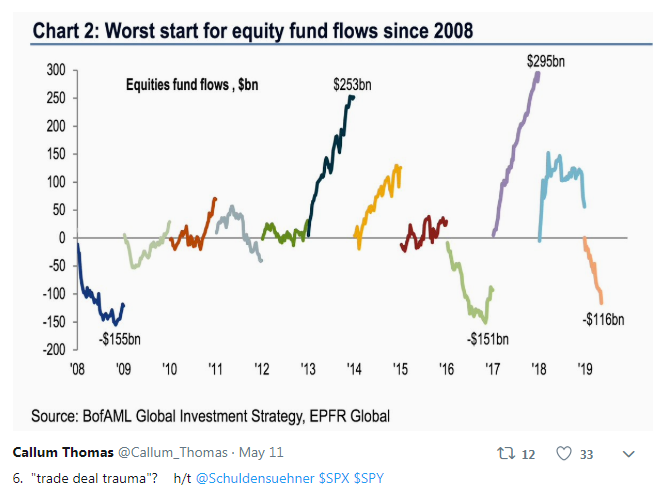

1.Most Hated Bull Market Ever…Worst Start for Equity Fund Flows Since 2008

Not usually the action at top of bull market…$116B Out of Equities

https://twitter.com/i/moments/1127307062789042176

2.Quality Factor Seeing Inflows and Performing Well in 2019….Invesco Quality ETF 42% Technology Stocks.

Next closest sectors below 11%

Product Details

The Invesco S&P 500® Quality ETF (Fund) is based on the S&P 500® Quality Index (Index).The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Index tracks the performance of stocks in the S&P 500®Index that have the highest quality score, which is calculated based on three fundamental measures, return on equity, accruals ratio and financial leverage ratio. The Fund and the Index are rebalanced and reconstituted semi-annually on the third Friday of June and December.

https://www.invesco.com/portal/site/us/investors/etfs/product-detail?productId=sphq

3.Big Chinese Internet Names Still Below 2018 Highs…Tencent and Alibaba.

4.We Have Mentioned Drop in Semiconductor Sales…Watching Stocks.

A Semi-Serious Decline

Thu, May 9, 2019

One sector that has been hit especially hard this week has been semiconductors. On top of the escalating trade tensions with China of which the sector is highly exposed, weak commentary from Intel (INTC) hasn’t helped. While off its lows of the day, the S&P 500 Semiconductor and Semiconductor Equipment group is still down more than the broader market with a decline of over 1.5% as of the early afternoon. If that weakness holds into the close, it will mark the fourth straight day of 1%+ declines. To put that kind of streak into perspective, since the lows of the financial crisis, there have only been three other four-day stretches where the group showed declines of a similar magnitude and the last time the group had a longer streak was 15 years ago in April 2004! The most recent of the three prior four-day streaks of 1%+ declines was back in August 2015.

As far as the semiconductor group’s price chart is concerned, the picture isn’t any prettier. For now, today’s drop has pushed the sector below its 50-DMA for the first time since January. In the process, the group also sliced right through what was potential support at levels that acted as support in the late summer/ early fall of 2018.

©2019 Bespoke Investment Group

Bespoke Investment Group

https://www.bespokepremium.com/interactive/posts/think-big-blog/a-semi-serious-decline

5.Another Example of How Tough it is to Time Market.

What Inning Are We In?

Posted May 10, 2019 by Ben Carlson

The markets are always and forever going to be cyclical but the timing and magnitude of those cycles will always be different. No one can forecast these things with accuracy and if they could they wouldn’t spend their time warning you about them.

Plus, even if I gave you the exact start and end dates of the next recession you still may not be able to take advantage. This is the performance of the S&P 500 during every recession going back to the mid-1920s:

In 8 out of the past 15 recessions — so more than half the time — stocks were actually positive during the duration of those economic slowdowns. In fact, in 6 out of these past 15 recessions, stocks were up double digits.

The average and median returns for this list were -1.2% and +4.1%, respectively. Since World War II, those numbers were +3.6% and +5.9%.

This doesn’t mean stocks weren’t down big around these slowdowns but bear markets don’t perfectly align with the start and end dates of recessions. The last recession ended in June 2009 but stocks had already begun rallying hard in early-March of that year. By the time the 2001 recession began stocks were already down close to 20% and they fell even further after the recession ended.

There’s no way to perfectly line up economic and market cycles because investors over- and underreact to these situations.

The bigger risk for most people is constantly forecasting where we are in the cycle and then guessing what that means for their money based on faulty predictive abilities.

Where you are in your investment lifecycle is far more important than where we’re at in the economic or market cycle.

Your risk profile and time horizon are much easier to define than what inning we’re in.

https://awealthofcommonsense.com/2019/05/what-inning-are-we-in/

6.Walmart Retail Sales Still 4x Amazon.

