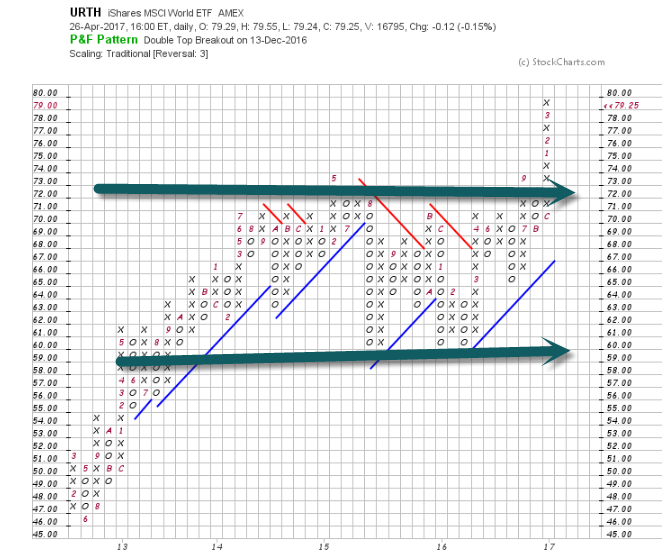

1.MSCI World Index Hits New Highs After 4 Years of Sideways.

Do Global Equities Stink No More?

MSCI World ETF—2013-2017 Sideways Now Breakout.

www.stockcharts.com

2.Remember When Jeff Gundlach Said “It’s Over” if Deutsche Bank Breaks $10…It Hit $11 at Lows Before Bouncing to $20.

Earnings Last Night……

DB Chart bounce off 2016 scare

Deutsche Bank profit more than doubles

Deutsche Bank profit more than doubles

Published: Apr 27, 2017 2:13 a.m. ET

JENNYSTRASBURG

Deutsche Bank AG on Thursday reported a solid rise in net profit in the first quarter, in its first results since its $8.5 billion capital increase.

The German lender reported net income of EUR575 million ($627 million) in the quarter, compared with EUR236 million for the same period last year and in line with expectations.

Revenue was EUR7.3 billion, a 9% decrease from last year. Revenue was roughly flat when adjusted for the impact of credit spreads.

The results are Deutsche Bank’s first since it completed an $8.5 billion capital increase earlier this month in conjunction with strategic changes announced in March.

The fundraising, Deutsche Bank’s third sale of new shares since 2013, put to rest many investors’ immediate concerns about the lender’s capital buffers. The bank is also reuniting its corporate-finance and deal-advisory business with its trading unit under two investment-banking co-heads, less than two years after splitting the businesses apart.

Chief Executive John Cryan said in a statement that cost-cutting efforts are paying off, and “asset flows are returning across the bank.” Deutsche Bank suffered client defections in the third and fourth quarters of 2016 amid concerns about its capital buffers and pending legal settlements.

Debt-trading revenue increased, particularly in interest rates and credit trading, while stock-trading revenue declined largely due to late-2016 outflows of clients in the bank’s prime-services unit, which finances trades for hedge funds and other clients. Deutsche Bank also was hurt by higher costs to fund its trading and client-financing businesses.

Investment-banking revenue was mostly unchanged. The process of cutting clients in some areas hit revenue slightly, as it has in recent quarters. Asset-management revenue declined, while revenue increased in the private and commercial client banking business.

Write to Jenny Strasburg at jenny.strasburg@wsj.com

http://www.marketwatch.com/story/deutsche-bank-profit-more-than-doubles-2017-04-27-24851353

3.Credit Suisse was Second Watch List Bank to DB….60% Bounce and Raising Capital.

Credit Suisse Will Raise $4 Billion to Address Capital Concerns

By CHAD BRAYAPRIL 26, 2017

Continue reading the main storyShare This Page

LONDON — Credit Suisse said on Wednesday that it would raise $4 billion through a share sale, part of efforts by the bank to restructure and address longstanding capital concerns.

