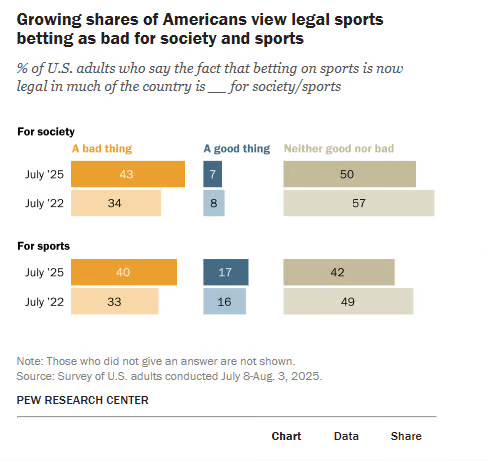

1. Largest Retail Investor Demand Ever Last Month

Retail demand. “We have just witnessed the largest Retail Investor buying EVER. Retail has bought over +$100B of US stocks in the last month, the largest 1M buying on record.”

Morgan Stanley via @marlin_capital

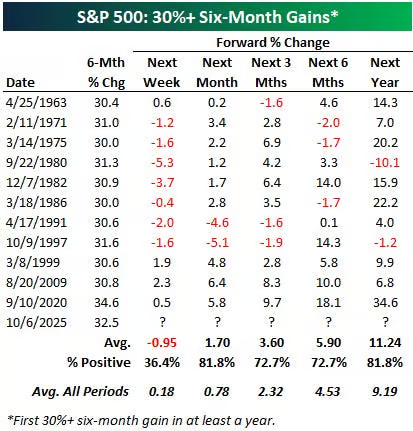

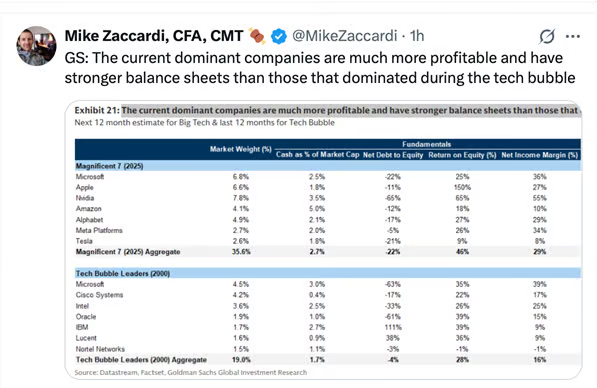

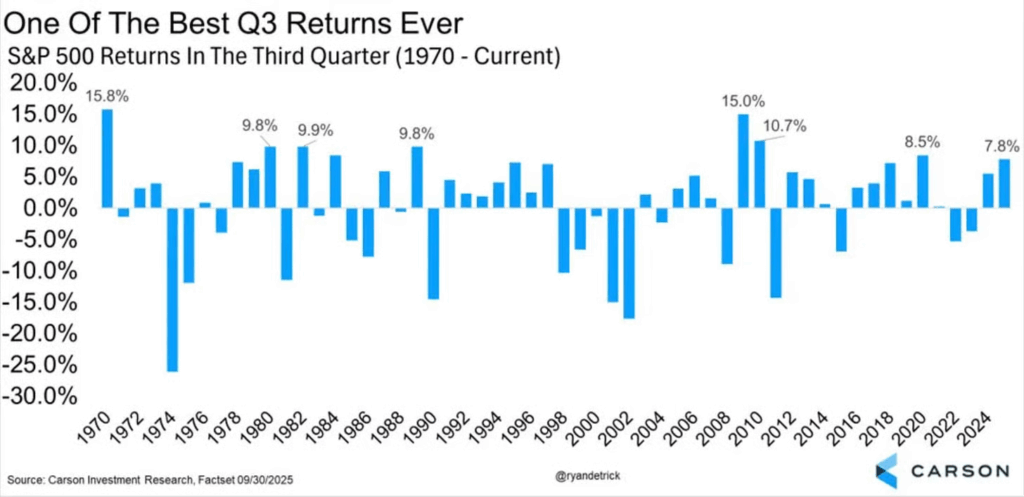

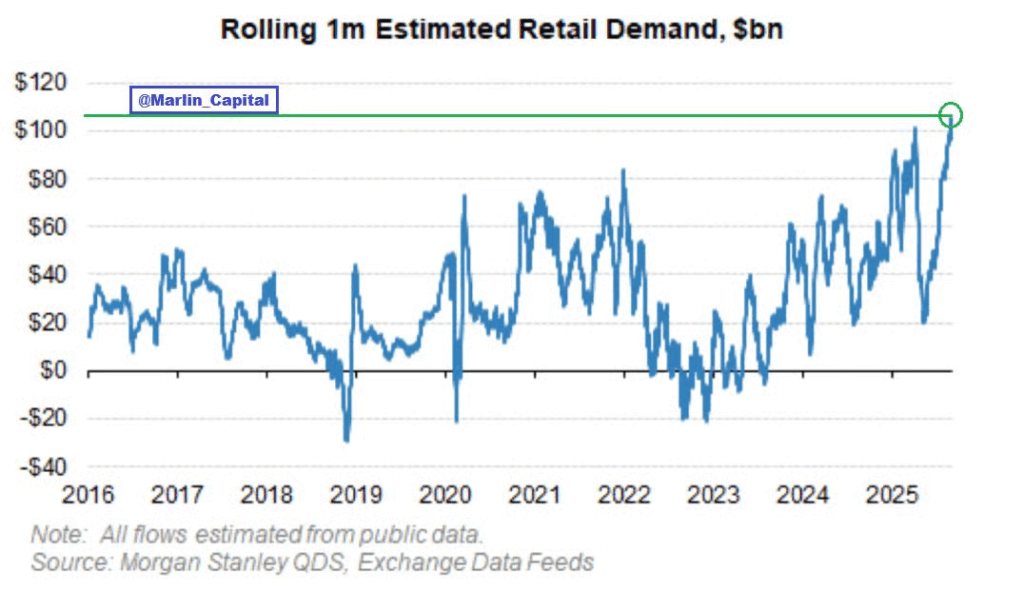

2. Earnings Season Kicks Off Next Week….Tech Earnings Still Delivering

Ryan Detrick

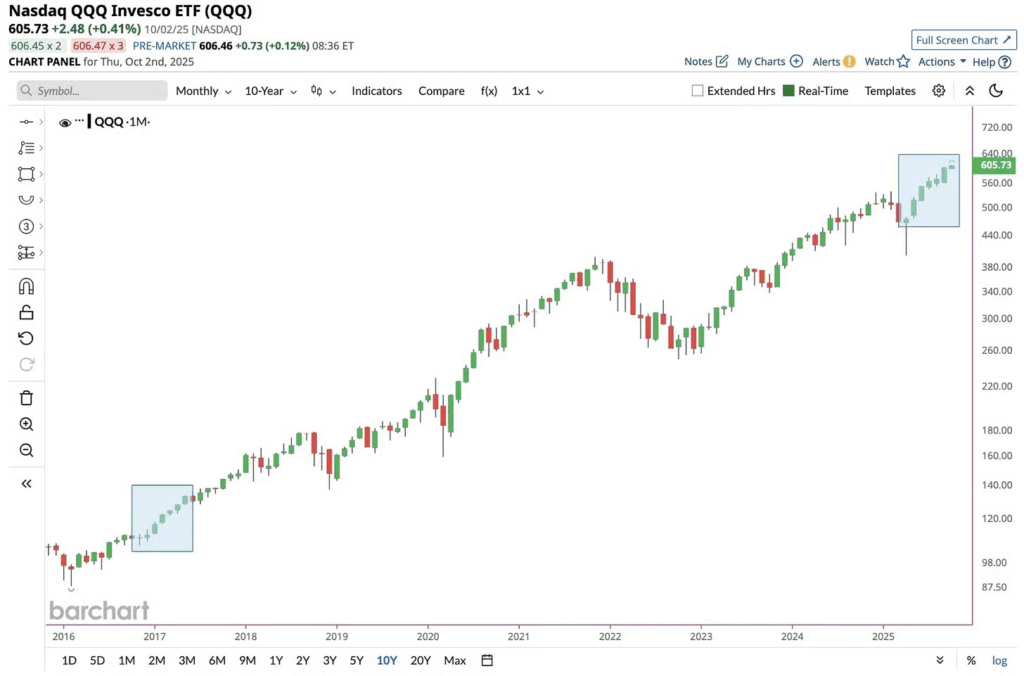

