1.Growth Continued to Dominate in Q1 Rally.

Ned Davis Research www.ndr.com

2.Sector Performance Q1 Tech Still Leads.

Nasdaq Dorsey Wright

www.dorseywright.com

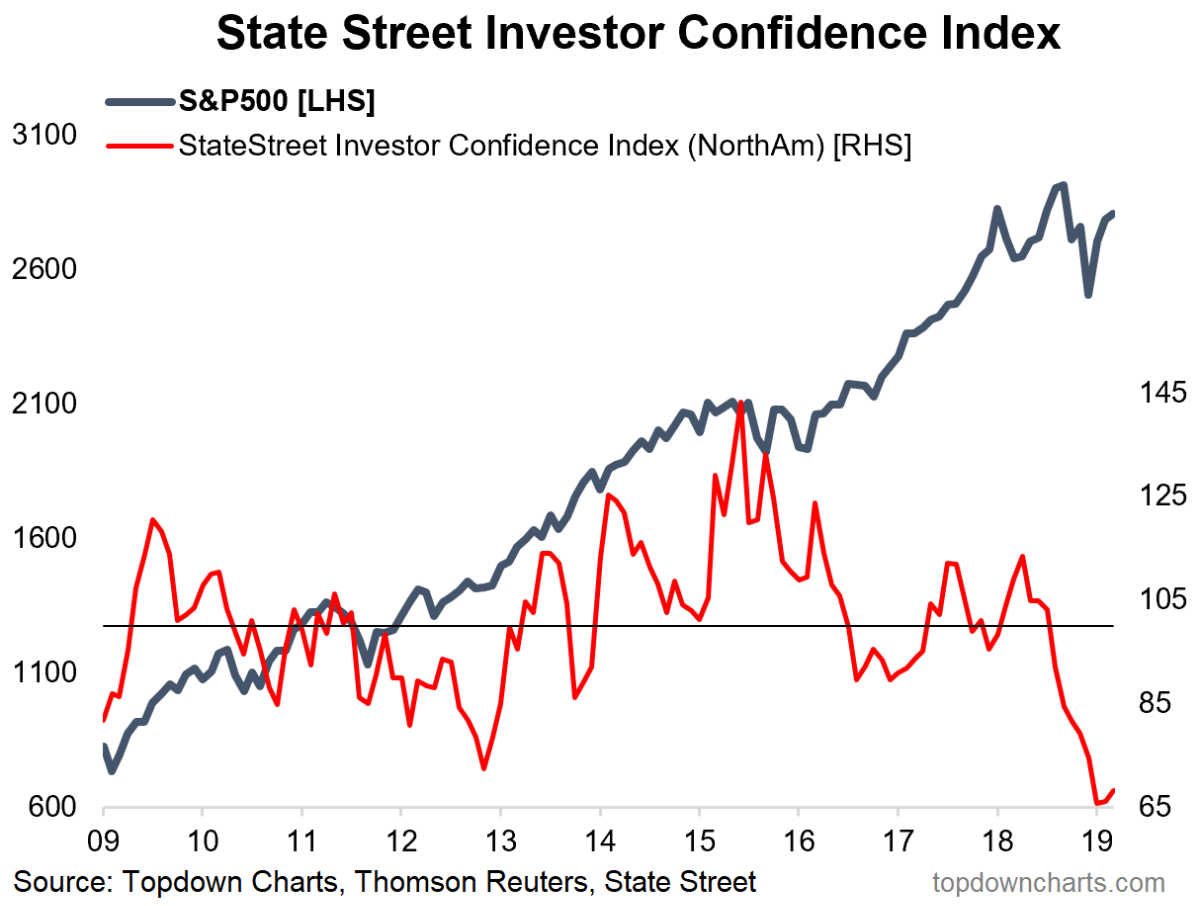

3. Institutional Investors Stayed Defensive on Rally.

Institutional Investors – on the sidelines? This chart shows the State Street investor confidence index for North America, and it seems that after heavily de-risking into the correction, institutional investors have been very reluctant to rebuild exposure to risk assets. I think this chart reflects the challenges of late-cycle investing, and also has key implications for the market outlook (you could argue it points to “cash on the sidelines”). (source)

https://www.topdowncharts.com/

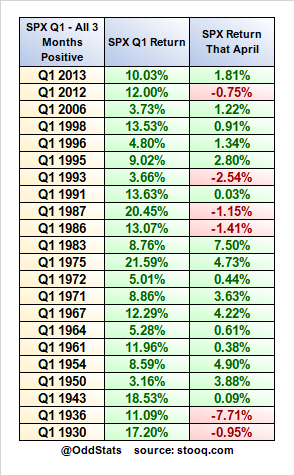

4.April Seasonality After 3 Straight Green Months.