The move is a further step in attempts by Tidjane Thiam, the lender’s chief executive, to shift its business model away from riskier, capital-intensive trading and banking. First-quarter earnings released on Wednesday appeared to validate the strategy, as the company returned to a profit.

The Swiss lender, which has large operations in London and in New York, has shrunk its investment bank and is placing greater emphasis on its wealth-management business, particularly in Asia and in other emerging markets.

Mr. Thiam, who joined Credit Suisse in 2015, announced plans in October of that year to raise $6.3 billion in capital and to reduce the bank’s costs by billions of dollars by the end of 2018. The company said at the time that it might need to raise as much as 11 billion Swiss francs, or about $11.1 billion, to complete its restructuring.

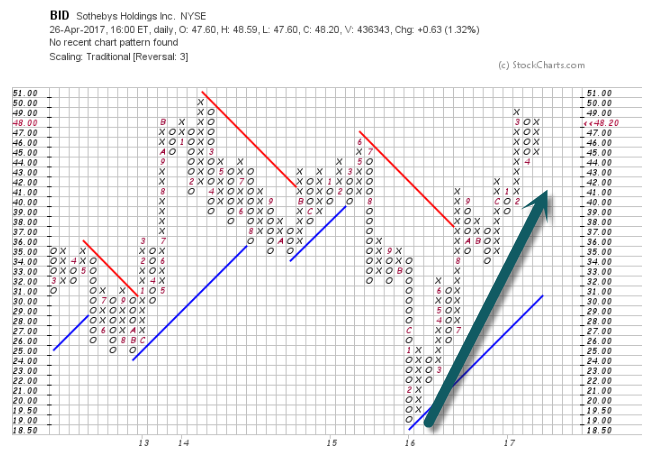

4.As Global Markets Lead this Year…Sotheby’s About to Make New Highs.

Global Ultra Wealth Watch Stock—BID

Sotheby’s 157% Move Off Bottom in 2016

www.stockcharts.com

www.stockcharts.com

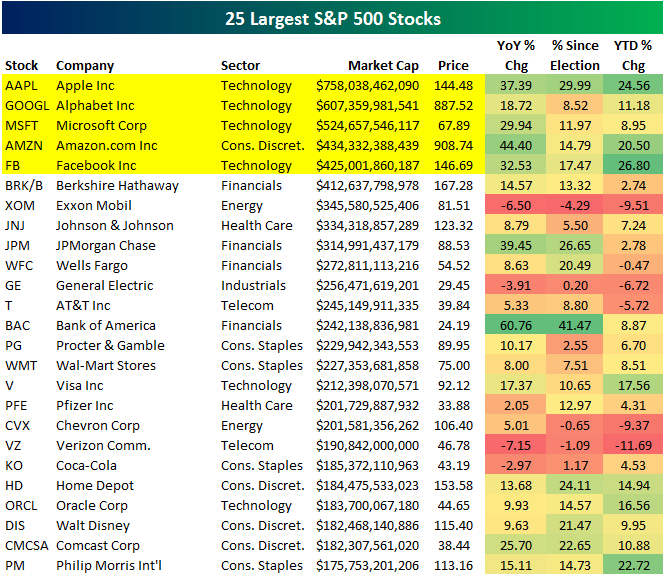

5.Mega-Tech Market Cap Swells to $2.75 Trillion

Apr 26, 2017

The five largest stocks in the US equity market are now Technology stocks, and together they make up more than $2.75 TRILLION in market cap. (While Amazon.com’s official sector categorization is Consumer Discretionary, we consider it Tech first and foremost.)

Below is a list of the 25 largest S&P 500 stocks (through 4/25/17). The top five are highlighted in yellow — Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon.com (AMZN), and Facebook (FB). It wasn’t long ago that Exxon Mobil (XOM) was the largest stock in the world, and prior to that, it was General Electric (GE). Now XOM ranks 7th and GE ranks 11th. Brick-and-mortar behemoth Wal-Mart (WMT) also used to rank in the top three, but it has slipped all the way down to 15th with a market cap that’s just over half the size of online competitor Amazon.com.

