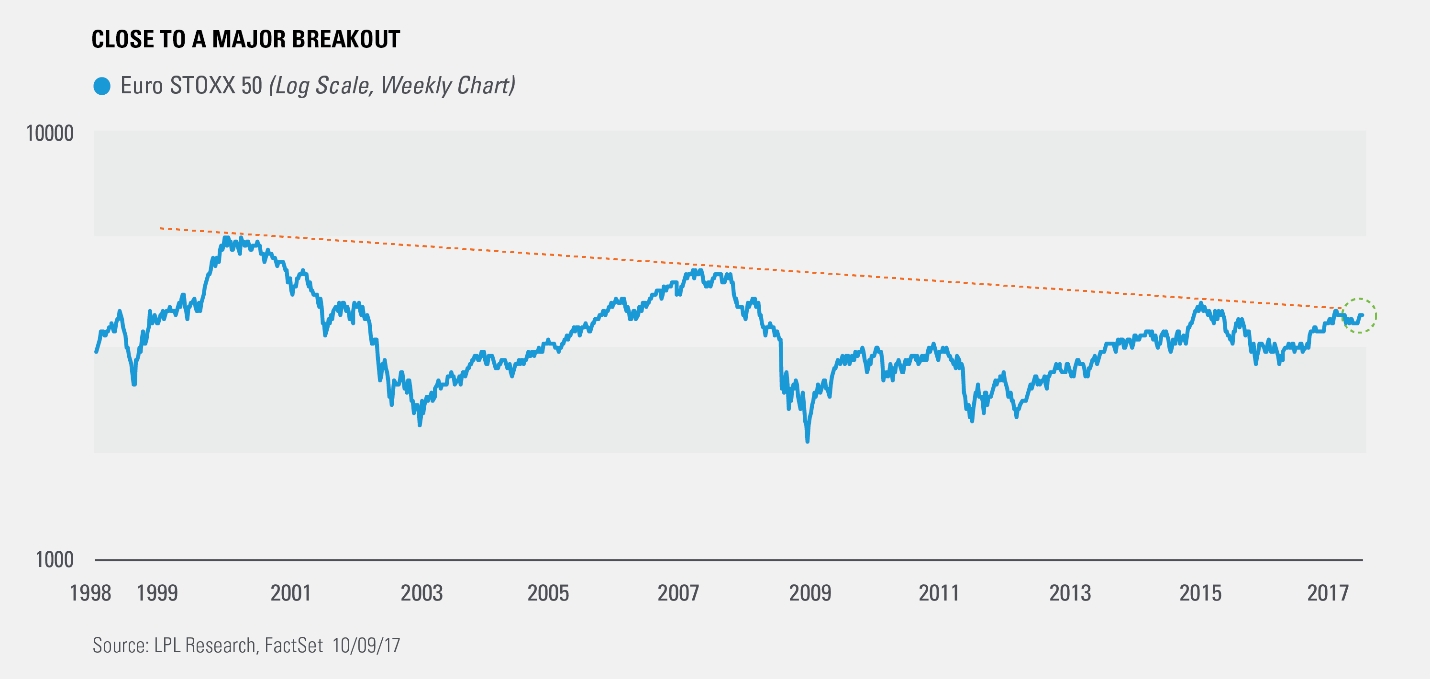

1. Eurostoxx 50 …Close to a Break-Out Level that Goes back to 1999.

Here’s where things get interesting. The monthly chart above shows the Euro STOXX 50 has broken above its long-term trend, but the weekly chart below shows us that the breakout hasn’t happened yet. This is why it is important to look at varying timeframes.

Given various global markets are already breaking out, it is likely only a matter of time until the Euro STOXX 50 breaks out above this trendline. Per Ryan Detrick, Senior Market Strategist, “Though when looking out into 2018 we continue to see better opportunities domestically and in emerging markets, Europe is finally pulling its own weight. This is yet another sign that we are amid a global bull market and it should continue into 2018, if not further.”