The S&P 500 $SPX just put together 3 straight green months to open a year and you want to know how April has done in the past when this has happened. The pattern is obvious – if you can’t spot it immediately, you should close your trading account.

https://twitter.com/OddStats/status/1112066241986859008

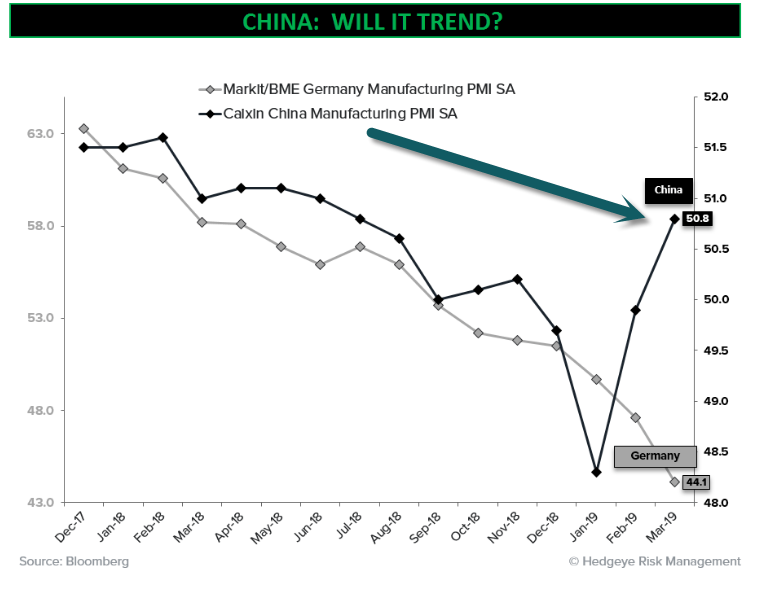

5..Story Overnight is Big Jump in Chinese Manufacturing Numbers.

Chinese Numbers Trend vs. Germany.

https://app.hedgeye.com/insights/74343-chart-of-the-day-china-will-it-trend

https://app.hedgeye.com/insights/74343-chart-of-the-day-china-will-it-trend

6.Look for Chinese Stocks Making New Highs.

FXI China Large Cap Look for Breakout.

China Small Cap-Already made new highs….50day thru 200day to upside.

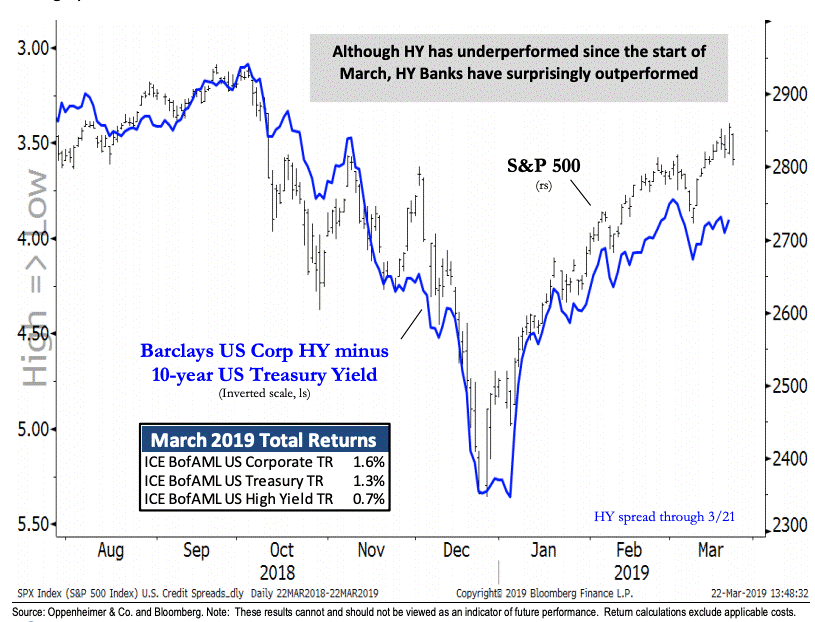

7.No Major Stress in High Yield Credit Spreads or Bank High Yield.

A Missing Caveat to Last Week’s Sell-Off

From Josh Brown Reformed Broker Blog

No Signs of Major Credit Stress

The cautionary drop in interest rates isn’t being confirmed by signs of major stress in high-yield credit spreads either, by our analysis. While high yield has underperformed both Treasuries and corporate bonds in March, weakness hasn’t been meaningful in relation to the year-to-date outperformance going into this March peak; i.e., it’s been within trend, in our view. It’s also interesting to note that while banks have been a key underperformer in the equity market since the start of the month, the industry has surprisingly outperformed within the high-yield market.

Ari goes on to show that, for the month of March, high-yield bonds issued by banks are the top total return performing credits, still up 1.8% in March versus the return for the entire high-yield index of just .7%. So if you thought people were selling assets out there because they think there’s some fundamental issue with the economy or the financial system, you’d be very wrong.

https://thereformedbroker.com/2019/03/23/a-missing-caveat-to-last-weeks-sell-off/

