1.Stock Bubble? $8 Trillion in Bonds Outstanding have Negative Interest Rates.

Torsten Slok

Torsten Slok

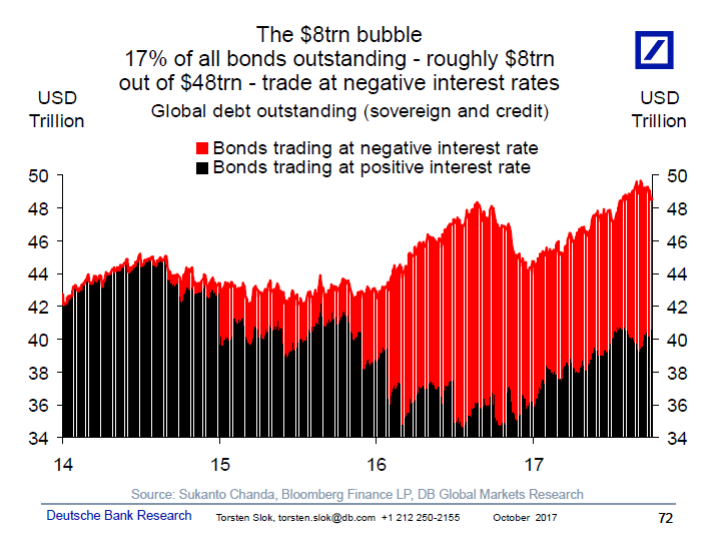

Sometimes clients ask me “Where is the bubble in financial markets?”. I think the answer to that question is easy: It is the red area in the chart below. $8trn in global debt is trading at negative interest rates. Think about it; almost a decade after the financial crisis we still have $8trn in bonds which yield negative returns.

It is the unattractiveness of these bonds for investors which is the biggest bubble in markets today. These $8trn in negative yielding assets have forced investors around the world into all kinds of other asset classes such as IG credit, loans, mortgages, HY bonds, equities, and even emerging markets fixed income and equities.

The Fed running down their balance sheet by a 50 billion here and $50 billion there is not going to make a difference to this chart. The real test will be when the red area in the chart below turns black. When these $8trn suddenly begin to yield a positive return how are global investors going to react? The fear is that when the risk-free interest rate goes higher then credit spreads will widen and equities underperform as investors leave risky assets and come home to higher-yielding government bonds. In finance terms, if the risk-free rate goes higher why should I then be buying risky assets?

When will this bubble burst? It will happen the day we begin to see inflation in the US. Because higher US inflation will mean more and faster rate hikes from the Fed, which will mean higher rates globally, including in Europe and also Japan. The good news is that consensus doesn’t expect US core inflation to move higher until 2018Q2. The bad news is that the $8trn in the chart below shows that investors don’t believe we will ever see inflation again. The bottom line is that the central bank exit has barely started and once inflation does start to move higher then checking out from Hotel Easy Money will be a lot more difficult than checking in.

Torsten Sløk, Ph.D.

