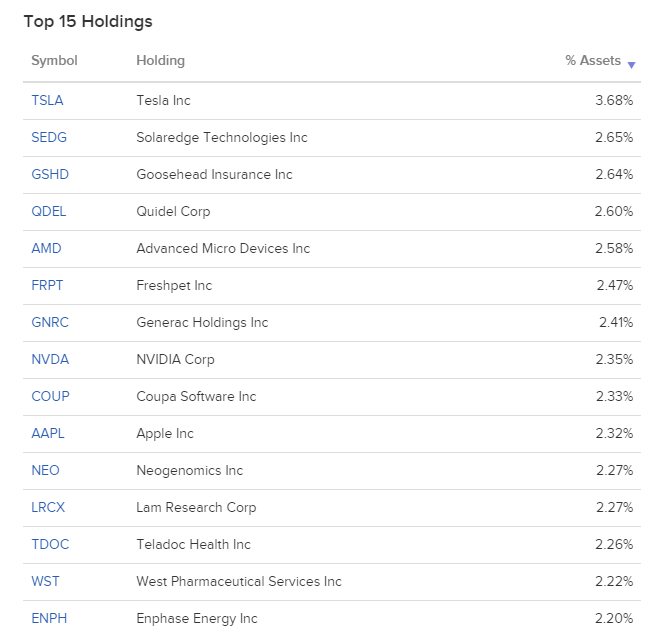

1. Hottest Momentum ETF in U.S. is QMOM

(Alpha Architects) https://alphaarchitect.com/

QMOM +26% vs. MTUM +15.5% vs. SPY +5%

Concentrated MO MO 50 Holdings

https://etfdb.com/etf/QMOM/#holdings

2. Five Year Inflation Expectations Well Off Bottom

Markets were paying close attention to minutes from the Fed’s recent meeting due later in the day for any hints on what the Fed could announce in September – Some investors speculated the Fed will adopt an average inflation target, which would seek to push inflation above 2% for some time.

The $20 trillion U.S. Treasury market is giving the Federal Reserve a thumbs-up for its efforts to revive inflation after the coronavirus pandemic threatened to inflict a damaging bout of deflation on the U.S. economy – The best measure of that is inflation-adjusted interest rates on 10-year Treasury bonds, which have plunged well below zero as nominal yields held fairly steady. Other signs of success include rising expectations for future prices among U.S. households

