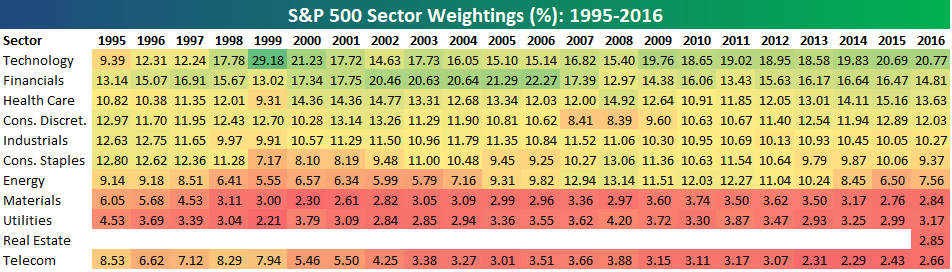

1.Bespoke’s S&P 500 Sector Weightings—

Energy 2019 Less Than 5%

Fri, Sep 20, 2019

S&P 500 sector weightings are important to

monitor. Over the years when weightings have gotten extremely lopsided

for one or two sectors, it hasn’t ended well. Below is a table showing

S&P 500 sector weightings from the mid-1990s through 2016. In the

early 1990s before the Dot Com bubble, the US economy was much more evenly

weighted between manufacturing sectors and service sectors. Sector

weightings were bunched together between 6% and 14% across the board. In

1990, Tech was tied for the smallest sector of the market at 6.3%, while

Industrials was the largest at 14.7%. The spread between the largest and

smallest sectors back then was just over 8 percentage points.

The Dot Com bubble completely blew up the balanced economy, and looking back

you can clearly see how lopsided things had become. Once the Tech bubble

burst, it was the Financial sector that began its charge towards

dominance. The Financial sector’s sole purpose is to service the economy,

so in our view you never want to see the Financial sector make up the largest

portion of the economy. That was the case from 2002 to 2007, though, and

we all know how that ended.

Unfortunately we’ve begun to see sector weightings get extremely out of

whack once again.