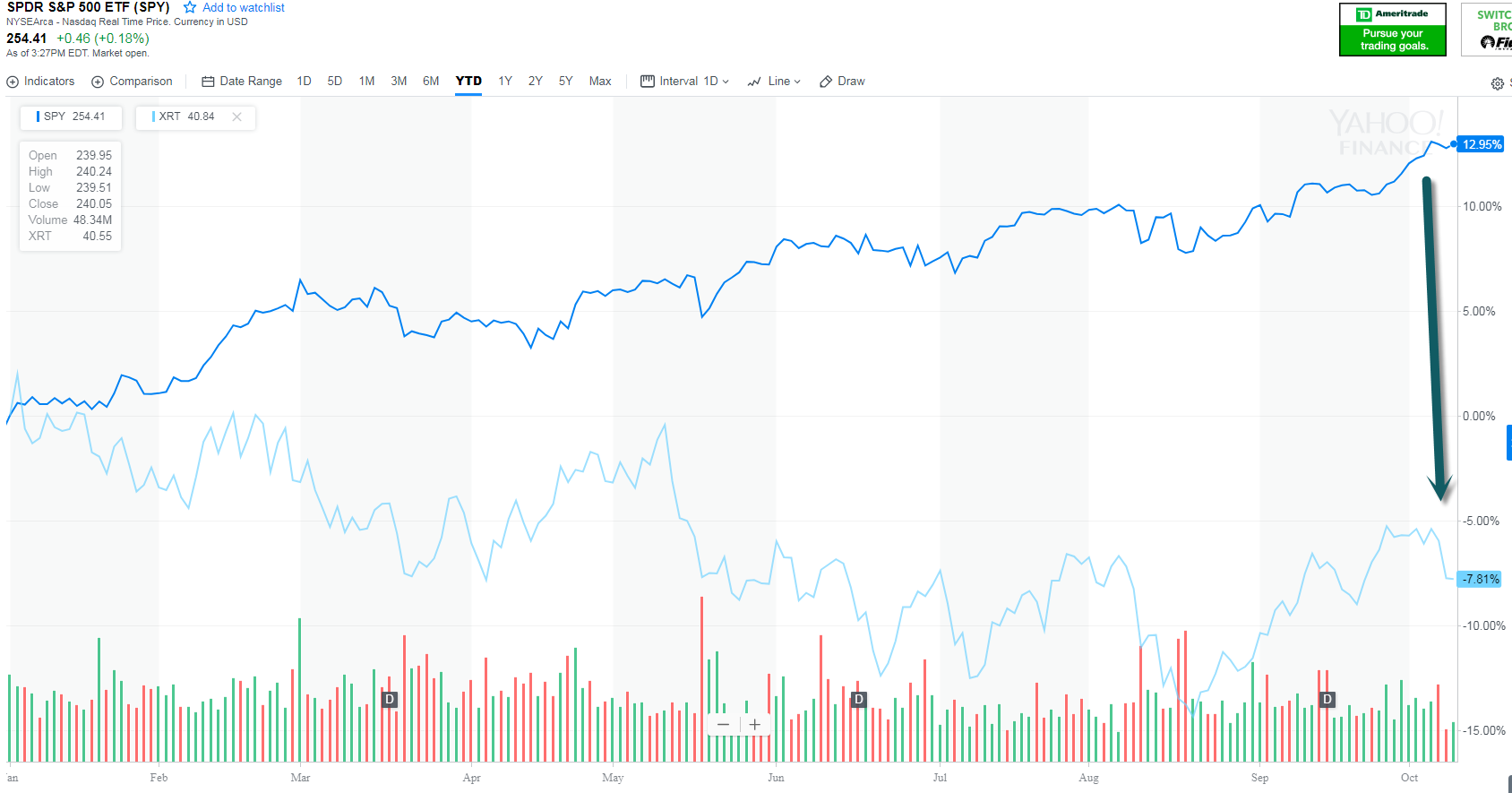

2.Retail Continues to Get Smoked in AMZN/Discounter World….SPY +12.95% vs. XRT (retail) -8%

