Happy 4th of July

1. RobinHood Claims to “Democratize Trading.”…..$70m Fine Largest Ever by Finra Yesterday……..61% of Revenues Come From Options Trading According to IPO Filing.

Days after Charlie Munger called Robinhood ‘a gambling parlor,’ the free-trading app revealed options trading as its largest source of revenue

Warren Buffett, CEO of Berkshire Hathaway, and vice chairman Charlie Munger.

- Charlie Munger of Berkshire Hathaway called Robinhood “a gambling parlor” on Tuesday.

- The free-trading app said it derives a bulk of its revenue from options trading in its S-1 IPO filing.

- Options trading is often viewed as a risky way to leverage exposure to the stock market.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Just two days after Charlie Munger of Berkshire Hathaway called Robinhood “a gambling parlor,” the free-trading app said it derives a majority of its revenue from options trading.

The comments from Warren Buffett’s right-hand man came in an interview with CNBC on Tuesday night, in which the billionaire investor said, “it’s telling people they aren’t paying commissions when the commissions are simply disguised in the trading.”

On Thursday, Robinhood filed its S-1 with the SEC, a necessary step the company has to take prior to going public. The document revealed the underlying drivers of Robinhood’s business, from options, equities, and crypto trading, to securities lending and payment for order flow.

In 2020, Robinhood generated $720 million in revenue, of which 61%, or $440 million, was derived from options trading. Robinhood’s options trading revenue grew 298% in 2020, relative to 2019, as the pandemic and government stimulus checks led to a boom in stock market trading by retail investors.

Options trading is often viewed as a much riskier form of trading relative to stock trading, as it gives investors leverage to increase their exposure to short-term or long-term moves in the stock market.

While less risky option trading strategies exist, like selling covered calls on an underlying stock holding, a bulk of the options trading among Reddit “YOLO” investors tends to be buying directional put or call options with short-term expiration dates. Unless timed properly, these types of options trades can lead to a loss of nearly all invested capital.

“[Robinhood is] a gambling parlor masquerading as a respectable business,” Munger said.

Robinhood probably disagrees with Munger. In the company’s S-1 filing, it laid out how it’s democratized stock market investing for 18 million users through $0 trading commissions, an easy-to-use app, and education initiatives.

The company said more than 50% of its customers say they are first-time investors.

A customer named Angelina was quoted in Robinhood’s S-1 as saying, “The investor in my head was someone who wore a suit and a tie. Robinhood changed that for me.”

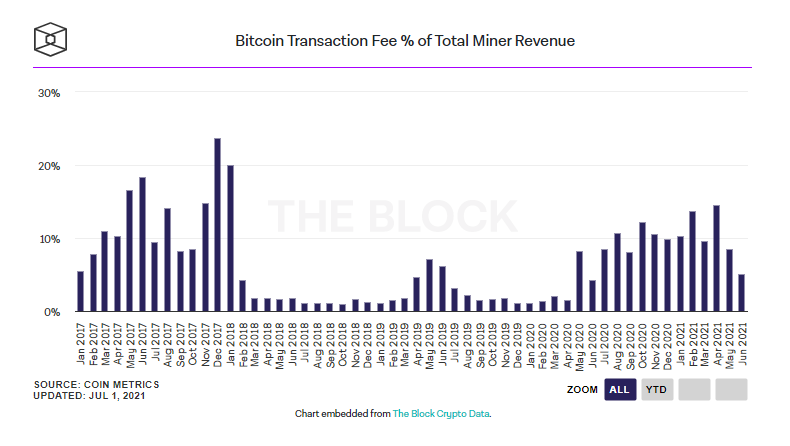

2. Crypto 6 Straight Weeks of Outflows….Bitcoin and Ethereum miner revenue declined by 42% and 53%, respectively, in June

CoinDesk reported last week that open positions in bitcoin futures had tumbled by 59% from an April 13 peak, an indication that institutional investors are being cautious.

“Institutional demand appears to remain somewhat lackluster,” Glassnode wrote in its Monday report.

by Yogita Khatri, THEBLOCKQuick Take

- The total revenue of Bitcoin and Ethereum miners fell sharply in June compared to May.

