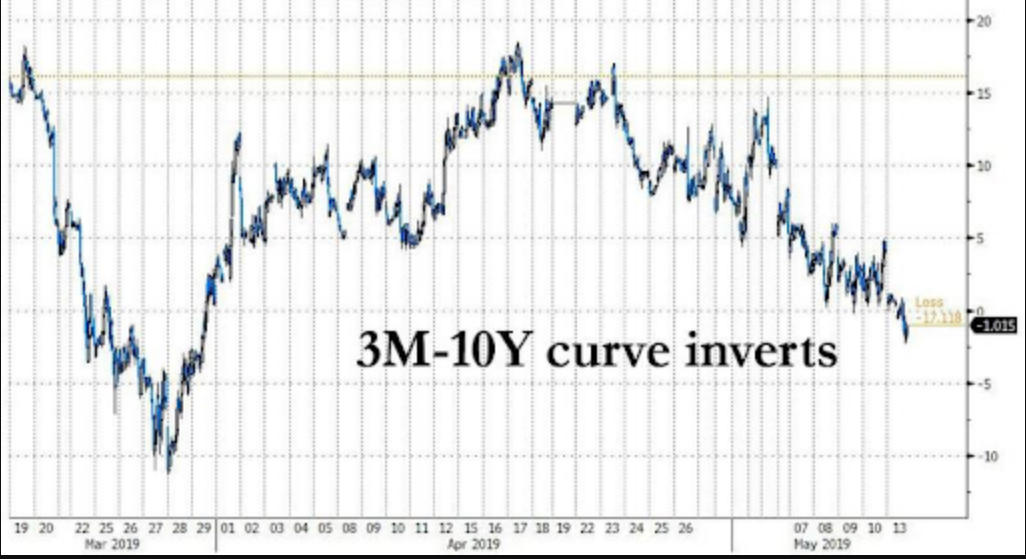

1.The Yield Curve Re-Inverts.

Global Yield Curves

Stock-market bears say don’t forget about this yield-curve signal as trade fears sink equities

Stock-market bears say don’t forget about this yield-curve signal as trade fears sink equities

Published: May 13, 2019 4:31 p.m. ET Flattening curves around world will stoke slowdown fears: economist

2.Emerging Market Close Below 200 Day.

EEM-Emerging Markets ETF.

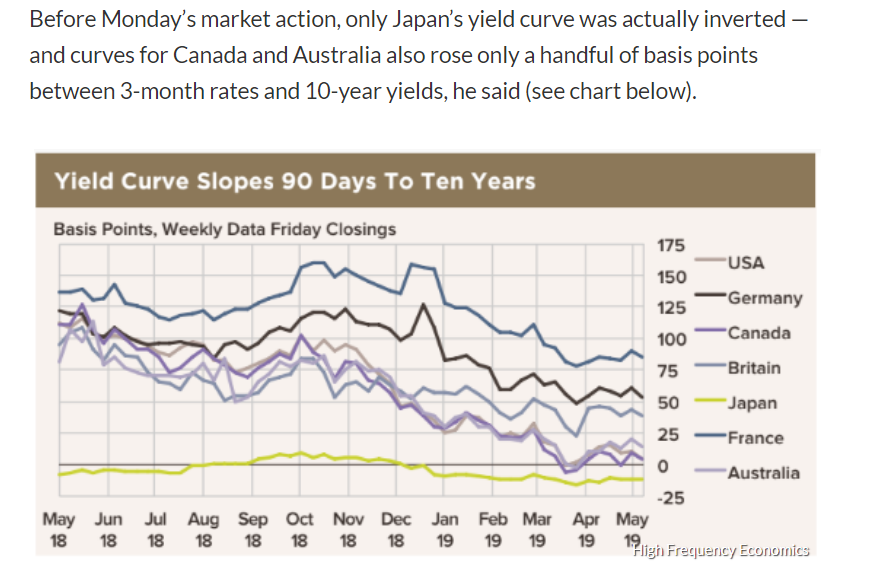

3.Top 10 U.S. Imports From China.

Chinese state media blamed the U.S. for a lack of progress in trade talks while emphasizing China’s economic resilience, as the world awaits details on measures Beijing has promised in retaliation for the U.S. raising tariffs on Chinese goods.

