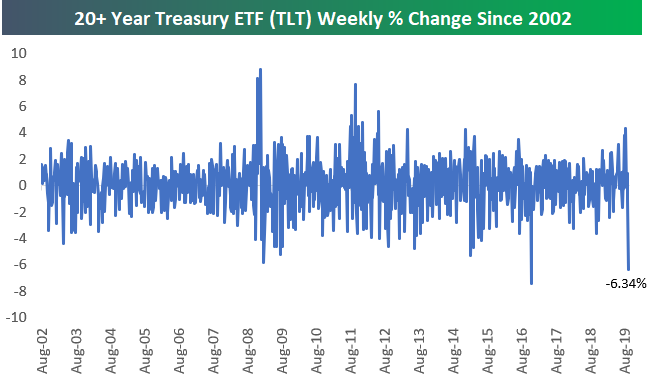

1.Long-Term Treasury ETF (TLT) Has 2nd Biggest Weekly Drop Ever

Outside of equities, we saw a

massive move higher in Treasury yields this week and a massive drop in Treasury

bond prices. For the 20+ year Treasury ETF (TLT),

this week’s 6.34% drop was its second worst week on record since it began

trading back in 2002.

Below is a look at TLT’s historical weekly

percentage change, and we also show how TLT has performed in the weeks and

months following one-week drops of more than 5% like we saw this week. As

shown in the table, TLT has normally continued lower for a while following big

down weeks. Start a two-week

free trial to one of our three membership levels to

receive Bespoke’s most actionable ideas.

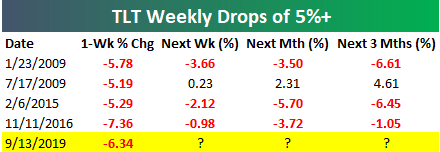

2.History of Speculative-Grade Default Rates…Hitting New Lows

Founder and CEO at Agecroft Partners

https://www.linkedin.com/in/donsteinbrugge/

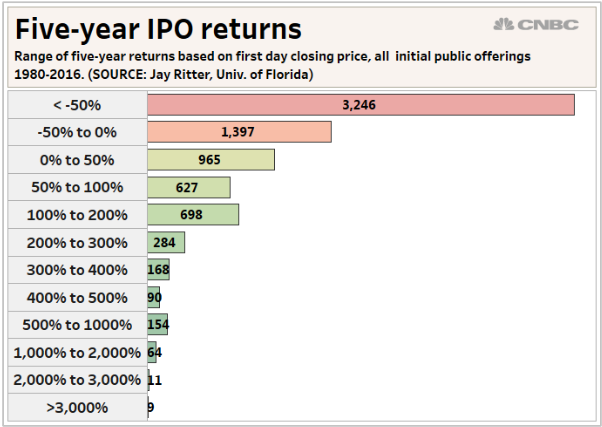

3.80% Of IPOs Losing Money in 2019

https://www.topdowncharts.com/single-post/2018/03/14/A-Familiar-if-Ominous-Sign-in-the-US-IPO-Market

- -More than 60 percent of more than 7,000 IPOs from 1975 to 2011 had negative absolute returns after five years in the secondary market, according to a UBS analysis using data from University of Florida professor Jay Ritter.

- -“First-day returns aren’t predictive for subsequent returns,” says UBS’ head of asset allocation Jason Draho. “IPOs can be attractive investments if you can get an allocation, but much less so if you’re buying in the secondary market.”

- -From 1980 to 2016, the average six-month return for IPOs is about 6 percent or 2 percent excess return, versus the over 18 percent average gain on the first day over the past 40 years, according to the data.

- -More recently from 2000 to 2016, the six-month absolute and excess return has been both negative.

Don’t be fooled by the ‘unicorn’ hype this year, most IPOs lose money for investors after 5 years–YUN LI

4.Wal-Mart Opens First Walmart Health Center.

- -Walmart on Friday opened up its first Walmart Health center in Dallas, Georgia.

- -The location is located next to a Walmart Supercenter, with a separate door for those looking to use the health services.

- -The new clinic is the start of Walmart’s ambitions to get more embedded in the healthcare industry, with plans to open another center in Calhoun, Georgia.

- -The new centers come equipped with primary care, counseling, home care, eye and hearing exams, and dentistry.

Take a look inside Walmart’s newest health clinic that’s just the start of its push into healthcare Lydia RamseyLydia Ramsey

https://www.businessinsider.com/photos-of-walmarts-new-health-clinic-in-dallas-georgia-2019-9

Walmart All-Time Highs.