Tel: 212 250 2155

2.Equity Flows YTD

Financial sector equity ETFs make a move

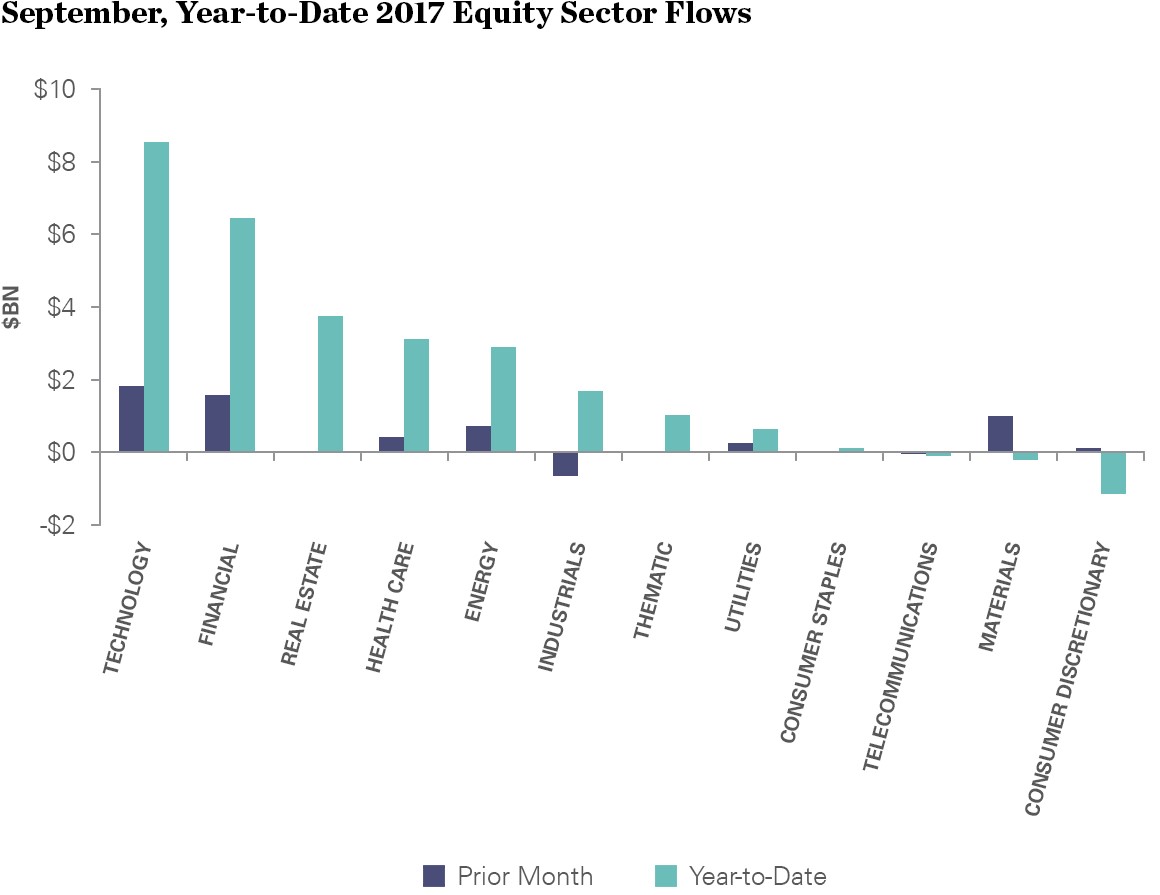

Talk of tax reform has been beneficial for financial firms, as interest rates have risen and banks have an average effective tax rate of nearly 30%. Bank stocks are also benefitting from attractive valuations and growth. As shown below, investors funneled $1.5 billion into financial sector equity ETFs during September.

Source: Bloomberg Finance L.P., as of 9/29/2017

Energy is the horse to watch down the stretch for a comeback story. With the spot price of oil increasing to more than $50/barrel, inflows reached nearly $1 billion in September. In another sign of positivity for the sector, short interest for energy-related sector ETFs declined during the month.