From Dave Lutz at Jones Trading.

4.Intel a Fast -25% Correction

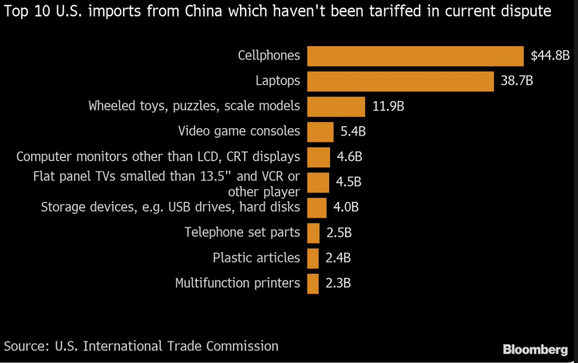

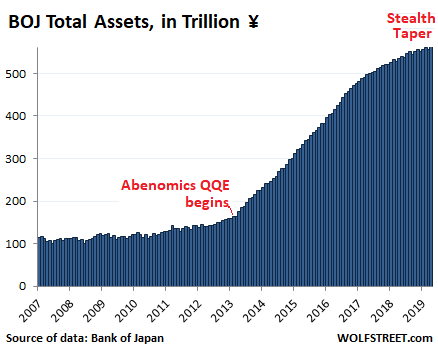

5.Some Argueing That Global QE Party is Over

QE Party Over, Bank of Japan Stealth-Tapers Further

by Wolf Richter • May 11, 2019 • 47 Comments • Email to a friend

Straggler behind the Fed and the ECB gets the drift.

Total assets on the balance sheet of the Bank of Japan at the end of April ticked up from March but were flat with the record in February: ¥562 trillion ($5.1 trillion). This amounts to a gigantic 102.2% of nominal GDP. But the BOJ has been tapering its asset purchases since peak QE at the end of 2016, and the growth has slowed to a snail’s pace, by Abenomics QE standards.

Despite the BOJs repeated promises of adding ¥85 trillion to its balance sheet every year, the BOJ hasn’t done that since peak QE in 2016 when it added ¥93 trillion. The additions have consistently decreased since then. Over the 12 months through April, it has added merely ¥27 trillion, the lowest 12-month increase since early days of ramping up Abenomics in March 2013. This amounts to a stealth taper:

Meanwhile, the government of Japan has been borrowing and issuing new debt with reckless abandon, and the gross national debt outstanding has ballooned to ¥1.12 quadrillion, or 203% of nominal GDP (measured in yen).

But no problem: the BOJ started buying every Japanese government security that wasn’t nailed down, with the government selling new securities to the banks, and the banks selling them to the BOJ for a small profit. In addition the BOJ mopped up what was coming on the market. The BOJ now holds 43% of all outstanding Japanese government securities, up from 25% in January 2015.

These massive purchases of Japanese government securities, and to a lesser extent, the purchases of corporate bonds, equity ETFs, and Japan REITS, have created this enormous balance sheet, but note the flattening spot at the top, a result of the stealth taper:

https://wolfstreet.com/2019/05/11/qe-party-over-bank-of-japan-stealth-tapers-further/

6.Weakest Treasuries Demand Since ’08 Sends Bond-Market Warning

As the U.S. government kicks off its debt sales this year, here’s one potentially worrisome sign for traders to keep in mind: the steep decline in demand at its bond auctions.

Of the $2.4 trillion of notes and bonds the Treasury Department offered last year, investors submitted bids for just 2.6 times that amount, data compiled by Bloomberg show. That’s less than any year since 2008. The bid-to-cover ratio, as it’s known, fell even as benchmark Treasury yields soared to multi-year highs in October, before falling back to their lows last month.

Granted, it’s not as if the U.S. will have trouble borrowing as much as it needs. And there’s little in the data to suggest weak auctions lead to bond losses. Yet the drop-off is an early warning that demand for Treasuries may not keep up as the U.S. goes deeper into the red. Debt supply jumped in 2018 largely because of the Trump administration’s tax cuts. Forecasts show the deficit could soon swell past a trillion dollars and stay that way for years to come.

