1.Chinese Investment in the US Drops 90% Amid Political Pressure

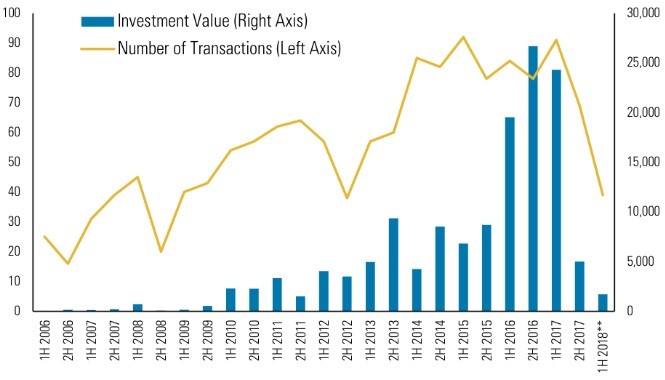

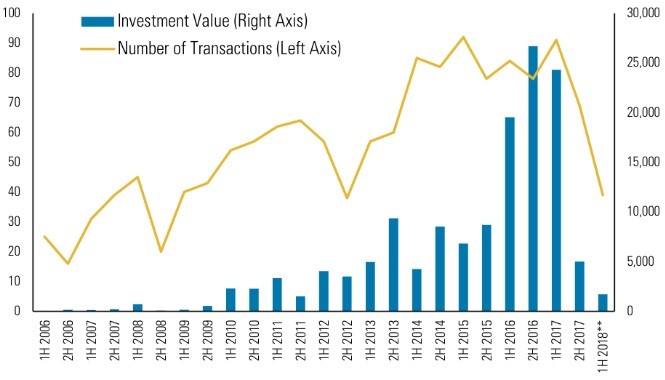

- Chinese acquisitions and investments in the U.S. fell 92 percent to just $1.8 billion in the first five months of this year, consulting and research firm Rhodium Group says.

- Counting divestitures, net Chinese deal flow to the U.S. during that time was a negative $7.8 billion, the report says.

- Beijing is trying to limit capital outflows and excessive leverage, while the Trump administration is increasing scrutiny of Chinese investments in the U.S. amid concerns about intellectual property protection.

Evelyn Cheng | @chengevelyn

The decline follows a sharp drop in the second half of last year as pressure from both Beijing and the Trump administration curbed a recent surge in cross-border investment. Completed Chinese deals in the U.S. hit a record $46 billion in 2016, and dropped to $29 billion in 2017, according to Rhodium.

Completed Chinese FDI deals in the US* in $ millions (2006-2018)

Source: Rhodium Group. *Includes completed M&A transactions with over 10% resulting stake and greenfield projects that have broken ground. **January to May 2018.

https://www.cnbc.com/2018/06/20/chinese-investment-in-the-us-drops-90-percent-amid-political-pressure.html

Continue reading →