A winner from overseas

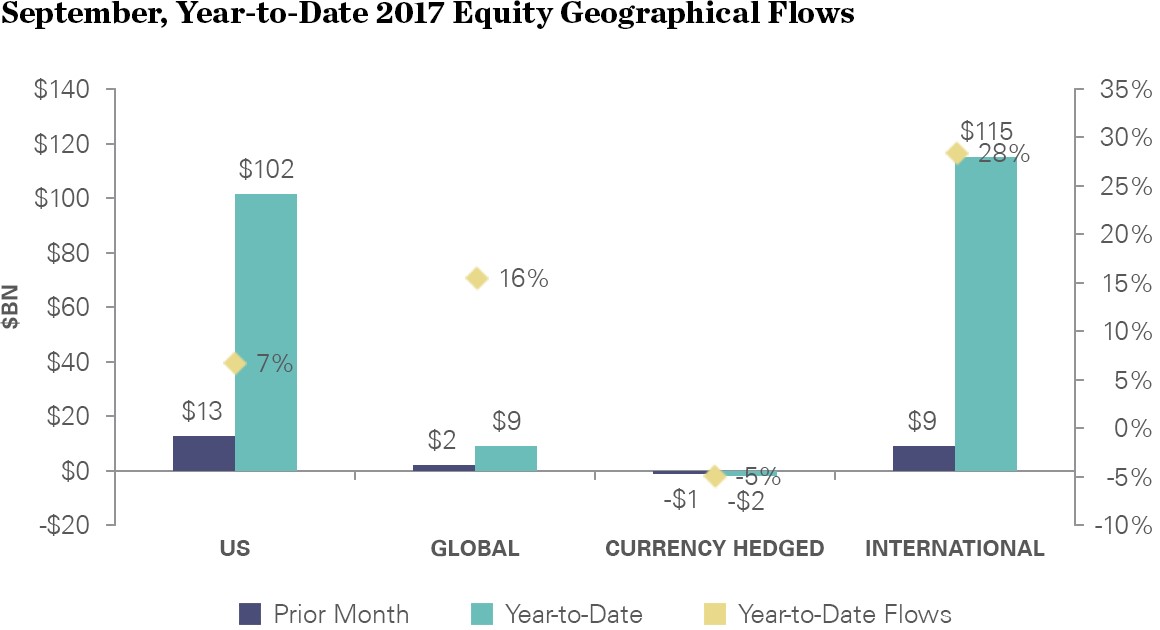

Much like trainers fawning over a horse with strong lineage from overseas, investors have sought out non-US exposures all year. As shown below, inflows into US ETFs have topped $100 billion year-to-date, representing 7% of start-of-year assets. Meanwhile, inflows into international ETFs total $115 billion, equaling 28% of start-of-year assets. This shift is not surprising, given attractive valuations and projections by the International Monetary Fund that the engine of growth will be outside of the US.

Source: Bloomberg Finance L.P., as of 9/29/2017

3.More Flow Show..Where are Advisors Allocating?

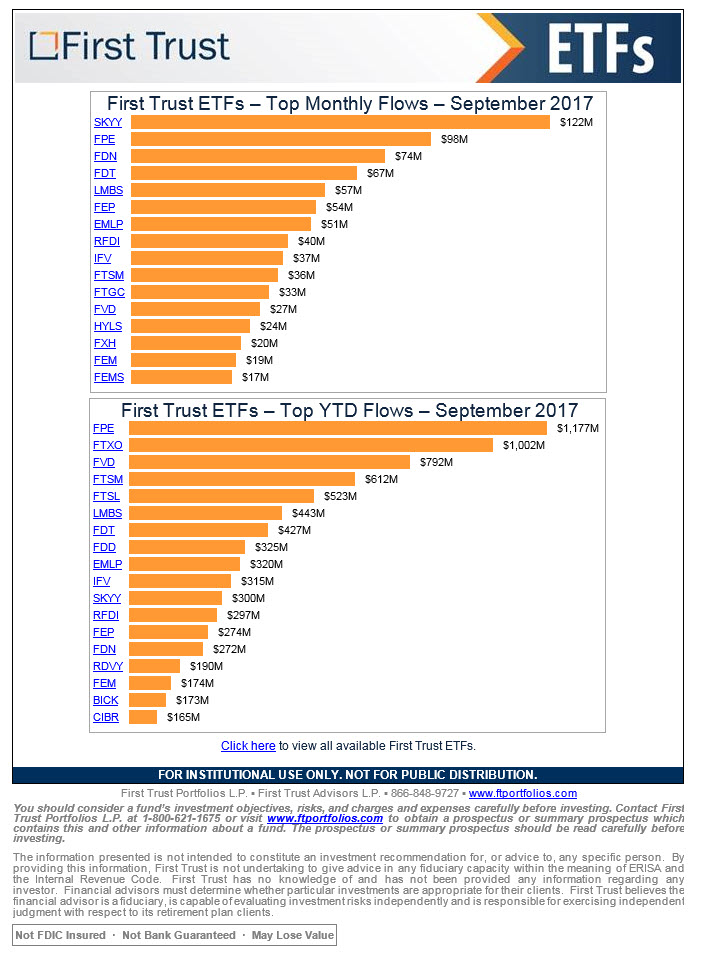

Preferreds Lead YTD Flows.

