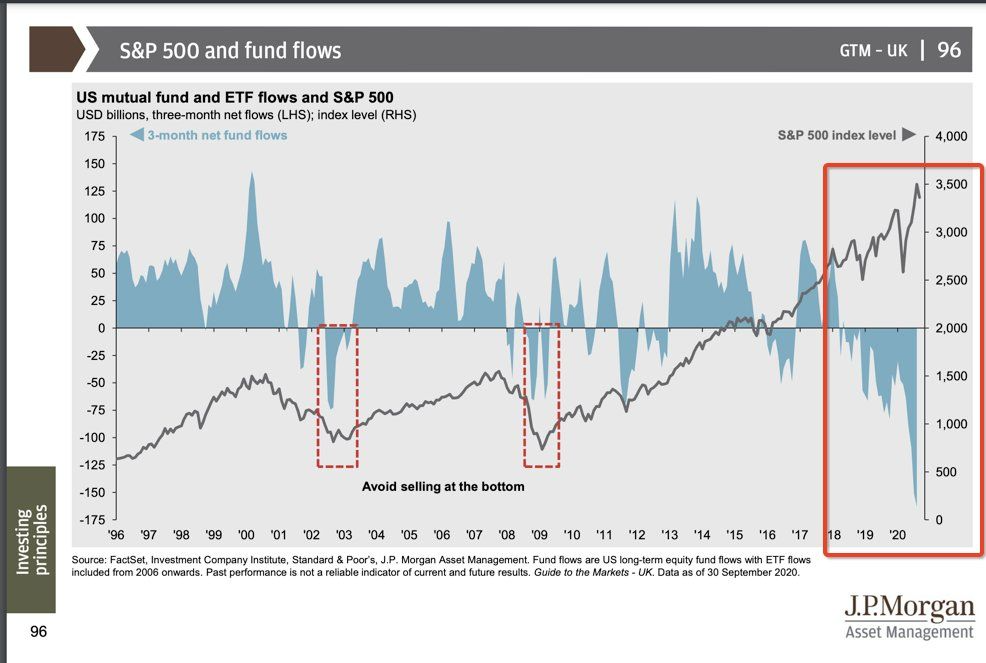

1. The Emotional Investor—Market Participants Selling Stocks During the Entire Rally

Daniel Crosby, Ph.D. • 1stChief Behavioral Officer at Brinker Capital2d • 2 days ago

Continue reading

Daniel Crosby, Ph.D. • 1stChief Behavioral Officer at Brinker Capital2d • 2 days ago

Continue readingLooking back—Schwab Liz Ann Sonders

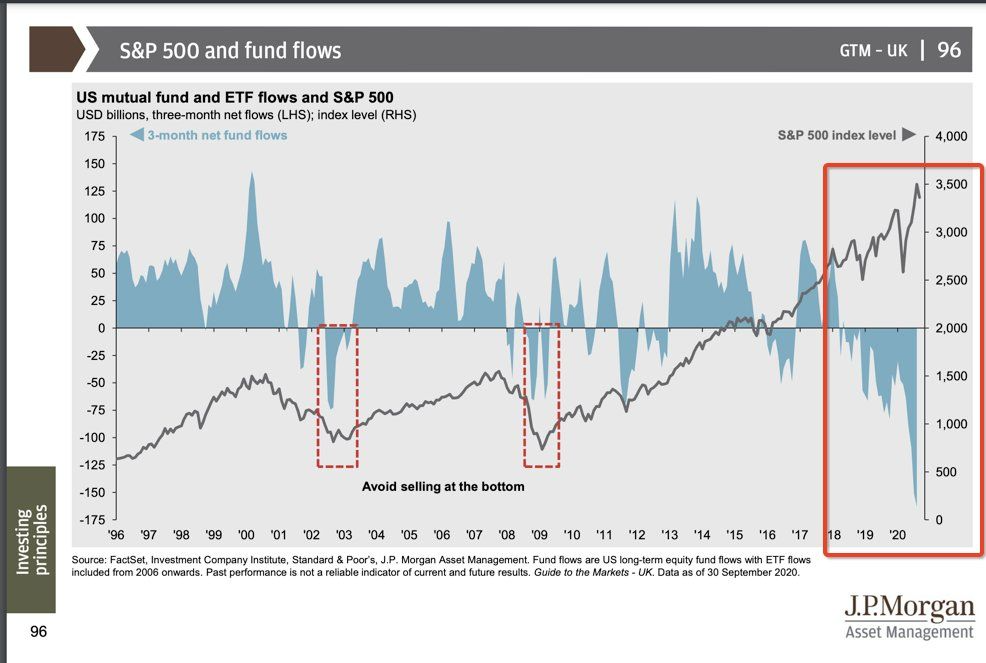

We use the Dow Jones Industrial Average (Dow) as the proxy for U.S. stocks in the analyses below because of its longer history than the S&P 500, which wasn’t created until the late-1920s. Likely highlighted more by Democrats than Republicans is the fact that, since 1900, the stock market has performed better when Democrats sit in the White House than when its inhabitant was a Republican.

As you can see in the first two bars in the chart below, if an investor had invested $10,000 starting in 1900, but only had it in the Dow when Republicans were president, it would now be worth nearly $99k. On the other hand, that same $10,000 would have grown to nearly $430k if it was invested only when Democrats were president. Seems like an obvious decision to make then? Not so fast. That same $10,000 in 1900 would have grown to more than $4.2 million if the investor had remained in the market the entire time, regardless of which party has presidential power.

Staying Invested vs. Investing in Single Party

Source: Charles Schwab, Bloomberg, as of 10/2/2020. For illustrative purposes only. The above chart shows what a hypothetical portfolio value would be if a hypothetical investor invested $10,000 in a portfolio that tracks the Dow Jones Industrial Average on 1/1/1900 under three different scenarios: a Republican presidential administration; a Democratic presidential administration; or staying invested in the market throughout the entire period noted. Chart does not reflect effects of fees, expenses or taxes.

Election Blues: Looking at Election History for Market Guidanceby Liz Ann Sonders of Charles Schwab, 10/6/20

TAN SOLAR ETF

30 year yield approaching May highs…+32% from lows.

Small cap value is trading at historical low valuation vs. S&P…..Chart showing some life….50 thru 200day to upside … But 200day still sloped downward.

FRED CHARTS

https://fred.stlouisfed.org/series/TDSP

Marketwatch-Ray Dalio

So what’s an investor to do?

Dalio said that China, where “almost everybody” is underweight, has fallen out of favor, but deserves more exposure, beginning with a diversified approach to investments in the region.

“That means to achieve the right kind of balance of assets in China,” he told CNBC. “Our approach is, we call it all-weather approach, it’s a certain balance in which you achieve balance without lowering the expected return. From that, you want to make the tactical moves.”

The Chinese yuan CNHUSD, 0.00%, he explained, could see greater usage outside the country as weaker global economies weigh on the the U.S. dollar DXY, -0.08% and other major reserve currencies. Dalio said that China’s interest rates are attractive, and the development of capital markets in the region has strengthened the yuan.

“You’ll see more of the internalization of the [yuan], and it’s a natural consequence because as the dollar and the major reserve currencies are having the challenges that we are talking about, some element of void will be there,” he said. “But first… get the exposure.”

