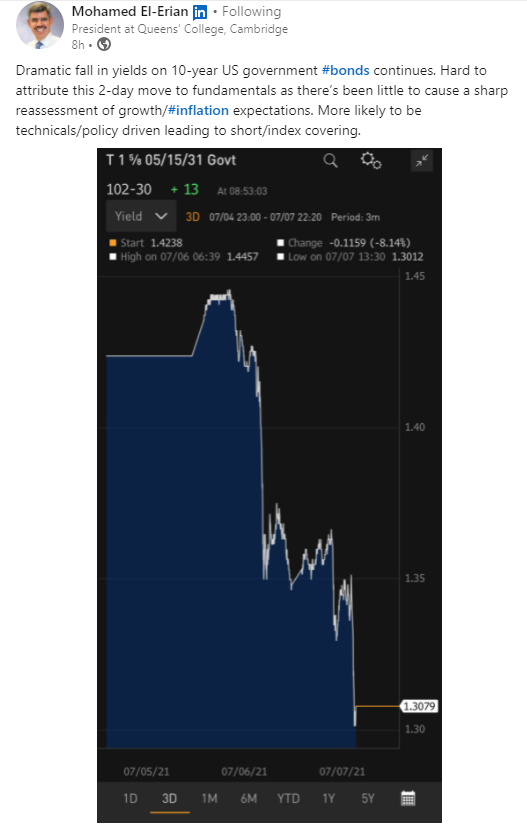

1. Two-Day Drop 10 Year Yield

Barrons–For the S&P 500, Friday’s close was its seventh high in row, the longest streak since 1997. The index, with a gain in June, rose for a fifth consecutive month, the longest streak since August 2020. It also gained 8.2% during the second quarter of 2021, its fifth consecutive quarterly gain, which is the longest streak since the fourth quarter of 2017. Its first-half gain of 14.4% was the best since 2019 and the second-best since 1998. There’s clearly strength in those numbers.

Continue readingHappy 4th of July

Days after Charlie Munger called Robinhood ‘a gambling parlor,’ the free-trading app revealed options trading as its largest source of revenue

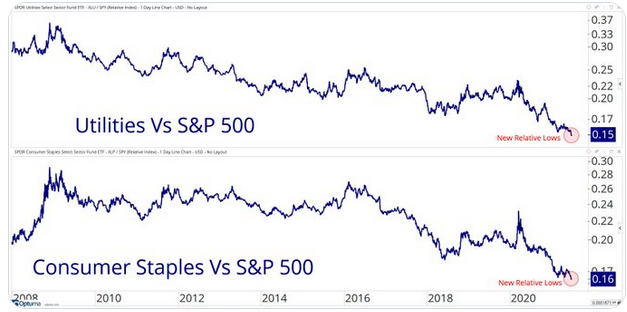

Dave Lutz Jones Trading–Investors have been rotating back into the technology stocks that they favored during Covid-19 lockdowns after inflation fears eased and low bond yields spurred a hunt for better returns. Optimism about the economic recovery, the prospect of more fiscal stimulus and confidence that the Federal Reserve will continue to support credit markets has also boosted sentiment in recent days, WSJ reports.

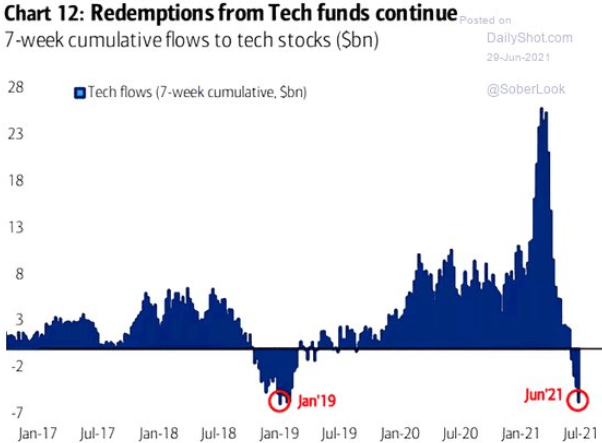

From Dave Lutz at Jones Trading-That said, EPFR notes Tech fund outflows continuing to accelerate so the pain trade is a Tech Rally