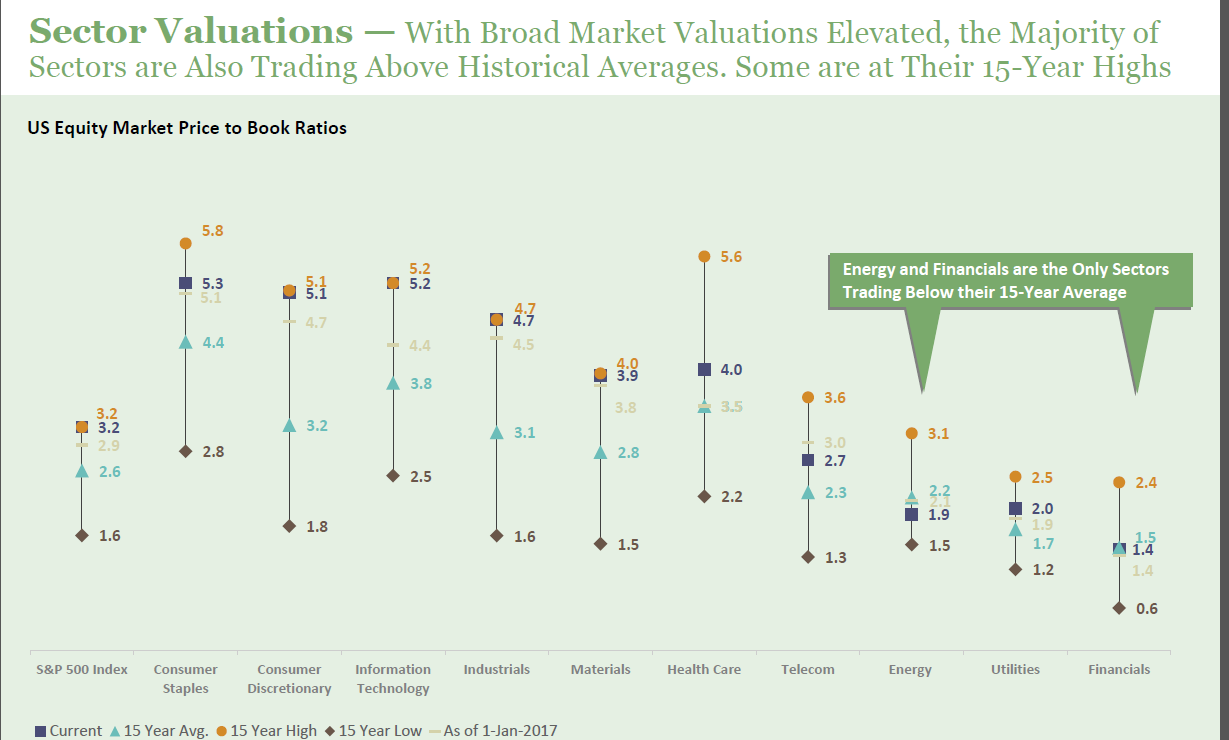

3.Sector Valuations Based On Price to Book.

SPDR BLOG.

4. These small-cap and mid-cap companies have a lot riding on Trump’s tax cut

The data

A company’s effective annualized income tax rate can be distorted to a large degree during any particular quarter or year, because of mergers, asset sales, legal settlements, impairment charges, accounting adjustments, etc. Because the rates can vary so wildly, we look at effective income-tax rates for the past nine reported quarters for U.S. companies included in the S&P Small-Cap 600 Index and the S&P 400 Mid-Cap Index, for which the data were available from FactSet. We included only companies for which the data were available for at least five of the past nine quarters. This left us with 854 companies, of which 157 had median effective tax rates below 20%.

