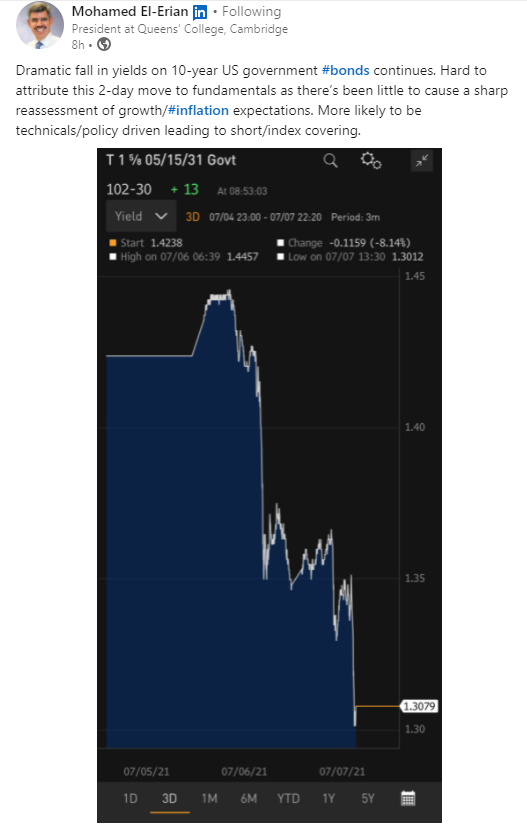

1. Two-Day Drop 10 Year Yield

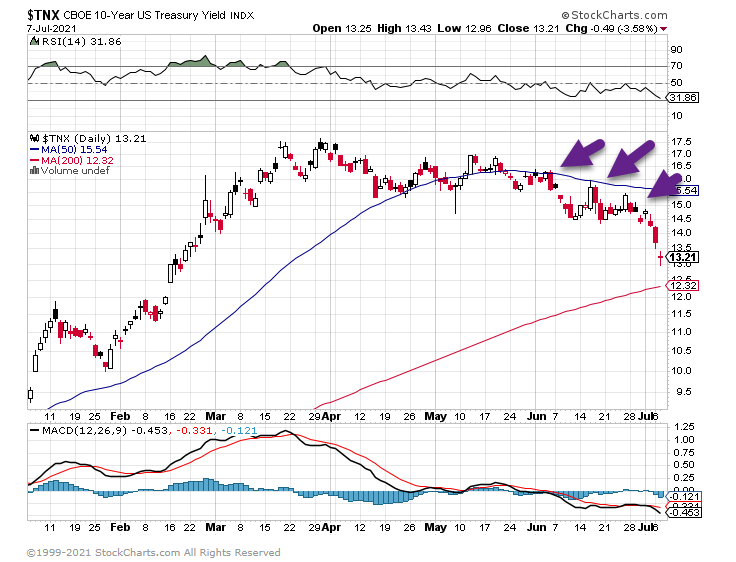

2. Ten Year Rates…3 Lower Highs and Rollover.

10 Year Treasury Yield Chart

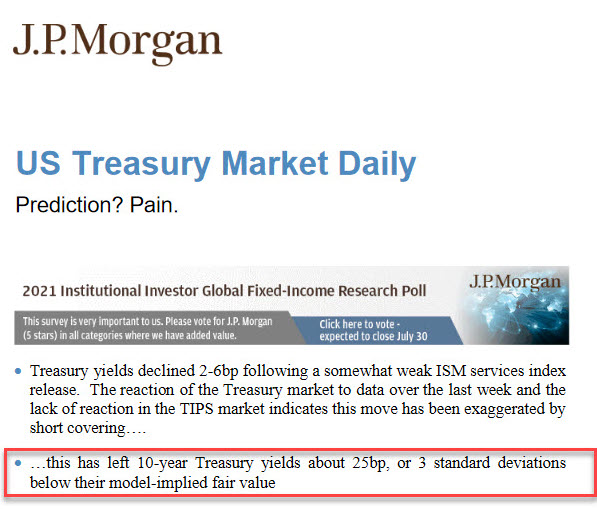

3. Good Summary–Why is the 10-year Treasury yield plunging to the lowest since February?

Marketwatch–Mark DeCambre

The pain trade

Bets that yields will head higher have been a losing wager on Wall Street and the unwinding of some positioning has contributed to aspects of the fall in long-dated yields.

