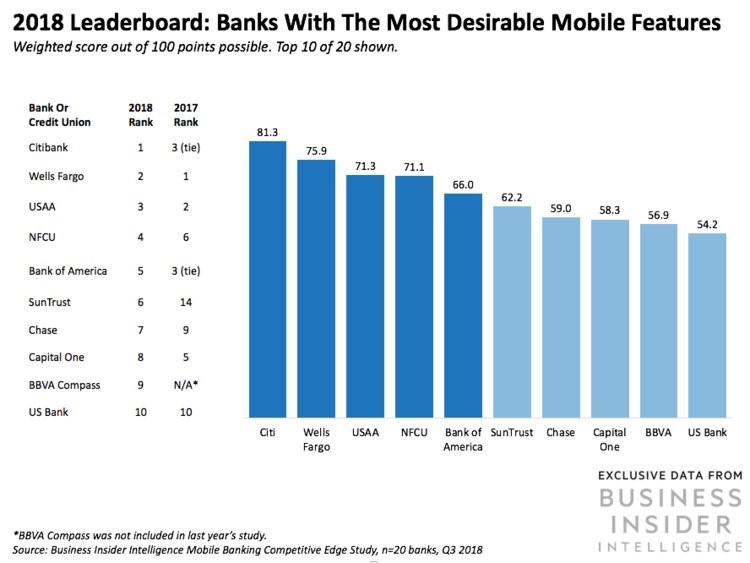

7. These are the top 20 US banks ranked by the mobile banking features consumers value most

Dec. 3, 2018, 9:33 AM

In Business Insider Intelligence’s second annual Mobile Banking Competitive Edge study, 64% of mobile banking users said that they would research a bank’s mobile banking capabilities before opening an account with them. And 61% said that they would switch banks if their bank offered a poor mobile banking experience.

https://www.businessinsider.com/the-mobile-banking-competitive-edge-report-2018-11

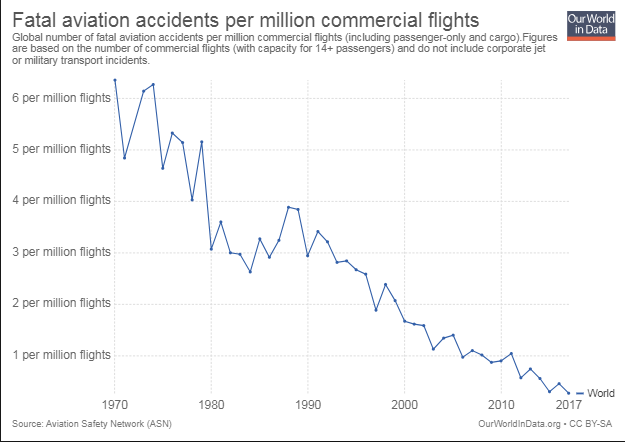

8.Plummeting Aviation Accidents…2017 was Record Low for Fatalities.

https://ourworldindata.org/grapher/fatal-accidents-per-million-flights?time=1970..2017

9.5 Seriously Stunning Facts About Higher Education in America

Research disturbs commonly held assumptions about college. Rob Henderson

Recently, some rich people and well-known celebrities got caughtcheating to get their kids into elite universities. They bribed sportscoaches, cheated the SAT, and fabricated phony credentials.

Beyond the scams of the rich and famous, though, there are other surprising facts about college in America. Facts closer to our everyday experiences. Here are five.

- 4 out of 10 college students fail to complete their degrees. According to researchfrom the National Student Clearinghouse Research Center, only 58-percent of students manage to complete their degree programs within six years. Bill Gates has called this figure “tragic.” He has written, “Based on the latest college completion trends, only about half of all those students will leave college with a diploma. The rest — most of them low-income, first-generation, and minority students — will not finish a degree. They’ll drop out.” Sadly, community college figures are even more dismal. A recent studyin California found that 70-percent of community college students fail out.

- Attending an elite university doesn’tboost income. What matters is the ability to get in. Economists Stacy Dale and Alan B. Krueger looked at two groups, totaling about 19,000 students. One group gained admission into elite universities, attended, and graduated. Another group also gained admission to elite universities. But this group, rather than attending the elite schools, chose to attend less selective schools instead. More than 20 years after they graduated, Dale and Krueger measured their incomes. They found no difference. A student who got into Princeton but attended Penn State made as much as a student who got into, and attended, Princeton.

- Graduating from a non-selective college doesn’t boost income. In a bookabout social class in America, researchers looked at how differently ranked colleges affected earnings. They found that students who attended the country’s most elite institutions earned about 84-percent more on average compared to those who had not graduated from college. Graduates of “somewhat selective” private colleges and “leading state universities” earned about 52-percent more than non-graduates. However, they found “no income advantage” for those who graduated from a “nonselective” college compared to those who did not attend college.

- A person with average academic ability has a higher than 50-percent chance of dropping out of college. For the general population, the average IQ score is 100. Research has foundthat, among white American college students, those with a 105 IQ score have a 50-percent chance of dropping out of college. They also report that the average IQ of a college graduate is about 114. But they also show that having a high IQ is no guarantee of graduating. Those who score 130 (very rare; about 2-percent of the population) still have a 10-percent dropout rate.