Here are the 20 companies in the in the S&P Small-Cap 600 Index and the S&P 400 Mid-Cap Index with the highest median effective income tax rates, according to the methodology described above:

| Company | Ticker | Industry | Median effective income-tax rate – past nine reported quarters | Minimum effective tax rate | Maximum effective tax rate |

| Clean Harbors Inc. | CLH,+0.43% | Environmental Services | 75% | 46% | 259% |

| Brink’s Co. | BCO,+0.12% | Misc. Commercial Services | 66% | 26% | 106% |

| Regis Corp. | RGS,+1.69% | Consumer Services | 60% | 43% | 149% |

| Providence Service Corp. | PRSC,+0.58% | Misc. Commercial Services | 57% | 43% | 73% |

| Heidrick & Struggles International Inc. | HSII,+0.47% | Personnel Services | 56% | 33% | 95% |

| WellCare Health Plans Inc. | WCG,-1.80% | Managed Health Care | 56% | 35% | 65% |

| Lumos Networks Corp. | LMOS,+0.00% | Telecommunications | 54% | 25% | 63% |

| Molina Healthcare Inc. | MOH,-2.25% | Managed Health Care | 54% | 41% | 63% |

| McDermott International Inc. | MDR,-0.14% | Oilfield Services/ Equipment | 53% | 28% | 623% |

| Magellan Health Inc. | MGLN,+0.00% | Managed Health Care | 50% | 40% | 91% |

| Rambus Inc. | RMBS,+1.48% | Semiconductors | 49% | -1,109% | 71% |

| Consolidated Communications Holdings Inc. | CNSL,+0.94% | Telecommunications | 48% | 39% | 99% |

| Evercore Inc. Class A | EVR,-0.32% | Investment Banks/ Brokers | 48% | 16% | 61% |

| Aerojet Rocketdyne Holdings Inc. | AJRD,-0.51% | Aerospace & Defense | 48% | 33% | 54% |

| Barracuda Networks Inc. | CUDA,+0.04% | Information Technology Services | 46% | -14% | 68% |

| Cogent Communications Holdings Inc. | CCOI,+3.10% | Telecommunications | 45% | 14% | 61% |

| ATN International Inc. | ATNI,+0.35% | Telecomunnications | 45% | 19% | 278% |

| R.R. Donnelley & Sons Co. | RRD,+0.79% | Commercial Printing/ Forms | 45% | -6% | 219% |

| Resources Connection Inc. | RECN,+0.34% | Personnel Services | 45% | 41% | 49% |

| Wisdom Tree Investments Inc. | WETF,+1.15% | Investment Managers | 44% | 41% | 71% |

| Source: FactSet | |||||

Because skewed data could temporarily lead to high effective tax rates, we are also showing the minimum and maximum effective income tax rates for the nine-quarter period.

5-6. Great Stuff from Bespoke Investments.