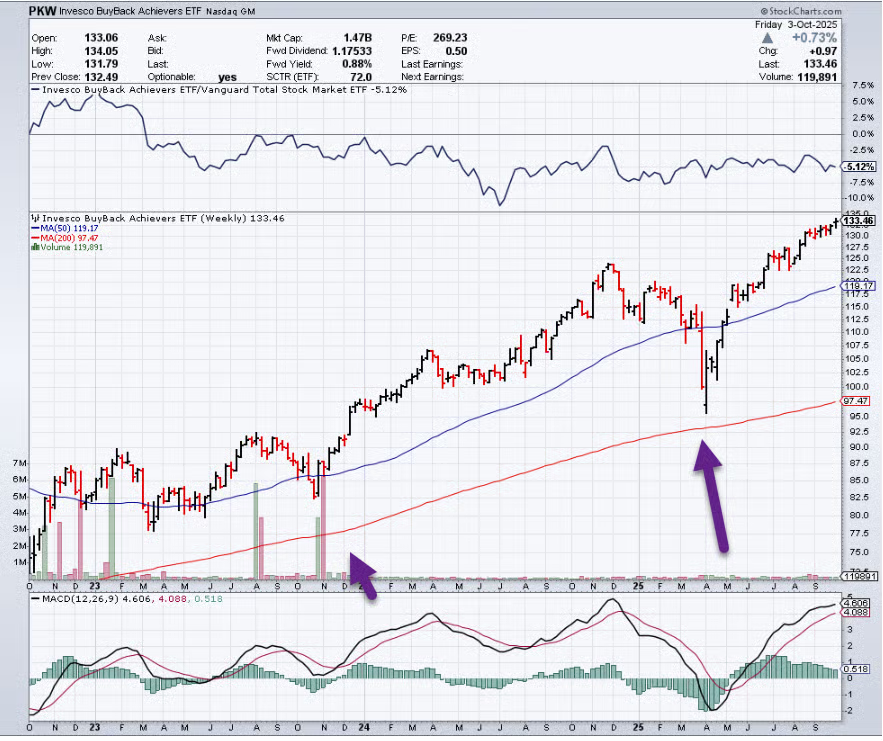

3. Softbank Another Leg Up From Japan Bull News…$20-$70 2025

StockCharts

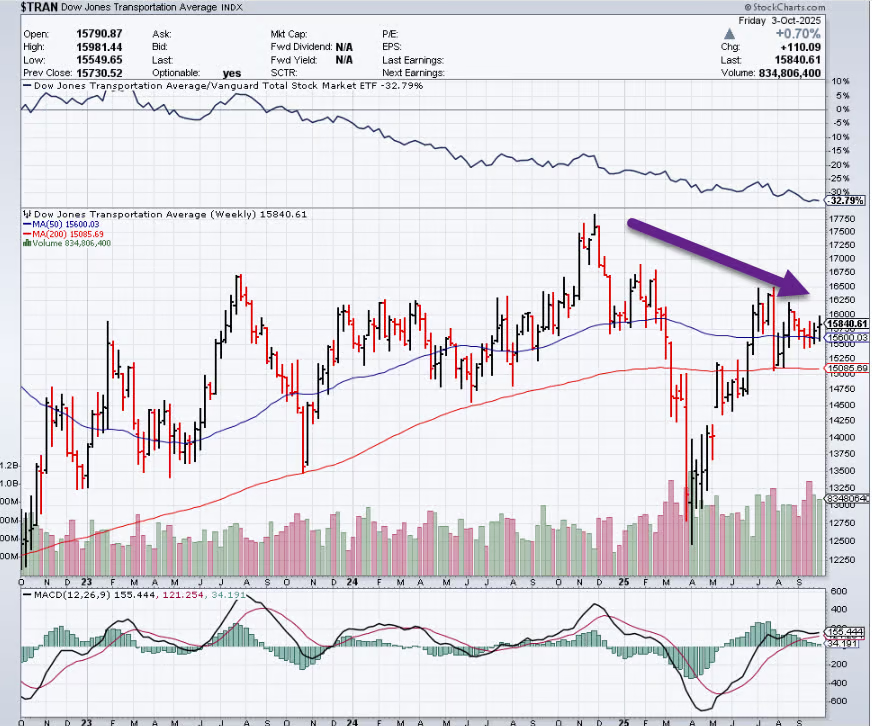

4. Airline ETF Still Below Pre-Covid Highs

StockCharts

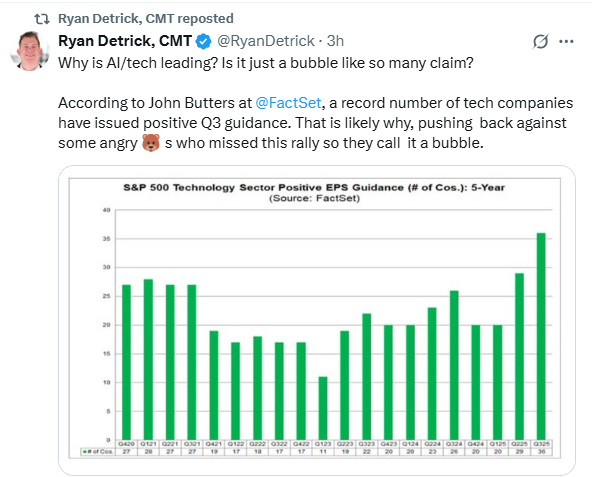

5. Silver Has Been Here Twice Before

Sam Ro

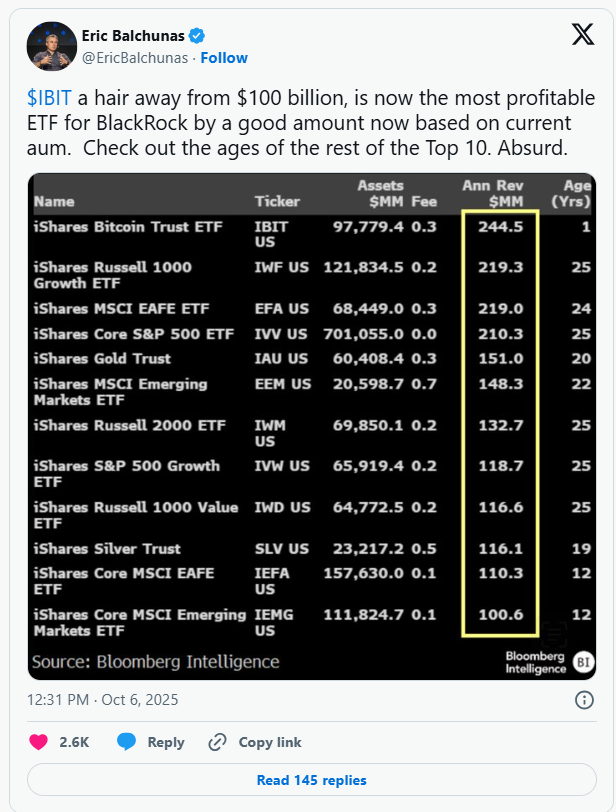

