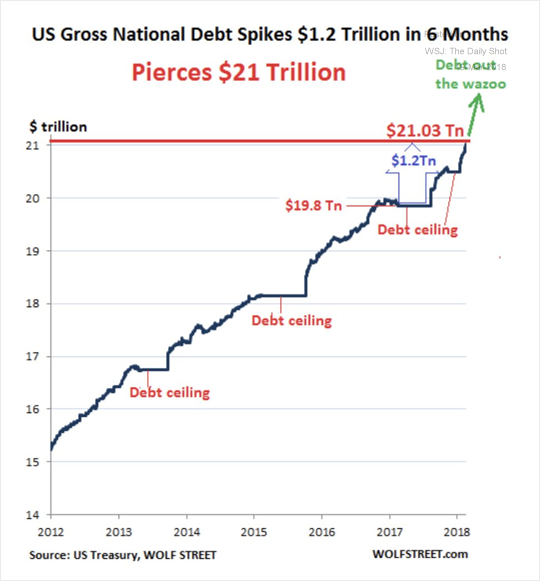

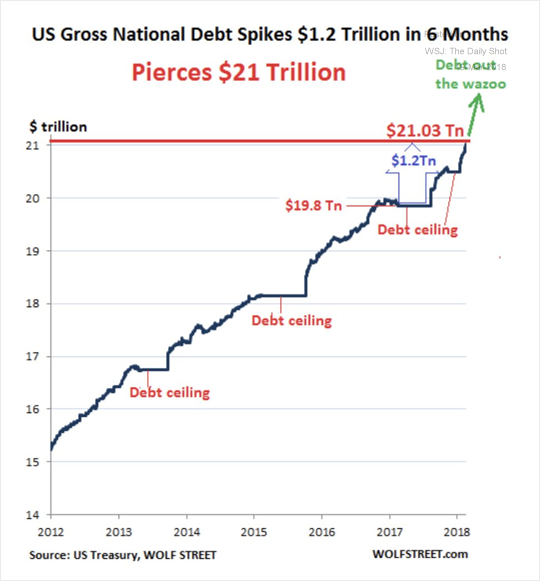

1.The United States: The federal debt has jumped $1.2 trillion since the debt ceiling has been lifted.