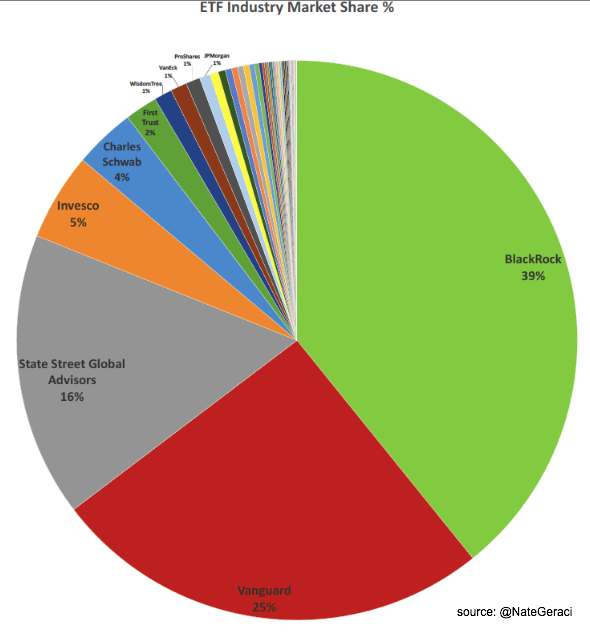

8.80% of Domestic ETFs Managed by Just 3 Firms.

Michael A. Gayed, CFA @pensionpartners

80% of all ETF assets are managed by just three companies. $BLK $STT

Found at Abnormal Returns Blog www.abnormalreturns.com

9.America’s Wealthiest Households Have Record Cash on Hand…(Not Usually the Sign of a Top in Market)

Alexandre Tanzi

America’s wealthiest households are stashing their cash at record levels. The top one percent have three times more in readily available cash than the bottom half, with holdings jumping from less than $15 billion shortly before the last recession to a record $303.9 billion at the end of 2018, according to Federal Reserve data released last week. By contrast, while holdings for the bottom 50 percen

Read more at: https://www.bloombergquint.com/global-economics/america-s-wealthiest-households-have-record-cash-on-hand-chart#gs.3cub42

Copyright © BloombergQuint

10.Great Leadership isn’t about control. It’s about Empowering people.

- Published on March 19, 2019

Trust is the foundation of any successful relationship, whether professionally or personally and when it’s broken, it is extremely hard to repair. I once had a supervisor if I was over one minute on my lunch time, she would send an email to remind me of my lunch hours, even though most of the time I never took my full lunch hour. I couldn’t even send an email without her approving it first. She was so inflexible that it was overbearing. I couldn’t trust her. When employees feel they can’t trust their boss, they feel unsafe, like no one has their back, and then spend more energy on survival than performing at their job.

The corporate world is littered with such micromanagers. Sadly many organizations prefer these managers because they seem to be on top of, and in control of everything. In the short term, they may produce results but in the long run they leave a trail of destruction in their path.

“It doesn’t make sense to hire smart people and then tell them what to to. We hire smart people so they can tell us what to do.” ― Steve Jobs

5 Damaging Effects of Micromanagement

1.Decreased Productivity – When a manager is constantly looking over their employees’ shoulders, it can lead to a lot of second-guessing and paranoia, and ultimately leads to dependent employees. Additionally, such managers spends a lot of time giving input and tweaking employee workflows, which can drastically slow down employee response time.

- Reduced Innovation – When employees feel like their ideas are invalid or live in constant fear of criticism, it’s eventually going to take a toll on creativity. In cultures where risk-taking is punished, employees will not dare to take the initiative. Why think outside the box when your manager is only going to shoot down your ideas and tell you to do it their way?

- Lower Morale – Employees want the feeling of autonomy. If employees cannot make decisions at all without their managers input, they will feel suffocated. Employees that are constantly made to feel they can’t do anything right may try harder for a while, but will eventually stop trying at all. The effects of this will be evident in falling employee engagement levels.

- High Staff Turnover – Most people don’t take well to being micromanaged. When talented employees are micromanaged, they often do one thing; quit. No one likes to come to work every day and feel they are walking into a penitentiary with their every movement being monitored. “Please Micromanage Me” Said No Employee ever. I have never seen a happy staff under micromanagement.

- Loss of Trust – Micromanagement will eventually lead to a massive breakdown of trust. It demotivates and demoralizes employees. Your staff will no longer see you as a manager, but a oppressor whose only job is to make their working experience miserable.

“Please Micromanage Me” Said No Employee, EVER.

Micromanagement is a complete waste of everybody’s time. It sucks the life out of employees, fosters anxiety and creates a high stress work environment. If you hired someone, it means you believe they are capable of doing the job, then trust them to get it done. A high level of trust between managers and employees defines the best workplaces and drives overall company performance. When you empower employees, you promote vested interest in the company. How can you empower others? Understand their strengths, support and utilize these strengths. An empowered workforce is more engaged. Engaged employees drive higher customer satisfaction and boost the bottom line. A Gallup study concluded that companies with higher-than-average employee engagement also had 27% higher profits, 50% higher sales and 50% higher customer loyalty.

Empowered employees are more confident, more willing to go the extra mile for employers, and more willing do whatever it takes to care for customers. In this volatile global marketplace, happy loyal employees are your biggest competitive advantage. If you want performance at scale: Select the right people, provide them with the proper training, tools and support, and then give them room to get the job done!

https://www.linkedin.com/pulse/great-leadership-isnt-control-empowering-people-brigette-hyacinth