1. January Performance Stats

LPL Blog

LPL Research

https://i1.wp.com/lplresearch.com/wp-content/uploads/2021/02/January-MIM.png?ssl=1

2. Silver–Short Interest is not High.

Bespoke Investment Group

Additionally, in terms of the ETF tracking silver (SLV), short interest as a percentage of shares outstanding is by no means at any sort of extreme either. While the most recent bi-weekly data did show a sharp uptick in the first half of January, short interest as a percent of share outstanding is not at an elevated level. Pulling that data forward to today, 3.72% of shares outstanding are short. That is in the 60th percentile of all readings since 2006 when the ETF began trading. It’s also well off the peak of 11.75% in June of 2011. So again, if SLV was to be a target for a short squeeze like GME, there is not nearly the same base of shorts as we saw in GameStop (GME) and other stocks last week.

https://www.bespokepremium.com/interactive/posts/think-big-blog/shorting-silver

3. Risk On at Current Level of Interest Rates-Equity Risk Premium Chart

Chart of the week-Blackrock

Estimated U.S. equity risk premium, 1996-2020

Past performance is not a reliable indicator of current or future results. It is not possible to invest directly in an index. Sources: BlackRock Investment Institute, with data from Refinitiv Datastream. Data are as of Jan. 28, 2021. Notes: We use the implied equity risk premium that incorporates current market prices, expected future cashflows and risk-free rates. We use MSCI USA Index to represent U.S. equities.

Assessing equity valuations can be difficult. Structural shifts such as persistently lower interest rates make it difficult to judge the signals from traditional metrics such as price-to-earnings ratios. The key question is whether the compensation investors are getting to take on additional equity risk, after factoring in current low interest rates, is fair. This is why we prefer to gauge valuation by looking at the expected return of equities over the risk-free rate, and our estimates for the U.S. market don’t appear stretched, as the chart above shows. This approach helps us assess valuations across different interest rate environments, yet the metric is only as good as the assumptions that go into it. Our new nominal theme suggests rates will stay low amid stronger growth and higher inflation, as central banks lean against any sharp rises in nominal rates. This should keep “real”, or inflation-adjusted yields, negative, and support risk assets, in our view. But if rates were to revert to historical averages, valuations would look a lot more stretched.

https://www.blackrock.com/us/individual/insights/blackrock-investment-institute/weekly-commentary

4. ISM Prices Paid Showing Some Inflation

The Prices Index “surged dramatically in January” to a level of 82.1%, after an eight-month upward trajectory, the highest since April 2011, “indicating continued supplier pricing power,” said the Manufacturing ISM Report On Business.

In the ISM data, a value above 50 means expansion, and a value below 50 means contraction. The higher the value is above 50, the faster the expansion. January saw the fastest expansion of the Prices Index since April 2011 (data via YCharts):

Of the roughly four dozen commodities in the index – from corrugated boxes via cold rolled steel and plastic resins to memory chips – only one showed a price decline (caustic soda); all others increased. Some of the prices started increasing more recently, but others have been increasing for eight months, including copper.

A number of commodities were considered in “short supply,” including:

- Copper

- Corrugated Boxes (for 3 months)

- Electrical Components (for 4 months)

- Electronic Components (for 2 months)

- Freight, trucking

- Semiconductors (for 2 months);

- Steel (for 2 months), cold rolled; fabricated; and hot rolled.

Inflation Galore at Manufactures, amid Massive Shifts in Demand, Supply-Chain Snags, Shortages, Lack of Shipping Capacity. And They’re Passing it On

5. What is Game Stop Really Worth.

NY Times Deal Book –State of play

By Andrew Ross Sorkin, Jason Karaian, Michael J. de la Merced, Lauren Hirsch and Ephrat Livni

In all the recent market mania, it might be easy to forget that there’s an actual company at the center of the frenzy. Here’s a quick look at the real-world prospects for GameStop, which begins the week with a market cap of more than $20 billion, up from $1 billion at the start of the year.

