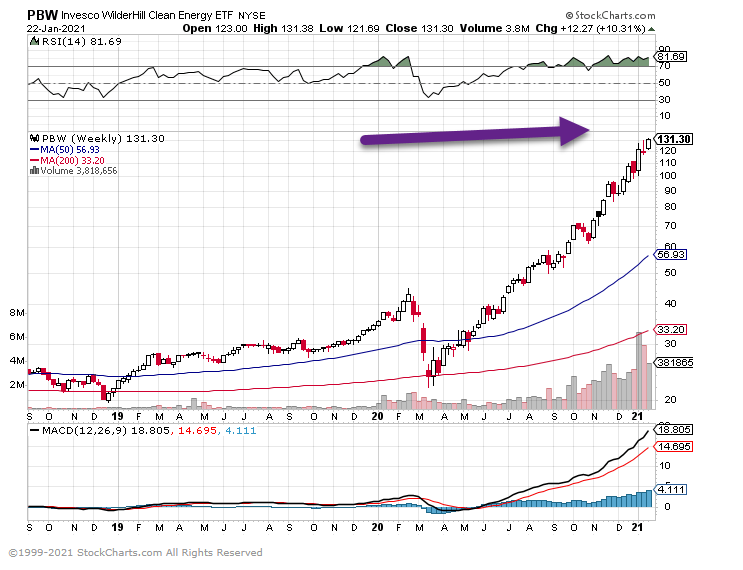

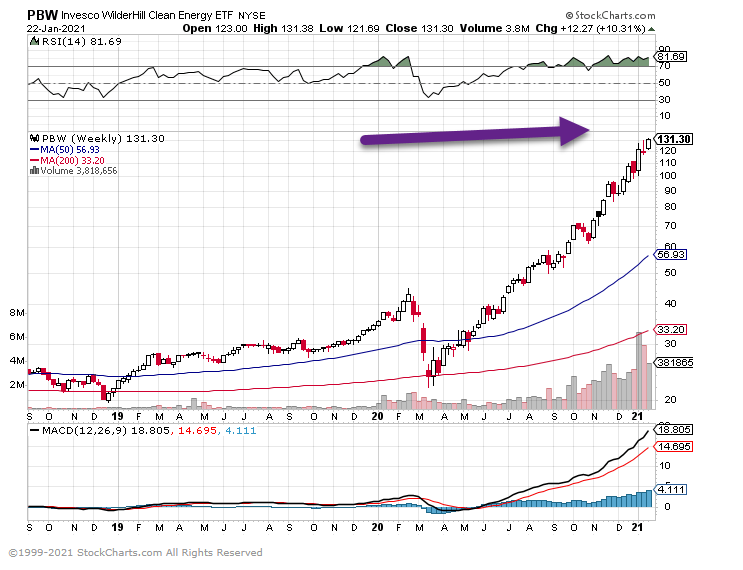

1. How Much Positive News is Priced into Clean Power?

PBW Clean Energy ETF -$25 to $131

PBW Clean Energy ETF -$25 to $131

| SUBJECT | TYPE OF ACTION | DATE |

| Re-engage with World Health Organization | End withdrawal process | Jan. 20 |

| Create position of COVID-19 response coordinator | Executive order | Jan. 20 |

| Rejoin Paris climate agreement | Sign an “instrument” | Jan. 20 |

| Revoke permit for Keystone XL pipeline, pause energy leasing in ANWR | Executive order | Jan. 20 |

| Ask agencies to extend eviction/foreclosure moratoriums | Request | Jan. 20 |

| Ask Education Dept. to extend student-loan pause | Request | Jan. 20 |

| Launch an initiative to advance racial equity, end “1776 Commission” | Executive order | Jan. 20 |

| Revoke order that aims to exclude undocumented immigrants from census | Executive order | Jan. 20 |

| Preserve/fortify DACA, which helps “Dreamers” | Memorandum | Jan. 20 |

| Require masks/distancing on all federal property and by federal workers | Executive order | Jan. 20 |

| Reverse travel ban targeting primarily Muslim countries | Executive order | Jan. 20 |

| Stop construction of border wall | Proclamation | Jan. 20 |

| Combat discrimination on the basis of sexual orientation, gender identity | Executive order | Jan. 20 |

| Require ethics pledge for executive-branch personnel | Executive order | Jan. 20 |

| Modernize and improve regulatory review | Memorandum | Jan. 20 |

| End “harsh and extreme immigration enforcement” | Executive order | Jan. 20 |

| Extend protection from deportation for Liberians in U.S. | Memorandum | Jan. 20 |

| Revoke certain executive orders concerning federal regulation | Executive order | Jan. 20 |

| Freeze any new or pending regulations | Memorandum | Jan. 20 |

| Fill supply shortfalls in fight vs. COVID-19 with Defense Production Act, other measures | Executive order | Expected Jan. 21 |

| Increase FEMA reimbursement to states for National Guard, PPE | Memorandum | Expected Jan. 21 |

| Establish “COVID-19 Pandemic Testing Board,” expand testing | Executive order | Expected Jan. 21 |

| Bolster access to COVID-19 treatments and clinical care | Executive order | Expected Jan. 21 |

| Improve collection/analysis of COVID-related data | Executive order | Expected Jan. 21 |

| Mount vaccination campaign amid goals such as 100 million shots in 100 days | Directives | Expected Jan. 21 |

| Provide guidance on safely reopening schools | Executive order | Expected Jan. 21 |

| OSHA guidance for keeping workers safe from COVID-19 | Executive order | Expected Jan. 21 |

| Require face masks at airports, other modes of transportation | Executive order | Expected Jan. 21 |

| Establish a “COVID-19 Health Equity Task Force” | Executive order | Expected Jan. 21 |

| Support international response to COVID-19, “restore U.S. global leadership” | Directive | Expected Jan. 21 |

Nick Maggiulli—Of Dollars and Data Blog

Markets often rhyme but rarely repeat

With the many eye-popping valuations of various technology IPOs in 2020, it can feel a bit reminiscent of 1999. And while stock prices might be high, 2020 is no 1999. Just take a look at the growth in the NASDAQ from 1995-1999 compared to 2016-2020 and you will see that it’s night and day:

This chart illustrates that there is a big difference between “bubble” and “BUBBLE.” As my colleague Michael Batnick recently argued:

I don’t think the stock market is in a bubble, but it’s surrounded by them.

Though we aren’t in 1999, some investors definitely are. Markets often rhyme but rarely repeat.

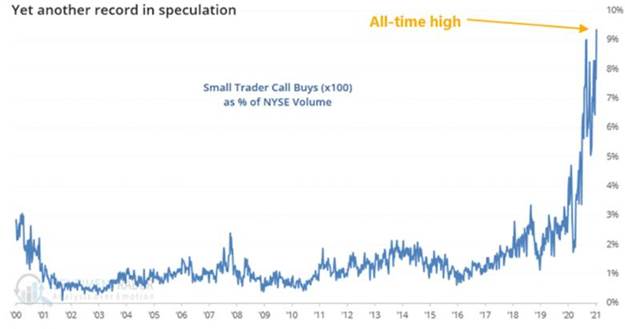

SentimentTrader didn’t think traders could get any more speculative than they were at the end of August. “We were wrong – For the first time, small trader call buying (adjusted for equivalent shares) exceeded 9% of total NYSE volume last week”

From Dave Lutz at Jones Trading

A headwind for the global economy: Shipping goods gets prices amid higher demand and a shrinking pool of empty boxes. Costly containers adding to general supply chain shocks due to pandemic, threatening to stifle already weakened globalization, BBG reports.