Most traders are positioned for 10 year yields at or around 2% in the near term because it is a bet that makes sense given that some Federal Reserve policymakers have articulated plans to eventually scale back on monthly purchases of assets that include some $80 billion in Treasurys.

Periodic surges in yields have forced a number of unwinds of short Treasury bets, which have amplified recent moves, analysts have said.

“And right now with rates, the pain trade is a continued move lower and flatter,” Greg Faranello, head of U.S. rates at AmeriVet Securities, wrote in a Wednesday note.

Weaker economy

A dimming outlook foraa fast economic recovery, highlighted by an uneven rebound in the labor market, may also be contributing to traditional haven buying for Treasurys.

U.S. businesses are struggling to fill millions of available jobs. Although the U.S. created 850,000 new jobs in June, it would take more than a year at that rate to restore employment to pre-pandemic trends, a far slower rebound than anticipated by economists months ago.

On Wednesday, the number of available jobs set a record for three straight months, with May producing a record 9.21 million openings.

To be sure, many are expecting that the jobs market will normalize as fiscal stimulus measures to help out-of-work Americans roll off in the months to come, compelling a fuller return to work.

Mizuho economist Steven Ricchiuto, in a Wednesday research note, wrote that there are some signs in layoffs and quits that imply that only a temporary challenge by businesses looking to fill jobs.

“Layoffs have declined to a new all-time low, and the level of hiring and quits have declined and are now closer to their pre-pandemic levels,” the Mizuho economist wrote. He continued:

‘This is somewhat concerning as it suggests recent net payroll gains are unsustainable. All together, these dynamics do offer some support for the argument put forward by the Fed hawks that the structural rate of unemployment has increased. However, policy changes that are driving these shifts will be largely rolled back over the coming months, so in our view, at minimum, it is highly premature to conclude that the labor market has structurally shifted.’

Treasury appetite

Demand for U.S. government debt has been strong, particularly as investments outside the U.S. offer yields at or below 0%. The German bond yield TMBMKDE-30Y, 0.185% hit its lowest level since March. That appetite for European debt has had some spillover to the U.S., investors say.

“The moves seemed to be more of a result of trades being stopped out rather than anything more fundamental,” wrote analysts at Mizuho in a report cited by Reuters.

“There is still a lot of cash to be put to work, and the possibility of momentum funds closing shorts ahead…may sustain the strength in rates in the near-term,” Mizuho said.

Delta, delta, delta

Concerns about the fast-moving delta variant of the coronavirus that results in COVID-19 also has been blamed for some buying in Treasurys.

The delta variant is now the most dominant form of SARS-CoV-2 in the U.S., according to new data from the Centers for Disease Control and Prevention. The more transmissible version of the coronavirus has raised concern that it may cause more infections among the unvaccinated, and even the vaccinated may have less protection against the delta variant than other variants of concern.

A dearth of supply

A lack of supply of Treasury bonds may also be an issue, which might sound odd, given the huge fiscal deficits the federal government has run up in its efforts to buffer the economy against the COVID-inspired downshift.

However, the Treasury General Account, or TGA, which the U.S. government uses to run most of its day-to-day business and is managed by the New York Fed, is now being steadily wound down after being run up to help mitigate the economic pain of the pandemic.

That reduction in the TGA has had the effect of shrinking the supply of bonds, one key factor in the recent moves in yields, argues John Luke Tyner, fixed-income analyst at Aptus Capital Advisors, which manages some $3 billion.

“We’ve just had less issuance because the government can rely on TGA to finance expenses,” Tyner said.

The Fed

The Federal Reserve statement and Fed chair Powell’s press conference after fits June 15-16 gathering highlighted the strange spot fixed-income investors find themselves in. The rate-setting Federal Open Market Committee broached the topic of tapering its $120 billion a month purchases of Treasurys and mortgage-backed bonds, and also the eventual raising of policy interest rates, which stand at a range between 0% and 0.25%.