- Still, their revenues are higher than December 2020 levels, when both bitcoin and ether were trading at lower prices.

The total revenue of Bitcoin and Ethereum miners declined by 42% and 53%, respectively, in June, compared to the previous month.

According to The Block’s Data Dashboard, Bitcoin miners raked in $839 million in revenue during June, compared to $1.45 billion in May. Bitcoin’s price drop and a drop in transaction volume (and therefore fees) appear to be the two main reasons behind the revenue fall. Bitcoin’s hash rate has also fallen by 50% since its peak in May, which has temporarily slowed down the rate of block production until the next difficulty adjustment — potentially also affecting revenue numbers.

https://www.theblockcrypto.com/post/110238/bitcoin-btc-ethereum-eth-miner-revenue-june

3. Bitcoin Active Addresses at Lowest Number Since April 2020

Omkar Godbole

As cryptocurrency markets struggle to gather upside traction, new data shows a declining number of bitcoin active addresses on the blockchain network.

- The seven-day moving average of bitcoin active addresses – ones active on the network as sender or receiver – fell to 758,165 on Wednesday, the lowest since April 2020, per data provided by blockchain analytics firm Glassnode.

- “The decline in active user participation is a sign of weak demand,” Charlie Morris, chief investment officer at ByteTree Asset Management, said. “The hype cycle is over for now, and the market is unable to attract new entrants at the same pace.”

- The seven-day average of the daily transaction count tracked by Glassnode has also dipped below 300,000 for the first time since March 2020.

- Network usage affects the demand for cryptocurrency and can influence its price.

- “When there’s greater usage, there’s more demand for the cryptocurrency, and that drives the price up,” Philip Gradwell, chief economist at the blockchain intelligence firm Chainalysis, told CoinDesk last year.

- The count of bitcoin active addresses led the cryptocurrency higher in the final quarter of 2020.

- The cryptocurrency is trading 5% lower on the day at $33,200 at press time, having failed to keep gains above $36,000 earlier this week.

https://finance.yahoo.com/news/bitcoin-active-addresses-lowest-number-182030430.html

4. The first half of 2021 saw record-smashing global deal numbers

Dan Primack, author of Pro Rata

Illustration: Brendan Lynch/Axios

Global deal-making smashed all-time records in the first half of 2021, as numerous trends converged into the perfect surge.

By the numbers: Deal volume topped $2.82 trillion between January and the end of June, with over 28,000 deals announced, according to Refinitiv.

- That represents year-over-year increases of 132% and 27%, respectively.

- The prior record-holder for first half deal volume was 2007 ($2.35 trillion) and for deal number was 2018 (around 26,000)

Data: Refinitiv; Chart: Axios Visuals

What’s happening? Cheap debt. Corporate cash at record levels. Private equity dry powder at record levels. FOMO. Accelerated U.S. deal-making because of Biden tax pledges. Simultaneous beliefs that pandemic plays are sticky and that reopening plays are undervalued.

- Plus, and this cannot be emphasized enough, a bull public equities market that has lifted all valuation boats. Being worth $1 billion in 2021 isn’t nearly as impressive as being valued at $1 billion just a couple of years ago, but it sure pretties up the aggregate numbers.

More data: Global private equity deals totaled $512 billion, up 152% from the first half of 2020.

- U.S. deal-making dominated, with a 48.2% market share ($1.36 trillion). This is a flip from 2020, when Europe had a higher H1 market share.

- Tech deals had a 23.5% market share, with industrials in a distant second place at 10.8%. In the first half of 2020, financials had led.

- The first half’s largest announced deal was the Warner Media/Discovery merger.

- Goldman Sachs remained atop the M&A advisory league table, with JPMorgan jumping from fourth to second place.