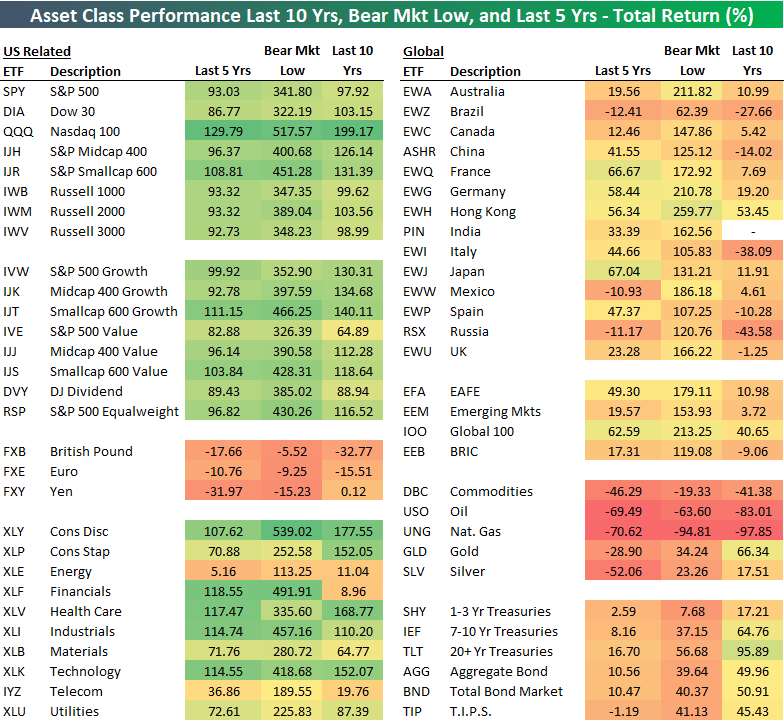

Asset Class Total Returns Over the Last 10 Years

Oct 10, 2017

Below is a look at our asset class performance matrix showing total returns for key ETFs that we track on a regular basis. Since today marks the 10-year anniversary of the start of the Financial Crisis bear market for the S&P 500, we thought it would be helpful to see how various asset classes have performed over the last ten years. We also include change from the ultimate low of the bear market on 3/9/09 as well as 5-year returns.

We’ll let the table do the talking on this one!

The Best and Worst Stocks and Sectors Since the Start of the Financial Crisis

Oct 10, 2017

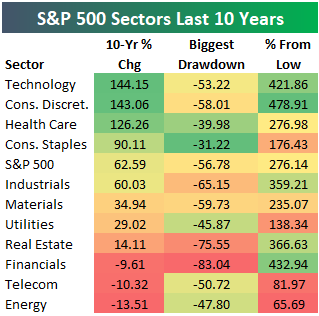

Ten years ago today marked the peak of the mid-2000s bull market for the S&P 500 and the start of the Financial Crisis bear market that ran from 10/10/07 to 3/9/09. Below is a look at S&P 500 sector performance over the last ten years along with how much each sector declined at its bear market low. We also include each sector’s current gain from its bear market low.

As shown, the Technology sector has gained the most over the last ten years from the prior bull market peak at +144%. Consumer Discretionary and Health Care are up the 2nd and 3rd most. Three sectors are still down from the 10/9/07 peak, however — Financials, Telecom, and Energy.

From their bear market lows, Technology, Consumer Discretionary, and Financials are up the most with gains of more than 400%. Both Telecom and Energy, on the other hand, are up less than 85% from their bear market lows.

https://www.bespokepremium.com/think-big-blog/

7.Cape Ratio Comments from Pension Partners.

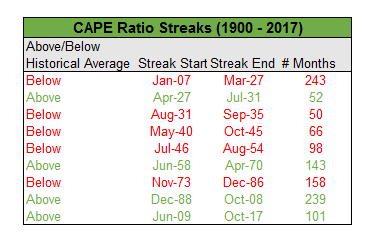

In the past 20 years, the S&P 500 has sported a CAPE Ratio above its historical average 97% of the time, or 233 out of 240 months. Only in the brief period from November 2008 through May 2009 were stocks deemed “undervalued,” trading at valuations below their long-term average.

As it turns out, long periods above or below the historical average valuation are not as uncommon as one might think. A market that is undervalued can remain undervalued for a long time (243 months from 1907 to 1927 just as a market that is overvalued can remain overvalued for what seems like an eternity (239 months from 1988 to 2008).

Read full story

https://pensionpartners.com/when-mean-reversion-fails/

Found at www.abnormalreturns.com

8.Death of a Nation …Venezuela.

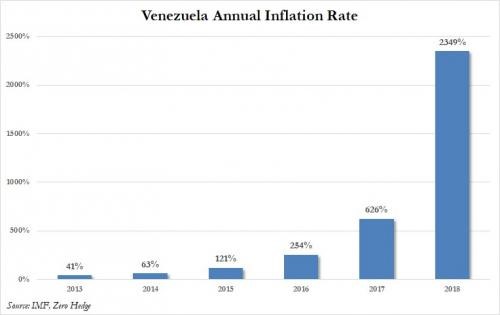

Back in January 2016, we showed what the collapse of Venezuela looks like, when in addition to charting Venezuela’s imploding currency (which back then was trading at a positive expensive 941 bolivars to the dollar), we presented what at the time was the IMF’s latest Venezuela inflation forecast, which stunned us as it surged from 275% in the just concluded 2015 to a whopping 720% at the end of 2016.