Running the numbers. GameStop’s annual sales peaked at nearly $10 billion before falling to $6.5 billion in its most recent pre-pandemic fiscal year. It has recorded a loss in eight of its past 10 quarters.

The biggest challenge. Gamers can now easily download their games directly instead of going to a store. That means GameStop needs to find a use for the more than 5,000 stores it operates. It could downsize, and it’s been trying, but this is expensive and difficult; unwanted retail properties are flooding the market. And shrinking to grow has not proven a path to retail greatness. In truth, few specialty retailers have turned their business around in the face of technological disruption. (Best Buy is an exception.)

cent strength in GameStop’s digital business over the holidays, and an upcoming refresh cycle for gaming consoles, as cause for optimism. Even so, it’s hard to justify its sky-high valuation: Its price-to-sales ratio is nearly the same as Amazon’s. Analysts’ average price target for the stock is just over $13 per share; in premarket trading today, the stock is at $300.

- “There’s no reason that stock should be where it is,” Bruce Cohen, co-founder of the retail advisory firm CH Consulting, told DealBook. “That is just a stock manipulation exercise.”

Why it matters. When investors get valuations wrong, “capital goes to less productive companies at the expense of companies that would have used it better,” said Eric Gordon, a professor at the University of Michigan’s Ross School of Business. This notion has not necessarily been tested by GameStop yet, which would have to raise funds at its current valuation, as other companies have done during the past year’s market rises.

- The “biggest risk,” according to Lynn Turner, a former chief accountant of the S.E.C., is that people stop putting money in the markets “because they think it’s turned from investing into betting at a craps table.”

6. Nio deliveries in January quadruple from a year ago, signaling a strong start to 2021

KEY POINTS-CNBC

· Chinese electric carmaker Nio said it delivered 7,225 vehicles in January, more than four times the number of cars delivered during the same month last year.

· Its rival Xpeng said it delivered 6,015 electric cars in January, a third-straight record month of deliveries.