The weakness “doesn’t matter until it suddenly does,” says Torsten Slok, Deutsche Bank’s chief international economist. “A declining bid-to-cover ratio increases the vulnerability and probability that investors suddenly will begin to think that a falling bid-to-cover ratio is important. Put differently, all fiscal crises begin with a declining bid-to-cover ratio.”

Read Newsmax: Weakest Treasuries Demand Since 2008 Sends Bond-Market Warning | Newsmax.com

https://www.newsmax.com/finance/streettalk/treasuries-bond-market-demand/2019/01/09/id/897532/

7.MJ Weed ETF- $156M inflows last week….Total AUM $1.5B.

Will Weed be recession proof?

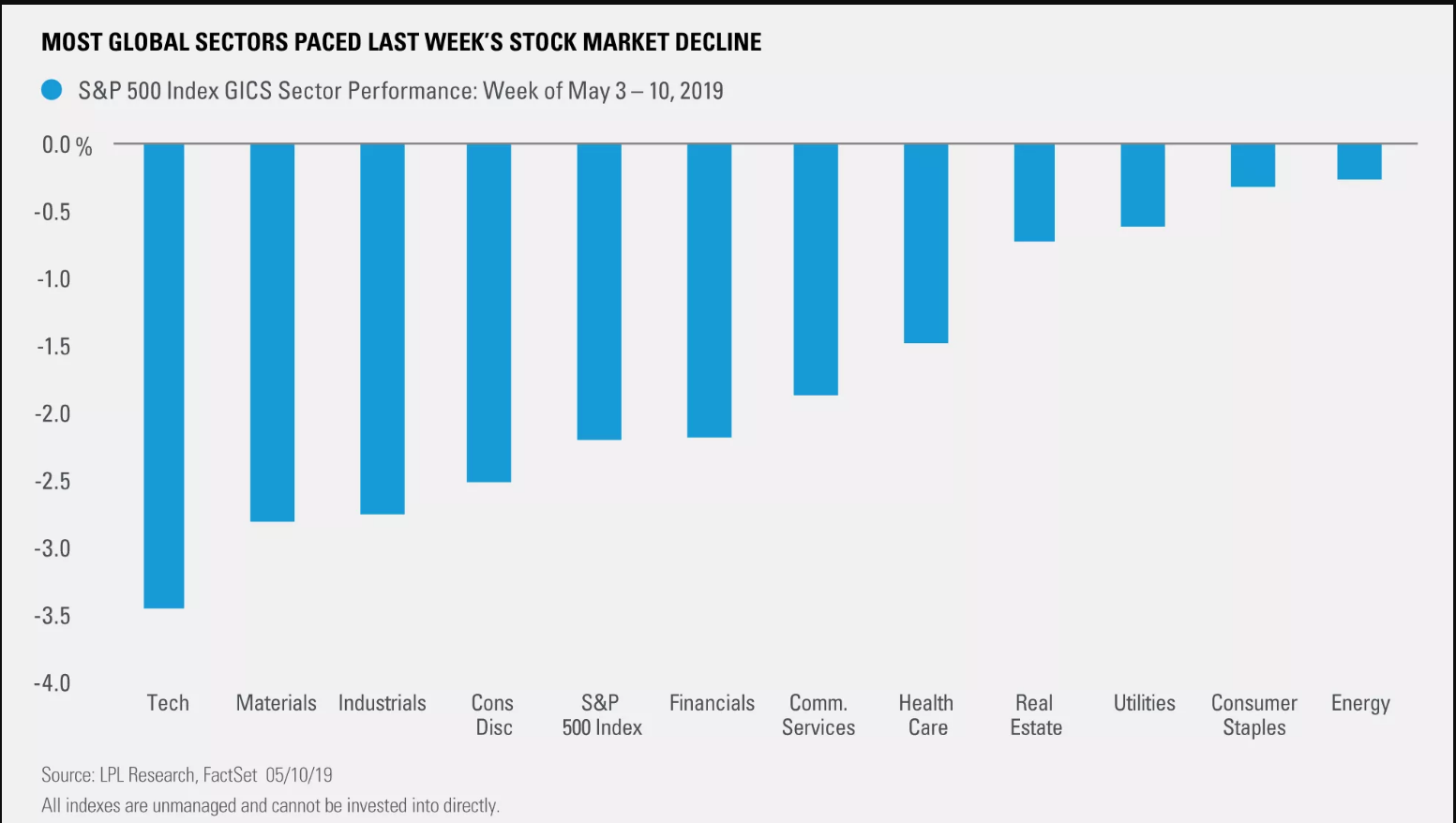

8.Global Sectors Reflect Trade Jitters..Before Monday.