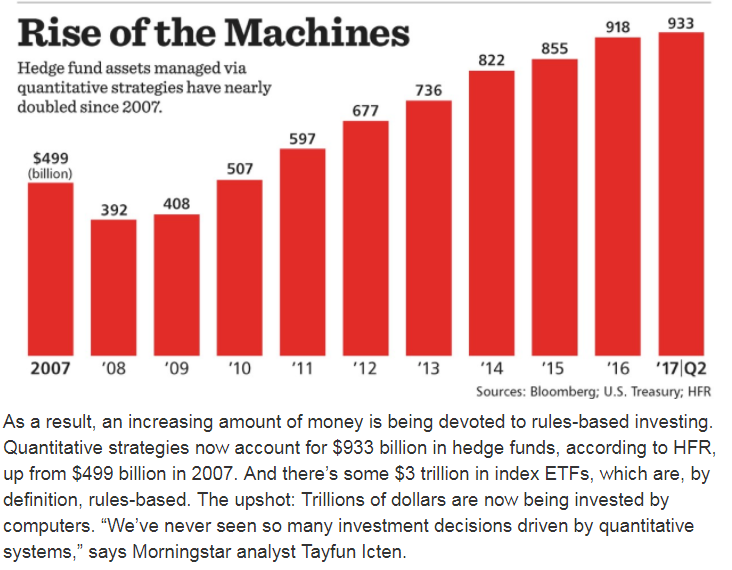

4.All These Flows into “Rules Based” ETFs + the Rise of Quant Based Hedge Funds to Almost $1T Creating New Crowding Theories Around Crashes.

Barrons Cover Story

5.After 2016 Weakness…Chinese Currency having Strong Year.

CYB Chinese Currency ETF.

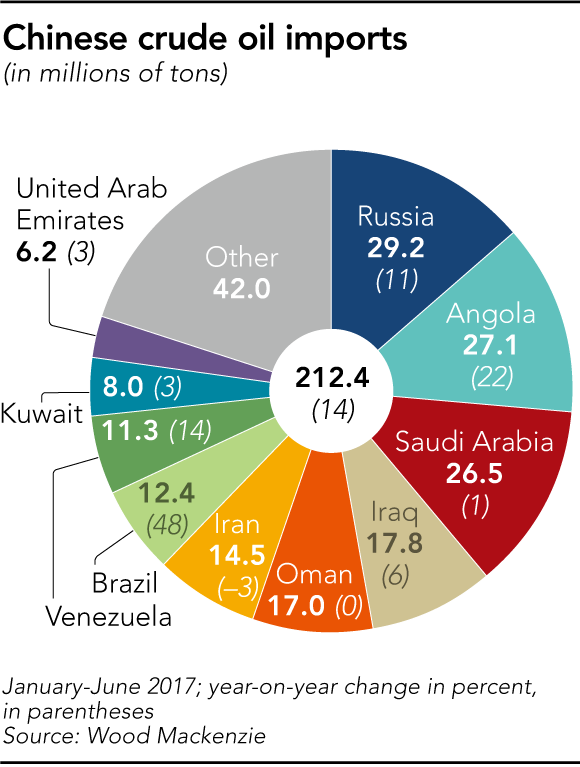

Remember Earlier this Year China Started Trading Some Oil Markets in Yuan…Including Angola 27% of Chinese Imported Crude.

The crude oil futures will be the first commodity contract in China open to foreign investment funds, trading houses, and oil firms. The circumvention of U.S. dollar trade could allow oil exporters such as Russia and Iran, for example, to bypass U.S. sanctions by trading in yuan, according to Nikkei Asian Review.

To make the yuan-denominated contract more attractive, China plans the yuan to be fully convertible in gold on the Shanghai and Hong Kong exchanges.

The world’s top oil importer, China, is preparing to launch a crude oil futures contract denominated in Chinese yuan and convertible into gold, potentially creating the most important Asian oil benchmark and allowing oil exporters to bypass U.S.-dollar denominated benchmarks by trading in yuan, Nikkei Asian Review reports.