Fast forward nearly two years until today, when the IMF released its latest estimate of what it believes will happen to Venezuela’s economy in the coming year and a half. What is striking, besides the fact that Venezuela has somehow still managed to avoid bankruptcy, is that the IMF now expects Venezuela’s hyperinflation to reach a staggering 2,349% in 2018, after rising by “only” 626% this year, the highest estimate for any country tracked by the IMF. While the South American country stopped reporting economic data in 2015, the IMF estimates that last year inflation clocked in around 254%, a number which is set to soar in the coming years for obvious reasons.

http://www.zerohedge.com/news/2017-10-10/what-death-nation-looks-venezuela-prepares-2300

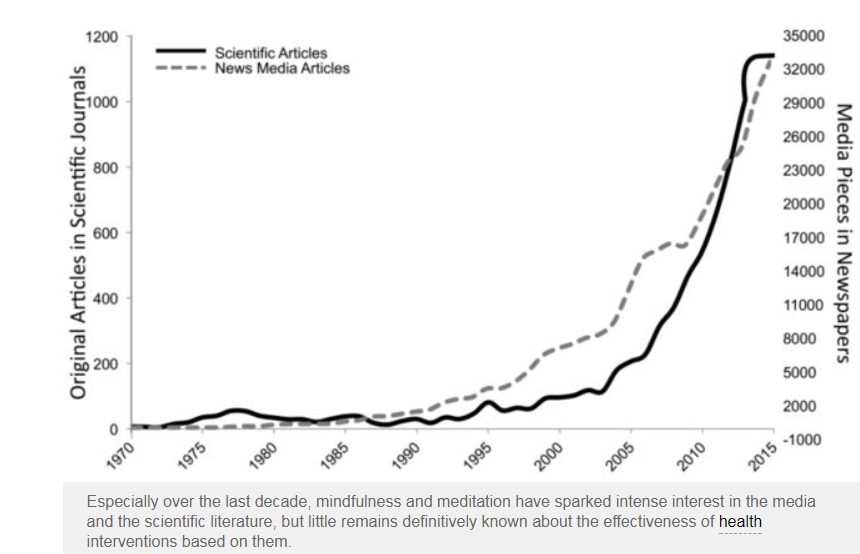

9.The Explosion of Meditation and Mindfulness….Hockey Stick Growth.

Is Mindfulness Being Mindlessly Overhyped? Experts Say “Yes”

Scholars want more rigorous science and less hype of so-called “mindfulness”.

Posted Oct 10, 2017

Christopher Bergland

The Athlete’s Way

A multidisciplinary team of 15 experts from renowned institutions and universities across the United States are calling for more rigorous science, less media hype, and clearer definitions of what is vaguely referred to as “mindfulness.”

In the introduction of a paper, “Mind the Hype: A Critical Evaluation and Prescriptive Agenda for Research on Mindfulness and Meditation,” recently published in the journal Perspectives on Psychological Science, the authors explain the impetus behind their somewhat urgent call-to-action regarding mindfulness: “Over the past two decades, writings on mindfulness and meditation practices have saturated the public news media and scientific literature (see graphic below). While this is not an isolated case, much popular media fail to accurately represent scientific examination of mindfulness, making rather exaggerated claims about the potential benefits of mindfulness practices. There have even been some portrayals of mindfulness as an essentially universal panacea for various types of human deficiencies and ailments. As mindfulness has increasingly pervaded every aspect of contemporary society, so have misunderstandings about what it is, whom it helps, and how it affects the mind and brain.”

10.Tai Lopez’s 4 Ways to Consume Information Like a Billionaire

This investor makes millions by reading books using this strategy.

The Oracles – CONTENT PROVIDER

Think about the last book you read and how it affected your life. Given the way we often passively consume information, it’s probable that you’ll struggle to recall three main points.