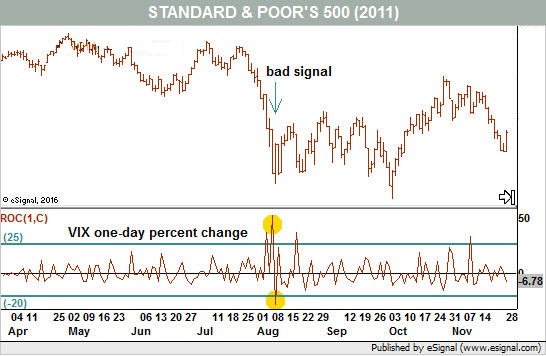

6.Follow Up to Yesterday…What Happens After a VIX Big One Day Drop.

Over the past three decades, a big one-day decline in the VIX usually led to several weeks, if not months, of gains for stocks.

We can think of it as a sudden surge in optimism following a rough patch in the market. Often, we will see a technical correction end at the same time, so we don’t know which is the chicken and which is the egg. Luckily, it doesn’t matter.

For example, in mid-2016 the market struggled and eased lower in a choppy manner. Uncertainty ahead of the election certainly played a role, but when the VIX fell, the malaise ended and the Trump Rally was born.

We can see examples in both bull and bear markets. In March 2008, when the financial crisis was still in full effect, the VIX fell 20% in one day—and that kicked off a two-month rally.

There is one caveat with using big down days in the VIX as a buy signal. If they occur soon after a spike higher, the signal is not good. In August 2011, the VIX fell 27% one day after spiking higher 50%. The market remained volatile and did not pull itself higher until October (see Chart 2).

Read Full Story at Barrons

Read Full Story at Barrons

http://www.barrons.com/articles/a-low-vix-signals-more-stock-market-gains-1493237236?mod=BOL_hp_highlight_3

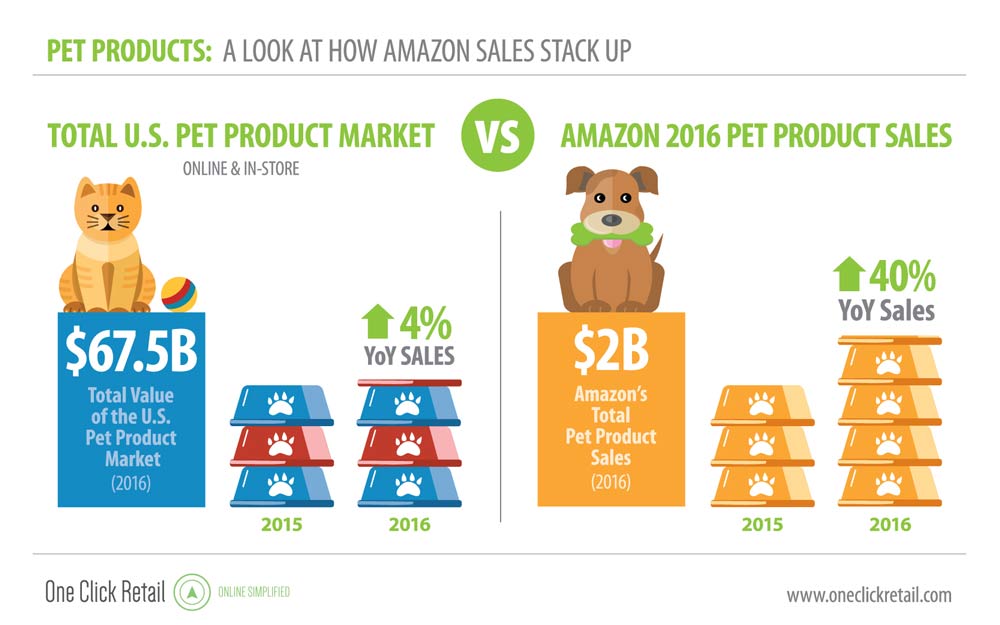

7.$67B U.S. Pet Products Market Meets Amazon….The Math Below Equates to Just Amazon’s Pet Division Holding $4B Market Cap.

