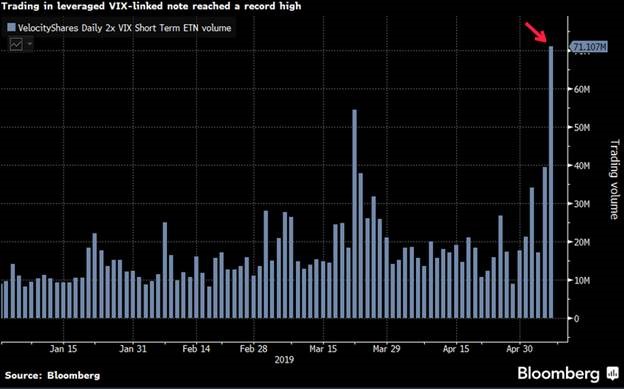

1.Leveraged VIX Trades Hit a Record Volume.

From Dave Lutz at Jones.

“The fact that inversion occurred with futures expiration still over two weeks away gives us confidence that this move isn’t just noise (the front of the curve can be volatile near futures expiration) but is actually showing a demand for protection in the market,” said Vinay Viswanathan, an equity derivatives strategist at Macro Risk Advisors – There was record volume in TVIX, the 2x VIX ETF, yesterday

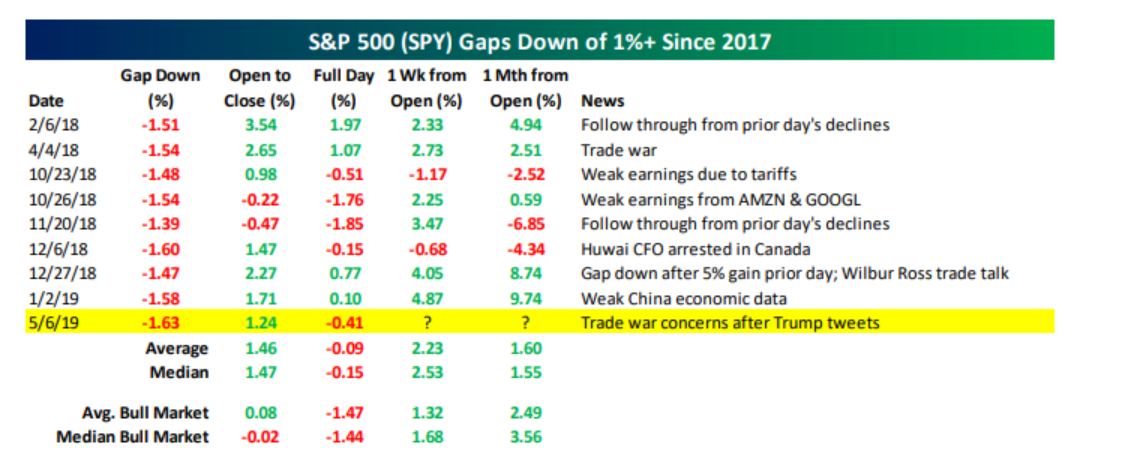

2.S&P Gap Downs Recent History.

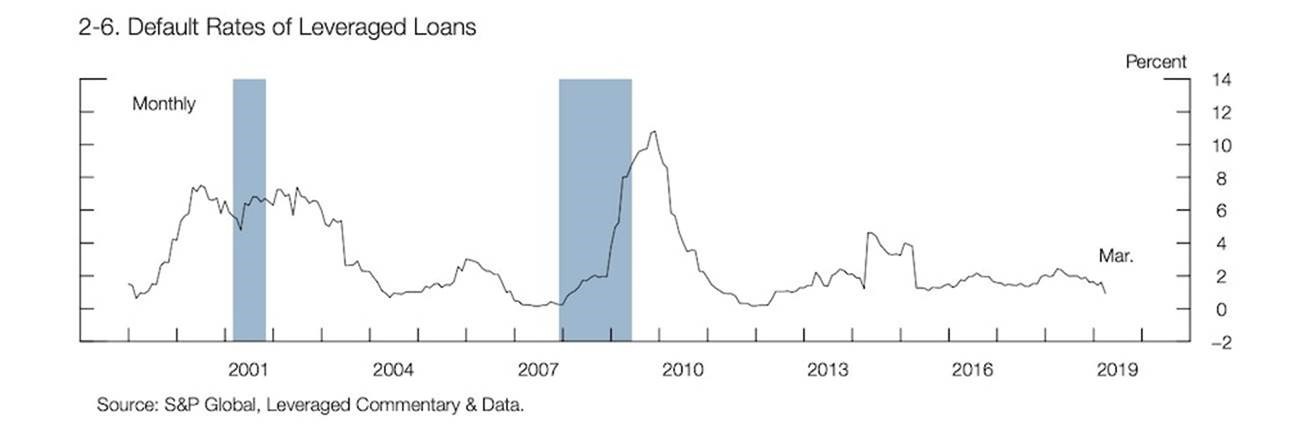

3.The Debate on Corporate Debt Dominating Talk of Next Downturn.