WSJ

Amazon’s Size Is Becoming a Problem—for Amazon–Branching out, the juggernaut is getting embroiled in controversies from Echo to cloud; a Twitter war with Elizabeth Warren

By

Christopher Mims

May 11, 2019 12:00 a.m. ET

7.10 Year Treasury Yield Trade Down to Late 2017 Lows.

8.Government Budget…Interest and Mandatory Spending vs. Revenues.

Holger Zschaepitz @Schuldensuehner May 11

More

US govt’s borrowing accelerating & set to go through roof on deficit spending & as US population aging & growth in Social Security spending set to structurally rise from 8%-10% of GDP to >17% in coming decades. Interest & mandatory spending will overwhelm rev around 2030 (via GK https://twitter.com/Schuldensuehnerhttps://twitter.com/Schuldensuehner

9.Gen Y Goes House Flipping.

-“When you buy these houses, you never think you’ll lose money,”

Young Real Estate Flippers Get Their First Taste of Losing

After piling in when the market was hot, investors are facing losses from homes that take too long to sell.

By

Prashant Gopal

Sean Pan wanted to be rich, and his day job as an aeronautical engineer wasn’t cutting it. So at 27 he started a side gig flipping houses in the booming San Francisco Bay Area. He was hooked after making $300,000 on his first deal. That was two years ago. Now home sales are plunging. One property in Sunnyvale, near Apple Inc.’s headquarters, left Pan and his partners with a $400,000 loss. “I ate it so hard,” he says.

A new crop of flippers, inspired by HGTV reality shows, real estate meetup groups, and get-rich gurus, piled into the market in recent years as rapid price gains helped the last property crash fade from memory. Many newbie investors are encountering their first slowdown and facing losses from houses that take too long to sell. Meanwhile, they face steep payments on a kind of high-interest debt—known as “hard-money” loans—that helped power the boom.

“Flipping only works in an appreciating market where homes move quickly,” says Glen Weinberg, the Denver-based chief operating officer of Fairview Commercial Lending, which is tightening its standards for real estate investors. “Those factors are now in flux, and that’s what’s going to lead to the demise of a lot of flippers.”

About 6.5 percent of U.S. sales in the fourth quarter were flips, or homes sold within a year from when they last changed hands. That was the highest share in seasonally adjusted data going back to 2002, according to real estate data firm CoreLogic. (It’s even higher than during the last boom, when there were more newly built houses for buyers to choose from.) Such deals were particularly attractive in Western markets such as Northern California and Seattle, where prices climbed by double-digit percentages annually. But some areas got too hot, and prices are flattening or falling. Fourth-quarter losses for flippers who sold within a year were the highest since 2009, according to a CoreLogic analysis that looks at buying and holding costs, but not rehab expenses. In the San Jose area, 45 percent of flips lost money.

Unlike the last decade’s housing crash, in which speculators bought simply to resell, many of today’s flippers sink money into fixing up properties. Their hard-money loans, which come from private investment groups, often have high interest rates and low down payments. The loans also are bigger because renovation costs are folded in.

Large companies including Blackstone Group LP and Goldman Sachs Group Inc. have gotten into such lending. Competition has helped drive interest rates on some of the loans below 10 percent, says Todd Teta, chief product officer at Attom Data Solutions, a real estate tracker. Now lenders “are easing capital requirements and lengthening loan terms because it’s taking longer to flip homes,” Teta says.

Many flippers are professionals who’ve been in the business for years. But the latest boom has also lured people such as Rachelle Boyer in Seattle, who got into property investing after attending a $25,000 real estate coaching program. The course taught her to think big, stay positive, and never quit. In 2016 she left a six-figure job and started flipping houses. When demand slumped last year, she fell behind on hard-money loan payments for two houses languishing on the market. She has one more to get rid of. “We will get through the dip. Things are already perking up a bit,” Boyer says. Nevertheless, she’s reconsidering the wisdom of reselling rehabs. Her goal now is to buy 25 houses in Pittsburgh, a cheaper, less volatile market, with a strategy of holding on to the properties as rentals.

Weinberg, the Denver hard-money lender, says he’s increasingly selective with borrowers and deals. He requires flippers to put 40 percent down on a house. But the lenders he competes with are financing purchase and rehab costs with only a small down payment or none at all. The flipper “can go in with no money, his pockets just blowing in the breeze,” he says. “The lenders are going to be left holding the bag.”

The downturn may provide an opportunity by lowering the cost of houses, but buyers have to be able to withstand losses. Bryan Pham, a Bay Area software engineer who also flips houses, has purchased four during the slowdown even as he’s had to put some projects on hold. After the downturn last year, he decided to pay $47,000 extra in loan extensions so he could keep three homes off the market, waiting for spring demand to kick in. Pham estimates he’ll take a $50,000 loss on one home that was listed for $1.1 million and took a month to go under contract. “I’ve seen people make foolish decisions in the past and still make money,” he says. “Now you have to be conservative.”

