1. S&P 500 Gained 5% Five Quarters in a Row Only the Second Time Since 1945

Barrons–For the S&P 500, Friday’s close was its seventh high in row, the longest streak since 1997. The index, with a gain in June, rose for a fifth consecutive month, the longest streak since August 2020. It also gained 8.2% during the second quarter of 2021, its fifth consecutive quarterly gain, which is the longest streak since the fourth quarter of 2017. Its first-half gain of 14.4% was the best since 2019 and the second-best since 1998. There’s clearly strength in those numbers.

The quarterly streak, in particular, is impressive. The S&P 500 hasn’t just gained for five quarters in a row. It has gained more than 5% for five quarters in a row, only the second time since 1945 that the index has been able to pull off that feat.

By

https://www.barrons.com/articles/covid-19-delta-variant-stock-market-51625271990?mod=past_editions

WSJ-And individual traders appear still willing to employ a “buy the dip” strategy. On June 18, for example, retail investors bought more than $2 billion of shares on a net basis—beating every other day in at least the last two years, based on VandaTrack data—as the three major U.S. stock indexes pulled back almost 1% or more.

“People are still very optimistic,” said Jason Goepfert, president of Sundial Capital Research, which tracks how sentiment varies between individual traders and institutional investors.

2. Nasdaq Hits Previous Overbought Levels.

For Short-Term Traders

https://www.zerohedge.com/markets/heres-why-rally-seen-going-while

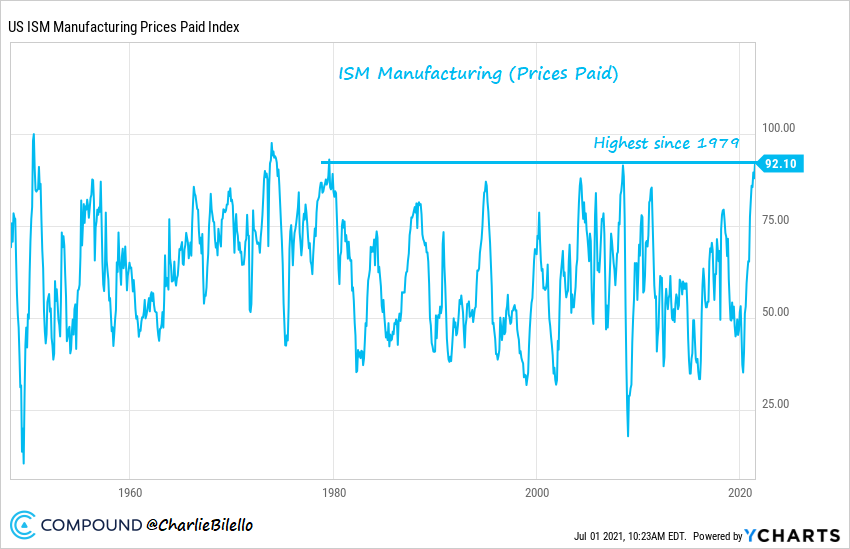

3. Prices Paid Index Hits Highest Level Since 1979

Charlie Bilello

High Demand + Supply Constraints = Rising Prices

The Prices Paid Index (a measure of inflation) in the ISM Manufacturing report rose to its highest level since 1979.

