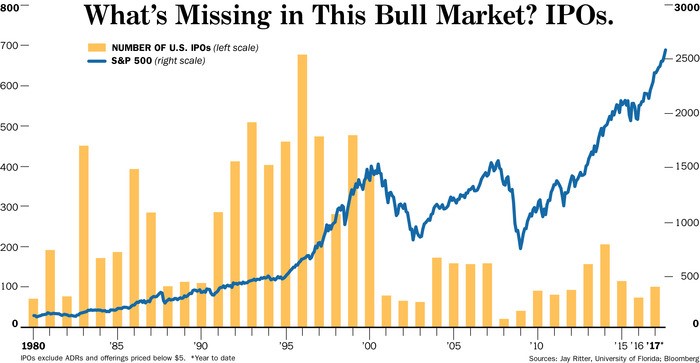

1.The 3rd Longest Bull Market Ever is Still Lacking IPOs

Barron’s

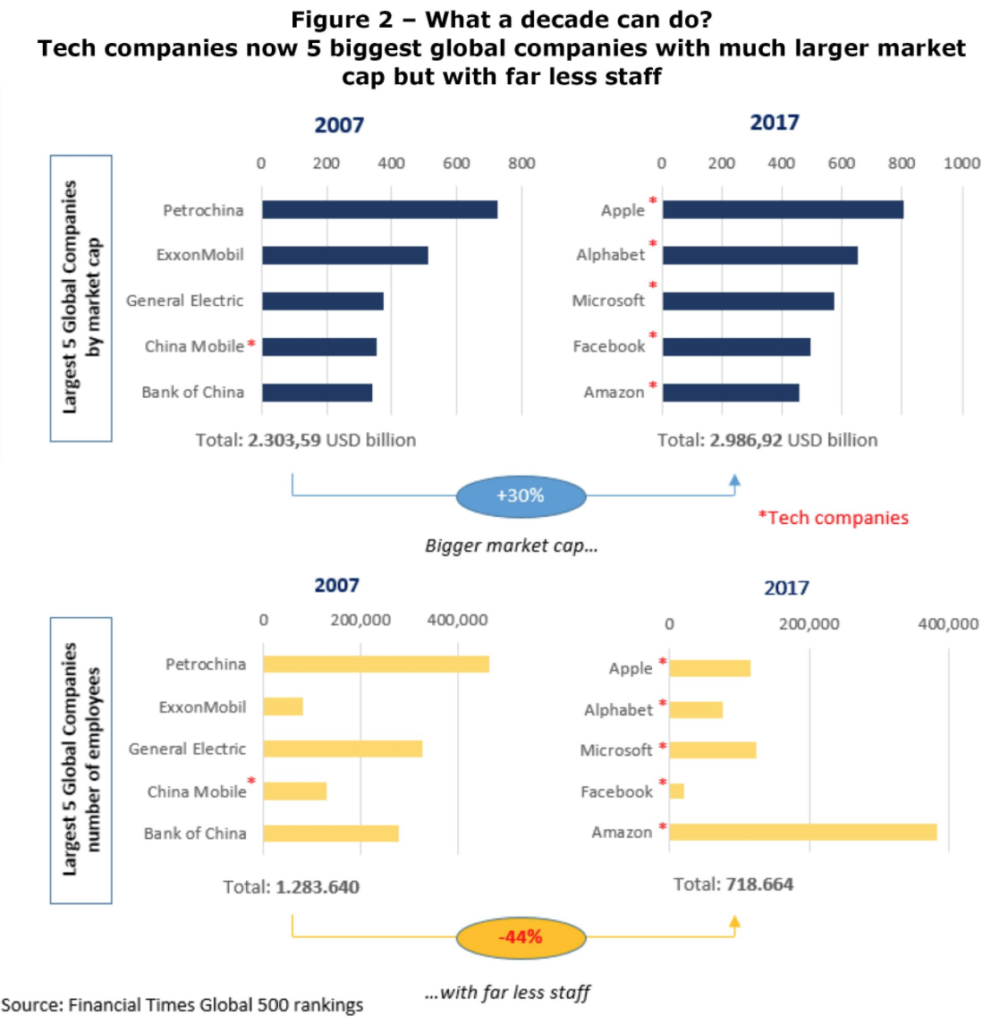

The dearth of companies making their trading debuts is an unusual feature of what has been a record run for the stock market. In the heady 1990s, there were an average of 436 IPOs per year in the U.S., based on Ritter’s data. Last year, there were just 74. A number of reasons have been cited, including increased regulations and scrutiny for public companies, as well as the deluge of private capital.

The flood of private money is overwhelming ..Stat of week

FOR NOW, IT’S HARD to blame entrepreneurs for holding back on IPOs. The flood of private capital has changed the calculus. In one example, Japanese conglomerate SoftBank Group has raised over $93 billion for a technology investment fund. Those dollars alone exceed the $84 billion in total proceeds raised in U.S. IPOs since the start of 2015.

Read full story

https://www.barrons.com/articles/unicorns-what-are-they-really-worth-1510974129