There hasn’t been this much risky corporate debt in years. The Fed is sounding the alarm about what that could mean for the economy.

Gina Heeb

May. 7, 2019, 03:06 PM

Reuters / John Gress

- In 2018, the amount of leveraged loans increased by 20% to above recent peaks in 2007 and 2014.

- The Federal Reserve this week flagged the sharp rise as a risk to the financial system.

- But institutions appear more resilient than before the financial crisis.

A rapid rise in levels of risky corporate debt has emerged as a top vulnerability in the world’s largest economy.

Leveraged lending in the US jumped by one-fifth to $1.1 trillion in 2018, above peaks seen during the financial crisis, the Federal Reserve said in a semiannual report out Monday.

That was particularly concerning because the largest increases were concentrated among the riskiest firms, which have lower credit ratings and large amounts of debt. Credit standards for business loans appear to have loosened over the past six months.

Default rates in leveraged lending remain relatively low, but officials cautioned that this could change in the case of a slowdown.

“Even without a sharp decrease in credit availability, any weakening of economic activity could boost default rates and lead to credit-related contractions to employment and investment among these businesses,” the report said.

Federal Reserve

4.Should Investors Worry About Corporate Debt? It Depends on Who You Ask.

Economists can’t seem to agree on whether investors should worry about corporate debt.

The great debt debate first flared up at the end of 2018, when fears about leverage caused severe market volatility, and essentially froze credit markets for most borrowers.

A lot has changed since then. Just this week, drugmaker Bristol-Myers Squibb (BMY) sold the 10th-largest bond on record to finance its purchase ofCelgene (CELG). Demand for the debt was strong, even though the deal was initially controversial; shareholders approved the acquisition after some complaints, but regulators haven’t yet given it the all-clear.

The sale also occurred just one day after the Federal Reserve sounded a warning that debt burdens are still rising among the riskiest companies. Investors may have taken solace from economists at Goldman Sachs , who are arguing that U.S. companies are actually in good financial shape compared to history.

A few key facts are clear to both sides of the debate: First, corporate debt is near an all-time high compared to U.S. economic output. Second, underwriters’ standards have eroded sharply in the market for floating-rate leveraged loans, as specialized investment vehicles stoke demand. Third, the volume of corporate bonds rated BBB, three or fewer credit-rating tiers above junk, has ballooned to roughly 50% of the investment-grade market.

The Fed and Goldman Sachs take different views on the significance of these facts.

The Fed’s basic argument isn’t new; it was circulated by plenty of investors, strategists, and regulators heading into the fourth quarter’s market turbulence. But the central bank shows that the debt spree didn’t end with last year’s volatility.

In the first quarter, about 40% of new large leveraged loans left companies with debt that is six or more times larger than their earnings before interest, taxes, depreciation, and amortization, or Ebitda. For all of last year, about 30% of new loans left companies with debt six or more times Ebitda, close to the highest it has been since at least 2001. (Regulators have used six times Ebitda as an upper limit for leverage in guidance to underwriters at banks.)

“In 2018, the firms with the most rapid increases in their debt loads had riskier financial characteristics—higher leverage, higher interest expense ratios, and lower cash holdings,” the Fed says.

What’s more, public companies are more indebted compared to their assets than they have been in 20 years, according to the Fed’s report.

But Goldman Sachs prefers to look at debt held by all U.S. non-financial companies, not just those that are publicly traded.

Economist Daan Struyven found that corporate debt is well within its long-term historical ranges, compared to cash flow or assets. He determined that by adding up the Fed’s own measures of outstanding corporate bonds, loans, and commercial paper to determine U.S. companies’ debt burden.

Struyven also argues that companies should hold more debt than they have historically, because interest rates are low. Companies spend a smaller share of their cash flow on interest payments than they did 10 years ago, for example. Treasury and corporate bond yields have been less volatile than normal in recent years, which means companies’ funding costs have been steadier as well.

Companies are also borrowing long-term when interest rates are low, he notes, which means they face less risk of burdensome refinancing costs.

