1.Micro-Caps Barely Up for the Year After Yesterday.

Micro Cap ETF IWC YTD. …Still -20% from Highs.

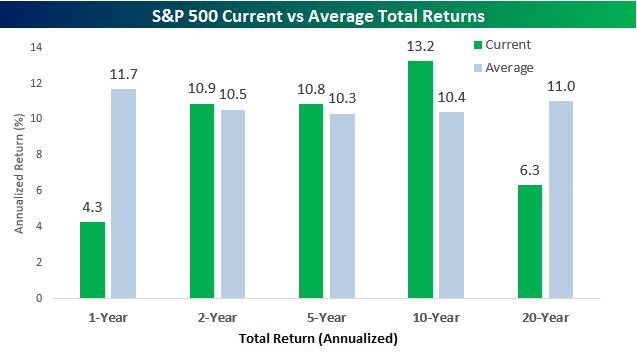

By just about all accounts, investors have been spoiled over the last ten years as the S&P 500 has rallied more than 13% on an annualized basis. However, when you compare returns for the market over the last one, two, five, ten, and twenty years, current returns are hardly at any sort of historical extreme. The chart below compares the S&P 500’s annualized performance on a total return basis to the average annualized return for all similar time frames. Looking just at the last year (through 9/30), the S&P 500’s total return is 4.3%, which is less than half of the historical average one year total return of 11.7%. Looking at two and five-year annualized performance figures, current returns are just modestly above their historical average. While the ten-year annualized return is almost three percentage points above the historical average, the current 20-year annualized gain of 6.3% is well below the S&P 500’s historical average of 11.0%.

https://www.bespokepremium.com/interactive/posts/think-big-blog/you-call-this-a-bull-market

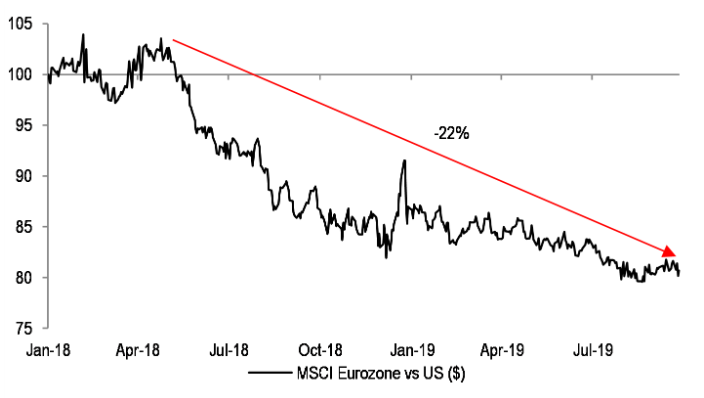

Continue readingThe JPMorgan analysts point out the eurozone stocks are underowned, after stocks have dropped 20% in U.S. dollar terms over the past 18 months.

Why JPMorgan says it’s time to switch to Europe stocks from U.S.By Steve Goldstein

Continue readingBarrons

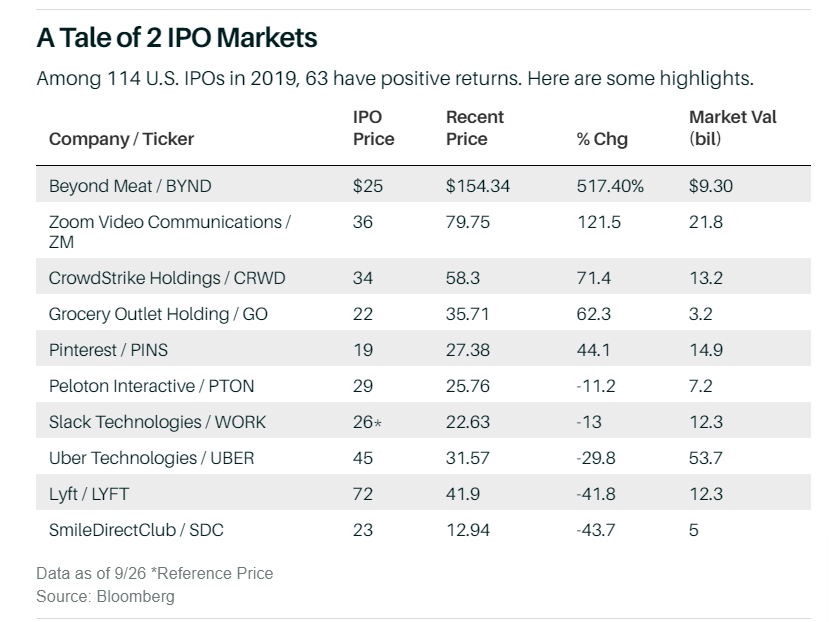

Amid the headlines about IPO disappointments, there is a broader takeaway: Investors have become more discriminating, and that’s good for everyone. “Everything has changed, and nothing has changed,” says Lise Buyer, founder of Class V Group, an IPO consulting firm. “Lately, there’s been lots of noise and fireworks, and hullabaloo about direct listings. But the No. 1 thing is that fundamentals have not changed. Institutional investors are pretty darned smart when looking at IPOs, regardless of structure and buzz. Investors will analyze the company, the prospects for the future, and the price at which they’re being offered the chance to invest. That has not changed as long as I’ve been in the business.”

IPO tracker IPOScoop.com counts 114 U.S. IPO pricings in 2019—63 have had positive returns.

IPOs Have Been Crushed in 2019. Why That’s Actually Good News for Stocks.

Continue readingAEIdeas Mark J. Perry@Mark_J_Perry

Found at https://www.morningbrew.com/

Continue reading