Think your nest egg is safe sitting in cash? Think again — billionaire investor explains where some of that money should go instead

By

CYB-Yuan ETF

Half a Billion Travelers Show China’s Economy Moving Past Covid

Travelers rise to nearly 80% of 2019 level but spending lags

Biggest holiday week since January will test China’s recovery

Sign up for Next China, a weekly email on where the nation stands now and where it’s going next.

Hotel prices shot up, ride-hailing apps crashed, tickets to the Great Wall sold out: after more than nine long, housebound months, almost half a billion Chinese people are taking a vacation.

With the Covid-19 pandemic largely under control in China, the Golden Week holiday is putting on display the country’s confidence in its economic rebound and its public health measures. Through the first four days of the week-long holiday that started Oct. 1, some 425 million people traveled domestically, according to the Ministry of Culture and Tourism, nearly 80% of last year’s throngs.

The surge of activity stands in stark contrast to the rest of the world — the global tourism industry is expected to lose at least $1.2 trillion in 2020 — and underscores the relative strength of China’s economic recovery. As of September, the OECD forecast a 1.8% expansion this year, putting China alone among the Group of 20 on pace to expand.

That positive outlook assumes the country can avoid another wave of coronavirus and the aggressive lockdowns China’s used to quash it. As millions crisscross the country during the holiday that marks the founding of the People’s Republic of China in 1949, no virus tests or quarantines required, the risks grow. Late last month, China opened its borders to foreign nationals holding valid residence permits.

“There is undoubtedly a risk in allowing mass tourism to resume and, in some ways, this is an early exercise in what the rest of the world will have to go through as global travel restarts next year,” said Nicholas Thomas, associate professor in health security at the City University of Hong Kong.

China hasn’t reported any local virus infections since Aug. 15, though it found two asymptomatic cases in late September, and the government has eased almost all of its peak-Covid travel restrictions. The ban on group tours was lifted in the middle of July, every district in every city has been designated ‘low-risk,’ and coronavirus test results are no longer required for cross-province travel.

Found at Crossing Wall Street https://www.crossingwallstreet.com/

Food is perhaps the best known consumable product, and the economic laws of supply and demand are pointing to an emerging pain point unlike any we have seen in recent history. To combat this looming problem, the agriculture industry is embracing technology, much of which is similar to that housed inside the smartphones we use today, giving rise to the precision agriculture market.

The problem

The current average life expectancy in the U.S. stands at 78.8 years according to a National Center for Health Statistics, which was on par with the 78.6 years in Europe reported as of 2019. By comparison, historical data from the United Nations reveals life expectancy in 1950 was 65 years in more developed regions of the world and 42 in less developed ones. The increase is driven by several factors, including a healthier lifestyle, which in and of itself has been found to add up 6.3 years for males and 7.6 years for women, according to findings from the UK Biobank.

At the same time, the United Nation’s Population Division expects the global population to hit 10.9 billion by the end of the current century compared to 7.8 billion in 2020. Rising disposable incomes among the growing population is fostering greater demand for complex proteins. More people living longer poses a challenge to the nutritious diet aspect of that healthier lifestyle, given that arable land per person is shrinking.

According to the FAO, arable land per person stood at 0.23 hectares (ha), down from 0.38 ha in 1970 and is expected to fall to 0.15 ha per person by 2050. We at Tematica describe that situation as a pain point, and pain points tend to give rise to solutions. In this case, it means we need to make better use of our existing farmlands, and that has prompted farmers to adopt technology to boost yields while helping to manage costs.

This wave of technology-meets-farming has given rise to the precision agriculture market, which is expected to reach $12.9 billion by 2027, according to Grand View Research, up from $9.65 billion in 2019.

What is Precision Agriculture?

According to the International Society of Precision Agriculture, “Precision agriculture is a management strategy that gathers, processes and analyzes temporal, spatial and individual data and combines it with other information to support management decisions according to estimated variability for improved resource use efficiency, productivity, quality, profitability and sustainability of agricultural production.”

In other words, it is about using high-tech tools to generate greater yield with less resources while minimizing any potential harm.

Just how important is this? The World Economic Forum estimates that if just 15% to 25% or farms were to adopt precision agriculture techniques, global crop yield could increase by 10% to 15% by 2030 while at the same time reducing greenhouse gas emissions and water use by 10% and 20% respectively.

That sounds great, but do we really need to do this?

Soil today is eroding up to 100 times more quickly than it forms. Some research indicates that we may have already lost more than one-third of the planet’s arable land. Even more concerning, if the current rates of soil degradation continues, the remaining arable land could become unfarmable in the next 60 years.

How does precision agriculture help?

The market that would become precision agriculture started in the 1990s with the adoption of GPS that allowed farmers to gather data and steer equipment automatically. While it may seem somewhat pedestrian in today’s connected world, GPS tractor guidance helped farmers to improve crop production by reducing overlaps and gaps when planting, fertilizing, and protecting crops. Over the last two decades technological developments including telematics, robotics, automated hardware, agriculture drones, and variable rate technology have expanded precision agriculture to include equipment guidance and automatic steering, yield monitoring, variable rate input application, remote sensing, in-field electronic sensors, section and row control on planters, sprayers and fertilizer applicators, and spatial data management systems.

Much like we have seen technology enable a host of new applications such as video conferencing and streaming video that has altered how we work and play, technology has expanded the capabilities of precision agriculture as well:

Existing as well as up and coming precision agriculture players to watch

Companies participating in the precision agriculture market include agriculture equipment companies such as John Deere (DE), AGCO (AGCO), CNH Industrial (CNHI), and Kubota Corp. (KUBTY) and even drone company Aerovironment (AVAV). There are also the technology enablers that include GPS companies such as Trimble (TRMB) and the applied technology business at Raven Industries (RAVN) as well as the chip and sensor companies that range from NXP Semiconductors (NXPI) to STMicroelectronics (STM) that serve the “smart farming” market.

As a confluence of factors have raised concerns over the long-term future availability of food, venture investors have been pouring capital into agtech startups. In 2019 alone, they invested $2.8 billion into the space across the globe, a fourfold increase over 2015. According to the 2019 AgriFood Tech Investment Review, investment in digital technologies (which combines the independent sectors of imagery, precision agriculture and sensors and farm equipment) made up about 41% of 2019 deal activity.

Some examples of these investments are Farmobile and its DataEngine that ingests and standardizes farming data so that it can be shared and used to create insights; Trace Genomics that provides soil DNA sequencing services to farmers and agronomists; and CiBo Technologies that allows farmers to create “virtual fields” with real-world inputs.

With greater adoption of artificial intelligence, big data, and the internet of things in the coming years we strongly suspect there will be new applications and further advances for precision farming, much like we’ve witnessed with the smartphone and the automobile of today compared to ten years ago.

Disclosures

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

After three decades as a CEO in various organizations there are definitely distinct lessons I’ve learned.

The Thrive Global Community welcomes voices from many spheres. We publish pieces written by outside contributors with a wide range of opinions, which don’t necessarily reflect our own. Community stories are not commissioned by our editorial team, and though they are reviewed for adherence to our guidelines, they are submitted in their final form to our open platform. Learn more or join us as a community member!

By

· Mary Lee Gannon, ACC, CAE at The Ladders

After three decades as a CEO in various organizations there are definitely distinct lessons I’ve learned.

1. When we focus on what we have to give instead of what we get we realize our value.

Why should someone work with, do business with, hire you, or spend time with you? And why now? If you can’t answer these questions your constituents won’t know either. What makes you distinctive? What do your employees need from you to thrive in their roles? What do your customers need that they haven’t even realized yet? This probing leads to a solid value proposition that gives you fulfillment and can be communicated in your messaging.