This was fairly interesting. David Lenhardt feels Blue Buffalo well positioned to benefit from growing online sales. It also means AMZN gained $4b+ in market cap from pet food sales if you believe the valuation of the private company Chewy. It’s a few good pieces of information and he suggests using BUFF for a view into retail online sales.

This was a HY credit call by ex – Petco CEO. I just found it an interesting look in retail in general including AMZN, BUFF, TGT, and private company Chewy.

Pet online retail sales are 4%-6% of the overall $46b pet product industry. Blue Buffalo is aggressively pursuing this channel with Amazon and Chewy.

Chewy online pet Start up with launched in 2012 with sales of $26m now has revenues of $900m in 2016 with a valuation of $4b. They are on track to and on track to book $1.5b in 2017. Chewy represents 43% of the online sales vs. Amazon’s 48% of pet food and litter in the U.S. They have yet to turn a profit. (http://www.forbes.com/sites/susanadams/2017/01/10/the-man-who-found-gold-in-dog-food/#38e88f135b0e).

Amazon – represents 48% of the online pet sales so the math suggests with that Amazon added $4.2b in market cap from pet food sales alone from 2012-2016. Chewy was valued by Forester Research at $4b.

· https://www.citivelocity.com/t/eppublic/122KT

8. Private equity real estate fund managers currently hold a record $247 billion of dry powder,

Preqin: Global Private Equity Real Estate Deal Flow Declines in 1Q 2017

North America sees downturn of deals, while Europe posts highest aggregate total since 1Q 2016.

Global private equity real estate deal flow declined in the first quarter of 2017, compared to 4Q 2016, according to Preqin data. Nearly 568 deals reflecting a combined total of $38 billion in assets were completed by the end of March, a 33% decrease in total deal size compared to the previous quarter. The aggregate deal value was the lowest recorded since the first quarter of 2014.

“Certainly, a climate of high valuations and intense competition are not aiding fund managers as they search for assets that offer the potential of outsized returns,” Andrew Moylan, head of real estate products at Preqin told CIO. “Furthermore, uncertain macro-economic conditions on either side of the Atlantic have seen many managers adopt a wait-and-see approach with the market still experiencing some volatility.”

While North America saw a downturn in deals, European deal flow was on the rise, with 205 transactions worth a combined $15 billion for the quarter. This was the highest aggregate total recorded since the end of the first quarter of 2016. About 63% of investors current consider Europe as offering the most attractive real estate investment opportunities.

In terms of sectors, office assets saw an uptick in demand, while capital committed to residential properties halved relative to the previous quarter. Value-added followed by opportunistic and distressed-oriented funds attracted the greatest amount of capital during the quarter.

Going forward, more than half of institional investors surveyed by Preqin expect to allocate $100 million or more to private real estate funds in the next 12 months. Nearly 57% plan to commit to at least four or more funds in this time period.

Moylan also remains bullish on investor appetite for private equity real estate.

“Private equity real estate fund managers currently hold a record $247 billion of dry powder, and two-thirds of those surveyed at the end of 2016 stated that they intended to increase their investment activity over the course of 2017,” he said.

“As such, it seems likely that deal flow will increase as the year progresses and managers continue to adapt to current market conditions. The obstacles that inhibited activity in Q1 will not disappear, but fund managers do still believe there are attractive opportunities in real estate, despite these challenges.”

Preqin: Global Private Equity Real Estate Deal Flow Declines in 1Q 2017

9.Read of Day…..4 Lessons Learned From Training Successful Traders

Team Trading

This piece was co-authoed by Mike Bellafiore and Steve Spencer, co-founders and partners of SMB Capital.

Every week we hear from aspiring traders asking how they can best pursue their success. In this article, we would like to share insights we’ve gained through our collaboration at SMB, a proprietary trading firm in New York.

Each of us has been involved in the training of professional traders for well over a decade. Over that time, we have learned a great deal about factors that make for trading success and failure. Our overriding takeaway is that the development of trading expertise is not so different from the development of elite performance in other fields, such as athletics and chess. It follows from a sustained developmental process.