The bottom line: There’s no indication that the first half deal-making drivers will abate in the second half, which means that the future will either be about an exogenous event or to the moon!

https://www.axios.com/deal-making-business-global-05c6ecad-e516-4b51-af84-6d58b670a279.html

5. Index vs. Active….2000-2020

At the end of 2020, $23.9 trillion was invested in mutual funds and $5.4 trillion in exchange-traded funds (ETFs), according to the 2021 Investment Company Fact Book. While most of that money is still actively managed, the indexed share of both of these categories combined has increased from 8% in 2000 to 19% in 2010 to 40% at the end of 2020, by my calculations.

Real Clear Market Blog https://www.realclearmarkets.com/

https://blogs.cfainstitute.org/investor/2021/07/01/a-pillar-of-modern-finance-turns-50/

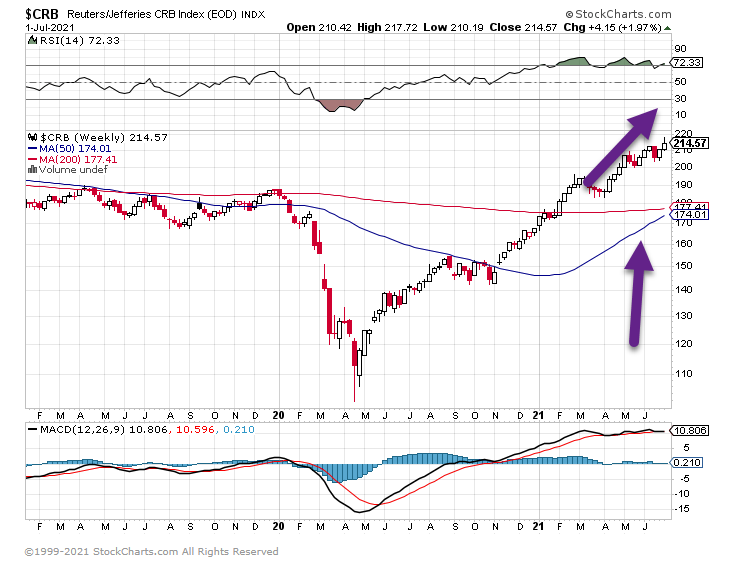

6. Jefferies Commodities Index New High.

$CRB—50 day about to break thru 200 day to upside.

7. Where Your City is in The Housing Cycle.

John Burns Real Estate

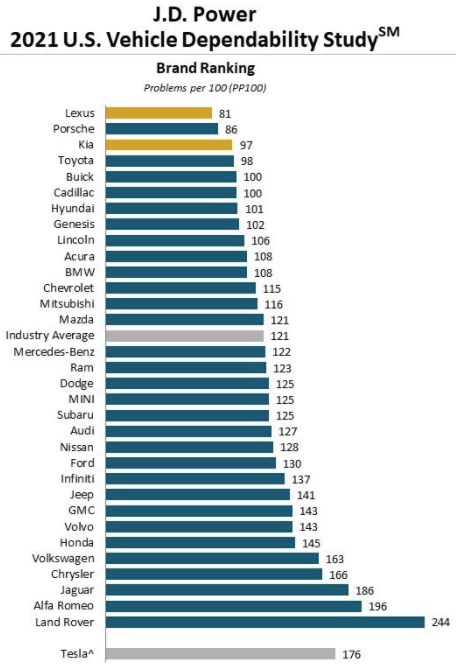

8. J.D. Power 2021 U.S. Vehicle Dependability Study

https://www.valuewalk.com/teslas-deal-with-catl-rings-alarms-for-new-4680-battery/