Don’t wait for a crisis to probe for opportunity. Anticipate the needs of others, how you will uniquely meet those needs and you stand alone.

2. When we are curious and compassionate, we become servant leaders instead of command and control tyrants.

We all know leaders whose direct reports fear them. And we know leaders who are revered. Your leadership starts with an open awareness of yourself and a dedication to improve – improve yourself, improve the work experience for others, improve the products and services you offer, improve the financial stability of your organization. This service mindset requires a mindful acceptance of yourself without judgment followed by a curious mindset.

Ask questions without making assumptions. That creates space for honesty and humility while dismissing the need for perfection. Your team wants to know that you struggle with the same things they do. It is relatable to be human.

3. There is power in having your boss’s back. Find a way to do that or go somewhere you can. Don’t stay and poison yourself and the culture.

Don’t be a victim or a toxin. It strips your executive presence, stagnates your career and is weak. If you are unhappy in your role you have three choices: 1) Find another position and leave. Make sure the problem is not your perspective which you will carry with you to a new role and still be unhappy; 2) Stay where you are, shift your perspective and focus not on office politics but where you can find fulfillment in new responsibilities; 3) Leave and go somewhere more in alignment with your values. It will take you a while to achieve the level where you are now but accept that if this choice fulfills you. Don’t do what complainers do – quit and stay.

4. Good people leave organizations because of bad managers who don’t position them to learn and advance. Mediocre people leave organizations for $1 more an hour, free lunch and a pool table in the break room.

Organizations are acutely aware of onboarding costs for new employees. Retention has become one of the most important focuses for corporate human resources departments. Most major consulting companies and large organizations have created elaborate coaching programs, scheduled feedback systems and shadowing arrangements to retain and position top talent. Benefits packages have become less important than the skill of leadership in recognizing the unique aptitude of each individual and positioning them with professional development opportunities that interest them.

5. ‘A’ people hire ‘A’ people, ask for their insight, and get out of their way. ‘B’ people hire ‘C’ people and micromanage them.

Leaders sometimes get caught in the trap of thinking they must understand everything everyone is doing. Not so. Hire people who have your weaknesses as their strengths. Then allow them to create. Ask questions to understand and challenge their perspective. Never feel threatened by them. If their posturing creates insecurity, coach around that to help them understand the effects of their behavior.

6. Emotional leaders hardly ever advance. Practice a good poker face.

Self-management is essential for a high performing leader. It starts with self-awareness and self-acceptance. Mindful daily practices that keep you in the moment such as meditation, deep breathing, creative projects, help to increase your awareness of your thoughts and your power over them. The goal is to increase the space between when you feel an emotion and act on it so that the choice is not to react but to remain calm, think through the assumption behind the emotion and release it.

7. Narcissistic leaders thrive on keeping their teams in chaos and fear so that nobody notices their ineptness. Stay off their radar screen by making sure they know you have their back, giving them all the glory and presenting your work with confidence so they can trust it. Then work on your exit strategy. Things will not get better.

It is no mystery how narcissistic leaders rise to power. They are charismatic, have certainty and people trust their confidence. Yet they lack integrity, a moral compass, and any semblance of collaboration or compassion. This makes them dangerous. You know you are dealing with a narcissistic leader if you liked them at first but something in your gut tells you that you can’t trust them. You feel as if you must be overly cautious in what you say and do. Over time you find that you are questioning your own relevance around them because they are more of a dictator than a seeker of alignment. Pacify them with complete honesty, good work, relevance, and trust. Then move on.

8. When we can look ourselves in the eye and not expect to be perfect, we give ourselves room to be human and walk in the shoes of others. When we try on a lot of different shoes, we become grateful that they are not all the same size.

Perfectionism kills careers. Done is better than perfect. Humility trumps being right. Humanity is diverse. And diversity adds perspective. Perspective only brings value when we hear it. We can’t hear it if it isn’t in the room. We won’t apply new ideas if we are married to the assumption that change compromises our own security. What we believed yesterday need not be what we carry forward today. The agile leader with grit who can adapt mid cycle opens to opportunity. The stuck leader stagnates and loses ground.

9. Executive presence is the ability to observe yourself from a third-party perspective and admire what you see.

The single biggest reason people don’t advance in their careers is because they feel they are not worthy – they don’t belong. Coincidentally, the single biggest reason people are unhappy is because they feel they are not worthy and don’t belong. So, to counter this achievers often misguidedly spend time and energy on the treadmill to nowhere working harder, reading self-help books, updating their resumes, firing off online applications, taking classes, only to find that nothing changes except now they are exhausted. Seeking fulfillment externally on issues that are internally motivated is not productive. Executive presence and confidence expand when we challenge our internal assumptions against what is actually true about ourselves. Here we begin to align with our values. There is much there to admire when the dust of business settles and the brilliance of clarity appears.

For more executive presence tips here is a link to Mary Lee’s 31 Executive Presence Practices for Leaders in the Corporate World.

Mary Lee Gannon, ACC, CAE has a unique perspective as an award winning certified executive coach, author and 19-year corporate CEO who helps leaders have more effective careers, happier lives and better relationships while it still matters. She is the founder of MaryLeeGannon.com, a coaching and consulting firm that helps leaders position their mindful impact – the same impact that took her from welfare to CEO of organizations worth up to $26 million. Schedule a call or get her free leadership tools at MaryLeeGannon.com

— Published on October 6, 2020

https://thriveglobal.com/stories/nine-lessons-from-the-corner-office/

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

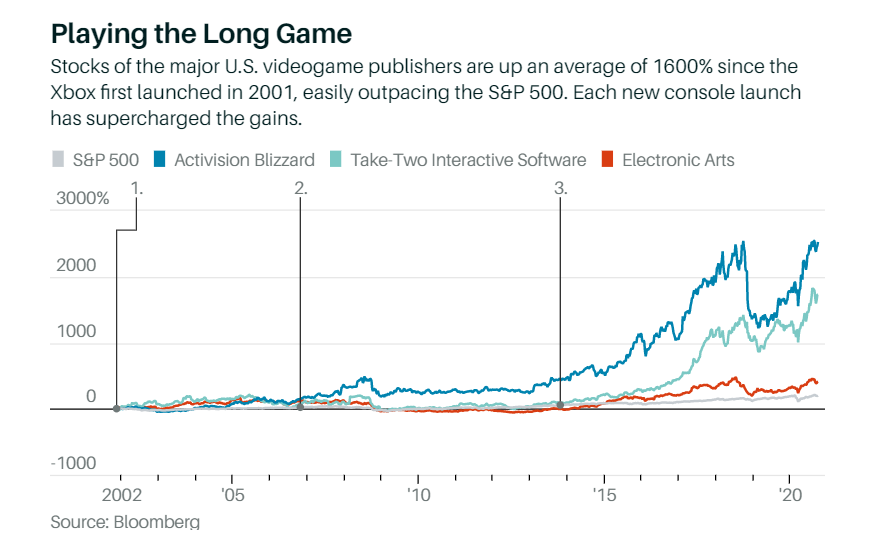

Videogame Stocks Have Soared for 20 Years. They’re About to Get Another Boost.By Max A. Cherney

