1. Sector Changes in the Dow….Tech Down Healthcare Up.

Bespoke notes The biggest shifts in sector weights with the Dow Changes will be in Health Care and Industrials (to the upside) and Technology and Energy (to the downside) – Roughly $31.5 billion of assets are benchmarked to the Dow, with $28.2 billion of passively managed funds linked. (The figures are $11.2 trillion and $4.6 trillion for the S&P 500.)

From Dave Lutz at Jones Trading.

2. Airlines vs. Gold Hitting Historical Lows.

Which Asset Is Most Sensitive to Vaccines?

The biggest underperformers under the pandemic — airlines — will likely come back with a bang should vaccines be cleared for broad use and virus counts decrease. At the same time, some of this year’s biggest gainers would slump, especially gold. Gold tumbled and value stocks gained after Russia’s vaccine news, imagine how much stronger the moves would be if an inoculation received full approval from a western nation or two. – BBG

From Chris Preston River and Mercantile

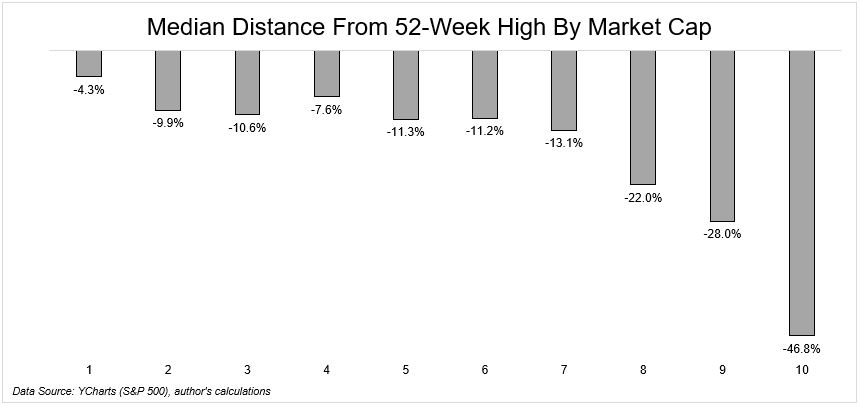

3. The Other 94%…Just 6% of S&P at 52 Week Highs

Posted August 20, 2020 by Michael Batnick

Yesterday, the S&P 500 made a new all-time high. However, of the 500 members in the index, just 6% were concurrently making 52-week highs.

This is a remarkable data point, but it doesn’t necessarily tell the whole story. What if the other 94% were just 2% from a 52-week high? They’re not, but if they were, this data point would obscure that fact.

This data point also doesn’t reveal that the median stock is 63% above its 52 week low. Most stocks might not be near a 52-week high, but they’re also very from their 52-week lows.

So how exactly are stocks doing? On an absolute basis, the median S&P 500 stock is down 3.1% year-to-date, while 56% of them are above their 200-day moving average. Hardly terrible, but not great either.

On a relative basis, it’s pretty gnarly out there. 64% of the S&P 500 is under performing the index in 2020. The median level of underperformance -22%. The 64% is actually in line with historical numbers, but the magnitude (-22%) sounds high. I don’t have that data, but would love to see it if anybody does.

The only thing you really need to know to determine how a stock has performed in 2020 is by looking at its market cap. Granted, there might be a little double counting going on because I’m measuring from today, not from Jan 1, but I’m nearly certain that the numbers wouldn’t change much at all.

It’s normal to worry about the market when fewer and fewer stocks are leading the charge, but this is not a new worry, we’ve been talking about this for years

I know this is the type of thing that doesn’t matter until it matters, but we should also consider an alternate outcome. What if a handful of the other 94% of stocks catch up? I’m not predicting that, but it’s an outcome that we have to at least be open minded to.

It’s always important to look beyond individual data points, because facts don’t always tell the whole story.

https://theirrelevantinvestor.com/2020/08/20/the-other-94/

4. Global companies raise most funds for the month of August in a decade

Scott Murdoch, Patturaja Murugaboopathy

(Reuters) – Companies raised the most funds in global equity and debt markets for the month of August in a decade as homebound bankers spend their summer fixing deals off the back of trillions of dollars of stimulus worldwide to fight the coronavirus pandemic.

Companies have raised $65.5 billion through initial public offerings (IPOs) and high-yield bond issuances globally so far in August, the highest for that month in at least 10 years, according to Refinitiv data. They raised $98.6 billion in July and $126.5 billion in June, which was the highest in 20 years.