Tai Lopez went from dead broke to running an empire of wildly successful companies, built on the back of a YouTube marketing juggernaut that nets him billions of views. He cites his ability to consume and apply information as the No. 1 reason he’s no longer broke and now worth millions of dollars.

Business giants like Mark Cuban, worth $3 billion, stop by his house. And he has regular one-on-one dinners with the former Microsoft CEO Steve Ballmer, worth an estimated $33 billion.

But Lopez didn’t learn how to crush it in college. He dropped out at age 19. He’s totally self-taught, reading a book a day and recommending the best ones in his popular online book club.

Lopez is not an outlier. Many of the world’s millionaires and billionaires cite reading voraciously as their secret competitive advantage. In fact, 1,200 of the world’s wealthiest people all read extensively.

When asked about the key to success, billionaire investor Warren Buffett once said: “Read 500 pages every day. That’s how knowledge works. It builds up, like compound interest.”

He’s not alone. Bill Gates consumes about a book a week. When asked how he learned how to build rockets, Elon Musk simply replied: “I read books.”

“Everybody wants a six-pack body,” explains Lopez. “But where are the people who want six-pack brains?” The answer is: they’re in a room with Tai Lopez, making more deals and cash than they know what to do with.

Here’s how to start consuming information like a billionaire in four steps.

- Start judging books by their covers.

Billionaires are discerning about what they read. That’s the first way they consume differently. You won’t find “50 Shades of Grey” or gossip magazines on their book shelves.

“The biggest problem non-millionaires have is what they read,” Lopez says. “You can be the best speed reader in the world, but it doesn’t matter if you’re reading the wrong stuff.” Lopez recommends reading high-quality content by authors with proven track records.

He cites “Made in America” by Walmart founder Sam Walton as a prime example. “Walton wrote ‘Made in America’ to pass along what he learned before his death,” Lopez says.

- Spend your time on three types of books.

Once you understand who to read, Lopez recommends splitting your time between three types of reading (just like diversifying your investments).

“In the morning, read a classic book that’s more than 50 years old.” Freud, Darwin, Plato—take your pick. Classic books challenge your brain more than the breezy, shallow styles of many bestsellers.

During the day, read a how-to book or content related to your industry, so you’re always sharpening your marketable skills.

Keep a good autobiography or biography by your bed at night. Lopez recommends “Kon-Tiki” (about Thor Heyerdahl’s epic voyage across the ocean in a primitive raft) or Arnold Schwarzenegger’s biography, “Total Recall.”

“Their courage rubs off on you,” Lopez says.

- Divide your day into thirds.

Now that you have the content, it’s time to consume it. Billionaires don’t just read books when they’re on the beach. They voraciously read during every available moment.

“People often set the bar too low,” Lopez says. “If you really want to change the game, divide your day into thirds.”

He recommends one-third of the day be devoted to consuming raw data—this is like putting fuel in the tank to be used later. Spend another third strategizing on what you’ve read and how it applies to your life, wealth, and business. (Maybe take notes on the book’s inside back cover.) Finally, spend one-third of your day executing what you’ve learned and analyzed.

- Put in the time and money.

There’s one final secret to how billionaires consume information, Lopez says. They dedicate large amounts of time and money to read more and better content.

“You don’t have to read six hours a day necessarily,” Lopez says. “But if you’re not putting in at least an hour a day, nothing will save you.”

He also recommends not blinking an eye when spending money on books, content, and courses. Billionaires, even millionaires, literally don’t give these costs a second thought—neither now or before they made their money. That’s exactly why they’re successful now.

“There are two things no one ever goes broke from,” Lopez says. “Giving to charity and doubling down on knowledge. Charity gives you purpose and knowledge cannot rust, rot, or depreciate.”

The more he learns, the more he earns. So can you. All it takes is dedicated commitment to consuming information like billionaires.

Get Tai’s Free Book of the Day Summary delivered to your inbox.