Source: @trevornoren; Read full article

From The Daily Shot

Source: @trevornoren; Read full article

From The Daily Shot

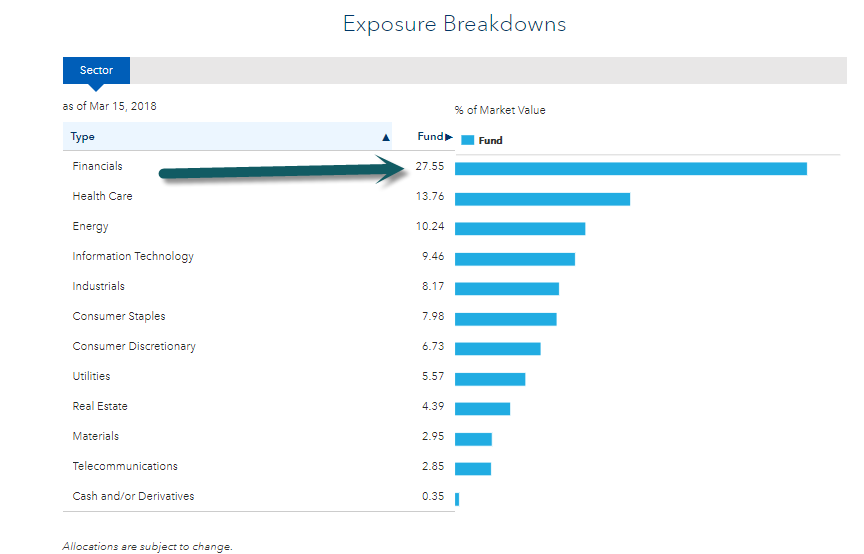

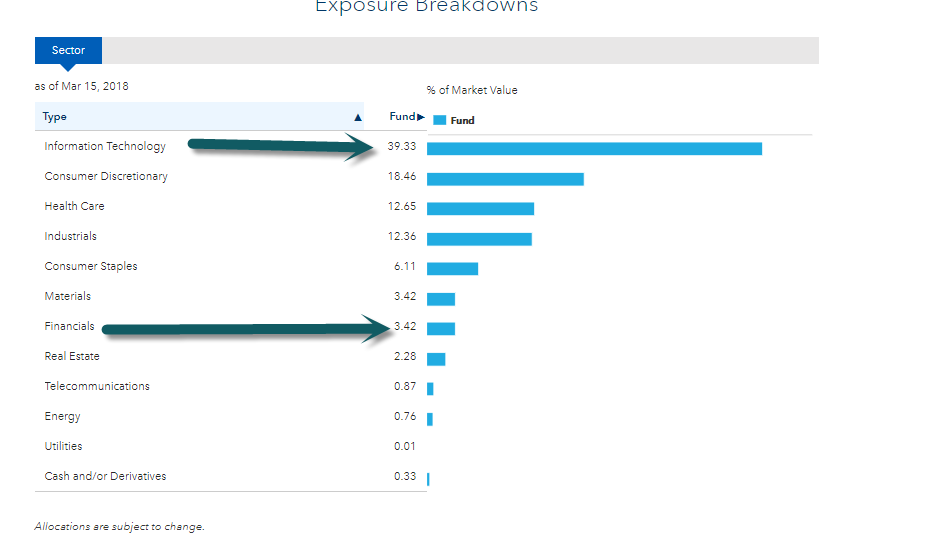

https://www.ishares.com/us/products/239708/ishares-russell-1000-value-etf

As for Treasuries themselves, they have settled into a new trading range after an almost 1 percentage point increase in the 10-year yield from September to late February. That stability has kept it from retesting the 3 percent level for now, a move above which is seen as a risk to many markets.

— With assistance by Andrew Janes, and Joanna Ossinger

https://www.bloomberg.com/

Wages: Same As It Ever Was?

03/14/2018

Kevin Flanagan, Senior Fixed Income Strategist—Wisdom Tree

The jobless rate remained at 4.1% for the fifth consecutive month, which is the low watermark for this expansion. The alternate measure of job creation, civilian employment, has been surging thus far in 2018, producing a two-month average of just under +600,000.

Let’s turn our attention to wages. Average hourly earnings (AHE) rose at an annual rate of +2.6% in February, following a downward revision of 0.1 percentage points for the prior month. In other words, the +2.9% surprise to the upside in January has now been dialed back a bit to +2.8%. Remember, one of the lynchpins behind the rise in the UST 10-Year yield this year was an increase in inflation expectations, led by said “January surprise.” The current pace leaves wages essentially “stuck in the mud,” at least for the time being, illustrated by the fact that the average year-over-year increase over the last two years has been that same +2.6% (see the graph).

So, when will that jobs trend translate to higher wages? According to the new Fed chair, a key force behind the frustrating lack of significant progress has been the result of “the weak pace of productivity growth in recent years.” Powell also stated that given the economic backdrop and strong job creation, he expects to see wages rising. This line of reasoning is definitely justified, but thus far, the results have been lacking. Nevertheless, there does seem to be an expectation that later this year, the annual rate of increase for AHE will eventually hit, and possibly eclipse, the +3.0% threshold. The bottom line is that, barring any unforeseen circumstances, the Fed will not be dissuaded from raising interest rates this year, a development expected for next week’s FOMC meeting.

