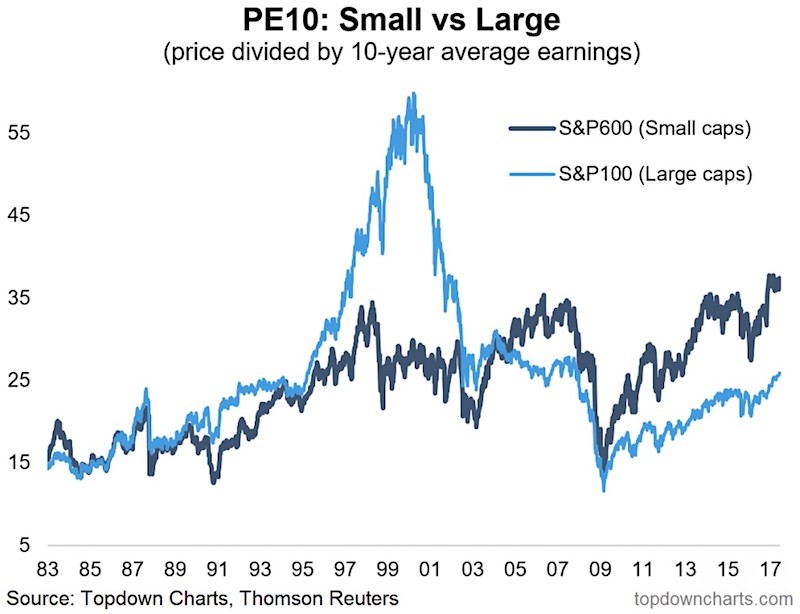

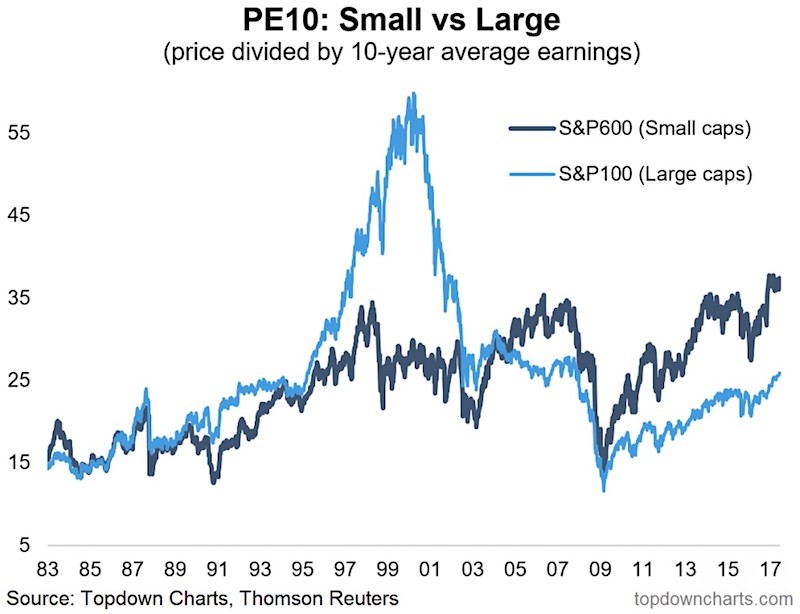

1.U.S. Large Cap Stocks Near Record Margins at 9%….Small Cap Margins 2.5% Just Above Long-Term Median.

Sep 25, 2017

The S&P 500 is currently up more than 1% during the month of September, and if it can simply finish the month in the green, it will be considered a big win given that September has historically been the worst month of the year for stocks.

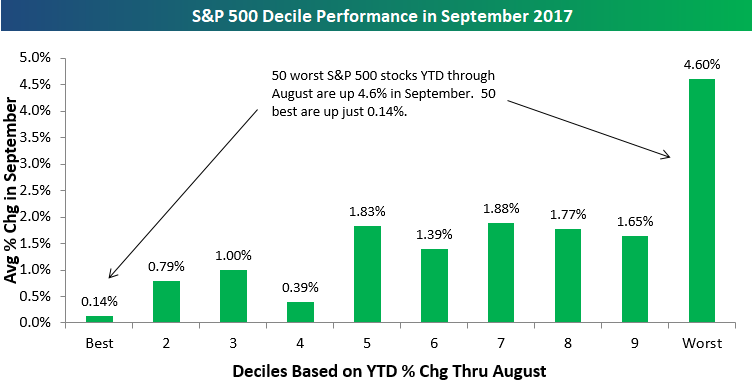

What’s interesting about the market’s performance this month is the underlying stocks that are driving major indices higher. We broke the S&P 500 into deciles (10 groups of 50 stocks each) based on year-to-date performance through August to see how the year’s biggest winners and losers heading into September are doing this month.

As shown below, it’s 2017’s biggest losers that have posted the biggest gains in September, while the year’s biggest winners have taken a breather. The 50 S&P 500 stocks that were performing the worst on a YTD basis through August are up 4.6% in September, while the 50 best-performing stocks YTD through August are up just 0.14%.

These stats show that momentum traders are likely under-performing in September. If you stuck your neck out and bought the most beaten down names, you’re likely having a banner month.

When I posted the map of Norway a few days ago, Annie made a comment saying that she didn’t really know the scale of the country and that it was interesting to compare it with its neighbors. When reading that, my very technologically advanced boyfriend said he could make a graphic superimposing Norway atop a map of the US, to see the size in comparison. And here it is! As you can see, it is a long and narrow country, almost as long as the US East Coast. On the West Coast, it would cover the distance from San Diego to Seattle. Enjoy:

Graphic: JY

A few facts:

http://www.slowtrav.com/blog/chiocciola/2009/02/map_of_norway_in_relation_to_t.html

http://www.barrons.com/articles/big-ipo-gain-dont-bet-on-it-1505529036

https://www.bloomberg.com/news/articles/2017-08-08/why-private-equity-is-betting-on-your-online-shopping-addiction