Dave Lutz at Jones Trading

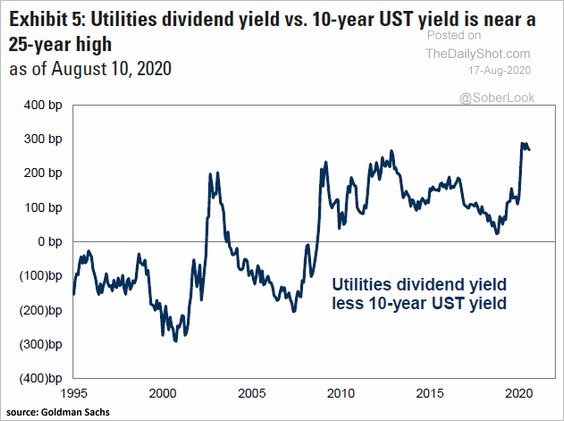

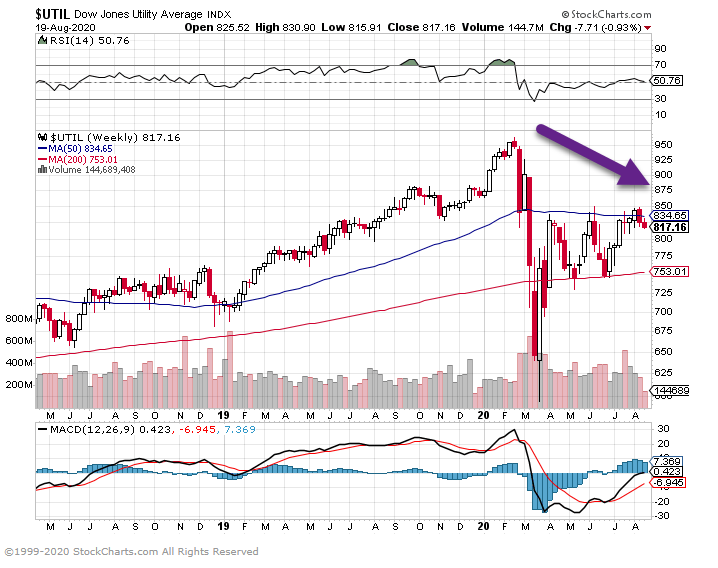

3. Utilities Dividend Vs. 10 Year at 25 Year High.

Liz Ann Sonders-Schwabhttps://twitter.com/LizAnnSonders

Utilities Still Well Below Highs

4. I Agree with Ben Carlson…The Chart Almost Looks Fake….TSLA

https://twitter.com/awealthofcs/status/1296100869998616582/photo/1

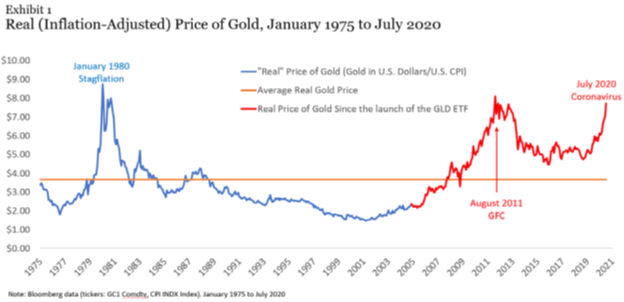

5. Gold at Historically High Levels in Real (Inflation Adjusted) Terms

Larry Swedroe

As you can see in the following table, the recent rally in gold has it trading at historically high levels in real terms.

How important is the real price of gold in terms of future returns? In their 2015 study “ The Golden Dilemma,” Claude Erb and Campbell Harvey found that “the real price of gold was a more important driver of future nominal and real gold returns than the realized rate of inflation.” With that in mind, is now a good time to buy gold? Erb, Harvey, and Tadas Viskanta, authors of the August 2020 paper “ Gold, the Golden Constant, COVID-19, ‘Massive Passives’ and Déjà Vu,” analyzed the historical evidence to help investors determine the answer to that question.

Now Might Not Be A Good Time To Buy Gold https://seekingalpha.com/article/4369361-now-might-not-be-good-time-to-buy-gold