A Fed on a more hawkish footing, one that suggests that the institution will be more inclined to remove monetary accommodation as the economy recovers, should be nudging yields up.

Investors will be eager to glean clues to future policy from the minutes of the Fed’s June meeting when they are published Wednesday afternoon.

2% or bust?

Despite the yield slump, a number of analysts are still committed to the view that the 10-year Treasury will hit 2% by the end of 2021, which would, perhaps, mark a spectacular surge in the last half of a year.

“We anticipate that the 10-year U.S. Treasury yield will finish the year at 2.0%,” writes Lauren Goodwin, economist and portfolio strategist at New York Life Investments, in a recent research report.

She makes the case that the sluggish pace of recovery in jobs is temporary, while rising debt and other factors won’t lead to a persistent shift in inflation.

“My estimation of these structural factors suggests that the underlying inflation trend will firm only modestly as the recovery continues…For now, any determination that they will be inflationary beyond the next 2-3 years’ recovery period remains somewhat speculative,” she wrote.

Aptus Capital’s Tyner says that if the 10-year breaks below 1.20% in its decline, then that could signal more structural problems in the economy, as gauged by fixed-income investors.

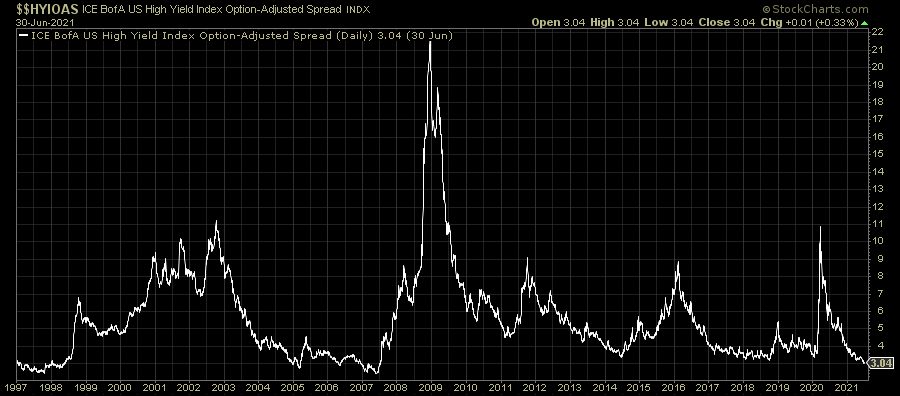

4. Long-Term Chart of High Yield Credit Spreads.

If we start by looking at where the high yield credit spread has been over the past 25 years, we can start to draw some conclusions.

Publisher of The Lead-Lag Report

July 2, 2021 – Credit Spreads Could Be Suggesting A Bond Bear Is Near (leadlagreport.com)

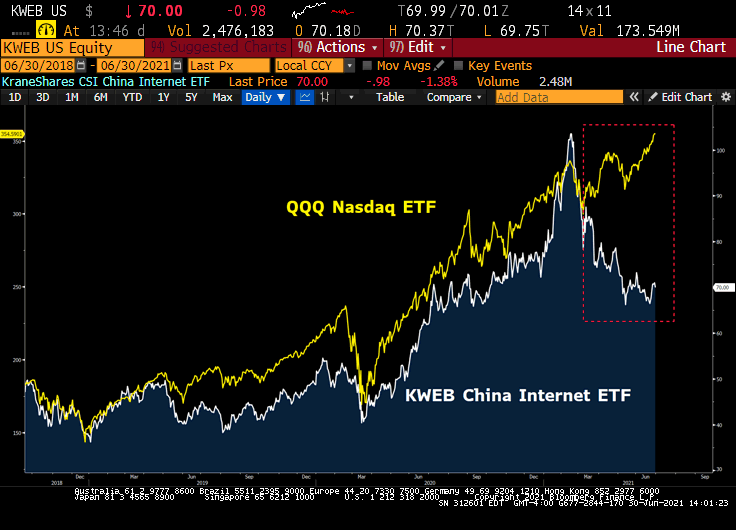

5. QQQ vs. China Tech Since Crackdowns

@Convertbond

China vs. the USA – The Big Tech Great Divergence, what is Underneath the Surface?