Bristol-Myers Squibb’s bond offering is a prime example of that dynamic. About half of the $19 billion sale was sold with maturities of 10 years or longer. And the company’s 20- and 30-year bonds saw the strongest investor demand.

Goldman Sachs also found that both economic growth and companies’ cash flows have become more predictable in recent decades—recessions are rarer and shorter, basically—which makes it easier for companies to meet their obligations to creditors.

As a whole, the corporate sector is earning more than it is spending, or, as Goldman Sachs puts it, the sector has a positive financial balance. Companies are in an “unusually healthy position this deep into a business cycle expansion,” Struyven writes. When it comes to the BBBs, the bank is bullish on sectors such as telecoms, since those companies are cutting down on debt.

Goldman Sachs’s side of the debate has its own sticking points, of course. Corporate debt may not be at a record high compared to cash or assets, but that is only a comforting fact when it is stripped of historical context. In previous business cycles, corporate debt levels set records during recessions, when profits dropped sharply and companies couldn’t cut debt quickly enough to keep up.

A lot of the bullish case for bonds relies on the idea that the economy will grow steadily for years. While it is possible that the U.S. is still in a “Great Moderation,” as the bank argues, the financial crisis showed how dangerous it can be to assume that current conditions will continue forever.

It should also be noted that neither the Fed nor Goldman Sachs thinks that the next recession will be as severe as the financial crisis, because bank balance sheets are far stronger than they were a decade ago.

The question appears to be whether there will be any recession at all in the next few years. If Goldman Sachs’s perspective is widely held among investors and banks, it doesn’t look like the yearslong boom in corporate debt will end any time soon.

Write to Alexandra Scaggs at alexandra.scaggs@barrons.com

MOST POPULAR TODAY

https://www.barrons.com/articles/investors-worry-corporate-debt-51557245073?mod=hp_LEAD_3

5.China Defaults Hit Record in 2018. 2019 Pace Is Triple That

Neoglory has the inglorious title of biggest 2019 defaulter

A state-linked issuer is among the five biggest in year so far

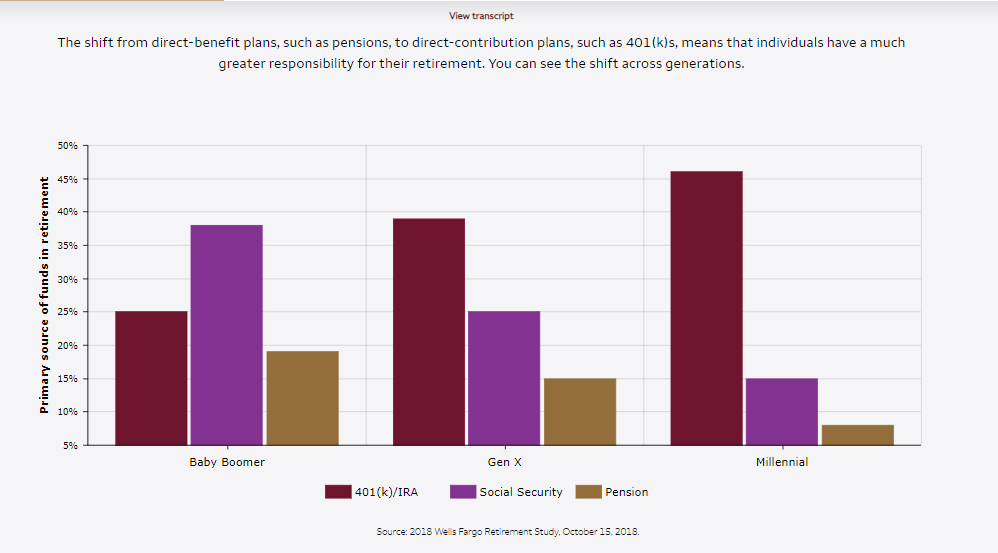

6.Generational Differences in Retirement Savings.

