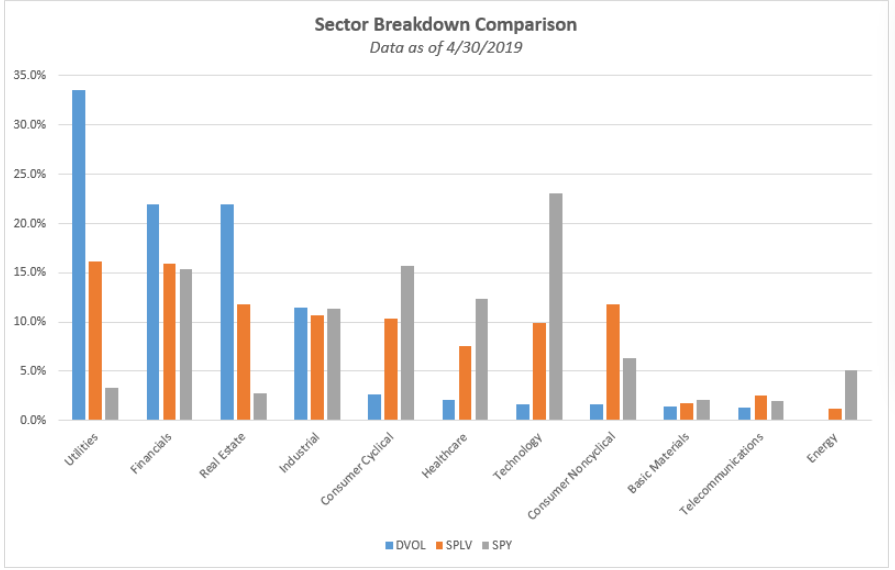

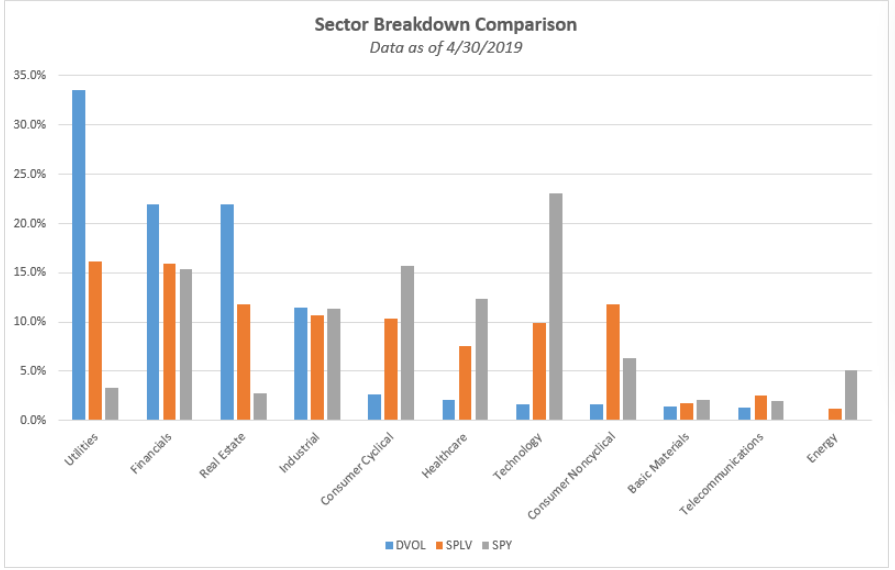

1.Difference in Sector Holdings Between S&P and Low Volatility Funds.

Huge spreads in tech and utilities.