Barrons

China is set to launch an oil exchange by the end of the year that is to be settled in yuan. Note that in conjunction with the existing Shanghai Gold Exchange, also denominated in yuan, any country will now be able to trade and hedge oil, circumventing U.S. dollar transactions, with the flexibility to take payment in yuan or gold, or exchange gold into any global currency.

The world’s second-largest oil exporter, Russia, is currently under sanctions imposed by the U.S. and European Union, and has made clear moves toward circumventing the dollar in oil and international trade. In addition to agreeing to sell oil and natural gas to China in exchange for yuan, Russia recently announced that all financial transactions conducted in Russian seaports will now be made in rubles, replacing dollars, according to Russian state news outlet RT. Clearly, there is a concerted effort from the East to reset the economic world order.

http://www.barrons.com/articles/the-coming-renaissance-of-macro-investing-1507957012

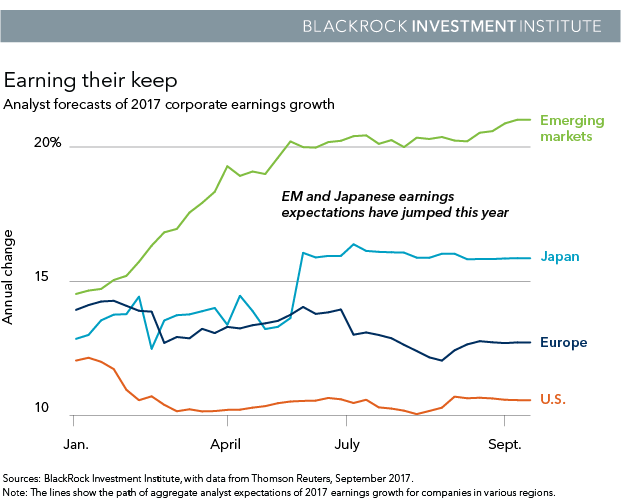

6.Japan and Emerging Markets Earnings Expectations Double.

A sustained expansion supports company earnings growth, we believe. All major regions are posting earnings-per-share growth higher than 10% for the first time since 2005, excluding the post-crisis bounce, our research shows. Analyst forecasts are holding steady in the U.S. and Europe, Japan is up and emerging market (EM) earnings expectations have almost doubled this year. See the chart below.

Blackrock Blog

https://www.blackrockblog.com/2017/10/06/3-investing-themes-q4/

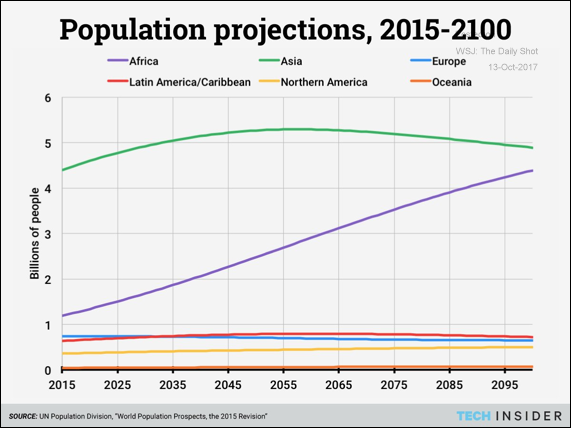

7.Food for Thought: Here is a long-term global population projection.

Source: @wef; Read full article

8.Read of the Weekend…Smart Phones are Frying Our Brains.

How Smartphones Hijack Our Minds

Research suggests that as the brain grows dependent on phone technology, the intellect weakens

The earlier research didn’t explain whether and how smartphones differ from the many other sources of distraction that crowd our lives. Dr. Ward suspected that our attachment to our phones has grown so intense that their mere presence might diminish our intelligence. Two years ago, he and three colleagues— Kristen Duke and Ayelet Gneezy from the University of California, San Diego, and Disney Research behavioral scientist Maarten Bos —began an ingenious experiment to test his hunch.