4. Another Look at the American Patent Break-Out….New Tech Revolution Coming??

Patents on America—Barry Ritholtz The Big Picture Blog

https://ritholtz.com/2021/07/10-monday-am-reads-315/

5. The Federal Income Tax is Historically Low.

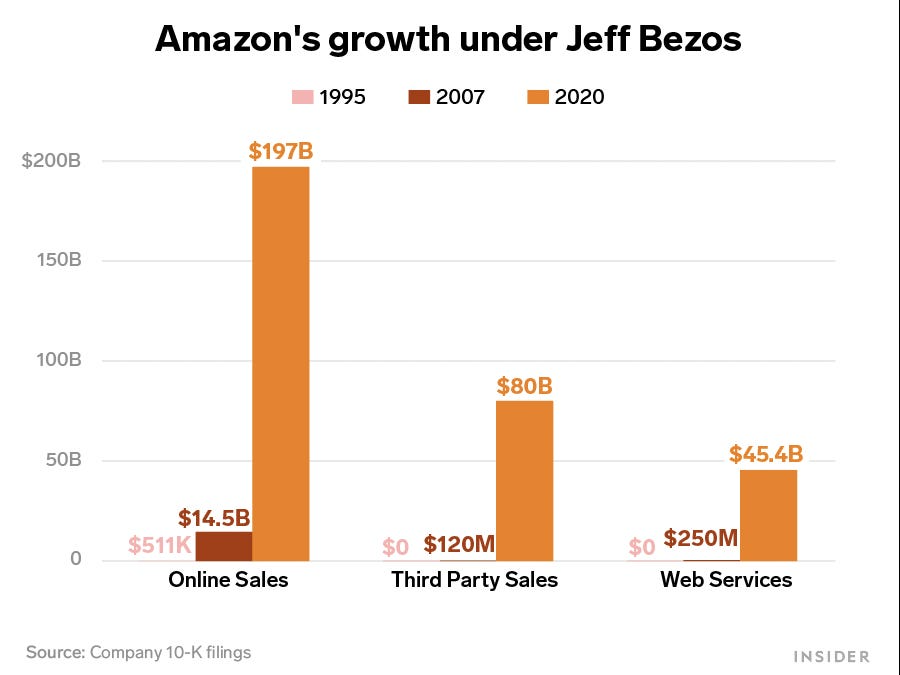

6-7. Numbers show just how staggeringly huge Jeff Bezos made Amazon in his 27 years as CEO

Jeff Bezos in 1997. Paul Souders/Getty Images

- After 27 years, Jeff Bezos is handing over the job of Amazon CEO to Andy Jassy.

- In the company’s first full financial year, it made just $511,000 in sales.

- Last year, Amazon made $386 billion and employed more than a million people.

- See more stories on Insider’s business page.

Amazon founder Jeff Bezos is stepping down from his job as CEO today after leading the company for 27 years.

The date is “sentimental,” he explained during his last earnings call before Andy Jassy took over. It was the date Bezos incorporated Amazon in 1994.

In that time, he helped bring the idea ecommerce from a whiteboard concept to an everyday reality for millions of customers around the world.

Insider went back through years of company filings to round up some of the key numbers that show just how massive Amazon has become under Bezos’ leadership.

Overall sales grew over 772,000 times from 1995 to 2020

Taylor Tyson/Insider

Amazon’s net sales in 2020 were roughly equivalent to the GDP of Argentina.

Online sales still dominate, but Third-Party Sellers and Web Services have grown into massive revenue sources

Taylor Tyson/Insider

Amazon says third-party small businesses sell half of the stuff in its marketplace, and that millions of customers use AWS every day.

The footprint has expanded from one office in Seattle to 475 million square feet

That’s more than 8,246 football fields’ worth of office space, fulfilment centers, data centers, physical stores, and more.

More than 1.3 million people are employed by Amazon

Only Walmart has more workers.

More than 95,500 drivers deliver packages for the company

Small suppliers are concerned about Amazon as a “gatekeeper” when selling to the federal government. Patrick Fallon/Getty Images

Most work for a network of more than 2,200 contractor partner companies.

Amazon has at least 30,000 vans and 20,000 trailers, and has an order for 100,000 electric vans

Keith Srakocic/AP

The company’s last-mile network delivered an estimated 5.1 billion parcels in 2020 — that’s nearly as many as the US Postal Service handles.

Amazon’s fleet of airplanes will number 85 by the end of next year

AP Photo/Ted S. Warren

The planes could make soon one-day delivery a possibility for 95% of the continental US.

https://www.businessinsider.com/amazon-facts-stats-how-bezos-grew-sales-company-as-ceo-2021-7

