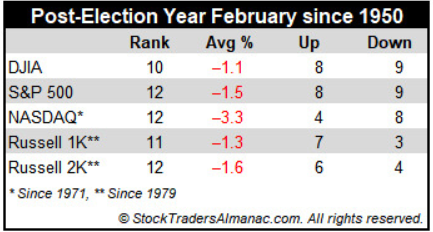

1. Post Election Feb. History

AlmanacTrader notes February’s post-election year performance since 1950 is miserable, ranking dead last for S&P 500, NASDAQ and Russell 2000. Average losses have been sizable: -1.5%, -3.3% and -1.6% respectively. February ranks tenth for DJIA in post-election years with an average loss of 1.1%. February 2001 and 2009 were exceptionally brutal. NASDAQ dropped 22.4% in February 2001, its third worst monthly loss ever.

From Dave Lutz at Jones Trading

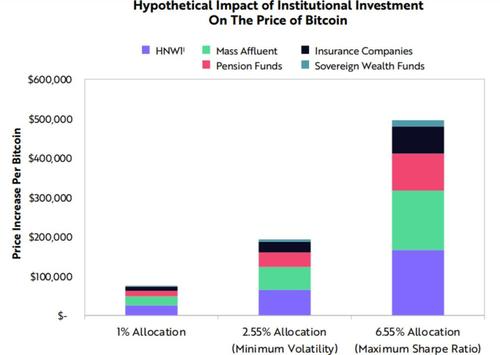

2. Institutional Money and Bitcoin.

Zerohedge

Finally, CoinTelegraph notes that, investment firm ARK Invest said in its latest report, “Bitcoin: Preparing for Institutions,” that even a 1% allocation from S&P 500 companies would be enough to increase BTC/USD spot prices by $40,000.

Their conclusion, as the chart above suggests,Bitcoin could fetch at least a $535,000 price tag if corporate buyers convert 10% of their cash reserves to the largest cryptocurrency.

https://www.zerohedge.com/crypto/crypto-extends-gains-ethereum-near-record-high-after-musk-musings

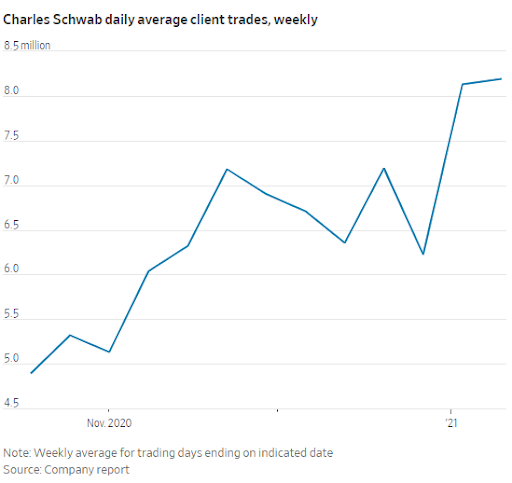

3. Charles Schwab Average Client Trades Double Since Nov. 2020.

Michael Batnick-Irrelevant Investor

https://theirrelevantinvestor.com/2021/01/27/animal-spirits-its-very-different-this-time/

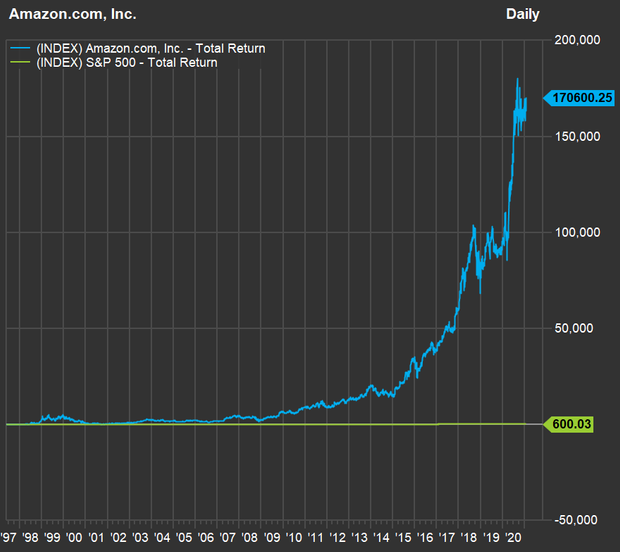

4. Amazon vs. S&P – Bezos

The career of Jeff Bezos as CEO of Amazon.com has been nothing short of amazing. And a very simple way to measure that is to look at one chart:

FACTSET

5. Markets Have Been at New Highs 43% of the Time Since 1949

https://www.linkedin.com/in/sean-barker-1611bb34/

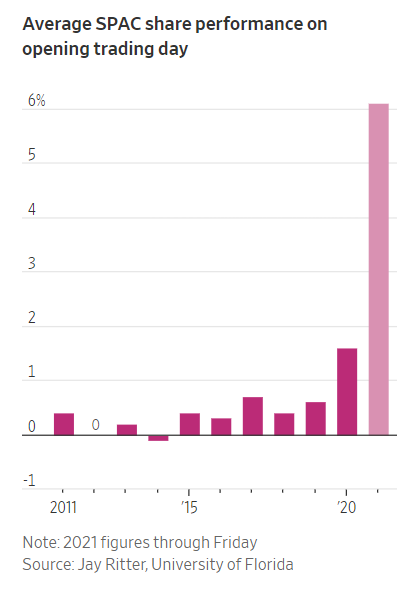

6. Game Stop Traders Moving into SPACS.

WSJ

By Amrith Ramkumar

Game Stop Traders Moving into SPACS https://www.wsj.com/articles/gamestop-day-traders-are-moving-into-spacs-11612175401?mod=itp_wsj&ru=yahoo

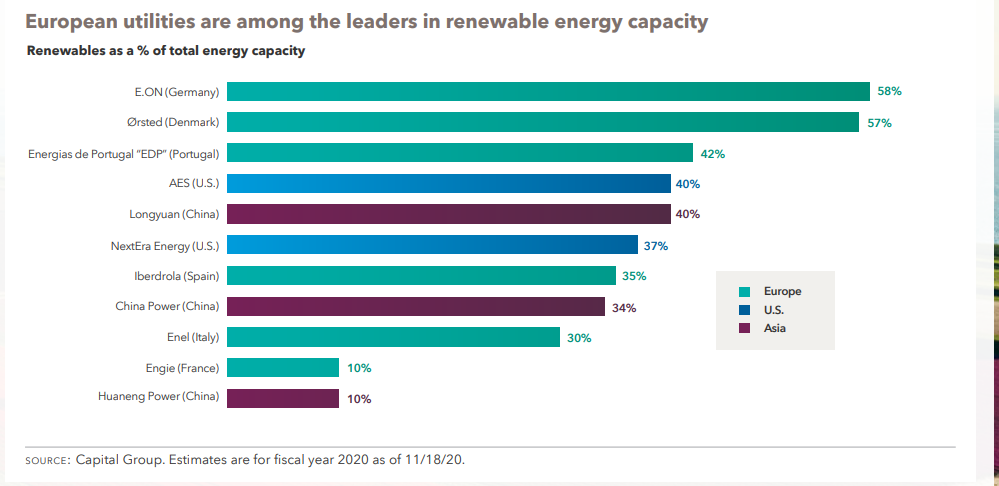

7. European Utilities Leaders in Renewable Energy Capacity

Capital Group

https://www.capitalgroup.com/advisor/pdf/shareholder/MFCPBR-080-646301.pdf

8. Five questions for the Congressional hearings on GameStop, Reddit and Robinhood-Josh Brown

Posted February 1, 2021 by Joshua M Brown

I’ve offered my assistance to the House Financial Services Committee to prepare for their upcoming hearings concerning the GameStop, Reddit and Robinhood conflagration. I hope they take me up on it. Either way, here are the questions that the committee should be seeking answers to:

1. Is there any evidence that professional operators have infiltrated message boards and orchestrated these wild short squeezes or has this been an entirely grassroots phenomenon? How vulnerable are the millions of ordinary investors who rely on functioning markets to subsequent bouts of message board-driven mania?

2. Are there any records of conversations having taken place between hedge funds and Robinhood during the short squeeze episode? Were any requests or demands made to halt or slow down trading in the affected securities for the benefit of any parties?

3. What aspects of the Robinhood service or app should be reconsidered in light of the potential for fraud, abuse or massive losses inflicted upon the general public – even if those potential losses are self-inflicted by lack of education or experience? What safeguards should be adopted by fintech firms offering access to markets and speculation so that people are sufficiently warned about the risks they are taking?

4. What does it say about the state of our society and the current wealth inequality epidemic that millions of young people feel they need to resort to expressing their rage via brokerage account?

5. Did any hedge funds, market makers, private equity firms, broker-dealers or other sophisticated professional actors reap extraordinary profits as a result of taking advantage (or profiteering) from this episode?

What would you want to hear Congress ask? Tell me here.

Found at Crossing Wall Street https://www.crossingwallstreet.com/

9. Law Firms Blowout Year

| LAW -MorningBrew TFW You Had a Great 2020 |

Better Call Saul

| If you’re on the lookout for more pandemic winners, may we point you to Big Law. The world’s highest-grossing law firm, Kirkland & Ellis, is on track to post record annual revenue of ~$5 billion for the 12 months ending in January, according to the Financial Times.What happened: Even as the global economy sagged under the weight of shutdowns, Kirkland’s three main areas of focus—private equity, restructuring, and litigation—all surged. Plus, with hyper-efficient Zoom meetings replacing four-dollar-sign client dinners, costs are way down…which means profits are way up.In a Wells Fargo survey of 125 law firms, net income (revenue minus expenses) grew 25.6% annually in the first half of 2020.Bottom line: Haunted by the 2008 financial crisis’s blow to the industry, law firms quickly moved to cut pay and furlough staff when the pandemic arrived last spring. But due to the unexpected boost in business, they’re back to padding wallets—firms paid junior staff bonuses of up to $100,000 at the end of 2020. |