https://twitter.com/Convertbond/status/1412882888740196356/photo/

6. Seven Consecutive New Highs…History Lesson

7. What’s Driving Share Prices? 2020 vs. 2021

https://www.advisorperspectives.com/commentaries/2021/07/07/earnings-bounce-poses-quality-test-for-equity-investors

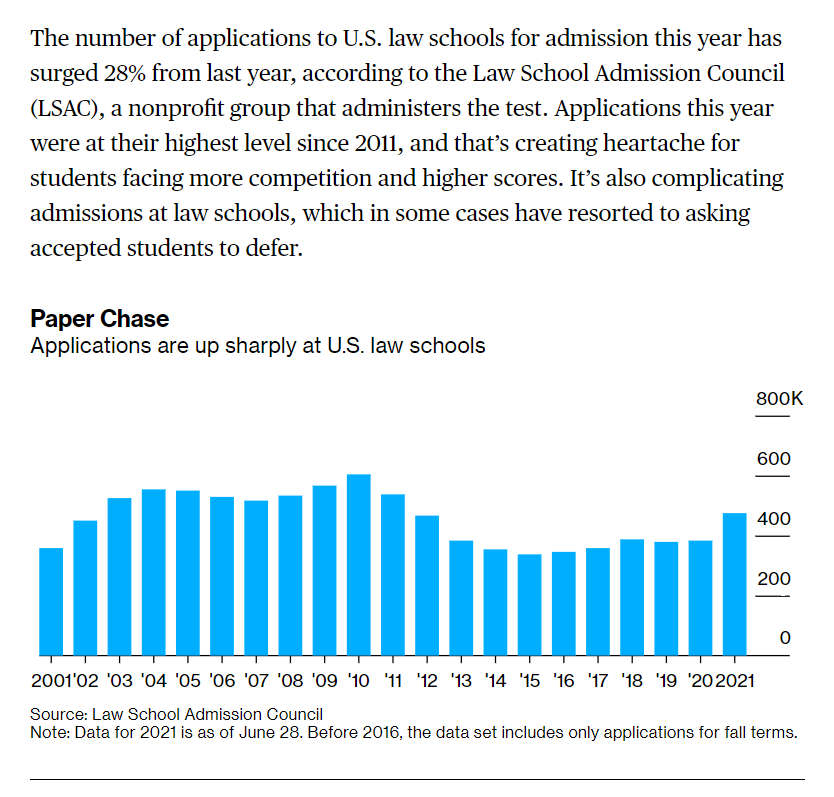

8. Number of Law School Apps Jumps 28%

9. Number of Troops in Afghanistan 20 Year History.

| The United States has now withdrawn more than 90% of its troops and equipment from Afghanistan, the Pentagon announced yesterday. That update comes less than 48 hrs since reports emerged from Afghan military officials that the US military had left Bagram airfield “in the middle of the night”, switching off the electricity at the base that had been occupied for almost 20 years. Hundreds, not thousands The update from the Pentagon suggests that the number of US troops left in Afghanistan is likely to now be in the hundreds, rather than the thousands, for pretty much the first time since 2001. At one point in 2011, around 100,000 US troops were stationed in various parts of Afghanistan, which is not to mention the thousands of contractors and troops from allies such as the United Kingdom, Canada, Germany, Italy, France and others that were also involved in the war. Much of the withdrawal from the war in Afghanistan came in the years after the killing of Osama Bin laden in 2011, who had been the founder and militant leader of al-Qaeda. Since 2014 a much smaller force of 8-10k troops has remained, although all will be gone by September 11th — the date set by President Biden for complete withdrawal.https://www.chartr.co/ |

10. Tim Ferris BlogThe Big Question: Are You Better Than Yesterday?

Big goals? Learn to think small. (Photo: H. Koppdelaney)

The following is a guest post from Chad Fowler, CTO of InfoEther, Inc.