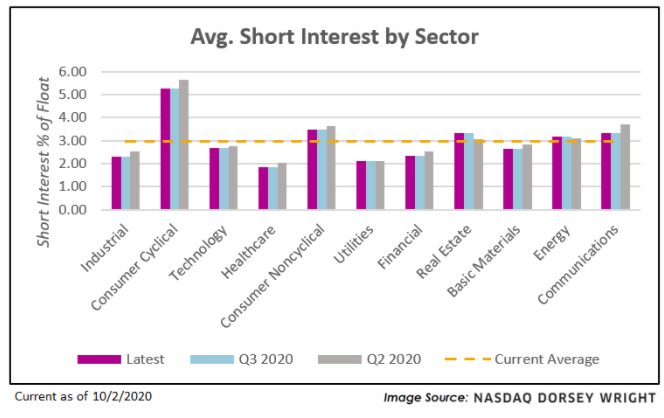

Nasdaq Dorsey Wright www.dorseywright.com

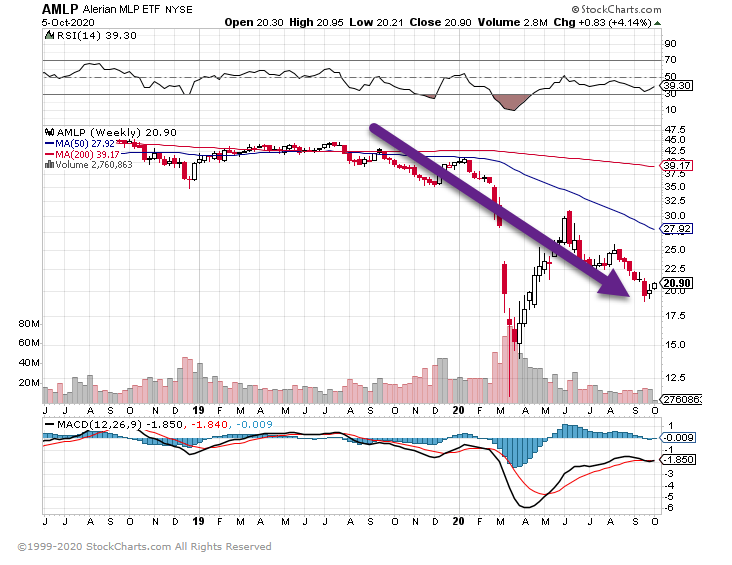

AMLP 2020

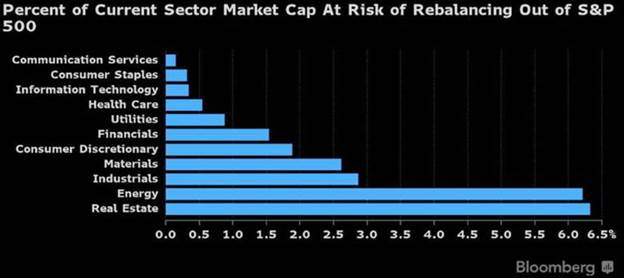

LizAnnnotes Given persistent weakness in certain sectors, a growing number of companies are at risk of rebalancing out of S&P 500 due to shrinking market caps …6.3% & 6.2% of Real Estate & Energy members, respectively, may drop out

From Dave Lutz at Jones Trading

https://indexes.nasdaqomx.com/docs/NDX_Fundamentals.pdf

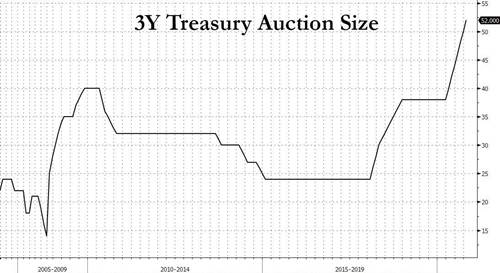

by Tyler Durden

Tue, 10/06/2020 – 13:19

TwitterFacebookRedditEmailPrint

After three consecutive record-large 3Y Treasury auctions, which also priced at progressively (record) lower yields, moments ago the Treasury sold another record amount of 3Y paper, when it auctioned off $52BN, up $2BN from $50BN a month ago, but in a notable reversal from the recent trend, the yield on today’s auction was 0.193%, which not only tailed the 0.191% When Issued by 0.2bps, but was the first 3Y auction since June that did not price at a new all time low yield, printing 2.3bps higher than the 0.17% in September.

https://www.zerohedge.com/markets/record-large-3y-treasury-auction-tails-yield-rises-all-time-low

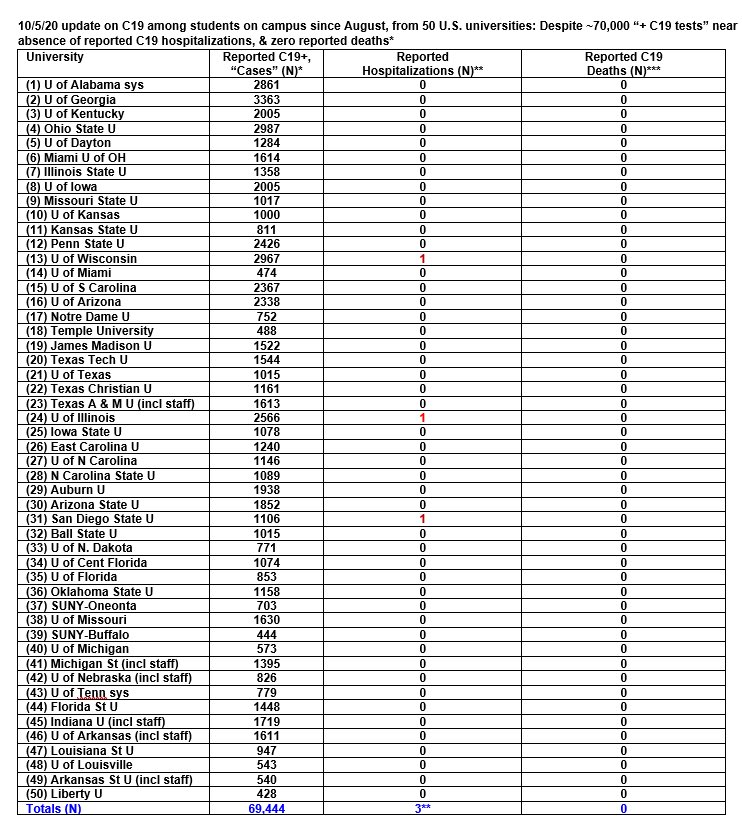

Out of 70,000+ positive reported COVID-19 cases on Universities: 3 hospitalizations 0 deaths