10. Hire Leaders for What They Can Do, Not What They Have Done

by Josh Bersin and Tomas Chamorro-Premuzic

Summary. The next time you are filling a leadership role, ask yourself three questions. First, does the candidate have the skills to be a high-performing contributor or the skills to be an effective leader? The performance level of individual contributors is measured largely through their ability, likability,…more

Fifty years have passed since the publication of The Peter Principle, but its rule still applies today. “In time, every post tends to be occupied by an employee who is incompetent to carry out its duties,” noted Laurence J. Peter, the educator behind this famous work. His theory postulates that most competent people are promoted until they reach a position that is above their skill level, at which point they cease to grow.

Academic studies show that promotions are still largely a reward for past performance, and that organizations continue to assume the attributes that have made someone successful so far will continue to make them successful in the future (even if their responsibilities change). This may explain why there are still a large number of incompetent leaders.

Organizations that wish to select the best people for leadership roles therefore need to change how they evaluate candidates. The next time you are filling a managerial position, ask yourself three questions:

1. Does the candidate have the skills to be a high-performing contributor or the skills to be an effective leader?

The performance level of individual contributors is measured largely through their ability, likability, and drive. Leadership, by contrast, demands a broader range of character traits, including high levels of integrity and low levels of dark-side behaviors born out of negative attributes likes narcissism or psychopathy.

The difference between these two skill sets explains why great athletes often end up being mediocre coaches (and vice versa), and why high performers often fail to succeed in leadership positions.

We all know that the most successful salespeople, software developers, and stockbrokers have exceptional technical skills, domain knowledge, discipline, and abilities to self-manage. But can those same skills be used to get a group of people to ignore their selfish agendas and cooperate effectively as a team? Probably not. Leaders do need to obtain a certain level of technical competence to establish their credibility, but too much expertise in a single area can be a handicap. Experts are often hindered by fixed mindsets and narrow views, which result from their years of experience. Great leaders, however, are able to remain open and to adapt, no matter how experienced they are. They succeed because they are able to continually learn.

This has been proved in many situations, particularly in the area of sales. A recent academic study of over 200 firms found that performance as a salesperson was negatively correlated with performance as a sales manager. If you promote your number one salesperson to management, you create two problems: You lose your top salesperson and you gain a poor manager.

2. Can I really trust this candidate’s individual performance measures?

The most common indicator of someone’s performance is a single subjective rating by a direct line manager. This makes measures of performance vulnerable to bias, politics, and an employee’s ability to manage up. Although peer-based and network-oriented performance management is growing, it is still in its infancy. As a result, performance measures may not be as reliable as you think.

This is likely why women still tend to be promoted less than men, even when their performance is identical. Many organizations promote people into leadership positions because they “create the right impression,” even if their actual contributions are minimal.

If you ask yourself the above question, and the answer is “no,” take some time to think about what good leadership looks like at your company. Are you looking for leaders who can drive great results? Bring people together? Listen and develop others? Or are you looking for leaders who can connect, innovate, and help evolve the business? Every company needs different types of leaders at different times, and someone who performs well in their current role may not be the right person to help you reach your most immediate goals.

3. Am I looking forward or backward?

The secret to selecting great leaders is to predict the future, not to reward the past. Every organization faces the problem of how to identify the people who are most likely to lead your teams through growing complexity, uncertainty, and change. Such individuals may have a very different profile from those who have succeeded in the past, as well as from those who are succeeding in the present.

Avoid promoting entirely based on culture fit. Although you may have good intentions in doing it, it often results in a lack of diversity of thought and outdated leadership models. In today’s ever-changing world, businesses are expected to grow as fast as the technologies surrounding them. Their models must be in constant transformation. What worked in the past and what is working in the present may not work at all in the future. Companies, then, need to get more comfortable thinking outside the box. This means taking “misfits” or “people who think differently” and placing them into leadership roles. Give them support and time to prove themselves. This is just one way to deepen your leadership pipeline.

You should also take an extra look at the people who “may not be ready,” and analyze them on the basis of their ambition, reputation, and passion for your business. Often the youngest, most agile, and most confident people turn into incredible leaders, even though their track record may not be the best. Mark Zuckerberg, one of the most successful CEOs in decades by many measures, had almost no business experience before he started Facebook. Steve Jobs had not run a large company before Apple, yet he had the insights, connections, and drive to make it a household name.

It’s time to rethink the notion of leadership. If you move beyond promoting those with the most competence and start thinking more about those who can get you where you want to go, your company will thrive. In other words, start considering those who have high potential, not just top performers.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.