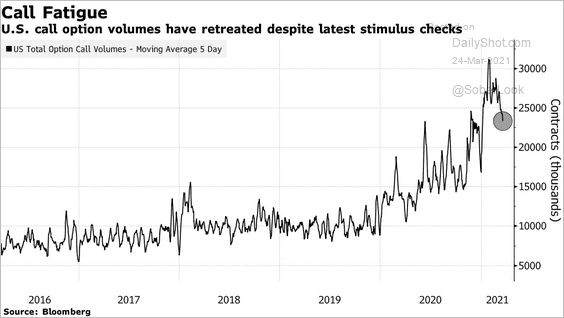

1. Stimulus Fatigue Call Options?

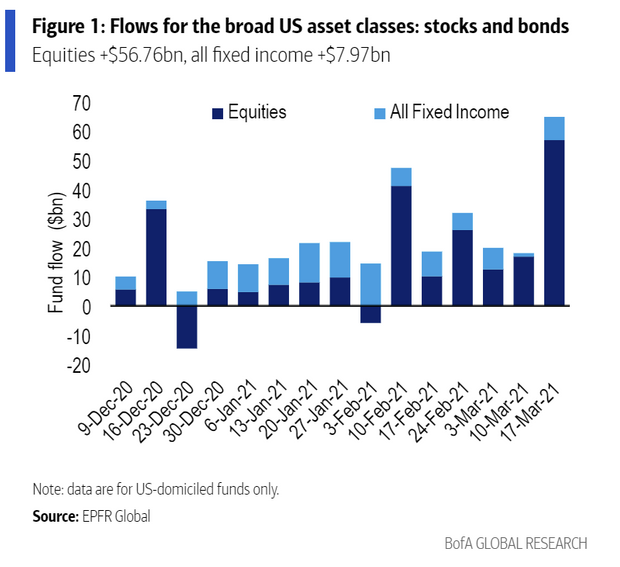

Marketwatch-Stock market investors poured a record amount of money into U.S. equity mutual funds and exchange-traded funds in the past week as the Dow Jones Industrial Average topped another milestone and the S&P 500 index also touched a record. BofA Global Research on Friday said U.S. equity inflows hit a weekly record of $56.76 billion in the week ending March 17, up sharply from $16.83 billion a week earlier. The Dow DJIA, 0.14% on March 17 closed above the 33,000 for the first time, while the S&P 500 SPX, 0.49% also finished at an all-time high.

Investors poured record $56.8 billion into stock-market funds as stimulus checks arrived-By William Watts

Continue readingRick Rieder-Blackrock -Global FIxed Income CIO

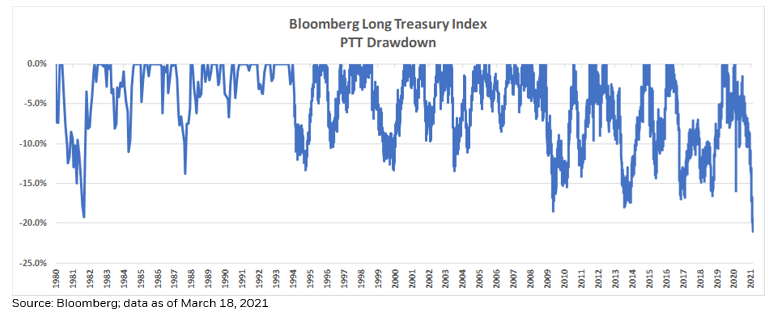

We’re in the midst of witnessing #BondMarketHistory, as the peak to trough drawdown for the Barclays Long Treasury Index now exceeds -20% (not including today’s move), its worst #drawdown going back 40 years and meeting what many consider to be a bear #market!