Graphic: Monthly global IPO proceeds here

Found at Crossing Wall Street blog http://www.crossingwallstreet.com/

5. The Growth Rate of U.S. Debt Outpacing WWII

We Have Crossed the Line Debt Hawks Warned Us About for Decades—

The debt of the United States now exceeds the size of its gross domestic product. That was considered a doomsday scenario that would wreck the economy. So far, that hasn’t happened

“At this stage, I think, nobody is very worried about debt,” said Olivier Blanchard, a senior fellow at the Peterson Institute for International Economics and a former chief economist for the International Monetary Fund. “It’s clear that we can probably go where we are going, which is debt ratios above 100 percent in many countries. And that’s not the end of the world.”

That nonchalant attitude toward what were once thought to be major breaking points reflects an evolution in the way investors, economists and central bankers think about government debt.

At the end of last year, the United States was about $17 trillion in debt — roughly 80 percent of the gross domestic product. In January, government analysts predicted that debt would approach 100 percent of the G.D.P. around 2030. But by the end of June, the debt stood at $20.53 trillion, or roughly 106 percent of G.D.P., which shrank amid widespread stay-at-home orders. (These numbers don’t count trillions more the government owes itself in bonds held by the Social Security and Medicare trust funds.)

That more than 25 percentage-point surge would represent the largest annual leap in American indebtedness since Alexander Hamilton founded the nation’s credit in the 1790s, outpacing even the debt growth at the peak of World War II, according to data from the Congressional Budget Office.

6. Tech vs. Dividend Growers 15 Year Chart

So it’s no surprise that the tech-heavy S&P 500 has been outperforming the S&P 500 Dividend Aristocrats for many years. But if you look back 15 years, the story changes:

Over 15 years, the S&P 500 Dividend Aristocrats Index has beaten the performance of the full S&P 500 Index.

FACTSET

These ‘Dividend Aristocrat’ stocks have been raising their dividends for decades, and there have been no dividend cuts during the pandemic By Philip van Doorn

7. Disney Leads Old Media Giants in Making Money From Streaming

Christopher Palmeri

Disney Leads Old Media Giants in Making Money From Streaming

(Bloomberg) — Online video is becoming a serious business for some of America’s oldest and largest media companies, with Walt Disney Co. leading the pack.

Disney will generate an estimated $11.2 billion in direct-to-consumer revenue this year, according to a report released Monday by Macquarie Research. That would account for 19% of its total sales — a level rivals in traditional media haven’t matched.

Macquarie credits Disney+, which quickly snapped up more than 60 million subscribers, and Hulu, a business that the company gained majority control of last year.

Fox Corp. and Comcast Corp. are the new-media laggards in the old-media group. Fox sold the bulk of its entertainment assets to Disney last year, and Comcast is just getting started in streaming: Its ad-supported Peacock service debuted nationally last month.

The big surprise, however, may be Lions Gate Entertainment Corp., which will get 18% of revenue from streaming this year, according to Macquarie. Lions Gate said recently that it had over 11 million online customers for its Starz service globally.

Analysts expect Netflix Inc. to generate almost $25 billion in revenue this year, virtually all of it from streaming.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

https://finance.yahoo.com/news/disney-leads-old-media-giants-191812649.html

8. 50% of U.S. Households Have Less Than $1000 Saved.

CHART OF THE DAY: Households Were Not Prepared For An Income Shock Keith McCullough @keithmcculloughhttps://app.hedgeye.com/insights/88256-chart-of-the-day-households-were-not-prepared-for-an-income-shock?type=macro%2Cmarket-insights

9. Betting on Return to Workplace

Erica Pandey, author of @Work

Illustration: Annelise Capossela/Axios

As the pandemic has persisted, Silicon Valley tech giants have extended their telework timelines — and some have even said that employees can stay home forever. But now those same firms are simultaneously betting on the future of the office.

Why it matters: Remote work has been successful at many firms, but the vast majority still have strong office cultures. The pandemic won’t drastically alter that.

- “COVID changed a lot of minds,” says Julie Whelan, of the commercial real estate firm CBRE. “That said, there are billions of square feet leased across the United States, and that’s not disappearing overnight.”

What’s happening: Office leasing activity in the second quarter of 2020 was down 44% year-over-year, CBRE reports. But it appears to be bouncing back, led by the tech titans.

- Amazon is adding 900,000 square feet of office space in New York City, Phoenix, Dallas, Detroit, San Diego and Denver. And Facebook is expanding its New York footprint with 730,000 additional square feet in midtown Manhattan.

- Amazon is also in the middle of building two large complexes to complement its Seattle headquarters. Its Hyderabad, India, building is 1.8 million square feet, and its Arlington, Virginia, campus — HQ2 — could be as big as 8 million square feet.

The tech giants’ bets on the importance of the office appear to be shared by other big firms.

- Per a CBRE survey of 126 companies, half of which are Fortune 500 firms, 70% are confident in setting long-term real estate strategies even amid the pandemic.

- 79% say the importance of the physical office will decrease slightly or remain the same when the coronavirus crisis is over.