https://investmentinstitute.wf.com/reports/reimagining-retirement/

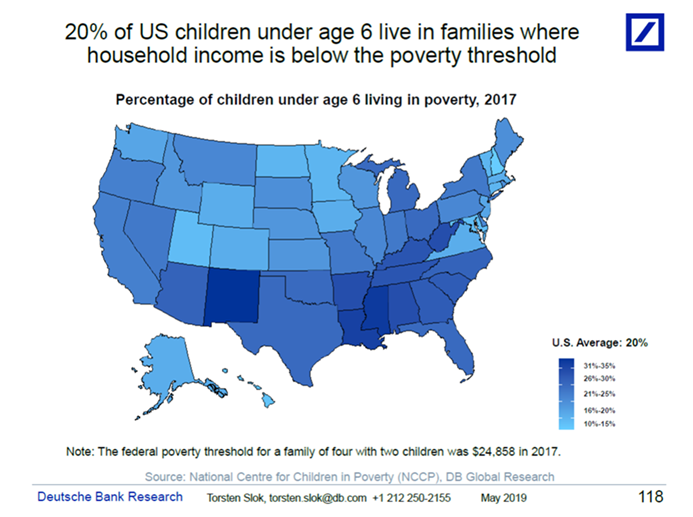

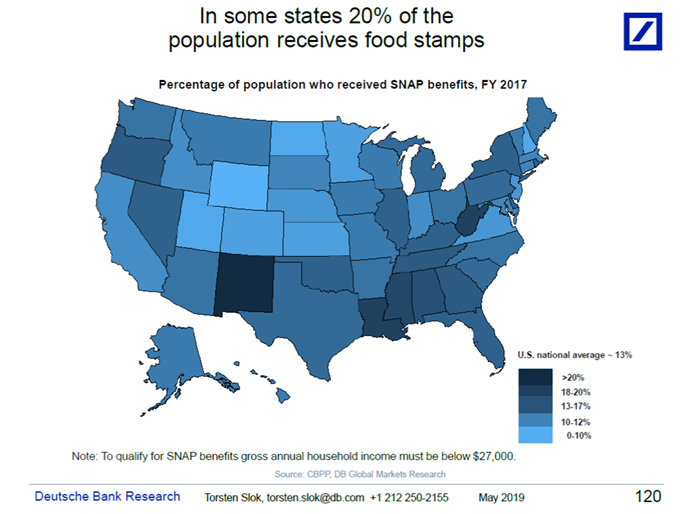

7.U.S. Poverty Rates.

I continue to get more and more questions from clients about US inequality and what it means for markets, see charts below and also our recent chart book here.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

8. Will You Choose Alive Time or Dead Time?

Will You Choose Alive Time or Dead Time?

Here is my latest post on Medium. It also explains the story behind the making of my book Ego is the Enemy…

A few years ago, I was really stuck. I had accepted a one-year consulting contract that required me to commute from Austin to Los Angeles. It paid very well, but the gig was a disaster.

Everything was in chaos. No one could get anything done. We were at the complete mercy of a Wall Street hedge fund and a bunch of lawyers who were battling for control of the company.

I was frustrated. After I ran into a brick wall multiple times, it was like learned helplessness. What could I do? What was the point? I decided to just sit there and collect my checks while I waited for my contract to end.

Then I remembered a piece of advice I had gotten from the author Robert Greene many years earlier. He told me there are two types of time: alive time and dead time. One is when you sit around, when you wait until things happen to you. The other is when you are in control, when you make every second count, when you are learning and improving and growing.

Robert knows a lot about alive time and dead time. Although most people think of him as an incredibly productive and accomplished writer of amazing books, they don’t know about the 20 years he spent in obscurity, working something like 80 different jobs — most of which he hated—where he was at the mercy of horrible bosses.

As he said, “The worst thing in life you can have is a job that you hate, that you have no energy in, that you’re not creative with and you’re not thinking of the future. To me, might as well be dead.”

This does not mean you should quit your job immediately if you don’t love it. What Robert did during those years greatly influenced his writing. He wasn’t dead in those dead-end jobs; he was alive — researching, learning, studying, and observing the forces he would document in 48 Laws of Power, The Art of Seduction, Mastery, and The Laws of Human Nature.

So I decided I would make the absolute most of every moment while I was stuck in L.A.

I could not control what was going on with the board of directors, but I could choose how to spend my days. I decided to make the next several months a kind of work-study program. I was going to learn everything I could about people, about myself, about the factors that had created this crisis. I was also going to fill every nonworking second with productive reading and research.