Posted by lplresearch

Trade fears drove stocks to their worst week of the year, down 2% after President Trump placed higher tariffs on $200 billion of Chinese goods and threatened fresh tariffs on an additional $325 billion in Chinese goods after the Chinese reportedly backed out of a trade agreement. It could’ve been worse, but talks in Washington, D.C., were reportedly constructive, according to Treasury Secretary Steven Mnuchin, which helped stocks get back some of the losses from earlier in the week.

“Keep in mind that even with Monday morning’s losses, the S&P 500 Index is still only about 4% below the all-time high,” said LPL Chief Investment Strategist John Lynch. “In the past, by this time of the year, stocks have typically pulled back 8–9%, so even though fundamentals still look pretty good to us, a pickup in market volatility should be anticipated.”

Last week’s sector performance clearly reflected trade concerns, with globally exposed sectors—industrials, materials, and technology—pacing the decline, as shown in the LPL Chart of the Day. These sectors have among the highest percentage of international revenue, and in China in particular.

https://lplresearch.com/2019/05/13/global-sectors-reflect-trade-jitters/

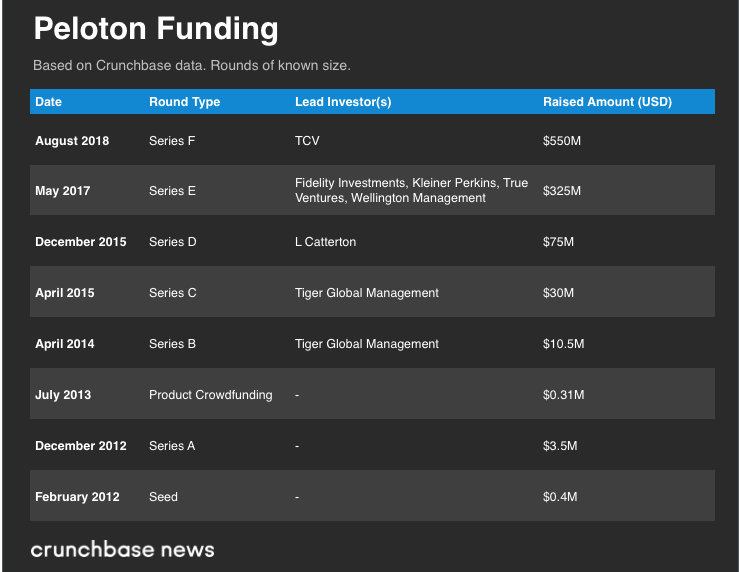

9.As Peloton Preps For An IPO, A Look Back At Its Funding History

Alex Wilhelm

February 12, 2019

Morning Markets: Peloton is lining up banks for an IPO. Let’s remind ourselves what we know about its performance as it heads towards a flotation.

Peloton, maker of expensive in-home bikes married to streaming spin classes, is looking to secure banks for an eventual IPO, according to the Wall Street Journal. The news isn’t surprising from the richly-valued Peloton; the company’s CEO said last year that his company would debut in 2019, for example.

If Peloton does manage an IPO this year, it will have demonstrated that at least one low-tech device can, in fact, be made successfully “smart” through the inclusion of high-tech items into a traditionally analog device. Peloton riders, who buy their hardware and subscribe to workout content, are somewhat risible as yuppies always are, but the company that their sweat powers could be a capitalist workhorse.

It will depend on margins, I think.

Peloton has posted material revenue and strong top-line growth in recent years. The subscription exercise shop put up around $400 million in revenue during 2017 and is on said to be on track for $700 million in its current fiscal year. That’s the sort of growth that investors love from venture-backed companies like Peloton.