Unfortunately, aspiring traders find few structured outlets for professional development. Whereas first-class athletic teams and chess organizations cultivate talent through years of development (high school and college competition, youth leagues, tournaments for performers at different talent levels), there are few comparable developmental platforms for young people seeking to build knowledge and skills in financial markets.

One result of this lack of developmental focus is a high failure rate, especially among active traders. Studying the investing performance of all traders in Taiwan, Barber and colleagues found that the group lost an average of 3.8% per year and 2.8% of personal income. Moreover, evidence suggests that traders do not learn from their losses, with the majority of those losses coming from experienced traders with a history of prior losses. A review of research finds that traders demonstrate cognitive biases and trading patterns that lead them to underperform market averages.

Still, our years of experience have also taught us that trading success exists across diverse ways of attacking markets and indeed can be cultivated through structured programs of development. The best known example of this has been the development of Tiger Cub money managers springing from Julian Robertson’s Tiger Management. Close mentoring and the development of a distinctive investment style led to superior returns over a period of years. Similarly, successful investment banks such as Goldman Sachs have cultivated talent by creating an internal university that facilitates personal as well as professional development. Smaller firms, such as the one where we collaborate, run internship and training programs that provide hands-on learning and skills development, much as occurs at minor league, developmental baseball clubs.

So what distinguishes the successful training efforts of financial organizations? Our experience points to four distinctive elements:

1. A structured curriculum – Medical schools offer an unusually clear view of the development of talent in performance domains. Every year, graduate programs of medical education produce competent professionals in fields as different as surgery, psychiatry, and internal medicine. Training begins with an undergraduate curriculum focused on basic science education. It then proceeds to observation and practice under experienced physicians followed by training in specialty fields. The curriculum thus addresses both knowledge and skill development, with sufficient time to cultivate high levels of skill. We have found it helpful to move new traders through three training programs in the first year, starting with a foundation of knowledge and proceeding through skill development in closely supervised simulated and live trading.

2. The integration of mentoring and coaching – Consider successful athletic organizations in college basketball and football as well as professional sports. The most successful coaches act as teachers and mentors, structuring practices to drill skills but also addressing the psychological aspects of performance. In the Department of Psychiatry where Brett teaches, psychiatry residents learn psychotherapy by video recording their sessions and replaying them with different supervisors. The review of the “tapes”, similar to the film reviews basketball and football teams conduct to prepare for upcoming games, facilitates mentoring of skills and the coaching of the performer’s own psychology. We have found it helpful for traders to send daily reviews to both a mentor/teacher and a performance coach, so that each day serves as professional and personal learning.

3. The organization of learning in teams – We have been struck by the success rates of efforts to train traders within the context of trading teams. Inexperienced traders taught basics and then left to learn on their own have a much lower success rate than those trading daily with their mentors and colleagues. Hedge Fund titan Kenneth Griffin Citadel, at Milken Institute Global Conference 2015, said, “Frankly you can’t succeed today in the markets unless you’re a part of a great team.” We agree. In medical education, the team concept is captured in the phrase “each one teach one.” Advanced medical students participate in training the beginners; interns supervise the advanced students; advanced residents supervise the interns; and attending physicians supervise the advanced residents. When each student is also a teacher, learning opportunities are multiplied. For example, we have seen particular success with junior traders building technology for senior traders to expand trading opportunities, while senior traders share their expertise with junior traders with respect to exploiting those opportunities. Similarly, junior traders who have mastered a specific trade setup may work narrowly with trainees on this opportunity, much as senior medical students mentor more junior ones in focal areas of experience.

4. Data based recruitment of talent – Success in performance fields starts with raw talent and proceeds with skill development through deliberate practice. Successful organizations recruit talent to ensure they are building on a solid base. Professional sports teams, for example, will measure the speed and athletic skill of prospective players. One joins an Olympic team only after having demonstrated prior success and development. Our internal research finds that unique cognitive and personality strengths distinguish traders with different strategies: successful investors are unlike successful daytraders; successful traders of macro markets are different from successful market makers and product specialists. One trader we work with is so fast with trade execution that a market making firm needed to place ‘guard rails’ on the firm’s order flow, as that trader was implementing decisions more quickly than their system could handle. A trader like this should gravitate toward short-term strategies that reward fast thought and action. Development is accelerated when training begins with students who possess the strengths required by their specific performance domains.