https://twitter.com/drsimonegold/status/1313199258393145344/photo/1

LOGISTICSAirline Industry Faces Cargo Shorts Francis ScialabbaIf you’ve been seeing a lot more of those weird-looking planes with big foreheads and no windows at the airport, that’s because demand for airplane cargo space is sky-high.It starts with vaccines According to the International Air Transportation Association (IATA), providing a single dose to the world’s 7.8 billion people would require 8,000 fully filled 747 cargo planes, which…is a problem considering there are fewer than one thousand 747 freighters on the planet, according to the IATA’s head of cargo Glyn Hughes.Plus, vaccines are fragile. They don’t care much about legroom, but the majority of vaccines in development need to be kept at a constant, near-freezing temperature to prevent spoiling. UPS and Lufthansa have been building massive “freezer farms” to prepare, though experts in the pharma industry still expect up to a 20% spoilage rate. Santa might be late, tooThe soon-to-be-released iPhones, Sony’s new PlayStation 5, and Amazon’s Prime Day items are all set to be shipped via cargo planes in the coming holiday shopping period. “We’re planning for the mother of all peaks,” the president of FedEx’s express division told investors in September.Many commercial airlines have retrofitted aircraft to 1) meet cargo demand and 2) keep their businesses afloat during a period of historically low passenger traffic. Still, it was new territory for many legacy carriers. American Airlines was flying nearly 140 all-cargo trips per week early in the pandemic, after flying zero such trips in the past three decades. Bottom line: This isn’t the cargo industry’s first mile-high rodeo—shipping pharma products has been a fast-growing and profitable line of business for carriers over the past 10 years. But the busy holiday season + vaccine distribution + fewer flights will push it to the limit. Francis ScialabbaIf you’ve been seeing a lot more of those weird-looking planes with big foreheads and no windows at the airport, that’s because demand for airplane cargo space is sky-high.It starts with vaccines According to the International Air Transportation Association (IATA), providing a single dose to the world’s 7.8 billion people would require 8,000 fully filled 747 cargo planes, which…is a problem considering there are fewer than one thousand 747 freighters on the planet, according to the IATA’s head of cargo Glyn Hughes.Plus, vaccines are fragile. They don’t care much about legroom, but the majority of vaccines in development need to be kept at a constant, near-freezing temperature to prevent spoiling. UPS and Lufthansa have been building massive “freezer farms” to prepare, though experts in the pharma industry still expect up to a 20% spoilage rate. Santa might be late, tooThe soon-to-be-released iPhones, Sony’s new PlayStation 5, and Amazon’s Prime Day items are all set to be shipped via cargo planes in the coming holiday shopping period. “We’re planning for the mother of all peaks,” the president of FedEx’s express division told investors in September.Many commercial airlines have retrofitted aircraft to 1) meet cargo demand and 2) keep their businesses afloat during a period of historically low passenger traffic. Still, it was new territory for many legacy carriers. American Airlines was flying nearly 140 all-cargo trips per week early in the pandemic, after flying zero such trips in the past three decades. Bottom line: This isn’t the cargo industry’s first mile-high rodeo—shipping pharma products has been a fast-growing and profitable line of business for carriers over the past 10 years. But the busy holiday season + vaccine distribution + fewer flights will push it to the limit. |

Morning Brew https://www.morningbrew.com/

Julia Buckley, CNN • Published 5th October 2020

1/7

Flood barrier: The MOSE Experimental Electromechanical Module protects the city of Venice from floods. Pictured October 3, the last mobile gate is about to be lifted at the Malamocco inlet off Venice’s Lido.

ANDREA PATTARO/AFP via Getty Images

Venice, Italy (CNN) — Sebastian Fagarazzi is used to moving his belongings around. As a Venetian who lives on the ground floor, every time the city faces acqua alta — the regular flooding caused by high tides — he must raise everything off the floor, including furniture and appliances, or risk losing it.

But on October 3, with a 135-centimeter (53-inch) high tide forecast — which would normally see around half the city under various levels of water — when the flood sirens went off, he did nothing. “I had faith,” he says.

Saturday was the first acqua alta of the season for Venice. It was also the day when, after decades of delays, controversy and corruption, the city finally trialled its long-awaited flood barriers against the tide.

Content by GlobeIn

Travel the globe with this subscription service

GlobeIn is a subscription service for ethically sourced artisan goods from around the world, kind of like a club for the world traveler who can’t make their annual trek this year.

A previous trial in July, overseen by Italian Prime Minister Giuseppe Conte, had gone well — but that was in good weather, at low tide. Earlier trials had not managed to raise all 78 gates in the barriers that have been installed in the Venetian lagoon.

Against all the odds, it worked.

At 12.05 p.m., high tide, St Mark’s Square — which starts flooding at just 90 centimeters, and should have been knee-deep — was pretty much dry, with only large puddles welling up around the drains.

The square’s cafes and shops, which often have to close for hours on end, remained open.

And in the northern district of Cannaregio, Sebastian Fagarazzi’s home stayed dry.

“I’d heard the [warning] sirens in the morning but I didn’t raise any of my furniture this time because the barrier lifted on the last test, and I had faith that it would work,” Fagarazzi, co-founder of social initiative Venezia Autentica, says. “This is historic.”

The defense system is called MOSE, the Italian for Moses, a name derived from the more functional Modulo Sperimentale Elettromeccanico, meaning Experimental Electromechanical Module. It consists of 78 flood barriers installed in the seabed at the lagoon’s three main entrance points.

When the high tide arrives, they can rise to form a dam, stopping the Adriatic Sea surging into the lagoon and flooding the city.

Delays and corruption

The new flood barrier in action at the Malamocco inlet off Venice’s Lido.

ANDREA PATTARO/AFP via Getty Images

Venice’s acque alte (“high waters”) are normally seen between October and March, and last a couple of hours, predominantly affecting the two lowest (and most visited) areas of the city: San Marco and the area around the Rialto. The phenomenon is usually caused by a combination of exceptionally high tides, low atmospheric pressure and the presence of a southern sirocco wind.

In recent years, their frequency and severity have been increasing due to climate change. On November 12, 2019, the city was devastated by an acqua alta that reached 187 centimeters, with almost 90% of the city flooding. Businesses have struggled to recover since, with a sharp dip in tourist numbers on top of damage costs. The destruction, followed by the pandemic, has brought locals to their knees.

The MOSE project has been in the works since 1984, but has been so beset by delays and corruption that many Venetians never believed it would work.

Deserted Venice contemplates a future without tourist hordes after Covid-19

“It doesn’t seem true,” says Serena Nalon, at the Bottega del Mondo shop in Cannaregio. Her business — a fair trade co-operative — suffered major damages in last year’s floods.

“I was very skeptical — not least because they’ve spent so much money, without any result until now, so this morning I had minimal expectations,” she says.

“I was worried when I saw the tide predictions, then somewhere between incredulous and happy when it worked. You appreciate things more when you don’t expect it.”

Nearby, Federica Michielan, owner of bar Ae Bricoe, felt the same. “It’s great — it’s finally been resolved,” she says. “At least, I hope it has, because if it breaks, we’ll be under water.”

‘Historic day’

A test in poor weather conditions had been the next step for the MOSE, which is not yet completed. And on Friday, when a full moon and high winds were predicted for the following morning, the city council asked permission to raise the barriers.

The usual flood sirens rang throughout the city at around 8 a.m. Saturday, while the test started half an hour later. By 10.10, the barriers were fully raised — and while the water level rose to 132 centimeters outside the MOSE, inside the lagoon, it remained at 70 centimeters — enough to keep San Marco dry.

“This was a historic day for Venice,” Mayor Luigi Brugnaro, who had watched the raising of the barriers with MOSE special commissioner Elisabetta Spitz, later told journalists.

“There’s a huge satisfaction, having spent decades watching helplessly as the water arrived everywhere in the city, causing vast amounts of damage.

“We have shown, not only with a tide that would have flooded the city but also with a sirocco wind of 19 knots, that it works.”

In the city, Venetians — many of whom had barricaded their property against the incoming water — could hardly believe their luck. At El Fornareto bakery in Cannaregio, locals grinned as they queued for bread in sneakers instead of the gumboots they’d usually be wearing. In the church of San Nicolò dei Mendicoli in the southern Dorsoduro district — which normally floods at 130 centimeters — the priest, don Paolo Bellio even referred to the success in his evening sermon.