Help me get my $%!^ in shape…ask me once a day: “Was today better than yesterday?” (nutrition / exercise) – today: YES!

When I read this I realized that it was the ticket to getting in shape. I recognized it from the big problems I have successfully solved in my life. The secret is to focus on making whatever it is you’re trying to improve and make better today than it was yesterday. That’s it. It’s easy. And, as Erik was, it’s possible to be enthusiastic about taking real, tangible steps toward a distant goal.

I’ve also recently been working on one of the most complex, ugliest Ruby on Rails applications I’ve ever seen. My company inherited it from another developer as a consulting project. There were a few key features that needed to be implemented and a slew of bugs and performance issues to correct. When we opened the hood to make these changes, we discovered an enormous mess. The company employing us was time- and cash-constrained, so we didn’t have the luxury to start from scratch, even though this is the kind of code you throw away.

So, we trudged along making small fix after small fix, taking much longer to get each one finished than expected. When we started, it seemed like the monstrosity of the code base would never dissipate. Working on the application was tiring and joyless. But over time, the fixes have come faster, and the once-unacceptable performance of the application has improved. This is because we made the decision to make the code base better each day than it was the day before. That sometimes meant refactoring a long method into several smaller, well-named methods. Sometimes it meant removing inheritance hierarchies that never belonged in the object model. Sometimes it just meant fixing a long-broken unit test.

But since we’ve made these changes incrementally, they’ve come for “free.” Refactoring one method is something you can do in the time you would normally spend getting another cup of coffee or chatting with a co-worker about the latest news. And making one small improvement is motivating. You can clearly see the difference in that one thing you’ve fixed as soon as the change is made.

You might not be able to see a noticeable difference in the whole with each incremental change, though. When you’re trying to become more respected in your workplace or be healthier, the individual improvements you make each day often won’t lead directly to tangible results. This is, as we saw before, the reason big goals like these become so demotivating. So, for most of the big, difficult goals you’re striving for, it’s important to think not about getting closer each day to the goal, but rather, to think about doing better in yourefforts toward that goal than yesterday.

I can’t, for example, guarantee that I’ll be less fat today than yesterday, but I can control whether I do more today to lose weight. And if I do, I have a right to feel good about what I’ve done. This consistent, measurable improvement in my actions frees me from the cycle of guilt and procrastination that most of us are ultimately defeated by when we try to do Big Important Things.

You also need to be happy with small amounts of “better.” Writing one more test than you did yesterday is enough to get you closer to the goal of “being better about unit testing.” If you’re starting at zero, one additional test per day is a sustainable rate, and by the time you can no longer do better than yesterday, you’ll find that you’re now “better about unit testing” and you don’t need to keep making the same improvements. If, on the other hand, you decided to go from zero to fifty tests on the first day of your improvement plan, the first day would be hard, and the second day probably wouldn’t happen. So, make your improvements small and incremental but daily.

Small improvements also decrease the cost of failure. If you miss a day, you have a new baseline for tomorrow.

One of the great things about this simple maxim is that it can apply to very tactical goals, such as finishing a project or cleaning up a piece of software, or it can apply to the very highest level goals you might have. How have you taken better action today for improving your career than you did yesterday? Make one more contact, submit a patch to an open source project, write a thoughtful post and publish it on your weblog. Help one more person on a technical forum in your area of expertise than you did yesterday. If you every day you do a little better than yesterday toward improving yourself, you’ll find that the otherwise ocean-sized proposition of building a remarkable career becomes more tractable.

Give it a try:

Make a list of the difficult, complex personal or professional improvements you’d like to make. It’s OK if you have a fairly long list. Now, for each item in the list, think about what you could do today to make yourself or that item better than yesterday. Tomorrow, look at the list again.

Was yesterday better than the day before? How can you make today better? Do it again the next day. Put it on your calendar. Spend two minutes thinking about this each morning.

https://tim.blog/2009/07/28/the-big-question-are-you-better-than-yesterday/

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..