5.One-Year Chart Walmart +24% vs. Amazon -4%

6.Summary of Attack on Aramco Oil Field…How Will Saudi’s Respond?

NY TIMES–DealBook Briefing: The World Reckons With a New Oil Order

Smoke from a fire at a Saudi Aramco facility.CreditCreditHamad I Mohammed/Reuters

Sept. 16, 2019

Good Monday morning. Updates from the Saudi government on the Aramco plants that were attacked could help determine whether the country will move forward with an I.P.O. for the state-owned oil giant. (Was this email forwarded to you? Sign up here.)

Oil is soaring after the attacks on Aramco

Crude oil prices posted their largest-ever jump in a single day, as Saudi Arabia continues to tally the damage caused by drone strikeson its state-owned petroleum giant, Saudi Aramco.

The price of Brent oil futures shot up as much as 20 percent, its biggest jump since the benchmark was created 30 years ago. It has since retreated a little bit to a 9 percent increase.

Shares in European airlines were down at least 3 percent in morning trading, while those in oil companies were up by about the same amount.

Subscribe to With Interest

Catch up and prep for the week ahead with this newsletter of the most important business insights, delivered Sundays.

Why the attack is so notable: The Aramco plants that were targeted are crucial to the company’s operations. If they are offline, for even a short while, it could drastically reduce the output of Saudi Arabia, the world’s biggest oil exporter.

Among the questions on the minds of companies, politicians and investors around the world:

• When will Saudi oil production return to its level before the attack? The country aims to restore part of its output today, but when things will return to normal remains unclear.

• How will the Saudis respond to the attack, for which Iranian-backed Houthi rebels in neighboring Yemen claimed responsibility?

• How will the U.S. respond? Secretary of State Mike Pompeo quickly blamed Iran, though President Trump so far has not. Mr. Trump did say the U.S. was “locked and loaded,” but some commentators think that America doesn’t have many moves left to play to punish Tehran.

• How will this affect Aramco’s I.P.O. plans? Lingering doubts among potential investors could harm the prospects of the stock offering.

The big picture: The world’s energy markets may not recover fully. Though oil prices may go down, lingering concerns about the fragility of the world’s petroleum supply may reverberate for a long time. And America’s shale boom may not be enough to pick up the slack if there’s a lengthy disruption in Saudi oil production.

____________________________

Today’s DealBook Briefing was written by Andrew Ross Sorkin, Michael J. de la Merced, Lindsey Underwood and Stephen Grocer.