The researchers recruited 520 undergraduate students at UCSD and gave them two standard tests of intellectual acuity. One test gauged “available cognitive capacity,” a measure of how fully a person’s mind can focus on a particular task. The second assessed “fluid intelligence,” a person’s ability to interpret and solve an unfamiliar problem. The only variable in the experiment was the location of the subjects’ smartphones. Some of the students were asked to place their phones in front of them on their desks; others were told to stow their phones in their pockets or handbags; still others were required to leave their phones in a different room.

‘As the phone’s proximity increased, brainpower decreased.’

The results were striking. In both tests, the subjects whose phones were in view posted the worst scores, while those who left their phones in a different room did the best. The students who kept their phones in their pockets or bags came out in the middle. As the phone’s proximity increased, brainpower decreased.

In subsequent interviews, nearly all the participants said that their phones hadn’t been a distraction—that they hadn’t even thought about the devices during the experiment. They remained oblivious even as the phones disrupted their focus and thinking.

A second experiment conducted by the researchers produced similar results, while also revealing that the more heavily students relied on their phones in their everyday lives, the greater the cognitive penalty they suffered.

In an April article in the Journal of the Association for Consumer Research, Dr. Ward and his colleagues wrote that the “integration of smartphones into daily life” appears to cause a “brain drain” that can diminish such vital mental skills as “learning, logical reasoning, abstract thought, problem solving, and creativity.” Smartphones have become so entangled with our existence that, even when we’re not peering or pawing at them, they tug at our attention, diverting precious cognitive resources. Just suppressing the desire to check our phone, which we do routinely and subconsciously throughout the day, can debilitate our thinking. The fact that most of us now habitually keep our phones “nearby and in sight,” the researchers noted, only magnifies the mental toll.

https://www.wsj.com/articles/how-smartphones-hijack-our-minds-1507307811

9.Read of the Day…What do Young Investment Bankers Worry About?

We asked dozens of young bankers to name their biggest Wall Street concern — and one answer came up over and over

Silicon Valley has been encroaching on Wall Street’s turf. Margin Call screenshot

Business Insider recently compiled a list of the top talent on Wall Street age 35 and under, interviewing dozens of bankers, asset managers, and traders in the process.

We asked the crop of dealmaker candidates making waves in investment banks and private-equity shops the same question: What’s your biggest concern about the industry?

While responses varied — some bemoaned market trends, like record-low volatility and sky-high valuations — a strong current ran through the vast majority of answers that underscores Wall Street’s challenge in keeping up with Silicon Valley.

Most notably, bankers are concerned with Wall Street’s ability to recruit and retain young talent given the competition from tech giants and startups that offer juicy perks, a more relaxed lifestyle, and an exciting, entrepreneurial environment.

There’s a reason Goldman Sachs is rebranding itself as a tech company and trying to hire engineers in droves.

The industry has changed swiftly since the financial crisis, and the stable, predictable career trajectory calcified over decades on Wall Street has largely been thrown out the window.

“When I joined the industry 10 years ago, if you were smart and had an interest in business, chances are you were coming into finance and consulting,” one private-equity standout told us. “We were able to get the best and brightest undergrads. With the advent of startups and tech — Google, Snapchat, or entrepreneurs — we’re finding it more difficult to recruit that top tier.”

A handful noted that banks, despite marked improvements in recent years, still struggled to offer a healthy work-life balance. Many of the people we spoke with in their early 30s had recently become parents, mixing that daunting responsibility into the cocktail of one of the most competitive, high-pressure career tracks out there.

Here’s what a couple of others had to say:

- “There’s been a shift in terms of talent and rigor — it’s hard to get people who are super, super committed,” a banker told us. “Work-life balance is very tough. People glamorize tech startup life.”

- “There’s kind of a lost generation from 2007 to now … for a lot of reasons they don’t want to work in banks,” another banker told us. “This 10-year gap of people that should be in banking that instead chose to go to venture or startup or charity.”

And in the same vein, young financiers are concerned that the technologies coming out of Silicon Valley may further drain the pool of opportunities.

“There’s a lot of fear about how much technology can replace day-to-day tasks,” one banker told us.

