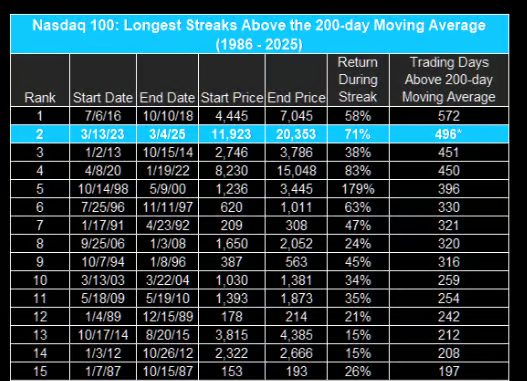

1. The Nasdaq 100 has Closed above its 200-day Moving Average for 496 Consecutive Trading Days, the 2nd Longest Uptrend in History

Zach Goldberg Jefferies

2. AMZN -17.5% Correction to 200-Day

StockCharts

3. 10-Year Treasury Yield Key Spot..Back to December 2024 Levels…Below 200-Day

StockCharts

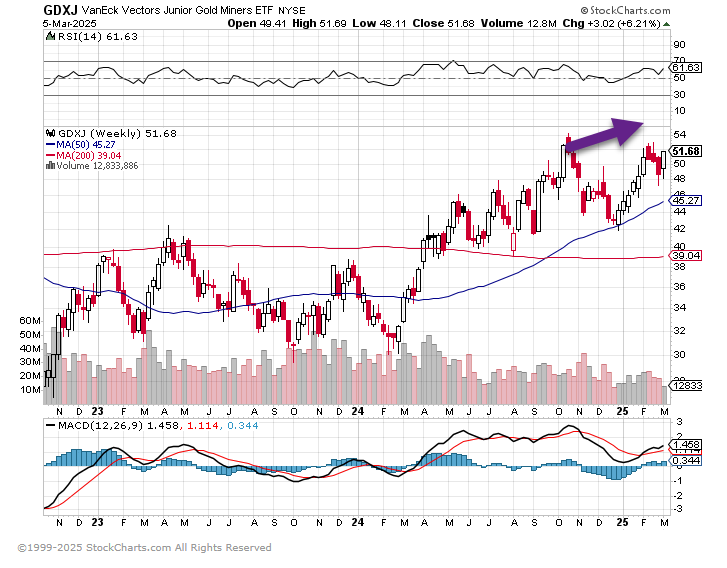

4. JR. Gold Miners GDXJ +15% YTD

StockCharts

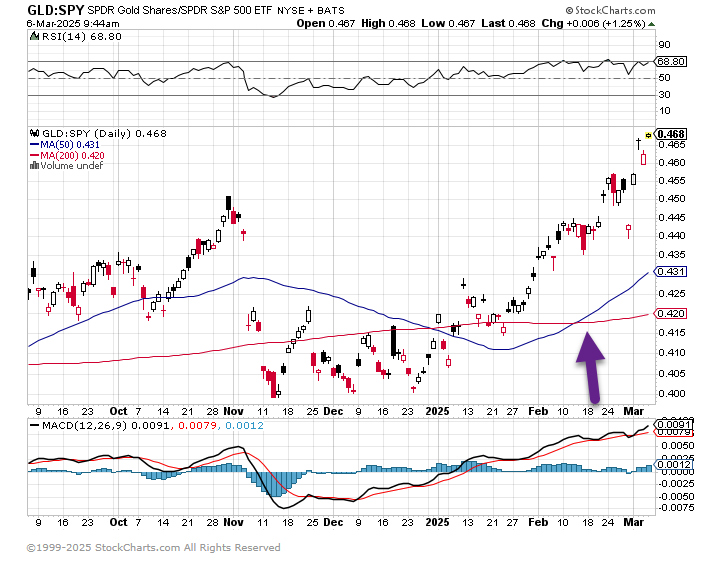

5. Gold Up Double the S&P 12 Months…GLD vs. SPY Chart

StockCharts

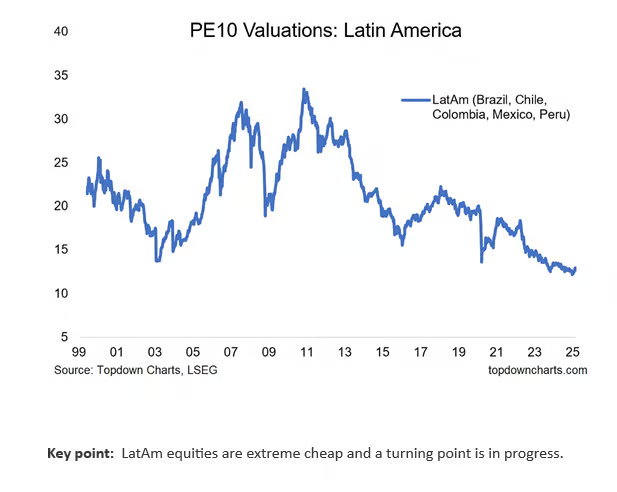

6. Weak Dollar Driving International Stocks…PE Ratios Latin America…All-Time Lows

Topdown Charts

7. Another High Beta Name Down Big…MDB -44%

StockCharts

8. Private Equity Stops Growing First Time in 20 Years

Via Morning Brew: While it might seem like private equity has dominion over everything from your dog’s vet clinic to your date-night seafood spot, the industry actually got smaller last year for the first time in 20 years. The amount of assets managed by PE firms fell 2% in 2024 to $4.7 trillion—marking the first time assets fell since consulting group Bain & Co. started tracking it in 2005, according to the Financial Times.

So, what’s squeezing private equity like private equity squeezes a mid-sized company it’s just acquired? The industry has a $3 trillion backlog of aging deals it can’t manage to sell off during a slow period for M&A, and investors are taking note and refraining from new investments into the industry. Bain found that PE funds are holding ~2x the assets they had in 2019, while the amount they’re selling is about the same—meaning it could take years to work through their excess holdings.

Morning Brew

9. 30-Year Mortgage Back Under 7%

Freddie Mac

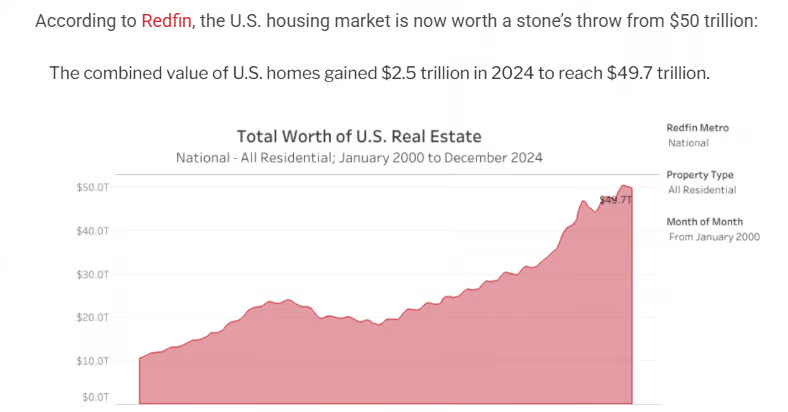

10. The U.S. Housing Market is Worth $50 Trillion

Wealth of Common Sense