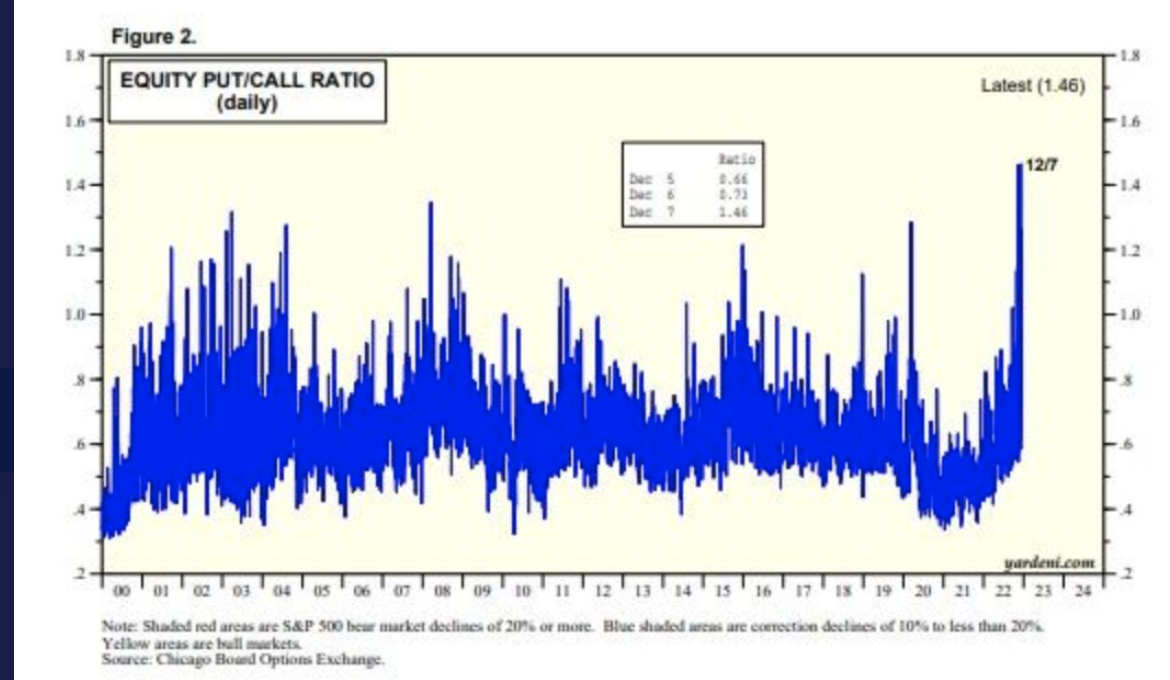

1. Equity Put/Call Ratio Highest in 20 Years?

A Contrarian Indicator -Investopedia

Contrarian investors use the put-call ratio to help them determine when market participants are getting overly bullish or too bearish.

An extremely high put-call ratio means the market is extremely bearish. To a contrarian, that can be a bullish signal that indicates the market is unduly bearish and is due for a turnaround. A high ratio can be a sign of a buying opportunity to a contrarian.

An extremely low ratio means the market is extremely bullish. A contrarian might conclude that the market is too bullish and is due for a pullback.

No single ratio can definitively indicate that the market is at its top or its bottom. Even the levels of the put-call ratio that are considered extreme are not set in stone and vary over the years.

Typically, investors compare current ratio levels to the average over some period of time to gauge if sentiment has changed recently. If the put-call ratio has fluctuated in a tight range and suddenly bumps higher, traders might see this as a sudden increase in bearish sentiment and make their moves accordingly.