But unlike software companies which purely rent their code to other companies, Peloton has two businesses: hardware (selling bikes and, recently, treadmills), and subscription content (a monthly $39 fee). If you had to guess which of the two will sport a higher gross margin, which would you pick?

The easy answer is the subscription content, and I think that that’s right, but I wonder if the hardware margins are as low as I initially thought, or the content as high-margin as investors likely hope. In short, I can’t get a great read on how high-quality Peloton revenue is from what we know externally.

That makes Peloton’s eventual S-1 filing all the more exciting a prospect; if the company has strong margins, its 75 percent year-over-year revenue growth is killer. At lower margins the results become merely good. We’ll see.

But there’s a lot of money wagered on Peloton’s side. I asked our own Savannah Dowling to list out Peloton’s funding for us, which looks like this:

That’s a total of $994.7 million in raised capital, most recently at a$4.15 billion valuation. No pressure, Peloton.

Found at The Morning Brew.

https://news.crunchbase.com/news/as-peloton-preps-for-an-ipo-a-look-back-at-its-funding-history/?utm_source=morning_brew

10.The 5 Best Ways to Make Business Connections, According to Master Networkers

At the Inc. Founders House, business leaders shared tips on how to facilitate new relationships.

By Malak SalehEditorial intern, Inc.com@malaknsaleh

Last month, during Austin’s SXSW festival, Inc. brought together a host of high-profile business executives and innovative entrepreneurs at the Founders House. Naturally, it was a group that was highly experienced and savvy in the art of networking. Some of the luminaries in attendance passed on their best tips for making connections at such events or anywhere you’re trying to meet potential business partners and develop new opportunities. Here are their five key lessons.

- Do your homework before formally networking.

Get to know the person you plan on talking to in advance. By doing thorough research, you should gain a rough idea of how you can appeal to that contact, says Elizabeth Gore, the president of Alice, an A.I.-based adviser for business owners. But professional relationships should benefit both parties. “Really think about that two-way connection,” Gore advises. When you approach someone, know what you can offer that person to make the interaction more memorable, authentic, and distinct.

- Adhere to the ’48-hour rule.’

After a business meeting or conference, or even just a quick chat over coffee, Gore says, it’s crucial to follow up within a short time frame. Once she parts ways with a potential professional contact, she puts a reminder in her calendar to check back within 48 hours. Getting in touch any later than two days after meeting someone can give the impression that you don’t care about the new relationship or the subject you discussed with your new contact.

- Be cutthroat in what you want.

Cindy Eckert, founder and CEO of the Pink Ceiling, a venture capital fund that invests in female-led businesses, preaches the value of persistence. She advises being upfront and tenacious in letting people know what you are out to accomplish–an approach that served her well on her path to entrepreneurial success. “You have to be convinced that you would be doing the other person a disservice by not telling them what you’re trying to do and how you’re trying to change the game,” says Eckert, who has sold two pharmaceutical companies for a total of $1.5 billion. “That is the mark of a true entrepreneur. They’re so determined that everybody will hear their vision.”

- Don’t ask this question.

Never ask somebody what he or she does immediately upon meeting that person, says Stephen Lease, the founder and CEO of sunglasses startup Goodr: “That is the lamest way to network possible.” Being authentic is key–which means skipping the small talk. The best professionals will approach a networking opportunity with fresh questions. Find a conversation topic to connect on, Lease says. Once you hit on something that can bond you with a prospective contact, you have better odds when it comes to asking that person for a favor.

Bonus tip: If your company sells a product, like sunglasses, always have a sample on you to give away when you meet someone, he adds. That’s how you leave a lasting impression.

- Carry yourself with a cool confidence.

“A good $50 to $100 million of our cap table came from random introductions,” says Chieh Huang, the co-founder and CEO of Boxed, an e-commerce company. Huang says it all comes down to being confident. “Go up to folks whether you know that they can help you or not,” he says. Greet them and ask them what they are talking about. “In my entire professional career, I’ve never gone up to a group of folks and asked that question and been rejected.”

https://www.inc.com/malak-saleh/networking-tips-founders-project.html