©1999-2021 StockCharts.com All Rights Reserved

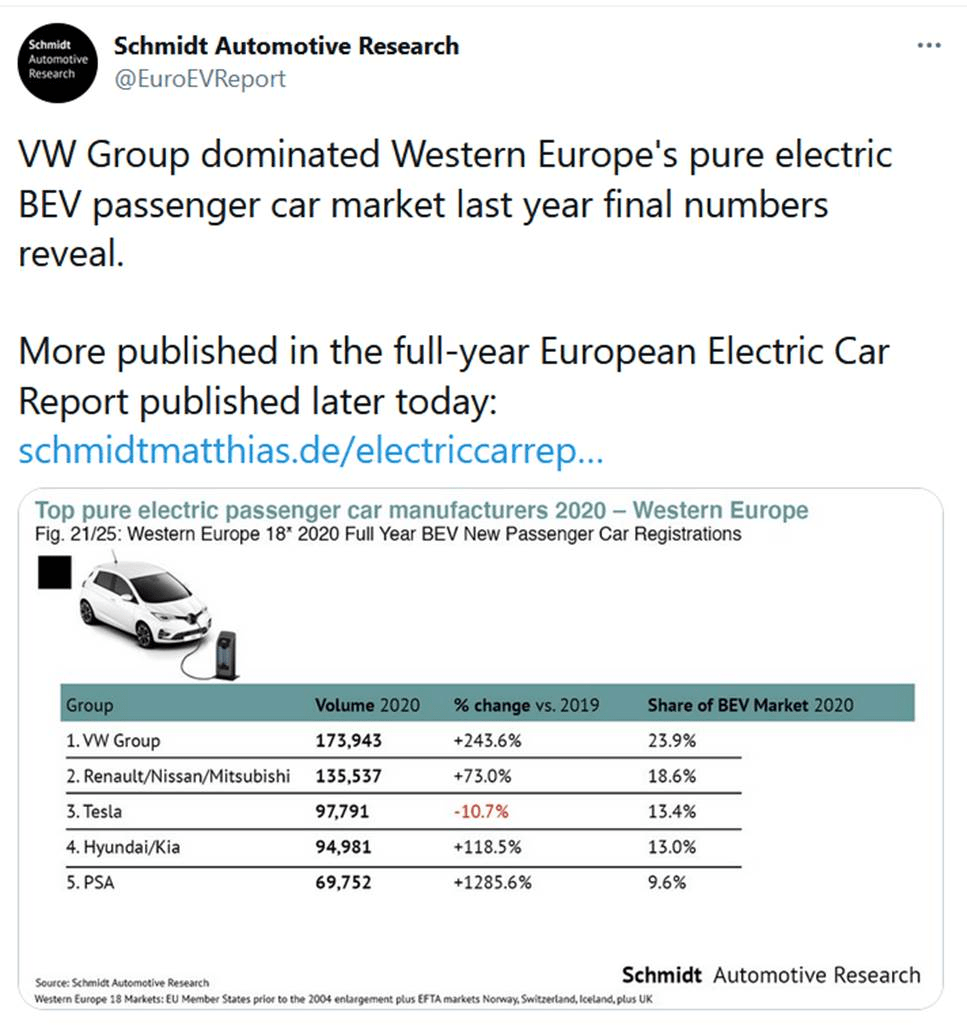

7. Tesla’s Western Europe Market Share Drops

Value Walk

8. Remote Working’s Longer Hours Are New Normal for Many Bloomberg

By Lucy Meakin

February 2, 2021, 2:58 AM EST

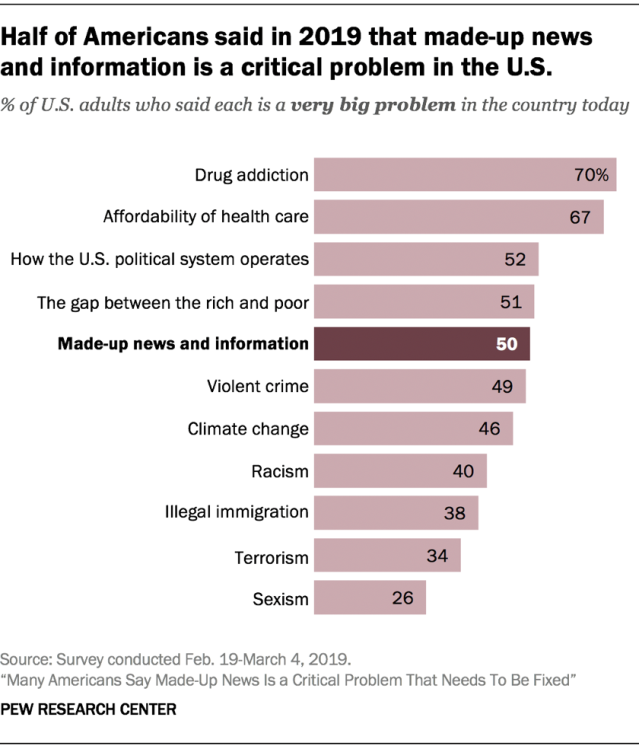

9. Americans List of “Very Big Problems”

Pew Research

https://www.pewresearch.org/2021/01/29/how-america-changed-during-donald-trumps-presidency/

10. How the Best Leaders Rethink and Unlearn What They Know

Popular organizational psychologist Adam Grant has a new book for our increasingly polarized times.

Many first-time entrepreneurs share a similar narrative: They stumbled upon a problem in need of solving and, against all kinds of odds, worked like crazy to come up with the best solution to it. I just had to figure it out!, they often say. I felt like such animposter!