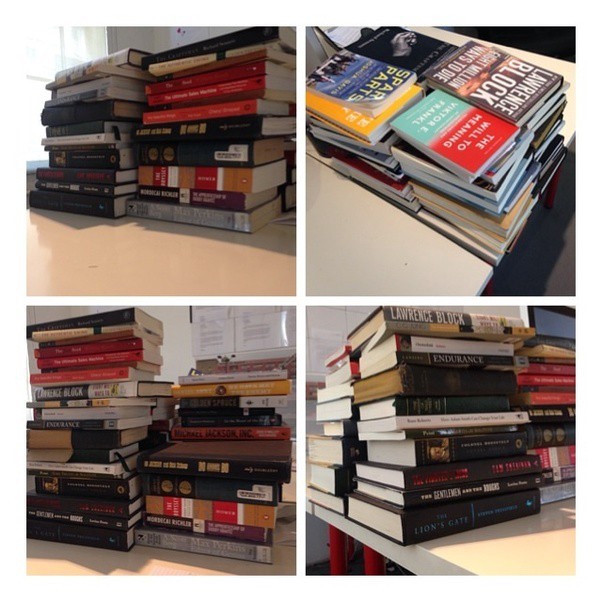

Here is my desk and the books I read in that time (compare that to a shot from earlier that summer):

Here is the notebook I filled, writing a daily note to myself (I decided I would open the journal every day before checking email).

Here is the box of notecards I filled. I am most proud of the second box because these notes became my book, Ego is the Enemy.

As frustrated as I was with that consulting gig, it was actually the perfect place for me to research and meditate on that book I was thinking about writing. (You could say the obstacle was the way.)

Life is constantly asking us, Is this going to be alive time or dead time?

A long commute. Are we going to zone out or listen to an audiobook?

A delayed flight. Are we going to get in a couple of miles by walking around the terminal or shove a Cinnabon into our face?

A tour of duty or a contract we have to earn out. Is this tying us down or freeing us up?

That’s our call.

In Ego, I told the story of Malcolm Little. In 1946 he was arrested for trying to fence an expensive watch he’d stolen. In his apartment, police found jewelry, furs, an arsenal of guns, and all his burglary tools. He was sentenced to 10 years in prison. He could have served his time simply counting the days. He could have planned his next crime spree. Instead, he started reading. He literally copied the dictionary word for word. Every minute he wasn’t in his bunk, he was in the library. That was how Malcolm Little was transformed into Malcolm X.

Why did Malcolm X wear glasses? Because he literally wore his eyes out reading in prison.

But the trade-off was worth it. Those five years he served were some of the most productive of his life. He breathed in every second while his fellow prisoners rotted away.

So many people are busy thinking about the future that they miss the opportunities right in front of them. We think the future is something that happens, rather than something we make.

We think, This is just a job; this is just a crappy couple of [months, minutes, weeks]. It doesn’t matter. We tell ourselves that we’re just doing this to pay for school or because we have to. That no good can come out of it, except the direct deposit every two weeks.

I carry this medallion with me everywhere I go…

Like Robert says, if you’re going to think like that, you might as well be dead. Your mind apparently is.

We have to choose to make every moment a moment of alive time. We have to decide to be present. To make the most of whatever is in front of us.

Might it be better if we were totally free; if we weren’t stuck in traffic or at the airport or on some dumb assignment from our idiot boss? Sure. But we aren’t.

So what are we going to do about it? We are going to find some advantage.

Pick up a book. Pick up a pen. Pick up the phone.

Open your eyes. Open your ears. Open your mind.

There is plenty you can get out of this. Plenty you can do to make this productive, purposeful time—even if the situation is not completely in your control.

Resist the temptation to let silly politics or wanderlust distract you. Resist the resentment or the despondency. These things won’t help you. Only hunger and determination will.

In the 1960s, French political protesters used the slogan Vivre sans temps mort(live without wasted time). That’s what great leaders and artists have done, even in terrible conditions like a prison sentence, an exile, a bear market or a depression, military conscription, even being sent to a concentration camp (see Viktor Frankl). Through their attitude and approach, they transformed their circumstances into something that fueled greatness.

They asked themselves, alive time or dead time? They answered with their actions. Can you?

As they say, this moment is not your life. But it is a moment in your life. How will you use it?

READ ON MEDIUM: Will You Choose Alive Time Or Dead Time?

P.S. The last couple months this email was sponsored by Scribd, which makes sense because this email is about books. This month the email is brought to you by something I also use and have used daily and weekly for going on two years: ButcherBox. I even invested in the company. Anyway, Butcherbox delivers high quality, grass-fed meat (free range organic chicken, 100% grass fed beef, heritage breed pork, no antibiotics, nitrates, sugar, etc) to your doorstep once a month–meaning my wife and I basically haven’t bought meat from the store ever since we started using it. It shows up, we put it in the freezer and a big chunk of our grocery shopping is done. We’re having grass fed Butcherbox NY strip for dinner tonight. So I love it, and would definitely recommend it to anyone who likes to cook and eats meat. If you sign up now, they’ll give you $20 off and put free bacon in your order…and shipping is free. Hard to beat. Enjoy!