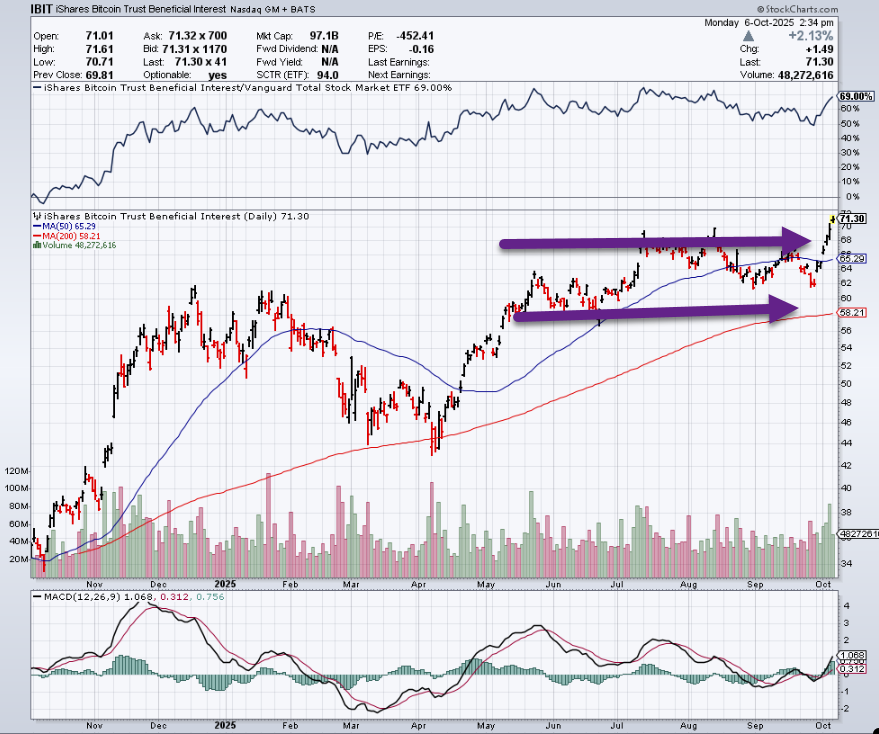

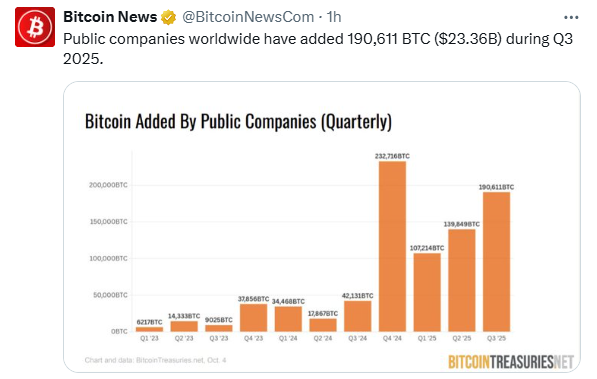

6. Public Companies Owning Bitcoin

Bitcoin News

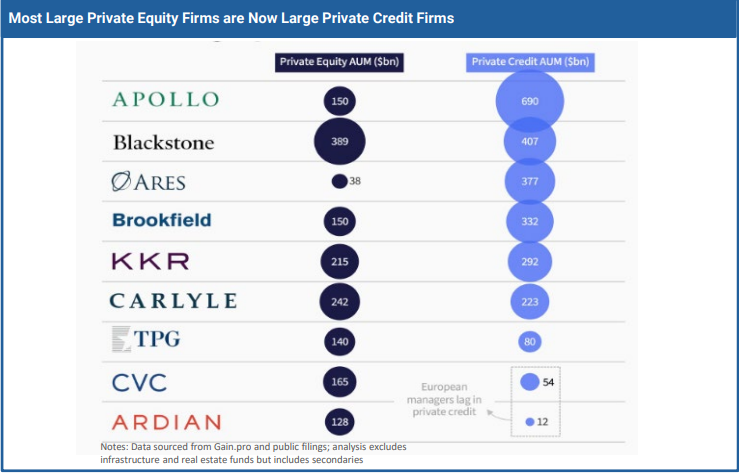

7. Most Large Private Equity Firms are Now Private Credit Firms

BRAMSHILL INVESTMENTS

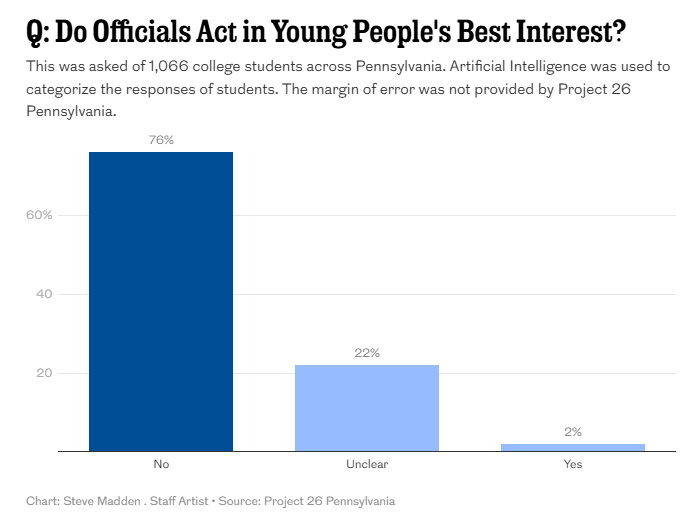