https://www.investopedia.com/

2. Dow Industrials Chart Breaks Above August Highs

Industrials 50day approaching 200day to upside

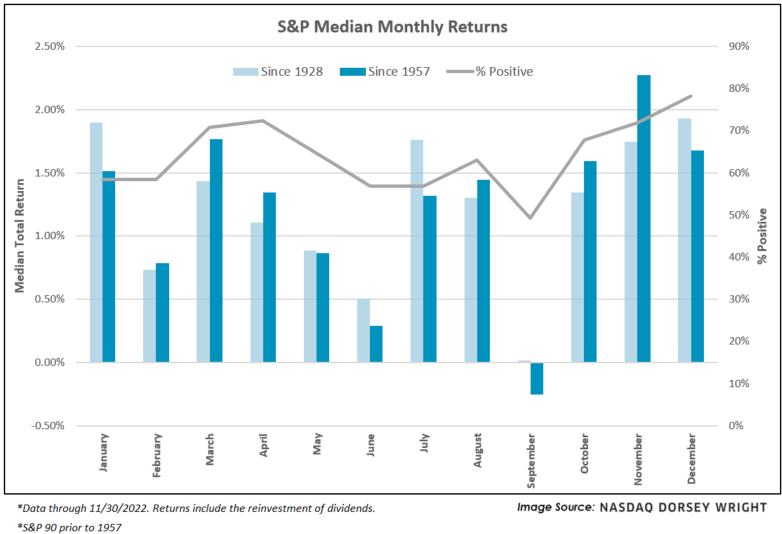

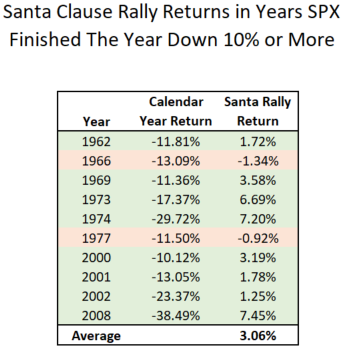

3. History of Santa Rally in Down Years

Nasdaq Dorsey Wright

https://www.nasdaq.com/

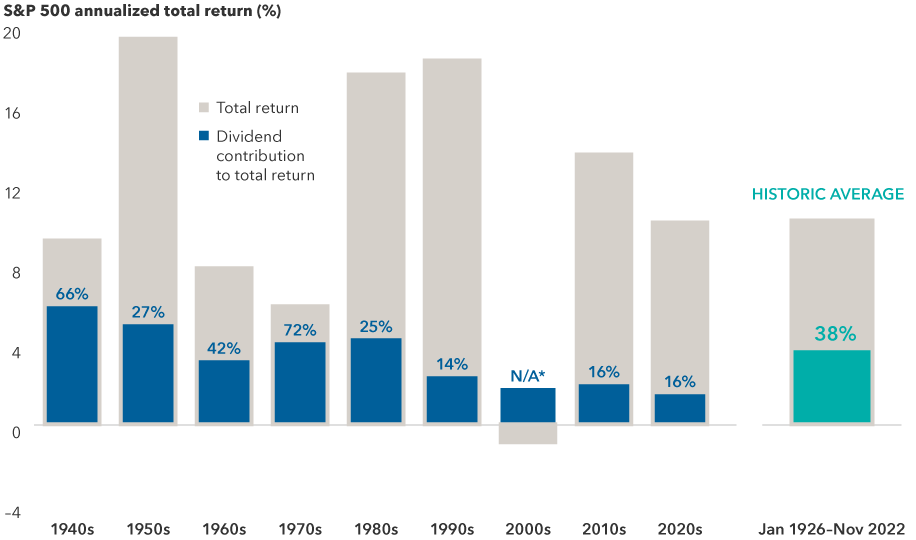

4. Reversion to Mean…Dividends Historic Average vs. 2010-2020

Capital Group-While dividends accounted for a slim 16% of total return for the S&P 500 in the 2010s, historically they have contributed an average 38%. In the inflationary 1970s they climbed to more than 70%. “When you expect growth in the single digits, dividends can give you a head start,” Wagner adds. “They may also offer a measure of downside protection when volatility rises, but it is essential to understand the sustainability of those dividends.”

Dividends have historically been a larger percentage of total return

Source: S&P Dow Jones Indices LLC. 2020s data is from 1/1/26 through 11/30/22. *Total return for the S&P 500 Index was negative for the 2000s. Dividends provided a 1.8% annualized return over the decade. Past results are not predictive of results in future periods

5. COMT Commodity ETF Breaking Below Early Fall Lows.

50day thru 200day to downside in October

6. Copper Miners Held 200 Week Moving Average in this Commodity Pullback

COPX still 10 points below highs but held 200 week average twice

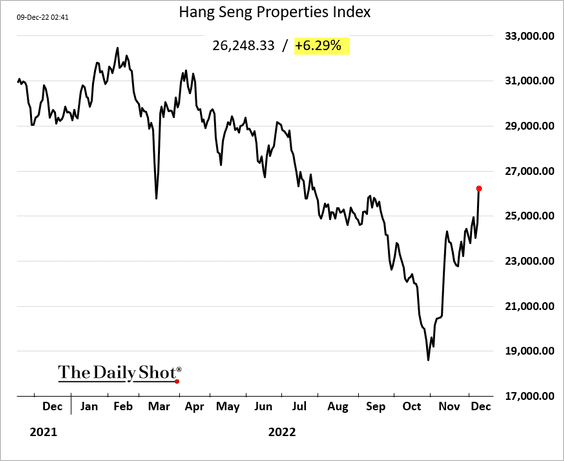

7. Chinese Property Index Rallying

China: Property stocks are surging.