____________________________

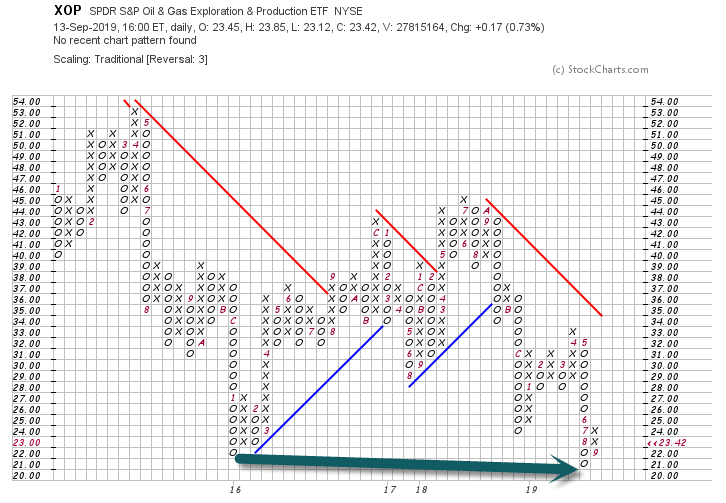

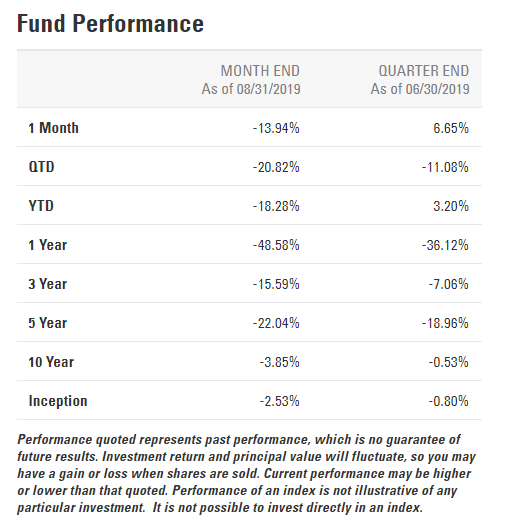

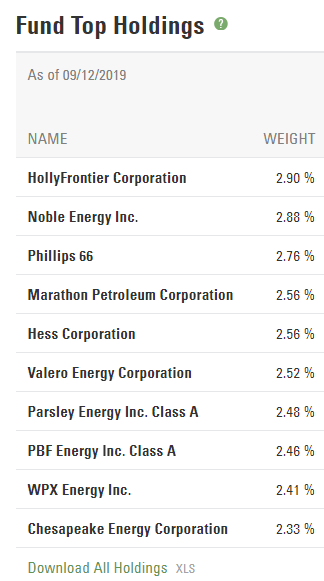

7.Oil and Gas Exploration Companies Broke Thru 2016 Lows.

State Street

https://us.spdrs.com/en/etf/spdr-sp-oil-gas-exploration-production-etf-XOP

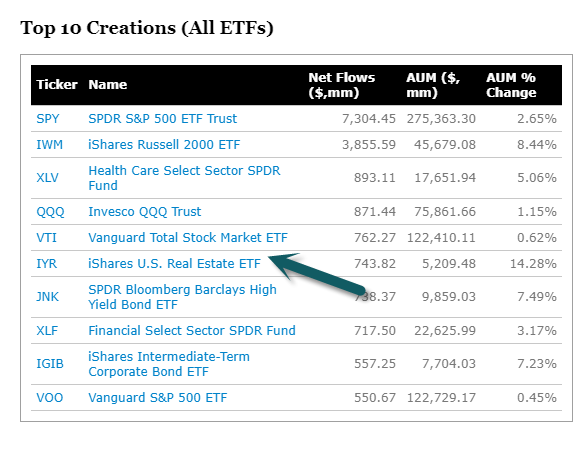

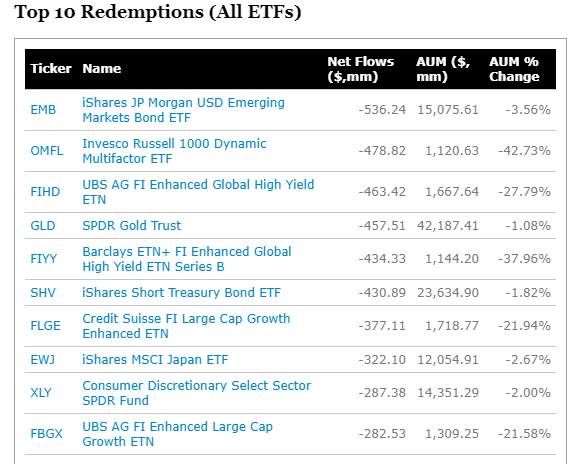

8.Creations and Redemptions in ETF World for the Week.

IYR REIT ETF 15% Bump in AUM

https://www.etf.com/sections/weekly-etf-flows/weekly-etf-flows-2019-09-12-2019-09-06

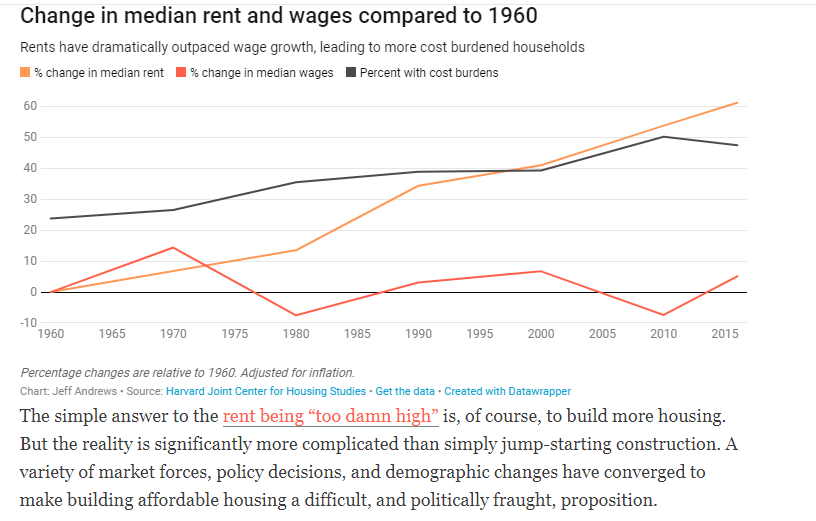

9.Wages Vs. Rents Since 1960

The affordable housing crisis, explained

Blame policy, demographics, and market forces

By Patrick Sisson, Jeff Andrews, and Alex Bazeley May 15, 2019, 1:30pm EDT

Illustration by Janna Morton

https://www.curbed.com/2019/5/15/18617763/affordable-housing-policy-rent-real-estate-apartment