“Today we were saved,” he said afterward. “We didn’t have to use the pumps. It was a surprise, but I’m happy it worked — especially as it has been so criticized. This is a day of joy for everyone.”

Calling it a “clear success,” commissioner Spitz underlined on Saturday that this is “only a fundamental step towards protecting the city and the lagoon.” The project — which also involves raising pavements in the lowest areas of the city to 110 centimeters, and permanent defense walls near the flood barriers — is due to be completed December 2021, when it will be handed over to the city.

Until then, it has been agreed that from now on, the barrier will be raised each time the tide hits 130 centimeters, meaning devastating floods such as last year’s should be a thing of the past (at least, in the medium term. Climate change means MOSE will not hold back the water indefinitely). However, once the city takes over, the barriers will go up earlier, at 110 centimeters.

https://www.cnn.com/travel/article/venice-flood-barrier/index.html

By John C. Maxwell | September 29, 2020 | 0

If you desire to be a great leader, then you need to learn to recognize and promote the best ideas no matter where or from whom they’re coming—man or woman, young or old, black, white, upside down or inside out.

Ideas are the lifeblood of an organization. Harvey Firestone, who founded the Firestone Tire and Rubber Company, said, “Capital isn’t so important to business. Experience isn’t so important. You can get both of those. What is important is ideas. If you have ideas, you have the main asset you need, and there isn’t any limit to what you can do with your business and your life.”

The progress and innovations of great organizations don’t come down from on high. Their creative sessions are not dominated by top-down leaders, nor does every meeting become a wrestling match to see who can dominate everyone else in a struggle to take credit. People come together as teams, peers work together, and they make progress because they want the best idea to win.

How does a great leader help create and surface the best ideas from his or her team?

I believe there are a few common ways.

1. Listen to all ideas.

Finding good ideas begins with an open-minded willingness to listen to all ideas. Mathematician and philosopher Alfred North Whitehead said, “Almost all really new ideas have a certain aspect of foolishness when they are first produced.”

During the brainstorming process, shutting down any ideas might prevent you from discovering the good ones. Group thinking (not to be confused with groupthink) can be such a positive: When we share our thinking among a group, we think faster, more innovatively and our thinking has greater value. Great thinking comes when good thoughts are shaped in a collaborative environment.

2. Never settle for just one idea.

Leaders can be so action oriented. They want to go. They want to make something happen. They want to take the hill! The problem comes when they fight their way to the top of the hill, only to find that it was the wrong hill.

One idea is never enough. Many ideas make us stronger. I once heard an analyst say he believed the reason the communist bloc fell at the end of the 20th century is because communism is built on only one idea. If anyone tried to do things a different way, they were knocked down or shipped out. In contrast, democracy is a system based on a multitude of ideas. Because of that freedom, in democratic countries creativity is high, opportunities are unlimited and the potential for growth is astounding.

3. Look in unusual places for ideas.

Good leaders are always searching for the next big thing. They cultivate their attentiveness and practice it as a regular discipline. As they read magazines, watch movies, enjoy leisure activities or engage with their colleagues, they are always on the lookout for ideas or practices they can use to improve their work and their leadership.

4. Don’t let personality overshadow purpose.

When someone you don’t like or respect suggests something, what is your first reaction? I bet it’s to dismiss it. You’ve heard the phrase, “Consider the source.” That’s not a bad thing to do, but if you’re not careful, you may very likely throw out the good with the bad.

Don’t let the personality of someone you work with cause you to lose sight of the greater purpose, which is to add value to the team and advance the organization. Set aside your pride and listen.

5. Protect creative people and their ideas.

Ideas are such fragile things when they first come to light. Advertising executive Charlie Brower says a new idea “can be killed by a sneer or a yawn… stabbed to death by a quip and worried to death by a frown.”

If you desire the best idea to win, then become a champion of creative people and their contributions to your organization. When you discover peers who are creative, promote them, encourage them, and protect them. Pragmatic people often shoot down the ideas of creative people—the very people who need to thrive and keep generating ideas for the benefit of the team.

6. Don’t take rejection of your own idea personally.

When your ideas are not received well by others, stop competing and focus your energy on creating. You will open the way for people around you to take their creativity to the next level.

I know that my ideas aren’t always the best ideas. I often think they are, but when everyone in the room has a different opinion, it pays to listen. The company owner doesn’t need to win—the best idea does.

* * *

Never forget that having a collaborative spirit helps the entire organization. When you think it terms of our idea instead of my idea or her idea, you’re probably on track to helping the team win.

That should be your motivation. Let the best idea win, and you will reap the rewards together.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

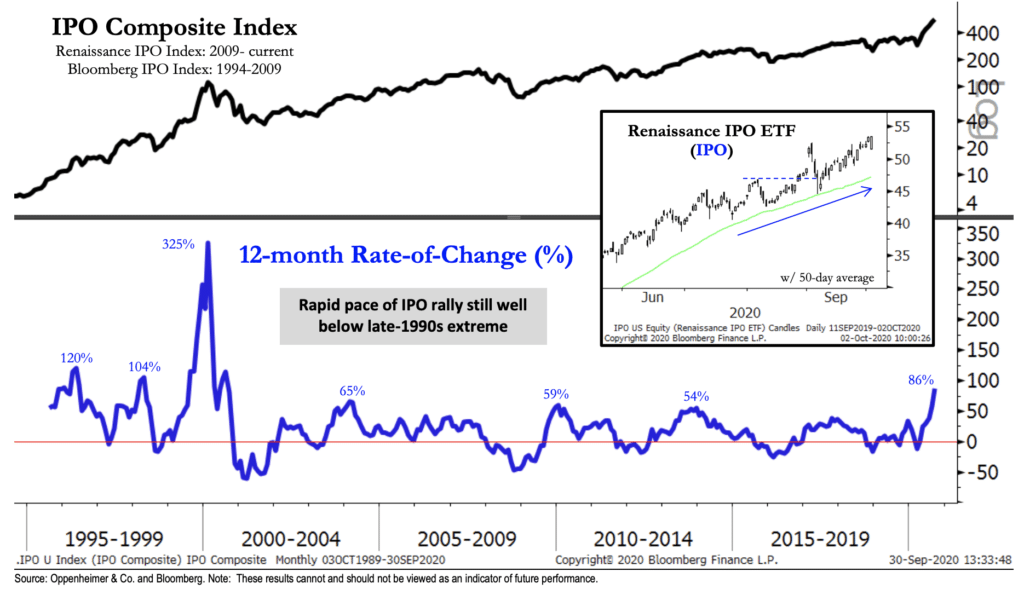

Reformed Broker Josh Brown Blog

I’m showing you a chart below that Ari Wald at Oppenheimer just put out, I think it’s a good way of viewing the difference between IPO performance in this era, versus that era. One of my guests from the podcast was Kathleen Smith, whose firm Renaissance Capital is actually the sponsor of the ETF Ari is looking at here:

Here’s Ari’s take (bold is me):

Continue readingThu, Oct 1, 2020

Even after September’s weakness, the S&P 500’s trailing 12-month total return stood at an impressive 14.9%. Given the events of the last 12 months, one could even say that performance is remarkable. What’s even crazier is that the S&P 500’s performance over the last 12 months is more than three times stronger than the 12 month period before that (+4.25%). The chart below compares the S&P 500’s annualized total returns over the last one, two, five, ten, and twenty years and compares that performance to the historical average return of the index over those same time periods.