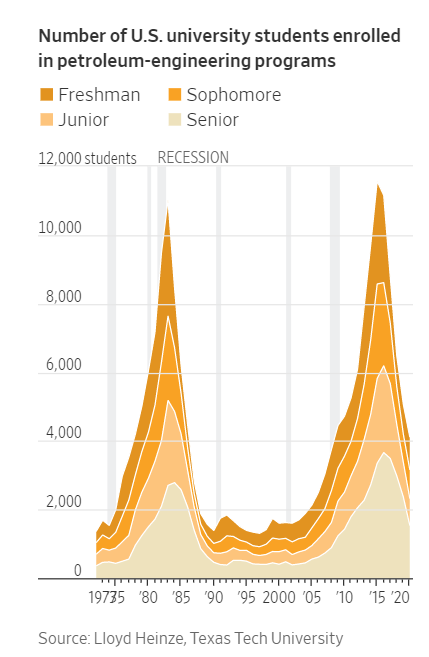

6. Millennials Not Going for Big Oil Careers

By Rebecca Elliott-WSJ

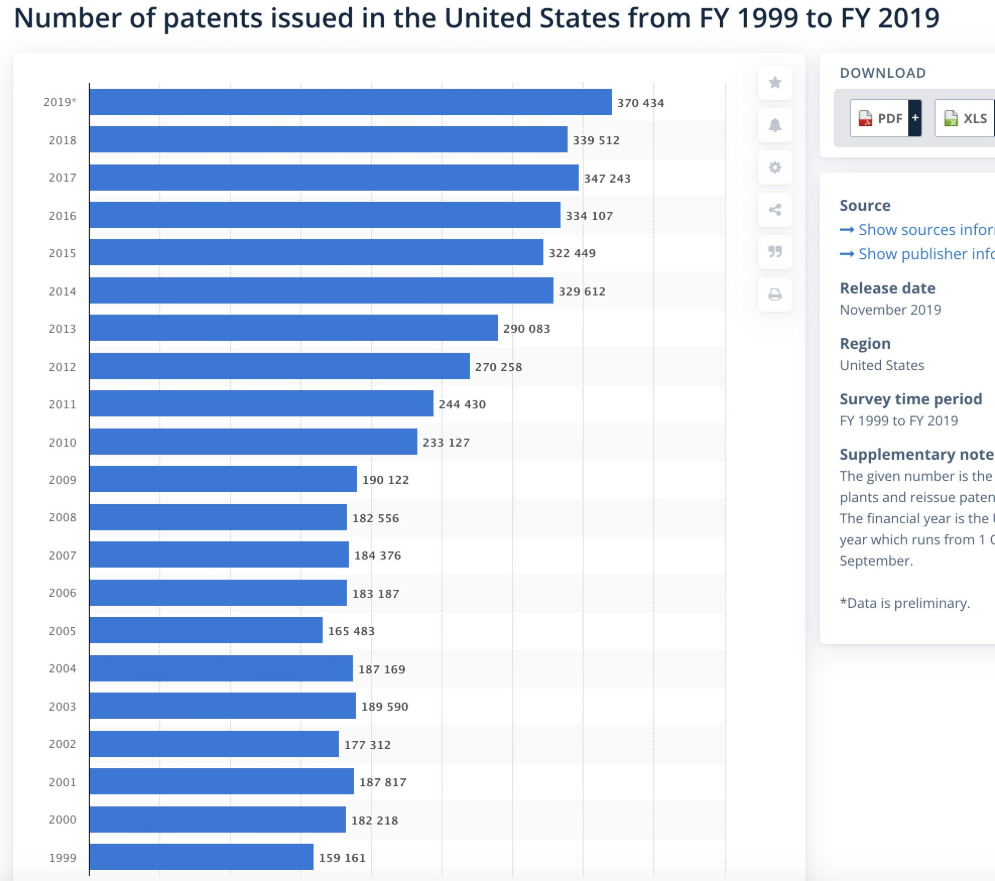

7. Number of Patents Issued Since 1999 Has Doubled.

Jim OShaughnessy

8. Lots of Good News on Housing Starts But We Are Seeing Spike in Mortgage Delinquencies.

Mortgage delinquencies spiked in the second quarter. As the unemployment crisis deepens, will the surge continue? Data from the invaluable

@SoberLook, https://thedailyshot.com/2020/08/18/the-ongoing-shift-to-suburbia-in-search-of-home-office-and-classroom/

https://twitter.com/adam_tooze/status/1295757939018358784/photo/1

9.Your Mortgage Refinance Could Cost Thousands More Thanks To New Fee

Natalie Campisi, Forbes Staff

Refinancing is set to get more expensive this fall. A new fee, known as the “adverse market refinance fee” (Fannie Mae) or the “market condition credit fee” (Freddie Mac), will be assessed to most refinance mortgage loans sold to Fannie Mae and Freddie Mac starting Sept. 1. The fee is a flat 0.5% or 50 basis points of the total loan amount, adding hundreds or even thousands of dollars to the cost of a refinance.

The new fee comes at a time when mortgage rates are falling to record-breaking lows and refinance activity is on the rise. Mortgage refinance activity last week was up by 9% from the prior week and was 47% higher than the same time last year, according to the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending Aug. 7, 2020.

The reason for the fee is to offset higher risk due to a shaky economy, both Fannie Mae and Freddie Mac said in bulletins issued Wednesday night. Most refinances, including cash-out refinances, would be subject to the fee.

“As a result of risk management and loss forecasting precipitated by COVID-19 related economic and market uncertainty, we are introducing a new Market Condition Credit Fee in Price,” according to a statement by Freddie Mac.

New Fee Runs Counter to Fed’s Efforts to Keep Costs Down

For a borrower refinancing a $350,000 mortgage, the fee would tack on an additional $1,750. For someone with twice that mortgage, the fee would add $3,500 on a $700,000 refinance.

PROMOTED

Grads of Life BRANDVOICE | Paid Program

5 Ways Employers Can Support Black Employees: A Young Leader’s Advice

For some, this fee is counterproductive to efforts the Federal Reserve has made since the start of the pandemic to encourage lending activity while making loans affordable by keeping mortgage interest rates low.

“The housing market has been able to withstand many of the most severe effects of the COVID-19 pandemic,” MBA President Bob Broeksmit said in a statement. “The recent refinance activity has not only helped homeowners lower their monthly payments, but it is also reducing risk to the (government-sponsored enterprises) and taxpayers. At a time when the Federal Reserve is purchasing $40 billion in agency (mortgage-backed securities) per month to help reduce financing costs for mortgage borrowers to support the broader economy, this action raises those costs and undermines the Federal Reserve’s policy.”

Fee Also Applies to Most Specialty Loan Refinance Programs

Both Fannie Mae and Freddie Mac have loan programs designed to help a wide variety of borrowers in need. These programs have caps on the total amount of fees that can be assessed, however, the new adverse market refinance fee would apply to all of these programs, regardless of the cap:

· Fannie Mae’s HomeReady refinance program is designed for borrowers facing financial challenges, and its high loan-to-value (LTV) refinance program offers a chance for borrowers making on-time payments to refinance their mortgages even if their LTV exceeds the maximum for standard cash-out refinances.

· Freddie Mac’s Home Possible mortgage refinance program is for low-income homeowners, and its Enhanced Relief Refinance mortgage program was created for borrowers who can’t refinance because of a drop in property values.

The only loans that are exempt from the new fee are home loans that qualify for single-closing interim construction financing and permanent financing, which is one mortgage for borrowers who are building new homes. This end-to-end loan covers buying the land, through the construction phase into the permanent home loan.

What You Should Do If You Want to Refinance

Despite the new fee, some borrowers will still be able to save money on their monthly mortgage payments, as well as the total interest paid on their loans, by refinancing. Mortgage rates are currently tracking below 3%, which puts nearly 18 million people in line to save money by refinancing, according to Black Knight, a mortgage technology, data and analytics provider.