So what does this mean for aspiring traders? One important implication is that silos don’t work. Each one, teach none is a formula for failure. The aspiring trader should look for training within organizations that actively foster the development of new talent. Learning curves are greatly accelerated through mentoring, coaching, and teamwork.

A second implication is that trading truly is like medicine or sports, embracing many distinctive performance domains. What makes a good basketball player is different from what makes a good gymnast. What makes a great surgeon is not what makes a superior psychiatrist. Training programs not only impart knowledge and skills; they also facilitate self-discovery. Even within basketball or gymnastics, one typically specializes in particular positions or events. In a medical specialty such as psychiatry, one may find a focus in psychopharmacology, psychotherapy, or child and family intervention. Via training, we discover where our passions and talents lie, and we cultivate those through structured learning, mentoring, and coaching with other specialists. Much of trading success consists of finding one’s niche within financial markets.

In short, the aspiring trader is best served by not trying to go it alone. Young athletes don’t try to make the Olympics on their own; nor do they join professional sports teams that way. Early career talent requires well structured developmental platforms that turn potential into performance. Those platforms exist at hedge funds, investment banks, and proprietary trading firms–and they are succeeding.

https://www.forbes.com/sites/brettsteenbarger/2017/04/25/lessons-learned-from-training-successful-traders/print/

10.7 Genius Ideas From My Genius Network

Practice what you preach, take action on what you teach.

I’m constantly telling you to keep learning, join Masterminds, and hang around people that make you play up a level in life.

And you better believe that I do the same.

One of my coaching investments each year is Joe Polish’s Genius Network Group. It’s $25,000 and I get a 10X idea at every meeting. Bedros is in the group, too.

Now, of course, I can’t reveal the biggest ideas I get at each meeting because that wouldn’t be fair to Joe or the other members, but today you’re getting 7 Genius Ideas from the group that can make a big difference in your life.

The first one alone, from my old friend (I met this kid when he was only 20 years old at an Underground Online event in 2009!) and new Genius Network member, Alex Maroko, can give your website a serious lift in traffic and sales. Enjoy them all! – CB

#1 – The “Alex 8-Way” Multi-Media Domination Formula from Alex Maroko

1. Film a 10-minute YouTube video.

2. Pull out a killer 30-second clip and make that into a 2nd YouTube video.

3-6. Take two highlights from the YouTube video and turn that into 2 Instagram videos and 2 Facebook videos.

7. If you have a blog, have an editor take the video and turn it into a high-value blog post, with both the video and transcript/editor commentary.

8. Finally, add a Call-To-Action to the end of the video, embed it on a page with a button below the video and send email traffic to it for a related offer.

#2 – Outsourcing Part I from Joe Polish

As you’re going through your day, keep a log of everything you’re doing that someone else can do. Try GetMagic.com as an on-demand personal assistant service.

#3 – Outsourcing Part II from Joe Polish

Find those who already know what to do. If you find these people, you don’t have to figure out what to do on your own. Who is the ‘who’ that knows how to do what you want? Identify what needs to be done and who already knows how to do it.

#4 – You Lose Nothing and Gain Profit If You Raise Your Prices from Joe Polish

If you raise your prices 10% you can lose as much as 40% of the business you have and still maintain the same net bottom line profit.

#5 – Simple Sales Strategies From Joe Polish

Make your offer risk free. If you take away the risk, you remove the fear, and then people will buy.

#6 – Ruthless Social Media Advice From Joe Polish

When it comes to email and social media, use it on other people; don’t let other people use it on you.

#7 – Build a Perfect Day Based on Your Pyramid of Values So You Have a Perfect Life

“People and experiences are the things that matter the most, not money and stuff. I live by one phrase: Make the right decision for your right life right now and always.” – Craig Ballantyne => http://www.perfectlifeworkshop.com