The S&P 500’s historical average 12-month return is 11.7%, so the current 14.9% gain exceeds that average by more than three full percentage points. Over a two-year window, though, the S&P 500’s annualized return of 9.4% is more than a full percentage point below the historical average. Looking further out, the S&P 500’s trailing five and ten-year annualized return has been much stronger than average, which makes sense given the long bull market we were in. Over a 20 year window, though, the S&P 500 is only just starting to work off some of the declines from the dot-com bust and as a result, the 6.4% annualized gain is four and a half percentage points below the long-term average of 10.9%.

Below we show how the current performance of the S&P 500 in each of the time frames shown compares to all other periods on a percentile basis. The S&P 500’s performance over the last year ranks just below the 56th percentile of all other periods, while the two-year performance ranks just below the 42nd percentile. Even as the five and ten-year periods have seen well above average returns, they still rank in just the mid-60s on a percentile basis. The S&P 500’s ranking over a 20-year time period is a completely different story ranking in single-digits on a percentile basis. Even with the equity market right near record highs, the last two decades have been forgettable for US equities. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day

2020 is the year of the bond ETF.

Found at Abnormal Returns Blog. www.abnormalreturns.com

If interest rates rose 1%…30 Year Treasury would drop -21%Historical yields on the 30-year U.S. Treasury have included the following:

Historical 30-Year Treasury Yields.

Source: MacroTrends

https://www.investopedia.com/terms/l/longbond.asp

Good Morning from Germany where dividends matter & artificially dope benchmark index Dax. Without dividends, German stocks’ return since 2000 high would be negative. While Dax has gained 60% since then, Dax Price Index, which like S&P500 does not incl dividends, has dropped 11.1%

We start with housing affordability, which has rarely been higher on lower mortgage rates and growing wages:

https://www.zerohedge.com/commodities/visualizing-us-housing-frenzy-34-charts

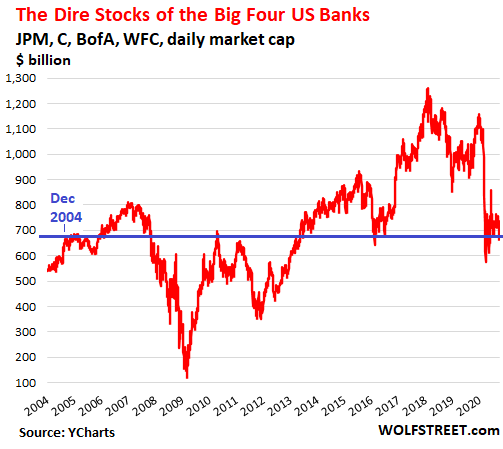

The Big Four bank stocks.

JPMorgan Chase [JPM] is down 32% ytd. At $96.27 today, it’s back where it first was in October 2017. Having about doubled since the peak before the Financial Crisis, it’s the least-dirty shirt of the batch.

Bank of America [BAC] is down 33% ytd. At $24.09, shares are down 56% from the peak before the Financial Crisis, and are back where they’d first been in December 1996, well, 24 years ago.

Wells Fargo [WFC] is down 56% ytd. At $23.53, shares are down 61% from December 2017 and are back where they’d first been in October 2000.

Citigroup [C] is down 46% ytd. At $43.11, shares – adjusted for its infamous 1-for-10 reverse stock split in March 2011 – are back where they’d first been in 1993.

My Big Four Bank Index, based on market capitalization, closed today at $685 billion (yup, $60 billion below Facebook’s market cap). That’s down 46% from its peak ($1,258 billion) on January 26, 2018. You see, banks got hit two years before the Pandemic. And the index is now back where it had first been on December 28, 2004, nearly 16 years ago (data from YCharts):

My Big-Four Bank Index already got crushed back to 2004 level.

By Wolf Richter for WOLF STREET.

REBNY: Real Estate Generates More Than 50% of NYC Tax Revenues

New York City’s real estate industry generated $31.9 billion in taxes over the last fiscal year, representing 53% of the city’s tax revenue, according to an analysis by the Real Estate Board of New York, which is holding its 124th Annual Banquet Thursday evening. The industry’s share of revenues is more than twice as large as the next closest contributor: personal income tax, with a 21% share.

The $31.9 billion comes from commercial and rental apartment buildings. It doesn’t include one-and-two family homes, cooperatives and condominiums or schools, hospitals and other publicly-funded structures.

“This report demonstrates the importance of real estate related tax revenue to our thriving city,” said REBNY president James Whelan. “If we want a progressive city, then we need a prosperous city. These findings underscore that policies that limit the amount of tax revenue generated by our industry are counterproductive to improving the lives of New Yorkers they aim to help.”

Bryson DeChambeau hits his tee shot on the 16th hole during the Rocket Mortgage Classic golf tournament at Detroit Golf Club. Brian David Gordon·

Bryson DeChambeau‘s radical transformation of his body and game has been one of the most polarizing issues of the summer. Just how crazy has DeChambeau been off the tee? Consider that over the five PGA Tour events since the three-month coronavirus shutdown, DeChambeau has hit 29 drives at least 350 yards, by far the most of any player. In fact, it’s more than the next two players combined. That is nearly the same number of drives of at least 350 yards as he had all of last season (30).

Most 350-Yard Drives Since PGA Tour Restart

| PLAYER | NUMBER OF DRIVES LONGER THAN 350 YARDS |

| Bryson DeChambeau | 29 |

| Matthew Wolff | 15 |

| Cameron Champ | 12 |

DeChambeau was not always this long off the tee. He’s averaging 323 yards per drive this season, up over 20 yards (+20.5) from 302.5. He is on pace to be the first player since 2005 to increase his driving distance by 20 yards over one season. The next-largest increase belongs to Tiger Woods, who increased his driving distance by 14.2 yards from 2004 to 2005.

Largest Year-Over-Year Increase In Driving Distance Last 15 Years

| YEAR | PLAYER | DISTANCE INCREASE IN YARDS |

| 2019-20 | Bryson DeChambeau | +20.5 |

| 2005 | Tiger Woods | +14.2 |

| 2017-18 | Graeme McDowell | +13.7 |

The massive distance has left DeChambeau just 149.2 yards to the hole on average for his approach shots this season. That is on pace to pass Bubba Watson (149.8 in 2014-15 season) for the shortest distance in a single season since 2005.

Shortest Average Distance To Hole After Tee Shot In Single Season Since 2005

| YEAR | PLAYER | DISTANCE TO HOLE AFTER TEE SHOT |

| 2014-15 | Bubba Watson | 149.8 |

| 2012 | Bubba Watson | 152.2 |

| 2011 | J.B. Holmes | 152.7 |

| 2016-17 | Rory McIlroy | 152.9 |

| * DeChambeau currently at 149.2 this season |

Another way to look at it: DeChambeau’s drives have covered more than 67% of the courses’ yardage this season. That’s (again) on pace to pass Bubba Watson’s mark from back in 2014-15.

Highest Percentage Of Yardage Covered By Tee Shots Single Season Since 2005

| YEAR | PLAYER | PERCENTAGE OF DISTANCE COVERED BY TEE SHOT |

| 2014-15 | Bubba Watson | 67.28 |

| 2016-17 | Rory McIlroy | 67.26 |

| 2012 | Bubba Watson | 67.05 |

| * DeChambeau currently at 67.43 |

As for head-to-head comparisons with Woods, DeChambeau is already on his way to doing something Tiger never did — lead the PGA Tour in driving distance. Woods finished second in driving distance in four different seasons, but he never led the field. However, relative to his peers, Woods’ peak driving distance season (2005) was slightly better when comparing distances to the PGA Tour average. In 2005, Tiger was 27.7 yards longer off the tee than the average player; DeChambeau is currently 27.1 yards longer than the PGA Tour average thus far this season.