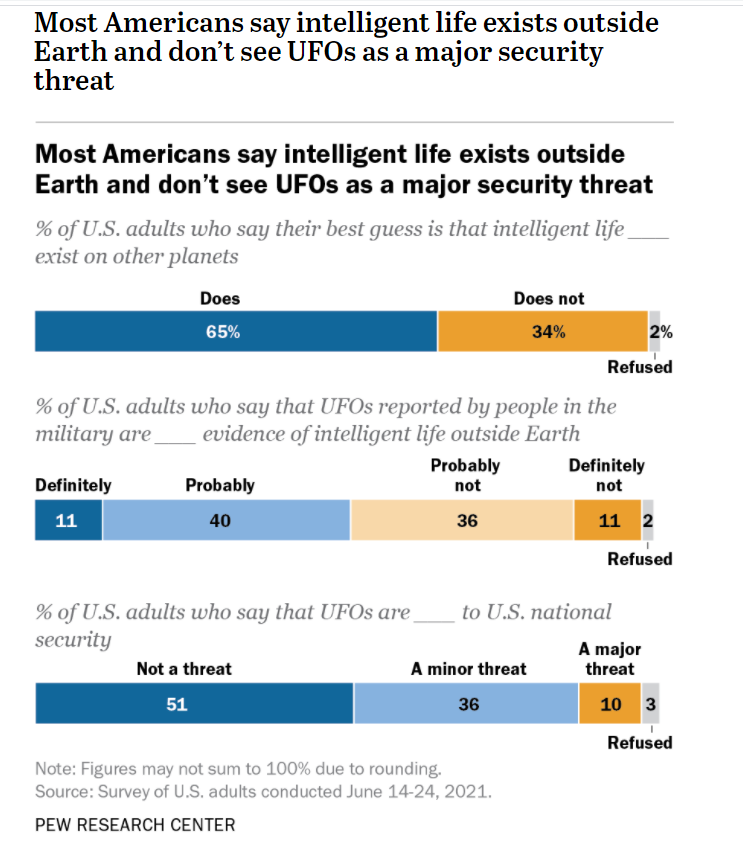

9. Majority of Americans Believe in Intelligent Life Outside of Earth

10. You Are Made To Win

Energy for Success Blog

You’re made to win. The only barriers to winning are the ones you allow to invade your mind.

If you decide you’re going to win, you will… it’s that simple.

The question is, what about your approach? What kind of an approach are you using to win?

Are you walking out onto a basketball court wearing baseball cleats on your feet? That’s clearly the wrong outfit.

No matter how much you’ve practiced, and no matter how refined your skills might be…

The wrong approach will get in the way of winning.

The baseball cleats for a basketball game example may seem strange. You might think, “That’s so obvious, nobody would do that.”

But consider this. There’s always a choice you can make, a bunch of different ways to get from A to B.

These choices and these different approaches you can take will determine how much you win. They’ll also determine what kind of a win you achieve.

The best outcome is a win-win, where your victory is shared by somebody else. This is what happens when you’re in The Source Energy and when connections are made.

So focus on your approach to winning and focus on your approach to life.

You can see right and wrong approaches everywhere.

What happens to the manager who tries to get employees to work harder by being a grouch and showing up for work every day in a bad mood? What does this approach get?

Employees will scatter, and relationships will disappear.

So let me ask you…

What’s your own personal approach?

The Winning Approach

You can’t get away from having an approach. It’s part of the way we behave. For instance…

Some people take a “wait and see” approach. Others take the approach that life is tough, and they’ll work through their difficulties.

What path are you pursing so you can win?

Is the approach you’re taking right now something deliberate, something you think about, or have you fallen into a pattern of behavior that you’re not really aware of?

The right approach is all you need to win. You pay attention, you keep taking productive and positive actions, and you keep noticing that you’re winning.

You monitor whether this approach is working or not. You make any adjustments that are needed, and then you keep going.

If I asked you to write down your approach, what would it be? Would your approach mention that you’re committed to winning, to doing what it takes to achieve your goals?

And what about your approach to living, and cherishing life itself, noticing the beauty and the joy that other people may never see?

These are a few ingredients of a winning approach.

What Winning Is Really All About

It doesn’t matter if you’re a sports fan. I love sports, and there are lessons from sports we can all learn from.

There are athletes and coaches who have lived remarkable and rewarding lives off the field or away from the basketball court.

One of the most inspiring was Jim Valvano, Jimmy V.

He coached at Johns Hopkins, Connecticut, Bucknell, Iona, and most memorably, for ten years, at North Carolina State. That’s where his underdog team won a national college basketball championship.

After his career, Valvano gave a now legendary speech. He told his audience…

“I just got one last thing, I urge all of you, all of you, to enjoy your life, the precious moments you have. To spend each day with some laughter and some thought, to get you’re emotions going.”