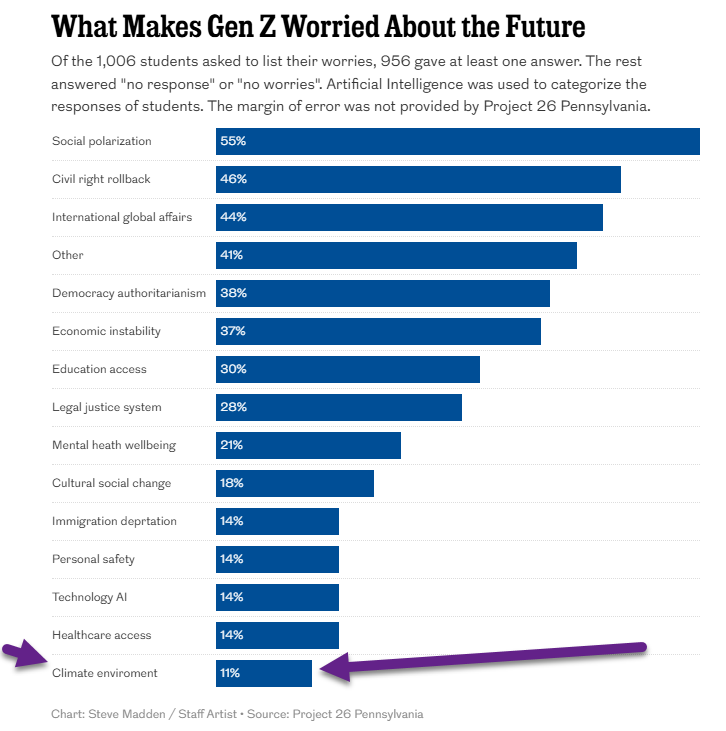

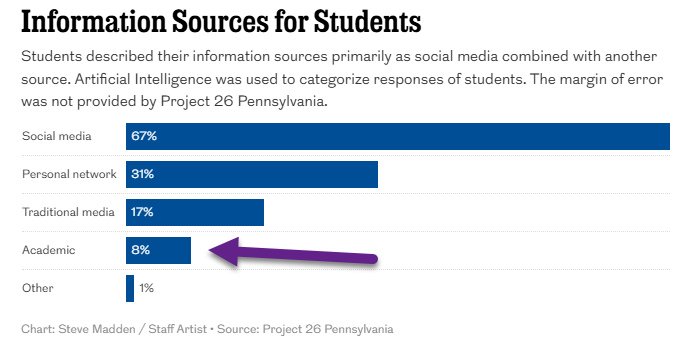

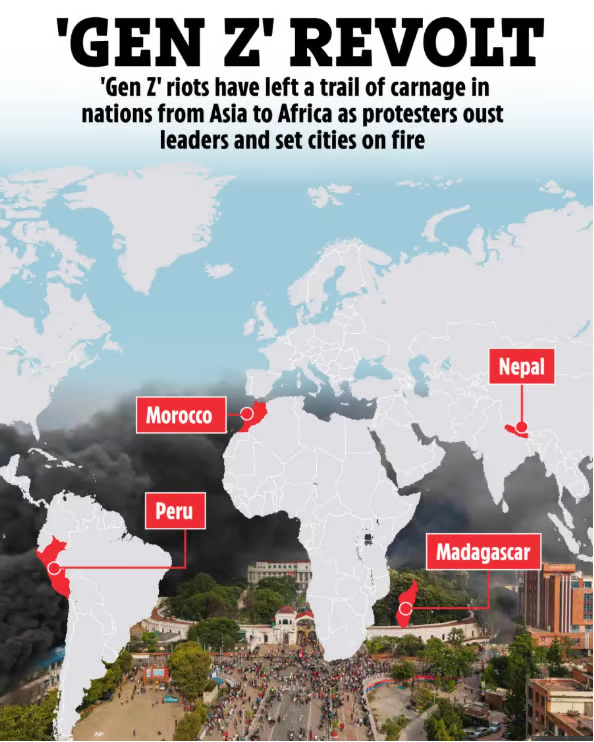

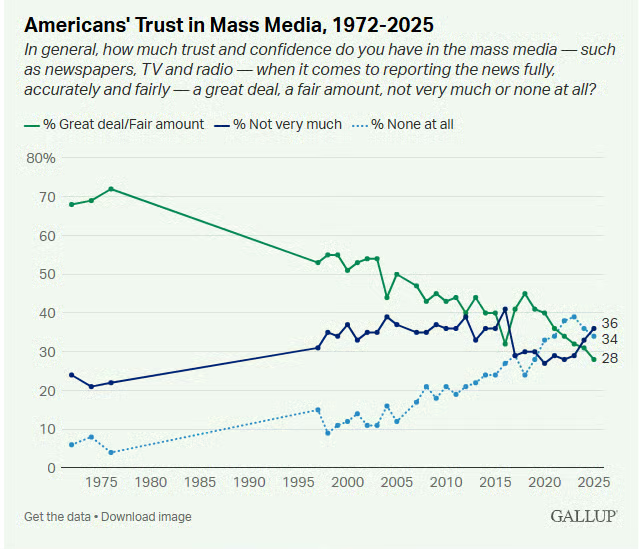

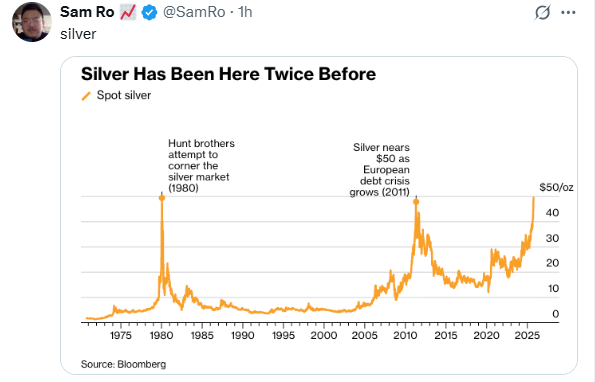

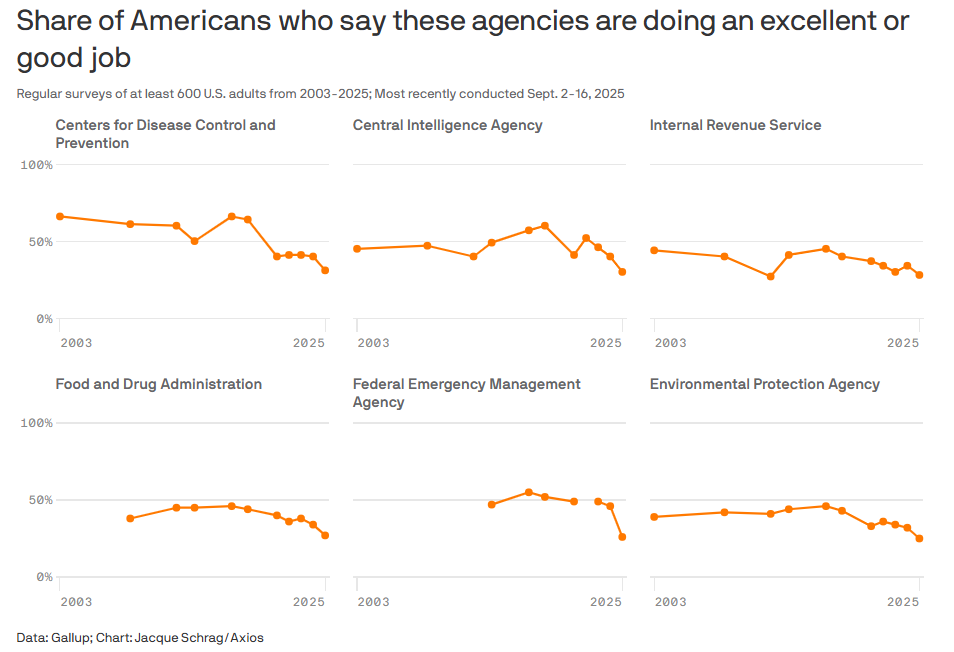

8. Loss of Trust in American Institutions Continues