https://dailyshotbrief.com

8. FAANG Stocks Lost $3 Trillion in Market Value…..Weight in S&P 19.5% to 13%

https://www.bloomberg.com/news/articles/2022-12-10/investors-call-time-on-faang-stock-dominance-after-nasdaq-s-rout?srnd=premium&sref=GGda9y2L

9. Surging retail theft could force Walmart to close stores and raise prices, CEO Doug McMillon warns

By

Shoplifting has gotten so bad at Walmart stores that the retail giant may shutter locations in areas where local governments are taking a soft-on-crime approach, the company’s boss said.

CEO Doug McMillon, who has led Walmart since 2015, confirmed the retailer has experienced an increase in “shrink” — a term the retail industry uses to address losses related to in-store theft or fraud.

“Theft is an issue. It’s higher than what it has historically been,” McMillon said during an appearance on CNBC’s “Squawk Box” on Tuesday. “We’ve got safety measures, security measures that we’ve put in place by store location.

“I think local law enforcement being staffed and being a good partner is part of that equation, and that’s normally how we approach it,” McMillon added. “If that’s not corrected over time, prices will be higher, and/or stores will close.”

The Walmart CEO did not elaborate on how many stores could be in danger of closure, or where the closures might occur. The Post has reached out to the company for further comment.

Walmart has 4,720 stores in the US and 10,586 locations around the world.

has more than 10,500 stores around the world.Corbis via Getty Images

McMillon added that Walmart takes a “city by city” and “location by location” approach to how it handles shoplifting

Rite Aid bosses blame out-of-control NYC shoplifting for $5M revenue hit

“It’s store managers working with local law enforcement and we’ve got great relationships there for the most part,” he said.

Walmart’s top boss is the latest executive to warn of significant impact from what is often described as “organized retail crime.”

Last month, Target CFO Michael Fiddelke said shrinkage had already shaved $400 million from the company’s profits – with the final impact expected to rise to more than $600 million for the full year.

Target CEO Brian Cornell added that his company had “seen a significant increase in theft and organized retail crime across our business.”

As The Post reported in September, Rite Aid executives grumbled that shoplifting in New York City had contributed to “unexpected headwinds” and resulted in a $5 million year-over-year increase in shrink-related losses.

“I think the headline here is the environment that we operate in, particularly in New York City, is not conducive to reducing shrink just based upon everything you read and see on social media and the news in the city,” Rite Aid’s chief retail officer Andre Persaud during an earnings call at the time.

https://nypost.com/2022/12/07/

10. 10 Reasons Why I Am Addicted To My Sauna by Ben Greenfield

Hippocrates Health Institute Publication On Clearlight Infrared® Sauna

10 Reasons Why I Am Addicted To My Sauna by Ben Greenfield

I have a confession to make: I’m an addict. Every morning I wander to my basement gym, flip the power on my sauna, step inside, and sweat hard for thirty minutes. Knowing I can venture downstairs and enter a chamber that gives my body a myriad of benefits simply makes a sauna a daily must. There are many reasons I sauna and you should too – 10 scientifically proven reasons, in fact. In no particular order of importance, they are:

1. Heart Health and Longevity

JAMA Internal Medicine shows that regularly spending time in a sauna may help keep the heart healthy and extend life. Researchers from Finland tracked 2,300 men for an average of 20 years. They found that the more sessions per week men spent in the sauna, the lower their risk of sudden cardiac death and fatal coronary heart disease. The sauna also extended the life of participants with other illnesses, including cancer.

2. Detoxification of Chemicals and Heavy Metals

The skin is a major detox organ, and sweating through skin is a critical human detox function, yet most people don’t sweat enough. Because of this, we miss out on a major source of toxin elimination: the skin. To combat these effects, an infrared sauna helps to purify the body from the inside out, eliminating compounds such as PCBs, metals and toxins that are stored in fat cells, which can undergo lipolysis and release toxins upon exposure to heat.