- And teleworkers across the country say they’ve developed an appreciation for the workplaces they once griped about.

But, but, but: While the pandemic won’t kill offices, its effects on where and how we work will linger.

- Look for many companies to pursue a hybrid of work-from-home and work-from-office. 61% of CBRE’s respondents say employees will be able to work remotely at least part of the time in the post-pandemic world.

- That means those firms won’t need as much space, and many will downsize.

The bottom line: “We’re changing why we need an office: It’s the social interaction,” Whelan says. “That doesn’t need to happen five days a week. But it still needs to happen.”

- As Jerry Seinfeld writes in his defense of New York City, “Energy, attitude and personality cannot be ‘remoted’ through even the best fiber optic lines.”

10. Ten Things You Do That Make You Less Likable

Too many people succumb to the mistaken belief that being likable comes from natural traits that belong only to a lucky few. Dr. Travis Bradberry shows you how being likable is under your control.

BY TRAVIS BRADBERRY, AUTHOR, EMOTIONAL INTELLIGENCE 2.0@TALENTSMARTEQ

Getty Images

Too many people succumb to the mistaken belief that being likable comes from natural, unteachable traits that belong only to a lucky few–the good looking, the fiercely social, and the incredibly talented. It’s easy to fall prey to this misconception. In reality, being likable is under your control, and it’s a matter of emotional intelligence (EQ).

In a study conducted at UCLA, subjects rated over 500 descriptions of people based on their perceived significance to likability. The top-rated descriptors had nothing to do with being gregarious, intelligent, or attractive (innate characteristics). Instead, the top descriptors were sincerity, transparency, and capable of understanding (another person).

These adjectives, and others like them, describe people who are skilled in the social side of emotional intelligence. TalentSmart research data from more than a million people shows that people who possess these skills aren’t just highly likable; they outperform those who don’t by a large margin.

Likability is so powerful that it can completely alter your performance. A University of Massachusetts study found that managers were willing to accept an auditor’s argument with no supporting evidence if he or she was likable, and Jack Zenger found that just one in 2,000 unlikable leaders are considered effective.

I did some digging to uncover the key behaviors that hold people back when it comes to likability. Make certain these behaviors don’t catch you by surprise.

1. Humble-bragging. We all know those people who like to brag about themselves behind the mask of self-deprecation. For example, the gal who makes fun of herself for being a nerd when she really wants to draw attention to the fact that she’s smart, or the guy who makes fun of himself for having a strict diet when he really wants you to know how healthy and fit he is. While many people think that self-deprecation masks their bragging, everyone sees right through it. This makes the bragging all the more frustrating, because it isn’t just bragging; it’s also an attempt to deceive.

2. Being too serious. People gravitate toward those who are passionate. That said, it’s easy for passionate people to come across as too serious or uninterested, because they tend to get absorbed in their work. Likable people balance their passion for their work with their ability to have fun. At work they are serious, yet friendly. They still get things done because they are socially effective in short amounts of time and they capitalize on valuable social moments. They focus on having meaningful interactions with their co-workers, remembering what people said to them yesterday or last week, which shows people that they are just as important to them as their work is.

3. Not asking enough questions. The biggest mistake people make in conversation is being so focused on what they’re going to say next or how what the other person is saying is going to affect them that they fail to hear what’s being said. The words come through loud and clear, but the meaning is lost. A simple way to avoid this is to ask a lot of questions. People like to know you’re listening, and something as simple as a clarification question shows that not only are you listening, but you also care about what they’re saying. You’ll be surprised how much respect and appreciation you gain just by asking questions.

4. Emotional hijackings. My company provides 360° feedback assessments, and we come across far too many instances of people throwing things, screaming, making people cry, and other telltale signs of an emotional hijacking. An emotional hijacking demonstrates low emotional intelligence. As soon as you show that level of instability, people will question whether or not you’re trustworthy and capable of keeping it together when it counts.

Exploding at anyone, regardless of how much they might “deserve it,” turns a huge amount of negative attention your way. You’ll be labeled as unstable, unapproachable, and intimidating. Controlling your emotions keeps you in the driver’s seat. When you’re able to control your emotions around someone who wrongs you, they end up looking bad instead of you.

5. Whipping out your phone. Nothing turns someone off to you like a mid-conversation text message or even a quick glance at your phone. When you commit to a conversation, focus all of your energy on the conversation. You’ll find that conversations are more enjoyable and effective when you immerse yourself in them.

6. Name-dropping. It’s great to know important and interesting people, but using every conversation as an opportunity to name drop is pretentious and silly. Just like humble-bragging, people see right through it. Instead of making you look interesting, it makes people feel as though you’re insecure and overly concerned with having them like you. It also cheapens what you have to offer. When you connect everything you know with who you know (instead of what you know or what you think), conversations lose their color.