That early period can be one of the most fruitful and special times in the life of an entrepreneur: You’re eager to learn and act on that new knowledge. You have confidence in your ability to achieve a future goal but also the humility to question whether you have the right tools, says Adam Grant, an organizational psychologist at The Wharton School of the University of Pennsylvania and author of the new book, Think Again: The Power of Knowing What You Don’t Know(Viking, 2021). It’s when you move from complete novice to somewhat successful amateur that you are likely to run into trouble. Fast growth can promote a false sense of mastery.

“That jump-starts an overconfidence cycle, preventing us from doubting what we know and being curious about what we don’t,” Grant writes. “We get trapped in a beginner’s bubble of flawed assumptions, where we’re ignorant of our own ignorance.”

In Think Again, Grant explores why entrepreneurs, executives–and really everybody–get caught in the trap of closed-mindedness, unwilling to change their assumptions and beliefs even when the evidence is right in front of them. In a turbulent world, he argues, your ability to rethink and unlearn matters far more than raw intelligence.

Article continues after sponsored content

VISASPONSORED CONTENT

Small Businesses Embrace New Technologies to Meet Changing Consumer Behaviors

So how do you second-guess yourself in the smartest way possible? Read on for the biggest takeaways from the book and from Grant, who discussed his work recently with Inc.

1. Beware of ‘founder syndrome.’

It can happen to even the most innovative founders: They bet (correctly) against the consensus and proved all the naysayers wrong. “And then they overgeneralize the wrong lesson: that every time they bet against consensus they will have better judgment,” Grant says. “That’s when arrogance and narcissism rear their ugly head.”

The better approach is to analyze why you were right and others were wrong in this situation. You need to attribute your success to something specific. Did you have different knowledge? A better approach to analyzing the problem? Were you lucky you lacked experience and came in with a fresh view? “Don’t follow your intuition; test your intuition,” he says. This is particularly important when you’ve done well in one realm and now want to launch in another. What worked at a consumer-facing startup may be irrelevant to a B2B venture.

2. Come up with at least one reason you might be wrong.

One of the easiest ways to try to curb overconfidence is to come up with even one viable reason why you might be wrong, Grant writes. “When you form an opinion, ask yourself what would have to happen to prove it false.”

Consider the fate of BlackBerry, a company that in 2009 accounted for nearly half of the smartphone market. The BlackBerry, its creator Mike Lazaridis believed steadfastly, was a device for sending and receiving email; people were never going to want to carry around the equivalent of a computer in their pocket. Many of his engineers believed otherwise. By 2014, of course, BlackBerry’s market share had fallen to less than 1 percent. What might have happened if he had questioned his assumptions?

3. Develop a trusted ‘challenge network.’

You are unlikely to be able to see all of your own blind spots, no matter how self-aware you become. To ensure you know what you don’t know, you need a team of employees willing to challenge you. Grant calls these employees “disagreeable givers.” “They dish out the tough love and critique you because they care and want to make your thinking better,” he says. Grant’s favorite way of identifying these types of people in a job interview is to ask some version of this question at the end of the interview: If you were going to reinvent our hiring process, what would you do differently?

Disagreeable people often will give you the most honest feedback without fearing repercussions. That last part is key: For disagreeable givers to be most effective, they must operate in a psychologically safe culture that treats mistakes as learning opportunities.

4. Find joy in being wrong.

This is perhaps the most challenging bit of advice in Grant’s book–particularly for entrepreneurs who are often rewarded for managing the expectations of others and projecting success–but it may be the most crucial. When Daniel Kahneman, the Nobel Prize-winning psychologist, discovers an aspect of his research or thinking is wrong, Grant says, his reaction is more like joy: It means he’s now less wrong than before.

Think more like a scientist performing an experiment and less like a preacher or politician defending your ideas. If you consider your own conclusions and theories as provisional, Grant says, you’re less likely to escalate your commitment to a losing strategy.

Inc. helps entrepreneurs change the world. Get the advice you need to start, grow, and lead your business today. Subscribe here for unlimited access.

https://www.inc.com/lindsay-blakely/adam-grant-book-think-again.html

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.