Wisdomtree Blog

https://www.wisdomtree.com/blog/2018-03-14/wages-same-as-it-ever-was

Posted by lplresearch

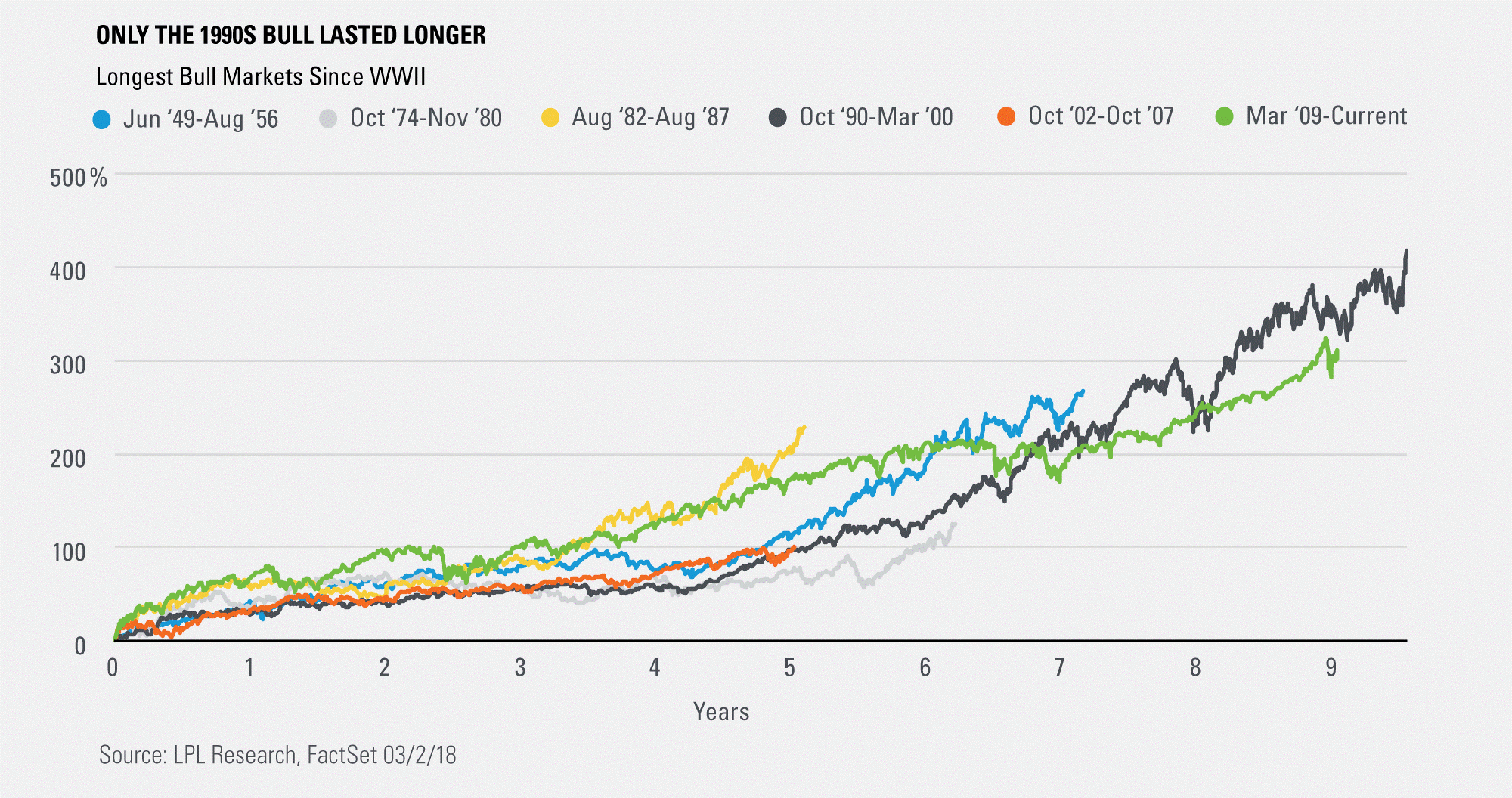

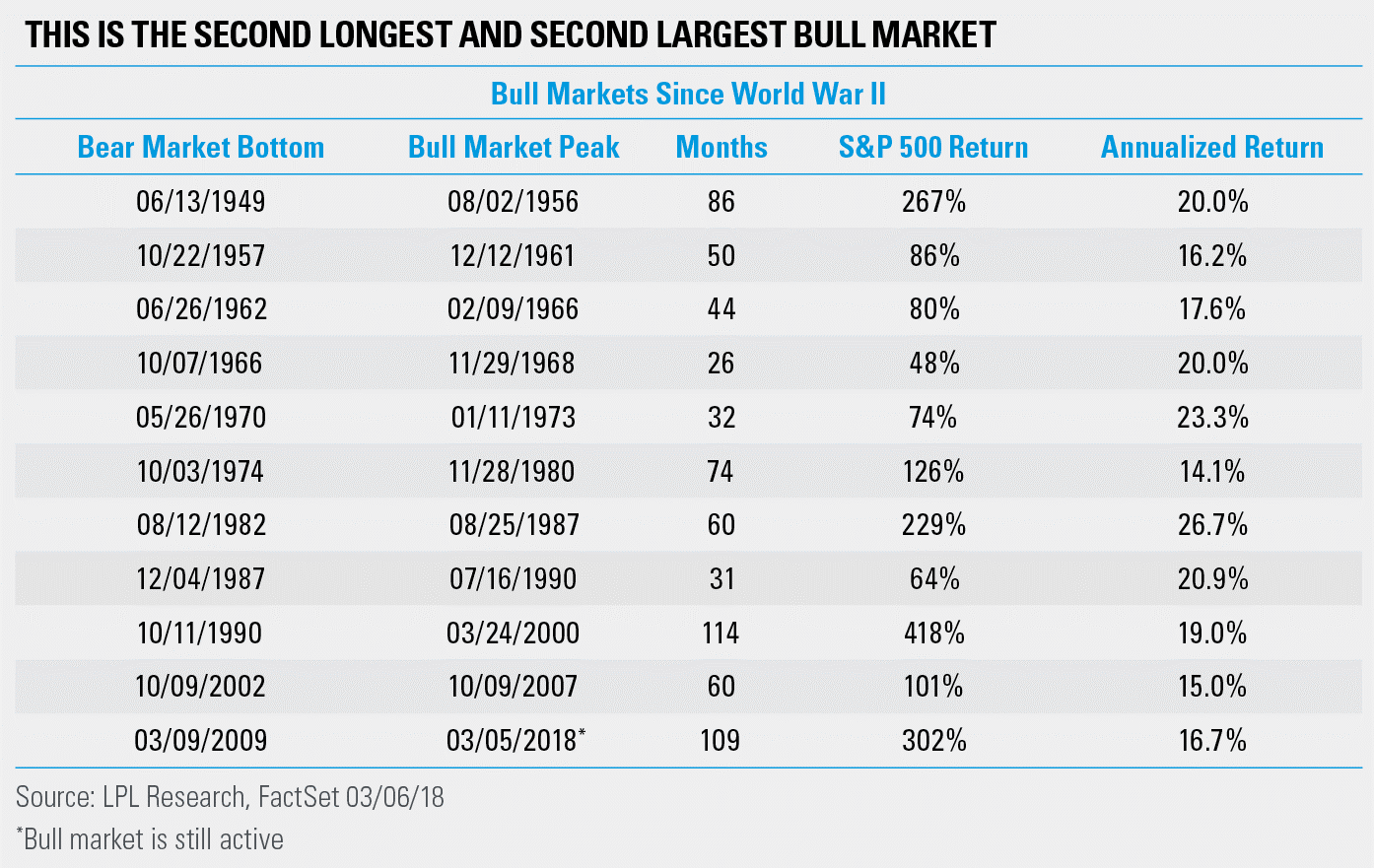

We shared the following chart in our latest Weekly Market Commentary, “The Bull Is 9, Can It Make 10?”, which shows that this is the second largest and second longest bull market ever—with only the ‘90s bull standing in the way of the record books.

https://lplresearch.com/2018/03/07/where-does-this-bull-market-rank/

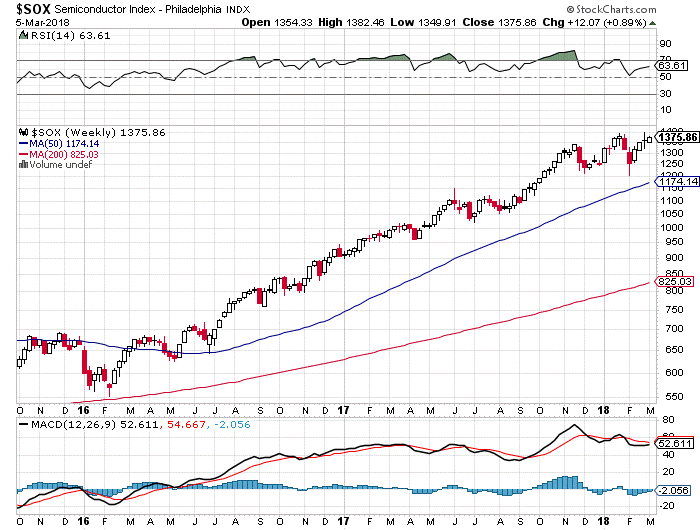

January sales of semiconductors topped records marking a year and a half of consecutive monthly gains, according to the Semiconductor Industry Association in a statement late Monday. January chip sales rose 22.7% to a record $37.6 billion, SIA said. Year-over-year sales in the Americas saw the largest rise with a gain of 40.6%, followed by Europe with a 19.9% rise, “Asia Pacific/All Other” seeing a 18.6% rise, China gaining 18.3%, and Japan rising 15.1%. “After notching its highest-ever annual sales in 2017, the global semiconductor industry is off to a strong and promising start to 2018, posting its highest-ever January sales and 18th consecutive month of year-to-year sales increases,” said John Neuffer, SIA president and chief executive, in a statement. Over the past 18 months, the PHLX Semiconductor Index SOX, +0.89%has grown 71%, compared with a 24% gain by the S&P 500 index SPX, +1.10% and a 39% gain on the Nasdaq Composite Index COMP, +1.00%