Former Citigroup CEO Vikram Pandit said last month that 30% of banking jobs could be gone within five years from the threat of automation and artificial intelligence, though relationship-based practices like investment banking face less risk than trading operations.

“I do think we need to be better coordinated about how Wall Street will protect itself against outsiders who are going to be encroaching on the banks’ turf,” another rising banker told us, highlighting Apple Pay, PayPal, and blockchain as emerging threats.

Banks may continue to struggle to lure talent back from Silicon Valley, but they’re awake to technology threats.

Investments in private tech companies by banks have soared in recent years. Goldman Sachs is leading the charge, but Citigroup, JPMorgan Chase, and Morgan Stanley are all very much in the game as well.

http://www.businessinsider.com/wall-streets-young-bankers-voice-their-biggest-concern-2017-10

10.Don’t Justify What You Want to Change

Steven Stosny, Ph.D.Anger in the Age of Entitlement

Free yourself from the chains of resentment.

Justifying resentment is like justifying hunger; you never have to do it. You never have to ask yourself, “Is my resentment justified?” The more important question is, “Do I want to be resentful?” If you don’t, you need to understand that justifying resentment strengthens and prolongs it.

There’s a neurological explanation for this. Resentment keeps us focused on a perception of unfairness – we’re not getting the help, appreciation, praise, reward, or affection we deserve. Mental focus amplifies and magnifies, whatever we focus on becomes more important than what we don’t focus on. Repeated focus over time forms mental habits. Justifying resentment strengthens the neural connections underlying it, and over time makes it more or less automatic, the default perception of consciousness. Resentful people complain and criticize out of habit.

Resentment is likely to become a bedrock of ego-defense, due to its low-grade adrenaline, which temporarily increases energy and confidence. We feel animated by the perception that we’ve been wronged, which feels better than the self-doubt and low energy that often occurs when we feel vulnerable. The problem with adrenaline is that it borrows energy from the future. After a bout of resentment, a crash into some form of depressed mood is inevitable. Worse, adrenaline enhances memory – experience marked by adrenaline is, in general, recalled more easily. (It’s often hard to get it out of your mind.) When you resent your partner, you’ll remember every perceived offense since you started living together. Instead of experiencing negative feelings as temporary states, it seems like you’re reacting to unfair or unreliable behavior that will not change and that overshadows most positive experience.

The other problem with adrenaline is that we build a tolerance to it so that it takes more and more of it to get the same level of energy and confidence. That means we have to justify more by amplifying and magnifying more. At that point resentment becomes chronic, the lens through which we see the world.

Characteristics of chronic resentment are:

- External regulation of emotions – other people seem to control your emotional states – they “push your buttons” or make you feel what you don’t want to feel.

- Vulnerable emotions – guilt, shame, sadness – are seen as punishments to be blamed, denied, or avoided, rather than motivations to heal and improve

- Narrow and rigid emotional range – you’re either resentful or numb.

Characteristics of chronic resentment in relationships:

- High emotional reactivity – a negative feeling in one triggers chaos or shut down in the other

- Power struggles – the goal is to win and be right rather than reconcile and connect

- Criticism, stonewalling, defensiveness, contempt.

The Urge to Justify

We justify resentment by citing evidence of other people’s unfairness.But the adrenaline we need for justification makes us subject to confirmation bias. The human brain is highly susceptible to confirmation bias under the influence of emotion arousal; it automatically looks for evidence that confirms its assumptions and ignores or discounts evidence that disconfirms them. Many studies have shown that whatever the brain looks for, it tends to find, in reality or in imagination.

The urge to justify is essentially self-talk, that is, we justify our feelings more to ourselves than to others. The urge to justify tells us that the emotion is probably not good for us, or else we wouldn’t have to justify it. You probably don’t have to justify an emotion that’s more conducive to health and well-being, such as compassion. You don’t go into work and say, “I was under so much stress last night and my partner pushed all my buttons and I lashed out with compassion, I took her perspective and felt more humane – it wasn’t the real me!”

You have an absolute right to your resentment. And you have a more compelling right to a live value-filled life, which is impossible with resentment.