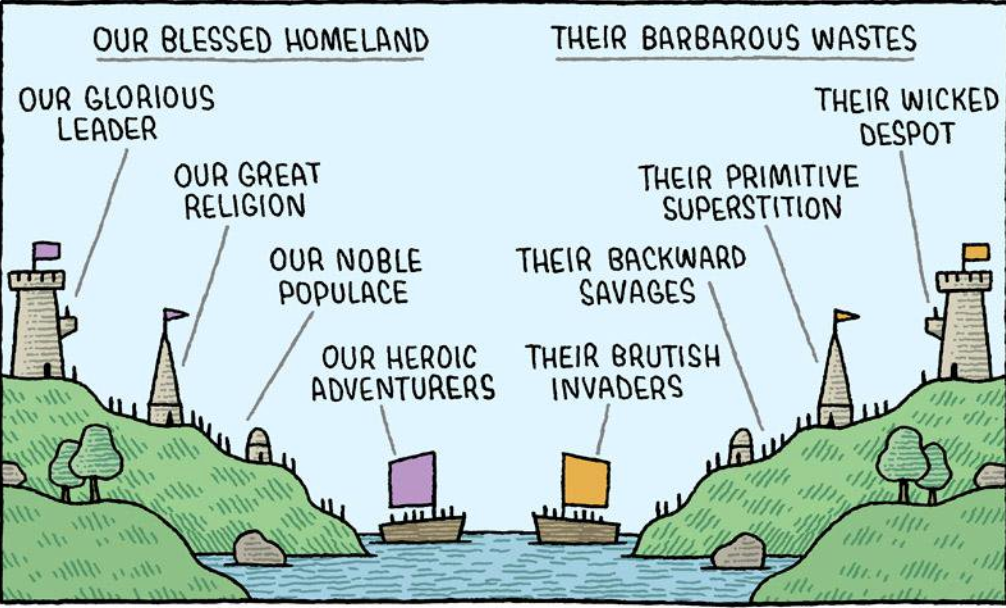

10.Immutable Truths and Arguing Fools

Sep 12, 2019 by Morgan Housel

There are a few things that are so obviously true, and true for everyone, that no one argues about them. But most stuff isn’t black or white. Most of the stuff we argue about usually have many truths – several “right” answers depending on the person and situation – and we’re actually arguing over the other person not having the same goals, needs, risks, and wants as you do. It’s a mess. And the only thing worse than thinking everyone who disagrees with you is wrong is the opposite: being persuaded by the advice of those who need or want something you don’t.

This is common in finance. You can count the number of things that are certain on one hand, so the “right” answer to most finance questions is just however much uncertainty you want to accept, which is not only different for everyone but constantly changing for everyone. People don’t agree on a lot of big investing points because they shouldn’t.

Realizing this pushes you towards the few immutable truths, contextualized by your needs, and away from foolishly arguing why two completely different people don’t think the same thing – which is so much of what happens in this industry.

Here’s an extreme example of what I’m talking about.

Stay in school. Work hard. Study. Get good grades.

Almost everyone reading this article agrees with those words. But most reading this article are not grade students in deep poverty. JD Vance was, and writes in his book Hillbilly Elegy:

As a child, I associated accomplishments in school with femininity. Manliness meant strength, courage, a willingness to fight, and, later, success with girls. Boys who got good grades were “sissies” or “fag**ts.” I don’t know where I got this feeling … But it was there, and studies now show that working-class boys like me do much worse in school because they view schoolwork as a feminine endeavor. Can you change this with a new law or program? Probably not. Some scales aren’t that amenable to the proverbial thumb.

This is so foreign to the world I know. But so is my world to them. I think they’re wrong, but they’d say the same to me. I’m sure I’m right; so are they. Often the reason debates arise is that you double down on your view after learning that opposing views exist.

Here’s another.

Former New York Times columnist David Pogue once did a story about harsh working conditions at Foxconn tech assembly factories in China. A reader sent him a response:

My aunt worked several years in what Americans call “sweat shops.” It was hard work. Long hours, “small” wage, “poor” working conditions. Do you know what my aunt did before she worked in one of these factories? She was a prostitute.

Circumstances of birth are unfortunately random, and she was born in a very rural region. Most jobs were agricultural and family owned, and most of the jobs were held by men. Women and young girls, because of lack of educational and economic opportunities, had to find other “employment.”