Pan, the aerospace engineer, is undeterred. He started a blog and podcast about flipping and plans to quit his job to focus on flips full time. He got into property investing after reading Robert Kiyosaki’s financial advice book, Rich Dad, Poor Dad. Pan began scouring online investment forums and attending meetup groups to learn more, but his biggest lesson came last year with the Sunnyvale home. He thought he got a “sweet deal,” negotiating the $2 million asking price down to less than $1.8 million. He and his partners decided to go all out on the remodel. The project took longer than expected, and then the market went soft.

Pan couldn’t afford to wait for a rebound. The holding costs alone for three properties he was trying to dump totaled $30,000 a month. The home sold for less than $1.7 million, or more than $80,000 below what he paid for it. “When you buy these houses, you never think you’ll lose money,” he says. “I fixed it up. It should be worth more, but things change.” —With Patrick Clark and Sydney Maki

BOTTOM LINE – Fueled by high-interest, hard-money loans from private investors, individuals have gotten into real estate speculation again.

10. The 5 Components of Emotional Intelligence for Great Leaders

Apr 28, 2019

By

Nora Mork

Many believe that the characteristics that make a good leader are the traditional traits, such as charisma, drive, and vision. However, what’s more important than all the other characteristics and is present in all of the greatest leaders is emotional intelligence. The best and most successful leaders are considered emotionally intelligent, meaning they can understand their own emotions and those of others.

This term became popular in 1996 when Dan Goleman published his book “Leadership: The Power of Emotional Intelligence” and defined the five parts of emotional intelligence which are self-awareness, self-regulation, internal motivation, empathy and social skills.

Below are the 5 components of emotional intelligence critical to be a great leader:

- Self-Awareness

Self-awareness is the ability to acknowledge in real-time your own emotions and passions and the effect those have on others. You know the impact your emotions have on your behavior and that they can be contagious. This means that an emotionally intelligent leader will keep a positive and inspiring tone to their emotions to motivate their team and keep a calm office.

Someone who has a short fuse and irrational reactions to certain things will undoubtedly affect the morale or their team. A leader who behaves in a calmer, more relaxed way, even in the face of unexpected obstacles or challenges will gain the respect of their team.

- Self-Regulation

Understanding your emotions and their effect is one thing, but a truly important aspect of emotional intelligence is self-regulation, the ability to channel or refocus potentially negative emotions into constructive action. For example, fear doesn’t lead to a failure to act but inspires a leader to tackle the thing they fear.

Self-regulation can be defined as personal accountability or staying in control of your emotions. If you are tempted to let your frustrations out on someone else, instead of holding your breath and counting to ten, try writing down the negative comments on paper then shredding it – this can be really helpful for letting off steam and regaining your calm.

“Holding on to anger is like grasping a hot coal with the intent of throwing it at someone else: you are the one who gets burned.” – Buddha

- Internal Motivation

A key component of emotional intelligence is self-motivation. This means that a person does not need external validation or factors such as money or status to drive their work. A self-motivated person will have naturally high standards, optimism, and passion towards achieving their purpose. This, in turn, motivates individuals working under such a leader.

How can you become more self-motivated? Consider why you’re doing your job, and why you were passionate about it in the first place. It’s important to understand your purpose and remind yourself why you love your job. If you come across an obstacle in your work, try to find a positive from it, or a lesson learned.

- Empathy

Empathetic leaders can relate to what other people are going through and can adapt their approach accordingly. Empathy in a leader means they listen to their team, both what they are saying verbally but also non-verbal cues such as tone and body language. This is critical for a good leader, as it creates an inclusive team with engaged and loyal members.

A leader without empathy won’t realize the impact their decisions or words have on others, which affects their ability to self-regulate. They may also ask too much of their team, or make unreasonable requests, whereas a leader with empathy will understand the individuality of each person’s situation and how that affects their work.

To improve your empathy, it’s as simple as putting yourself in someone else’s shoes. Seeing something from someone else’s perspective is invaluable for understanding their motivations.

“If there is any one secret of success, it lies in the ability to get the other person’s point of view and see things from his angle as well as your own.” – Henry Ford

- Social Skills

Social skills can include building rapport, team building, and networking. Social skills are important for dealing with awkward situations, conflict resolution, and motivating and praising team members.

These 5 components of emotional intelligence are important for any aspiring leader to understand. As an emotionally intelligent leader, you know how to manage your emotions and use these to motivate and inspire your team. The better a person becomes at managing these 5 aspects, the more chance they have of being a successful leader.