People are averse to those who are desperate for attention. Simply being friendly and considerate is all you need to win people over. When you speak in a friendly, confident, and concise manner, people are much more attentive and persuadable than if you try to show them that you’re important. People catch on to your attitude quickly and are more attracted to the right attitude than who you know.

7. Gossiping. People make themselves look terrible when they get carried away with gossiping. Wallowing in talk of other people’s misdeeds or misfortunes may end up hurting their feelings if the gossip ever finds its way to them, but gossiping is guaranteed to make you look negative and spiteful every time.

8. Having a closed mind. If you want to be likable, you must be open-minded, which makes you approachable and interesting to others. No one wants to have a conversation with someone who has already formed an opinion and is unwilling to listen. Having an open mind is crucial in the workplace, where approachability means access to new ideas and help. To eliminate preconceived notions and judgment, you need to see the world through other people’s eyes. This doesn’t require that you believe what they believe or condone their behavior; it simply means that you quit passing judgment long enough to truly understand what makes them tick.

9. Sharing too much, too early. While getting to know people requires a healthy amount of sharing, sharing too much about yourself right off the bat comes across wrong. Be careful to avoid sharing personal problems and confessions too quickly. Likable people let the other person guide them as to when it’s the right time for them to open up. Over-sharing comes across as self-obsessed and insensitive to the balance of the conversation. Think of it this way: If you’re getting into the nitty-gritty of your life without learning about the other person first, you’re sending the message that you see them as nothing more than a sounding board for your problems.

10. Sharing too much on social media. Studies have shown that people who over-share on social media do so because they crave acceptance, but the Pew Research Center has revealed that this over-sharing works against them by making people dislike them. Sharing on social media can be an important mode of expression, but it needs to be done thoughtfully and with some self-control. Letting everyone know what you ate for breakfast, lunch, and dinner, along with how many times you walked your dog today, will do much more harm than good when it comes to likability.

Bringing It All Together

When you build your awareness of how your actions are received by other people, you pave the way to becoming more likable.

What other things make people less likable? Please share your thoughts in the comments section, as I learn just as much from you as you do from me.

Shopify Founder: These Are the 2 Books That Made Me Into a Billionaire

Tobias Lütke credits these two books with transforming him from an awkward programmer into a successful leader.

BY JESSICA STILLMAN, CONTRIBUTOR, INC.COM@ENTRYLEVELREBEL

Tobias Lutke, CEO and co-founder of Shopify. Getty Images

Some billionaire business success stories got where they are on personal charm, salesmanship, and communication chops. Others were quiet, reserved “nerds” who just managed to build a product so awesome it took off like a rocket ship, forcing them to figure out the people side of business on the fly.

Shopify co-founder Tobias Lütke is solidly in the second camp. A programmer by trade, Lütke had no intention of having anything to do with the business side of Shopify, the Canadian startup he co-founded and which has since become an e-commerce juggernaut. But then, as he explained on Tim Ferriss’s podcast, circumstance intervened and he found himself needing to grow into a leader capable of scaling his startup, and fast.

He decided to source some reading that would arm him with the skills he needed. As he shares with Ferriss (hat tip to this excellent post by Alan Trapulionis), that process of soliciting recommendations ended up yielding two titles. Lütke credits them with teaching him the skills to build a billion-dollar business (as well as a multibillion-dollar net worth).

1. Influence by Robert Cialdini

“Influence was just the most mind-bending book you can imagine, because it essentially taught you all the ways humans are flawed and influenceable, and how, yes, computers are predictable, but once you make things for people you need to go into storytelling,” says Lütke.

“Which was news to me, frankly. I spent my teens with computers. Not with people,” he adds to laughs from Ferriss.

An international bestseller when it was first published in 1984, Influence remains a foundational work on the science of persuasion, so Lütke is far from the only brilliant-but-awkward young striver Cialdini has helped. If you’re looking for a quick summary of the book’s basic ideas, Trapulionis’s post has a useful rundown.

2. High Output Management by Andrew Grove

“One of the best books ever,” raves Lütke of this second classic by the former CEO of Intel, describing High Output Management as “a how-to manual that deconstructs the world of business into first principles. It’s like, here’s what matters. Here’s how to think about it.” By laying out building a business like an engineering exercise, Grove’s book made the whole challenge far less daunting, Lütke claims.

He’s not the only nerdy young entrepreneur riding a startup rocket ship to benefit from the legendary title. Mark Zuckerberg also claims the “book played a big role in shaping my management style.”

If you, too, are intimidated by the less technical aspects of building a business, it might be worth picking up these books. Who knows? They might even help you create a billion-dollar company too.

AUG 24, 2020

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

https://www.inc.com/jessica-stillman/shopify-tobias-lutke-andrew-grove.html?cid=sf01003

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.