Nasdaq Dorsey Wright

https://business.nasdaq.com/intel/dorsey-wright/index.html

Nasdaq Dorsey Wright

https://business.nasdaq.com/intel/dorsey-wright/index.html

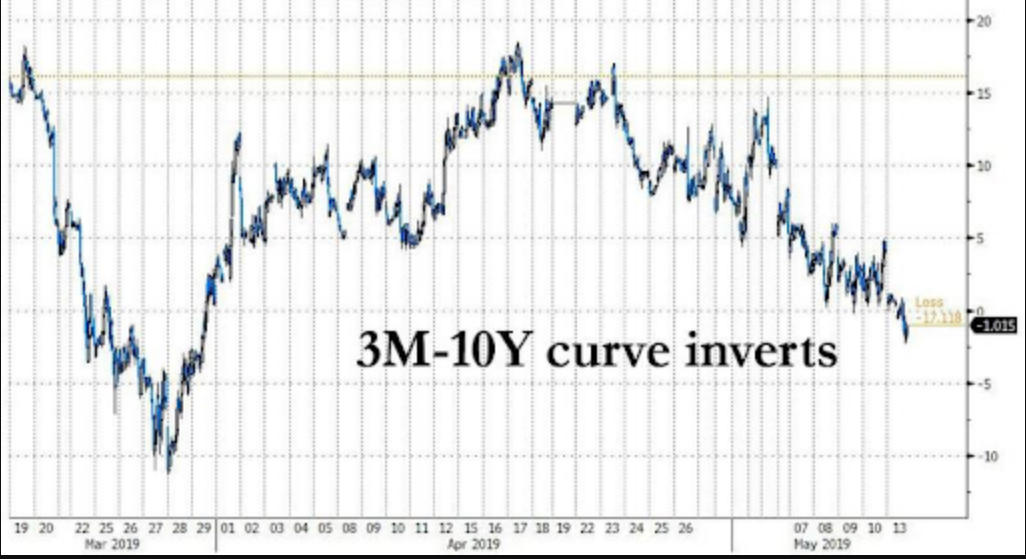

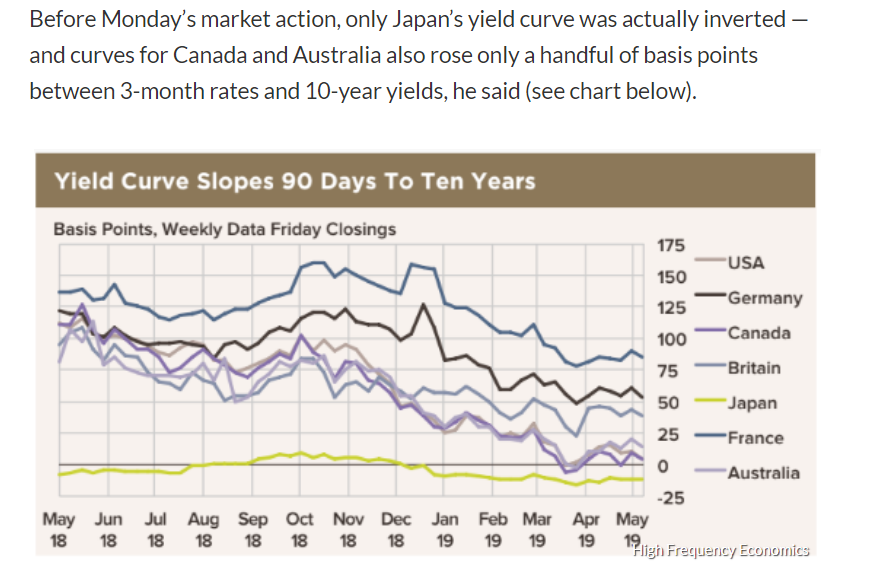

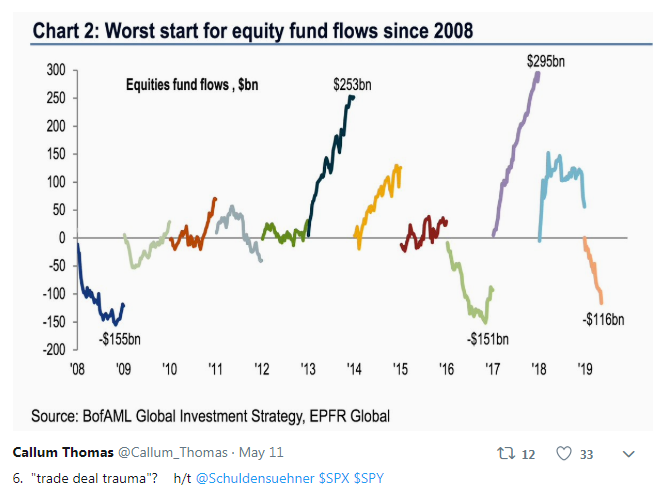

Stock-market bears say don’t forget about this yield-curve signal as trade fears sink equities