- SAT coachingand test prep aren’t important. Many people have heard that private SAT prep courses and private tutoring produce substantial gains. Test prep companies tout that their users receive boosts of 100 points or more after only a few weeks of study. Research doesn’t support this. A meta-analysis from researchers at Harvard found that, on average, SAT coaching produces a 10-point gain. They conclude that this gain is “too small to be practically important.” More recent research from Stanford supports this. They found that students receive an 11-15 point gain from SAT coaching, which roughly corresponds to getting 1 or 2 additional questions correct. Perhaps even more surprising, a study from 2015 found that private tutoring has no effect on SAT gains. As they put it, “our hypothesis that more elite forms of test prep (private tutor) would predict higher SAT scores was not confirmed. The only form of that prep actually associated with higher SAT scores was participation in a private test prep course, which translated into an 11-point gain on the SAT when compared to students with no preparation.”

The Purpose of College

The economist Bryan Caplan has written a provocative book titled The Case Against Education. According to Caplan, the value of college isn’t in what you learn. It’s in getting the degree. “Teachers have a foolproof way to make their students cheer: cancel class…such jubilation is bizarre. Since you go to school to acquire skills, a teacher who cancels class rips you off.” Unless the purpose of attending college isn’t to obtain skills. Maybe the purpose is actually just to obtain the degree.

Or, suppose you had a choice: attend college for 4 years, gain the skills, but have no degree at the end. Or get a degree right now, fully accredited, but not attend a single class. Caplan would not be surprised if you selected the second option. This suggests that education is less valuable than a degree. At least for earnings.

In sum, there are many odd facts about college that upset our commonly held assumptions. Before you pursue a new educational goal, it is worth looking into these research findings.

10.4 Startup Myths Holding You Back From Growth

March 19, 2019/Tamara Loehr/No Comments

@nina_p_v via Twenty20

While women-owned small businesses are still a minority, the numbers are set to rise with more and more women starting up on their own.

Related: How Women Are Rising in Business

Why do so many women start their own businesses? For many of us, the reason is work-life balance. We believe that being our own boss will mean more flexibility and the freedom to order our lives the way we want to.

The reality is that a small operation can be incredibly demanding in its early stages, and more than half of small businesses fail in the first three years. It’s tempting to keep your startup small and “manageable,” but businesses with a less than $50,000 annual turnover have the lowest survival rate, while those turning over $10 million or more have a much healthier chance of survival.

While growth can be fear inducing, we want to see more women entrepreneurs breaking through that seven- and eight-figure ceiling—and enjoy the perks of being your own boss, as well.

Don’t let these myths hold you back from playing a bigger game:

Myth #1: Staying small means staying flexible.

Many female entrepreneurs are motivated by flexibility when they decide to become their own boss. Then they discover the reality that running a business is hard at any size. Early in my career, I felt stuck in my business because all our clients wanted to deal with me personally; I believed that growing it bigger would make it even harder.

It seems counterintuitive that it would get easier as it grows, but while the business is just you (and a few employees), it relies on you being available and involved 24/7. Once you’ve grown and trained a reliable team to implement what you’ve developed, you’ll have more freedom to get away from the office day to day.

I’ve been through this process with several startups now, and my comfort zone is getting bigger each time.

Myth #2: If I want it done well, I have to do it myself.

At work: You’ll never get free if you insist on being the only face of your business; if you do, your clients will never want to deal with anybody else. It’s your responsibility to set culture so that your team learns to run the business as you would yourself.

Partnering up with like-minded people is essential for growth, but a perfect partnership is hard to find. Follow a few key principles and you can foster a healthy, powerful partnership based on shared values.

At home: A 2013 study showed that women who earned more money than their partners also did a larger share of household chores. Giving up control of those tasks to your partner, family members or hired help isn’t a weakness; it frees you to focus your energy. Concentrate on the areas where you bring unique value, and invite others in to share your life and take care of the rest.

Related: If You Want to Live More, You’ve Got to Do Less

Myth #3: I don’t have the resources to break into the international market.

Taking your product to the global marketplace can represent a huge mental block. But local growth takes a huge amount of time and effort, too. Think about the energy that you’re going to invest anyway and then consider the most effective way to invest it.

You could sleep in your own bed and knock on doors all day to promote your product at home. Or you could sleep overnight on an airplane and spend the same amount of energy taking much bigger meetings in Beijing or New York.

In my case, my business partner, Janine, has combined lifestyle and business by taking an apartment in Los Angeles, from where she can coordinate Gutsii’s U.S. product launches to correspond with launching in Australia. Another benefit of not trying to do it all alone!

Myth #4: It’s better to be a big fish in a little pond.

You won’t grow unless you’re prepared to be a little fish in a big pond. When I’m choosing whom to spend time with, I want to choose people who challenge me. I like working with people who intimidate me a little bit. Those people can teach me something!

It’s intimidating to seek out people who are smarter, wealthier, more experienced or higher risk-takers than you, but the rewards are worth it. You can’t predict the kinds of connections you’ll make or the people you’ll meet.

When Janine took the leap to move to Los Angeles, she didn’t know what was waiting for her there—she just knew that she wanted to rub shoulders with more inspiring people and see if our products could stand up in a more discerning market. She was recently named as a wellness leader in the city, despite only having moved there five months ago, something that never would have happened if she’d stayed in her circle of comfort.

Pushing your business out of its comfort zone involves personal and financial risk, and can represent a huge emotional burden. The support of your tribe is crucial, especially for women. We all need a little black book of people we can call on for advice, resources and expertise to help us handle the challenges of rapid growth.

Of course, the best way to widen your tribe and meet more amazing people is to step out of your immediate circle and step into a bigger game.