At the 1993 ESPY Awards, Jimmy V told his audience to laugh, think, and cry each day, and he said “don’t give up. Don’t ever give up.”

Two months later he passed away from adenocarcinoma, a glandular cancer.

Jim Valvano’s approach, when he was battling cancer, was to keep his life as normal as possible.

“Now I’m fighting cancer, everybody knows that. People ask me all the time about how you go through your life and how’s your day, and nothing is changed for me.”

This is what I mean by an approach.

So, here’s what you can do.

The Ingredient To Winning Most People Don’t Have

Patience.

Winning is not an overnight sensation. Winning in life is not picking the numbers for a lottery and getting instant gratification.

It’s not unusual for worthwhile things in life to take longer to arrive than you anticipate.

But being patient doesn’t mean accepting the fact that you need to spend years and years working on something before you can enjoy results.

Nothing could be farther from the truth.

You may have heard that it takes 10,000 hours to get good at something… and actually master it.

This is a theory that the writer Malcolm Gladwell suggested in his book, Outliers.

This is nonsense. I told my students about this and I used the word “spurious” to describe this kind of thinking.

Sure, it might take a while to get good at something, and clearly there’s nothing wrong with practice. But the reason I question the “10,000 Hour” theory is how those hours are spent.

If you’re learning a specific skill, whether it’s playing a guitar or analyzing a balance sheet, your progress depends on a number of factors…

- The quality of your teacher.

- Your motivation to learn.

- The related knowledge and skills you have when you start.

- Your dedication.

- Your passion.

All sorts of factors come into play. They can affect you on the way to your goal.

There’s something else. It’s your Energy.

This is The Source Energy, taught by The Masters of Traditional Chinese Medicine.

These are the men who begrudgingly shared their knowledge with me when I traveled again and again to The Sacred Mountains of China.

The Source Energy I help you connect with lets you create massive change and unparalleled personal achievement.

Great relationships, high performance, and winning without constantly banging your head against the wall.

They can be yours when your approach draws on The Source Energy. These things happen when you connect all the sensors in your body to the infinite number of vibrations that are part of The Source Energy.

Interested? All it takes is an open mind and some curiosity.

A great way to start is with The Dragon Eternal Success High Performance Program.

Take a look at it.

Let The Energy Make Your Personal Journey More Fun

There are all sorts of approaches you can take, and when you’re in The Energy, you’re able to see, feel, and hear more of them. Your awareness is fine-tuned so you make the best choice out of these approaches.

That’s what my student Julie M. did. She wrote me a note and told me…

“I had turned my chronic health conditions around through Bulletproof and joined their coaching program which led to much growth and self-discovery. I first encountered Dr. B in Denver at the Headstrong book tour. I was fortunate enough to attend the Be Unlimited event where we spent a day with Dr. B learning about and experiencing The Energy.”

“I knew this was the next path to follow, without having a specific desired outcome. Nine months later, I am a much-improved person.”

“From relationships to handling challenges, it amazes me how far I have come. I entered the program trying to build my business and feeling lost, now it is all coming together and will be better than I imagined, with the support of the most incredible community.”

You Can Do The Same Thing Julie Did

Once you decide you’re going to win…

Once you decide on an approach…

And once you’re committed to a life of better relationships, better health, and better financial success…

You can draw on the infinite power of The Source Energy to make your journey even more rewarding, more enjoyable, and more successful. You can make progress with less efforts and in less time.

The Energy removes obstacles. It clears the way for you to spend your days the way you’d like to spend them.

Getting started is easy.

Find out more about how to connect with The Source Energy.

Your Future

So give your approach some thought.

Find the correct way to win in the present, with whatever you want to get done.

Every single time you have a project, if you do something and it works, don’t you want to keep doing it, and keep having fun?

Whatever you’re doing, you want to keep it enjoyable.

That’s your future, and the approach that makes your projects and every aspect of your days enjoyable will nourish your life with both fulfillment and fun.

https://energyforsuccess.com/blogs/news/you-are-made-to-win

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.