The idea of working in a “sweat shop” compared to that old lifestyle is an improvement, in my opinion. I know that my aunt would rather be “exploited” by an evil capitalist boss for a couple of dollars than have her body be exploited by several men for pennies.

That is why I am upset by many Americans’ thinking. We do not have the same opportunities as the West. Our governmental infrastructure is different. The country is different.

Yes, factory is hard labor. Could it be better? Yes, but only when you compare such to American jobs.

If Americans truly care about Asian welfare, they would know that shutting down “sweat shops” would force many of us to return to rural regions and return to truly despicable “jobs.” And I fear that forcing factories to pay higher wages would mean they hire FEWER workers, not more.

Here again, a world completely foreign to my own leading to a debate over something one side assumed was black and white. I could fiercely debate this reader’s response, but I honestly don’t know what to make of it other than it being an example of when you introduce – to any topic – a little social nuance, a little economic variety, a little tribal identity, you’ll get opposing views.

Nothing we debate in investing is as important as those two stories. But so much of what we argue about is influenced by nuance and variety that makes two equally smart people come to different – sometimes opposite – conclusions.

Is this asset cheap? I don’t know. It depends how much time you have and what your stomach for risk is and what factors the broader market considers cheap and what factor future markets will want to bid up for and whether you’ve staked your career on cheap being a good thing. Ask different people and you’ll get different answers because there’s no right answer.

Does this strategy work? I don’t know. It depends what you consider “working” and how quickly your performance will be judged by your boss/client/investors/spouse. Again, there’s no right answer.

Should you care about this forecast? I don’t know. Depends how you’re already invested and how it’ll influence your decisions.

Should you save more? I don’t know. It depends how deeply you want to sleep at night.

Should we cut taxes? I don’t know. It’ll affect different people in different ways.

You can do this for almost every investment topic. The biggest things we argue about have risks, and risk just means the odds of success are less than 100% – either because something might not work for the intended person, or it’ll never work for an unrelated person. That’s why we’re arguing and debating. There are no right answers. I do things with my money that might make you cringe, and vice versa. But if it works for me and what you do works for you, so be it. Life is inconsistent.

We could stop there and it’d be enough. But the most important point here is acknowledging the risk that during your research you’ll be persuaded by the analysis and opinions of people who are different than you.

Maybe they have different timelines, or different needs, incentives, client demands, career/promotion quirks, sales targets, family matters, risk appetites, life experiences, cultural persuasions … on and on. I would never assume a champion bodybuilder’s diet and exercise routine would be appropriate for me. But for some reason the same thing doesn’t translate to finance, and college sophomores watch CNBC to gain insight into a billionaire hedge fund manager’s latest moves.

Turns out it’s hard to put yourself in someone else’s shoes, so the default is to subconsciously assume everyone wears the same ones you are. A group of psychologists recently looked at a bunch of studies measuring the accuracy of being able to predict someone else’s thoughts when going out of your way to understand their point of view. It wrote:

Although a large majority of pretest participants believed that perspective taking would systematically increase accuracy on these tasks, we failed to find any consistent evidence that it actually did so. If anything, perspective taking decreased accuracy overall while occasionally increasing confidence in judgment. Perspective taking reduced egocentric biases, but the information used in its place was not systematically more accurate.

This is why I’ll always think the young men who think good grades are for sissies and the Chinese businessmen offering deplorable working conditions are WRONG, even if they might argue back to me with just as much conviction. You have to live it to believe it.

So here’s the advice. And to avoid irony I hope this is broad enough to apply to most of us:

The few immutable truths of finance – the stuff no one argues about because there are right answers – are what matter most. But we hear about them the least, specifically because no one argues about them.

Spend most of your time contextualizing those truths within your own goals, needs and experiences, realizing that it’s OK if others disagree with your views and you disagree with theirs.

When you watch, listen, and read about other people’s views, the most important takeaways are insights into how people deal with risk and uncertainty, because those are the broad lessons that are likely to apply to the greatest number of people, including yourself.

Learning from others is a huge part of investing – every mistake has already been made and you can add years to your life learning from them vicariously. But most investment debates can and should be replaced by acknowledging that reasonable people can disagree because we’re all different and driven by things that are hard to quantify. The fun part of behavioral finance is learning about how flawed other people can be. The hard part is trying to figure out how flawed you are, and what makes sense to you but would seem crazy to others.

https://www.collaborativefund.com/blog/immutable-truths-and-arguing-fools/