Stock-market bears say don’t forget about this yield-curve signal as trade fears sink equities

Published: May 13, 2019 4:31 p.m. ET Flattening curves around world will stoke slowdown fears: economist

https://twitter.com/i/moments/1127307062789042176 Continue reading

From Dave Lutz at Jones.

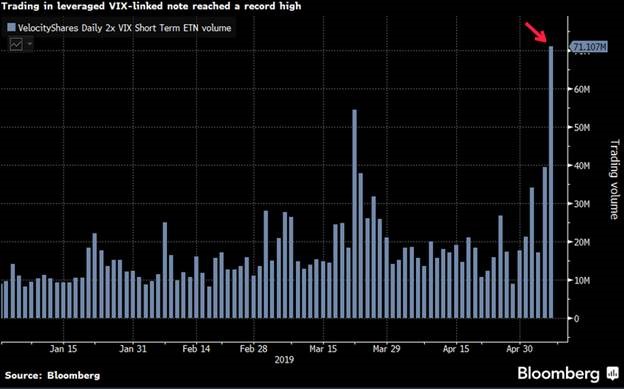

“The fact that inversion occurred with futures expiration still over two weeks away gives us confidence that this move isn’t just noise (the front of the curve can be volatile near futures expiration) but is actually showing a demand for protection in the market,” said Vinay Viswanathan, an equity derivatives strategist at Macro Risk Advisors – There was record volume in TVIX, the 2x VIX ETF, yesterday

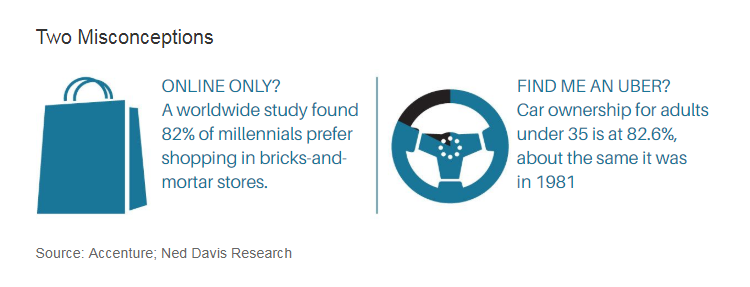

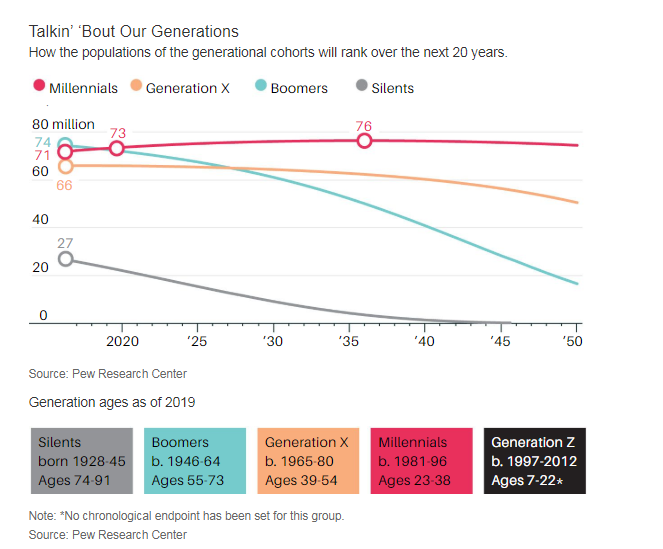

Millennial spending will account for 25% of total U.S. retail sales in 2020,

or $1.4 trillion annually.

Source: Accenture

5 Stocks to Ride the Coming Wave of Millennial Spending

Daren Fonda