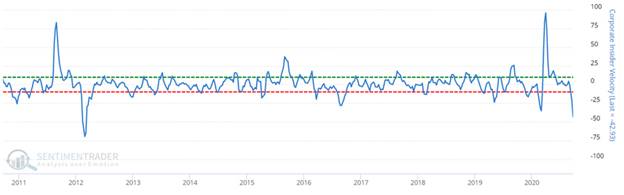

1. Insider Selling Fastest Pace Since 2012

INSIDERS SELL– S&P 500 execs sold shares of their own firms at a rapid pace in the last month. The selling picked up so much versus buying that a measure of insider velocity tracked by Sundial Capital showed the fastest exit since 2012. About $975 million of stock was dumped last week, more than twice the prior week, SEC data compiled by Bloomberg show. Their purchases increased by roughly 10% to $11 million.