Along with the new fee announced on Wednesday, there are closing costs that should be factored into your decision. Typically, these costs are about 2% to 3% of your total loan amount. Closing costs usually include title and insurance fees, appraisals, application fees and, in some areas, attorney fees.

Other things to consider before you refinance is whether you plan on moving. If you’re going to sell your home within a few years, you likely won’t save enough money refinancing to make up for the amount you spend in closing fees.

Finally, make sure your credit score is high enough to snag the interest rate you need to save money. Although many lenders are advertising sub-3% rates on 30- and 15-year mortgage refinances, usually only borrowers with above average credit scores (in the 700 and above range) will qualify.

Follow me on Twitter or LinkedIn. Send me a secure tip.

10. Ten habits of bad management

Image from Shutterstock.com

Jan 282019by Andre de WaalPrint This Article

If you’re looking to run a high-performance organization, you need to be able to be able to recognize the signs of bad management. If low-performing managers are not dealt with, an organization will never be able to become excellent. Here are ten habits to look out for that no organization should put up with:

Bad managers clean up the mess of their predecessors – even when there is no mess.

When appointed in a new position, the bad manager claims that the predecessor has made such a big mess of the department that it will take at least one year, if not more, to get everything in order, and of course the bad manager cannot possibly work yet on achieving the departmental targets this year…maybe next year too.

Bad managers are always busy, busy, busy

They are involved in many, many projects; in fact, they’re so busy that there isn’t enough time to work on regular tasks! And because these projects are vital for the success of the organization (or so they say), bad managers cannot possibly be expected to work on their departmental targets. They will get to that when their other projects are finished…which they never are.

Bad managers know how to play the goals game

They know that departmental goals should be loose, with lots of slack, which means the targets will be very easy to achieve. Bad managers will never get optimal results from their departments; but that doesn’t matter to them, bad managers would rather have low performance than run the risk of punishment for falling short of ambitious targets.

Bad managers only manage from a distance

Bad managers love to use performance indicators because these make it possible to practice hands-off management. This in turn makes it easy for bad managers to avoid the day to day department activities altogether. And of course, if anything goes wrong, they can dodge accountability: they weren’t there, after all!

Bad managers always blame somebody else

Bad managers have a host of excuses at their disposal when they don’t achieve departmental targets. They blame the management reports because these do not accurately reflect performance; their own reports show that they did achieve the targets.

Bad managers blame the outside world: the economy was going down, it has rained too much, it hasn’t rained enough, whatever – but that is the reason everything was going against the department and therefore it was just impossible to achieve the targets! Next year, they say, will be better. They blame the weakest colleague, it was his or her fault the department floundered. So the organization first needs to hire someone new before they can be expected to work on achieving their targets.

Bad managers make lengthy, impressive plans

When writing up the latest game plan, bad managers know that expansive, wordy, and complex plans always impress top management because it gives the impression that they are on top of their game and have thought of everything.

They also know that you can bury all kinds of assumptions and preconditions in these verbose plans, which function as safeguards when top management starts complaining that goals have not been achieved (“Well, you knew that could happen, we put it on page 237, section 3, line 5 …”).

An additional advantage is that employees will not read nor understand these, so it will take a lot of time before the department can actually start working on realizing the plan, if ever.

Bad managers only communicate in one way

Bad managers are all capable of holding an open forum for employees to voice concerns, questions, and suggestions. This sounds like the mark of a good manager, right? However, the bad manager only feigns interest in employee feedback, and won’t actually act on what he or she hears. Instead, bad managers stick to their own plans. If people complain, the bad manager will use open forums against the participants, claiming that any incompetency is the fault of everyone.

Bad managers only have eyes for the shareholder

Bad managers know who butters their bread: the shareholder. Therefore, bad managers work diligently on satisfying these shareholders, even it this works to the detriment of the organization’s long-term interests.

Bad managers are real Machiavellians

They have Machiavelli’s book, The Prince from 1513 on their bedside table and turn to it often for advice on how to practice effective “divide and conquer” strategies: manipulating colleagues, employees and bosses. As a result, the targeted members in the organization become preoccupied with guarding their backs instead of focusing on growing the department.

Bad managers have an exit strategy

When the organization is on the verge of holding a bad manager accountable for his or her (in)actions, the bad manager moves on to another organization. In fact, the bad manager had plotted his or her exit strategy for a long time, and always has a fall-back organization where he could flee.

It goes without saying that these ten habits don’t exist in HPOs! But as most organizations are not HPO yet, it is good for you to be able to recognize the signs of bad management. This way you can deal with these ‘bad managers’ quickly…which is, after all, also a characteristic of a HPO manag

https://www.management-issues.com/opinion/6398/ten-habits-of-bad-management/

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.