The Busyness Paradox, Explained

Here’s how the busyness paradox works: When we’re busy and have that high-octane, panicked feeling that time is scarce — what one participant called the “sustained moment of hecticness” through the work day — our attention and ability to focus narrows. Behavioral researchers call this phenomenon “tunneling.” And, like being in a tunnel, we’re only able to concentrate on the most immediate, and often low value, tasks right in front of us. (Research has found we actually lose about 13 IQ points in this state.) We run around putting out fires all day, racing to meetings, ploughing through emails, and getting to 5 or 6 PM with the sick realization that we haven’t even started our most important work of the day.

So we stay late at the office, or take work home in the evenings or weekends, and effectively steal time for work away from the rest of our lives. “If you’re in this firefighting state of time pressure and tunneling, you’re not making time to meet long-term goals. You’re not dealing with any of the root causes that led to the firefighting in the first place,” said Matthew Darling, ideas42 vice president and project lead. “The tendency is to do the stuff that’s easy to check off. That’s all you have the bandwidth for.” Tunneling and busyness are mutually reinforcing, Darling added. “Focusing on short-term tasks makes you not make strategic plans, which causes you to be busy.”

In theory, workers could just ignore any work they didn’t complete before, say, 5 PM, and call it a day. But it’s hard to break out of the tunnel now: Unlike a century ago, when Americans showed their status in leisure time, busyness has become the new badge of honor. So even as we bemoan workplaces where everyone is busy and no one is productive, busyness has actually become the way to signal dedication to the job and leadership potential. One reason for this is is that, while productivity is relatively easy to measure on a factory floor, or on the farm, we have yet to develop good metrics for measuring the productivity of knowledge workers. So we largely rely on hours worked and face time in the office as markers for effort, and with the advent of technology and the ability to work remotely, being connected and responsive at all hours is the new face time. “Tunneling” is no longer something that happens by accident,” Darling explained. “It’s a condition that workers are forced into by standard management practices.”

So how can behavioral science interventions begin to nudge this powerful busyness bias that keeps us all so stressed out?

One key will be to construct new mental modelsof the ideal worker. Right now, the model is someone who comes in early, eats lunch at their desk, stays late, emails at all hours, is always busy and always available to put work first — a definition that excludes anyone with caregiving responsibilities (which, in the U.S., is primarily women) or the desire for a healthy work-life balance.

So the interventions ideas42 are designing to improve work effectiveness and work-life balance may also wind up nudging the idea that an ideal worker in the 21st century is someone who does great work, is well-rested and healthy, and has a great life outside of work — not someone who’s trapped in the busy tunnel, chasing their tail, thinking small and on the road to burn out. These interventions are designed with the very foundation of behavioral science in mind: that human decision-making is shaped not by individual personality or willpower, but by the environment.

3 Ways to Break Your Employees Out of the Busyness Paradox

Recognize the power of social signals. When we’re at work, all we see are other people working. And when we see late-night emails or texts, we assume that our coworker or boss has been working all day or night without interruption, when perhaps they’d been out walking the dog or having dinner with their families. But that life outside work doesn’t register because we don’t see it. (More, we often don’t want to share our lives outside work with coworkers and bosses in order to preserve the busyness myth that we are always working.)

“You end up miscalibrating,” Darling explained, or thinking that people are working more than they actually are, so you automatically think you have to as well in order to keep up. Researchers point to a classic study of such “norm misperception” and how prevalent and damaging it can be: one nationwide surveyfound that a large share of college students overestimated the amount of alcohol their peers consumed. Over time, the best predictor for how much students wound up drinking was how much they thought their peers were drinking, even though, in reality, their peers weren’t drinking that much.

To correct that “always-on” misperception, researchers at ideas42 are testing the idea of making non-work time more visible. They’re asking managers to be more open about: taking lunch breaks, leaving the office on time, working flexibly, going on vacation, talking about life outside of work or care responsibilities, and more demonstrably encouraging others to do the same — potentially even including life events on shared calendars. Another experiment involves automatic reminders. These reminders would go out at the beginning of every year and would prompt people to schedule their vacations.

Researchers are also working with teams to design email, phone, and texting protocols to cut down or eliminate work communication outside of normal hours, particularly from leaders who set expectations for everyone else. Behavior might be tracked and made transparent so that, through the powerful nudge of social comparison, people and leaders would be held accountable and the new systems more likely to stick.

Build in slack for important work. Humans are terrible at estimating how much time and effort are actually needed to accomplish things. It’s called the planning fallacy, and the busyness paradox only exacerbates that tendency to underestimate and overpromise. So one intervention being tested is for workers to intentionally create slack in their calendars every week — in other words, intentionally schedule a block of slack time to finish up any work that got delayed after an emergency popped up, or to finish a project that took longer than you thought it would. The team at ideas42 came up with the idea based on a study of hospital operating rooms that found leaving one room unused for emergencies, rather than booking to 100% capacity, actually increased the number of surgical cases and revenue while cutting down on staff overwork

Another idea is to create “transition days” at work before and after vacations, where the only expectation of workers would be to wrap up work before leaving, and catch up on what they missed while they were out. That would give workers a better chance of truly unplugging and recharging during vacation, and help people ease back into work after. People won’t feel as compelled to answer emails throughout for fear of falling behind, or dread juggling the awaiting inbox with immediate work demands. “You almost always need a lot more slack than you think you will,” Darling explained, “and it is actually markedly important for doing good work.”

Slack time requires a new mental model — recognizing that, no matter how carefully we plan, work emergencies and unexpected demands will always crop up and projects and tasks will usually require more time than we’ve allocated. So creating blank space isn’t slacking off (pun intended); it’s time that enables you to get your most important work done effectively and keeping it from spilling over into the rest of your life.

Increase transparency into everyone’s workload. Many people participating in our project felt they were always busy — going to meetings, answering emails, collaborating with others — but not necessarily productive. They found it difficult to find chunks of uninterrupted time to concentrate on a big project, much less plan or think or strategize. Some even said they used their paid time off just to have a day of uninterrupted, independent work.

So one intervention ideas42 researchers are experimenting with is an effort to “concretize” work by actually scheduling in time to work on the week’s priorities and making actual workloads transparent to bosses and coworkers. The thinking is that that transparency is likely to create positive friction every time someone wants to call a meeting. With priority work made more transparent, calling a meeting won’t be seen as cost free, but a values trade-off: what is everyone not doing because they’re at this meeting? And is the meeting the better use of everyone’s time?

Another idea involves “meeting hygiene” — can meetings become more efficient with a required agenda, limited time, and concrete action plan? Researchers may also test meeting and email black out days to encourage concentrated work time.

In the end, the hope is that these interventions will help people begin to act their way into a new way of thinking. If they see they can work more effectively andhave a healthier work-life balance, perhaps instead of praising people who brag about being super busy and working all the time, they’ll begin to think: If workers aren’t getting their most important work done, are on the verge of burnout, and have little time for life, what needs to change at this organization?

Brigid Schulte is a journalist, author of the New York Times bestselling Overwhelmed: Work, Love and Play When No One has the Time and director of the Better Life Lab at New America.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.