Axios

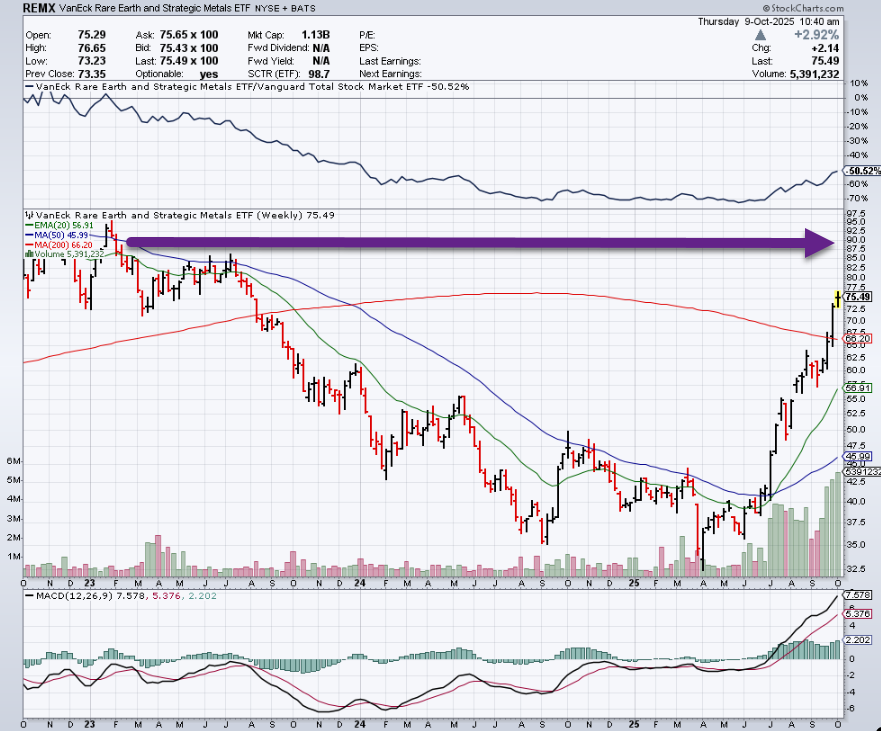

9. Rare Earth ETF Double Off Bottom…Still Below 2023 Highs

StockCharts

10. Are you a high-hope thinker? take the quiz

There’s been a fair amount of research done on whether optimism is good or bad for you, not just in investment outcomes but generally in life satisfaction. On the one hand, some studies conclude, optimism has a highly positive effect on mindset, motivation, entrepreneurial mojo, and even reactions to medical treatments. It helps people recover from setbacks, and increases the chance they will save money for what they expect to be a rosy future.