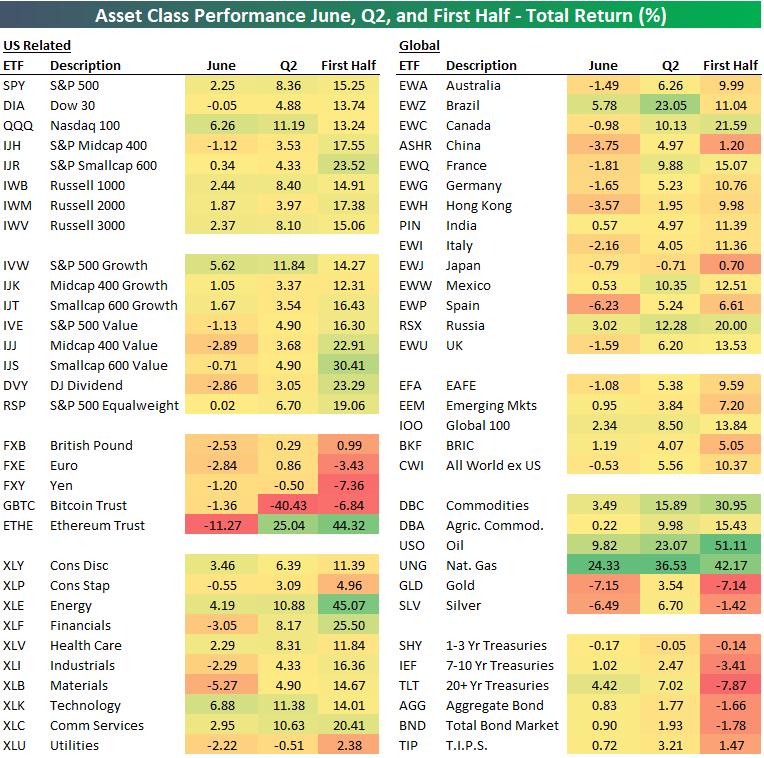

8. Energy and Ethereum Lead The Way Higher in First Half…First Half Returns Grid

Bespoke Investment Blog–The first half of 2021 is now in the books. Below is a look at our Asset Class Performance Matrix highlighting total returns in June, Q2, and the first half of 2021 using key ETFs that we monitor on a regular basis.

Across asset classes, energy was the winning theme with commodities like oil (USO) and natural gas (UNG) boasting some of the strongest first-half returns alongside Energy sector stocks (XLE). USO was the top performer of these with its 51.11% total return since the start of the year. Alongside XLE and UNG’s over 40% gains, the Ethereum Trust (ETHE) also rallied 44.32%, albeit there has been a significant pullback in the past month. Although ETHE posted big gains, Bitcoin (GBTC) took a loss with a 6.84% decline in the first half. That is not to say it was not up significantly at one point during the first half as Q2 alone saw a 40.43% loss that brought it into the red for the half. The only other assets to have fallen by more than Bitcoin in the first half were the Japanese Yen (FXY), Gold (GLD), and long bonds (TLT). TLT saw the weakest returns of all of these over the course of the past six months but more recently it has experienced better performance relative to other assets. In fact, its 4.42% rally in June was almost double that of the S&P 500.

In the equities space, again Energy was the top performer while small caps and value outperformed as well in the first half. That was not necessarily the case in June though as there was evidence of rotation out of value and into growth. The NASDAQ 100 (QQQ) and S&P 500 Growth (IVEW) were two of the top-performing ETFs in June and Q2 while value stocks actually fell in June.

As for international equities, Canada (EWC) and Russia (RXS) were the strongest country ETFs in the first half. While it was not enough to lift its first-half gain to the high end of the range of countries shown, Brazil (EWZ) did see a large degree of outperformance in Q2 with a 23.05% gain. That is nearly double the next best performer, Russia. Additionally, these were the only two countries up significantly in June as most countries saw a loss. Year-to-date, China (ASHR) and Japan (EWJ) have been the weakest of the country ETFs. Click here to view Bespoke’s premium membership options.

9. Pew Research….Voting, Paying Taxes and Following the Law Makes a Good U.S. Citizen.

2In addition to voting, paying taxes and following the law, a majority of Americans said several other traits were very important to good citizenship, including serving on a jury if called (61%); respecting the opinions of others who disagree (61%); and participating in the U.S. census every decade (60%). (The survey was conducted before the Commerce Department announced it would add a question about citizenship to the 2020 census – a decision blocked by the Supreme Court last week.)

10. Five Steps to Cultivate a State of Flow for More Happiness

Flow can make you more productive and happy. Take these steps to find your flow.

Have you ever found yourself so immersed in a task that everything around you seemed to fade into the background, a zen-like focus getting you so “in the zone” that time stood still?