3. Athletic Recovery for Pros and Weekend Warriors

Growth hormone is crucial for repair and recovery of muscles, and research has shown that two 20-minute sauna sessions elevated growth hormone levels two-fold over baseline. Two 15-minute sauna sessions at an even warmer temperature resulted in a five-fold increase in growth hormone. And two one-hour sauna sessions for 7 days has been shown to increase growth hormone 16-fold! For an additional recovery benefit, sauna also increases blood flow to the skeletal muscles, which helps to keep them fueled with glucose, amino acids, fatty acids, and oxygen, while removing by-products of metabolic processes such as lactic acid and calcium ions.

4. Arthritic and Muscular Pain Relief

In The Annals of Clinical Research Volume 20, research results show the benefits of sauna for relief of pain and increased mobility. Pain relief induced by a sauna was attributed to an increase in the release of anti-inflammatory compounds, as well as an increase in positive stress on the body, causing it to release natural pain-killing endorphins. More than 50% of participants reported relief of pain and an increase in mobility.

5. Muscle Gain and Fat Loss

Sauna can promote muscle growth and fat loss by improving insulin sensitivity and decreasing muscle protein catabolism. Intermittent hyperthermia has been shown to reduce insulin resistance in obese mice, and in this case insulin resistant diabetic mice were subjected to 30 minutes of heat treatment, three times a week for twelve weeks. The results were a 31% decrease in insulin levels and a reduction in blood glucose levels, both of which can contribute to an increase in muscle growth and an increase in weight control and fat loss. It has also been shown that a 30-minute intermittent hyperthermic treatment can cause a significant expression of something called ‘heat shock proteins’ in muscle, which is correlated with 30% more muscle regrowth after a week of immobilization. In other words, if you don’t exercise but you sauna instead, you can still maintain muscle!

6. Immune System Boost

The Journal of Human Kinetics investigated the effect of sauna on the immune system, specifically white blood cell profile, cortisol levels and selected physiological indices in athletes and non-athletes. After the sauna session, an increased number of white blood cells, lymphocyte, neutrophil and basophil counts was reported in the white blood cell profile, showing that sauna use stimulates the immune system. German medical research shows that saunas are able to significantly reduce the incidences of colds and influenza.

7. Skin Rejuvenation

When your body produces sweat via the deep sweating you experience in an infrared sauna, the rate at which dead skin cells are replaced can be increased. At the same time, heavy sweating helps to remove bacteria out of the epidermal layer of the skin and the sweat ducts. This pore cleansing also causes increased capillary circulation, which can give the skin a softer-looking, younger appearance. When you sweat, the movement of fluid to the skin delivers mineral-rich nutrients and also helps to fill spaces around the cells, increasing firmness and reducing the appearance of wrinkles. So by continually flushing waste through skin cells via the use of hyperthermia, you increase skin health, tone and color, and cleanse the pores.

8. Relaxation and Better Sleep

Researchers have found that a sauna can help provide a deeper, more relaxed sleep, relief of chronic tension, and relief of chronic fatigue issues, most likely due to a release of endorphins from the sauna. As endorphins are released into your body, they create a soothing, tranquilizing effect that not only helps to minimize chronic arthritic pain and other muscle soreness, but can also help with relaxation and sleep.

9. Increased Cardiovascular Performance

Research has shown 30 minutes of sauna treatment after exercise can cause an increase in oxygen consumption and red blood cell production. In temperatures of an infrared sauna, your skin heats up and core body temperature rises. Then, in response to these increased heat levels, the blood vessels near your skin dilate and cause an increase in cardiac output. So with regular sauna use, you are training your heart muscles and improving your cardiac output.

10. Increased Stress Resilience

Multiple research studies have shown that hyperthermia via the use of a sauna can prevent protein degradation and muscle loss by triggering the production of heat shock proteins. Heat shock proteins are then used by your cells to counteract potentially harmful stimulus, including environmental stress from pollutants, toxins, heat, cold, exercise stress and more. So, can you blame me? I’m addicted to my sauna and knowing these 10 benefits, I feel very good about myself when I walk out of my daily sauna session. If you’re up for the challenge, I’d recommend that for the next thirty days you try the Finnish practice of visiting a sauna four to five times a week for twenty to thirty minutes.

If you’re interested in an infrared sauna cabin for home, click here to view our range of full-spectrum saunas, far-infrared saunas, and outdoor saunas.

Share this post

https://infrared-sauna.com.au/