On the other hand, too much optimism can backfire. People who are very optimistic may under-estimate risk and over-estimate their abilities. They may visit the doctor less often than they should, employ overly risky investment strategies, and be less happy in the long-run if their expectations for future success are not met.

If you’re a parent, you’ve probably noticed how most kids allow their over-optimism to take the place of robust planning: until they eventually learn better, they’re so confident things will work out that they often skip the part where they have to actually study for their test, practice for their try-outs, or save money for the thing they might want later.

Optimism is passive– a somewhat complacent belief that good things will probably happen to you, without much need for planning or preparation on your part. This is distinct from the concept of hope, which is “the glass is half full”, but also implies that you can impact your future satisfaction by actions you take.

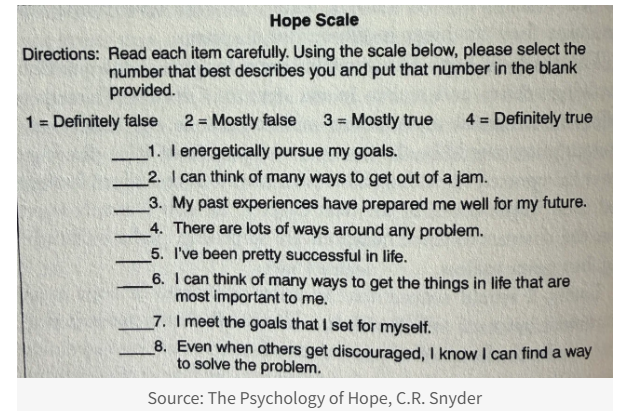

One of the founders of the Positive Psychology movement in the 1990s was a research scientist named C.R. Snyder, author of the influential 1994 book The Psychology of Hope. In it he argued that a better predictor of life satisfaction is whether you have a strong combination of agency (the motivational energy to set and pursue goals) and “way-power” (the confidence that you will be able to find a way to attain your goals).

If you’re curious, you can take the same quiz thousands of research subjects have taken over the last 30+ years:

Contessa Capital Advisors

Source: The Psychology of Hope, C.R. Snyder

Better yet, try it with your kids and talk about the results over dinner.

To score the quiz, points are from 1 to 6 with the highest being “All of the Time”. Source: The Psychology of Hope, C.R. Snyder

Beyond his hope scale, some characteristics Snyder ascribed to “high-hope” people (quiz score over 24) include a propensity to downplay negatives and focus on problem-solving, a sense of humor even during times of struggle, a tendency to care about their physical health, and a social network they can call on for support.

All this raises the obvious question: what are all these people hoping for?

Snyder’s research showed that high-hope people don’t just set goals; they connect them to something larger, and generate multiple strategies for getting there. That’s what allows them to bounce back when life blocks the first route.

A meta-goal is bigger than any single outcome. It’s the overarching aim that organizes your smaller goals. For example, “being healthy and energetic as I age” is a meta-goal. The daily sub-goals under it might be as simple as exercising three times a week or getting enough sleep. If one pathway fails — say you get injured and can’t run — the meta-goal still stands, and you can find another path, like swimming or yoga.

You can train yourself to think more hopefully by setting meaningful goals, breaking them into doable steps, and brainstorming alternate routes when you hit obstacles. Even small habits — reframing a setback as “just one blocked path,” or practicing saying “what’s another way I could try this?” — are productive.

When I work with clients I include a statement of financial purpose—effectively a set of meta-goals–in their action plan. Like an investment policy statement, it’s the umbrella for the smaller sub-goals related to how much money to spend or save and how much risk is worth taking. It’s also a chance to practice anticipating different pathways.

Meta-goals aren’t just for financial plans. Since we’re talking about hope, it’s worth mentioning the amazing, inimitable Jane Goodall, who died this week at age 91 after a lifetime of education and conservation. She often spoke about her four reasons for hope — the energy of youth, the power of the human brain, the resilience of nature, and the strength of human connection and spirit. Her meta-goal was clear and unwavering: to protect and honor life on Earth. The specific pathways changed — research, advocacy, writing, youth programs — but the larger purpose never did.