This is flow.

Science has long shown that a flow state is the pillar of peak performance. There are numerous benefits associated with being in this state, including enhanced concentration, feelings of control, and improved productivity.

But now we’re learning that there is another important outcome that accompanies flow. One that has gone unnoticed: happiness.

Research shows that flow is a precursor to well-being and general life satisfaction. People who are happier find themselves in flow states more often and for longer periods of time.

The originator of flow theory, Mihaly Csikszentmihalyi, says that the rewards of flow are inexhaustible and boundless. He argues that during such a state, the activities being done (whether it’s a sport, art, business, or socializing) become intrinsically valuable. The acts themselves become worth doing for their own sake. The type of happiness that flow induces isn’t a fleeting hedonism. It’s a lasting sense of personal meaning and fulfillment.

And now researchers are keen on finding ways to get everyday normal people to enter into flow through daily activities. Flow and positive emotionality, it’s now believed, can be cultivated. It’s a matter of changing your mindset. Here are five different ways you can find more flow.

1. Make your intentions clear.

Flow is based on the system in the brain called intention memory. Rather than storing information from the past, this memory system allows you to be proactive by planning ahead. To activate it, consider the following:

· The task needs to challenge you (i.e. make use of your skills). You may think the easier the better, but this can often lead to boredom and apathy (the opposite of flow).

· The completion of this task should fulfill a goal that is personal to you.

· It’s key to analyze the steps that will bring you closer to this goal. Try to make sure the actions performed at each step are done deliberately, as opposed to habitually (at least to begin with and in time, with more flow experienced, the activity will eventually become more of a habit).

2. Stick to one goal at a time.

Flow is all about implementing one goal at a time. We often convince ourselves that multitasking is the way to do things, but it’s not. It makes us inefficient and leads to countless distractions.

Luckily, research suggests that there is a way to protect you and your goalsfrom all the outside noise. According to the model of motivation, taking an “action-orientation” to your behaviors can help keep you on track towards achieving a single goal. Do the following:

· Disengage: Whether it’s a negative thought or a conflicting desire, you must disconnect from anything that acts as a barrier between you and your goal.

· Take initiative: Turn your intentions (outlined in the first step above) into actions.

· Be persistent: Maintain your performance until your intentions are fulfilled. It’s important that you check back in with your initial intentions (first step) because we often lose sight of what we originally planned.

article continues after advertisement

Source: silviarita on Pixabay

3. Practice mindfulness.

Being mindful means you’re focused on the present moment in a non-judgmental fashion.

A study found that athletes who engaged in a six-week mindfulness training program were significantly more likely to experience flow during their performance. Here are a few ways to engage in mindfulness:

· Perform the 5-4-3-2-1 coping technique. This method is meant to help you relax and draw your attention to the present moment. List five things you can see, four things you can hear, three things you can feel, two things you can smell, and one thing you can taste.

· Practice mindful meditation by using meditation apps.

4. Develop an autotelic style.

People with an autotelic style personality find pleasure in the task itself, rather than using that task as a stepping stone to advance their career or relationships. These individuals can balance work and play, resulting in greater enjoyment of life. They have no trouble getting into a state of flow. Here are a few tips to live like an autotelic person:

· Loosen up: It’s hard to enjoy what you’re doing if you’re constantly stressed out. Allow yourself to relax and be immersed in the activity in front of you. The mindfulness tips will also help here.

· Be adventurous: Increase your chances of finding what you enjoy by opening yourself up to new experiences. Find new hobbies, talk to new people, and experience things that are different than what you’re used to.

5. Find the balance between skill and challenge.

To enter a state of flow, you need to find a balance between the challenge level of a task and your skill level. If this balance is not met, you may experience feelings such as anxiety and worry. Find this balance by doing the following:

· Begin by stating all the steps necessary to complete a task.

· Then rate the degree of difficulty on a scale of one to five.

· Next, assess your skill level and rate it. Draw on past experiences if necessary.

· Now, with your skills in mind, re-rate how challenging you think the task is. Ideally, you want your challenge rating and your skill rating to match.

A version of this also appears on Health Central.

Nick Hobson, Ph.D., Leandra McIntosh, and Maryam Marashi

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.