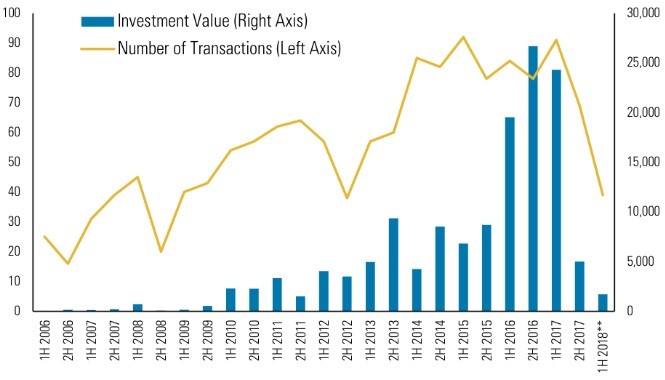

1.Chinese Investment in the US Drops 90% Amid Political Pressure

- Chinese acquisitions and investments in the U.S. fell 92 percent to just $1.8 billion in the first five months of this year, consulting and research firm Rhodium Group says.

- Counting divestitures, net Chinese deal flow to the U.S. during that time was a negative $7.8 billion, the report says.

- Beijing is trying to limit capital outflows and excessive leverage, while the Trump administration is increasing scrutiny of Chinese investments in the U.S. amid concerns about intellectual property protection.

The decline follows a sharp drop in the second half of last year as pressure from both Beijing and the Trump administration curbed a recent surge in cross-border investment. Completed Chinese deals in the U.S. hit a record $46 billion in 2016, and dropped to $29 billion in 2017, according to Rhodium.

Completed Chinese FDI deals in the US* in $ millions (2006-2018)

Source: Rhodium Group. *Includes completed M&A transactions with over 10% resulting stake and greenfield projects that have broken ground. **January to May 2018.

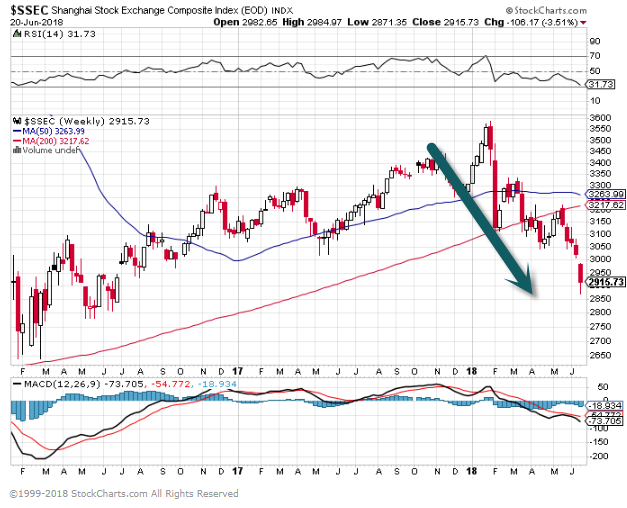

2.Shanghai Index Closing In On 20% Correction….-18.5% From Highs.

Shanghai Composite.

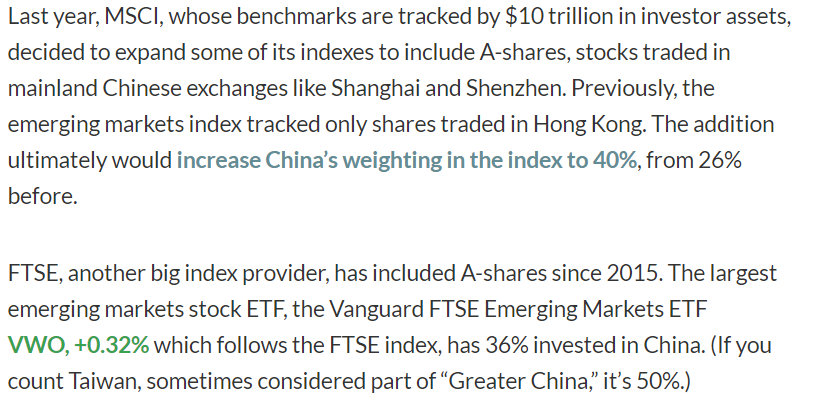

3.Keep In Mind China Now 40% Of MSCI Benchmark

Howard Gold Marketwatch

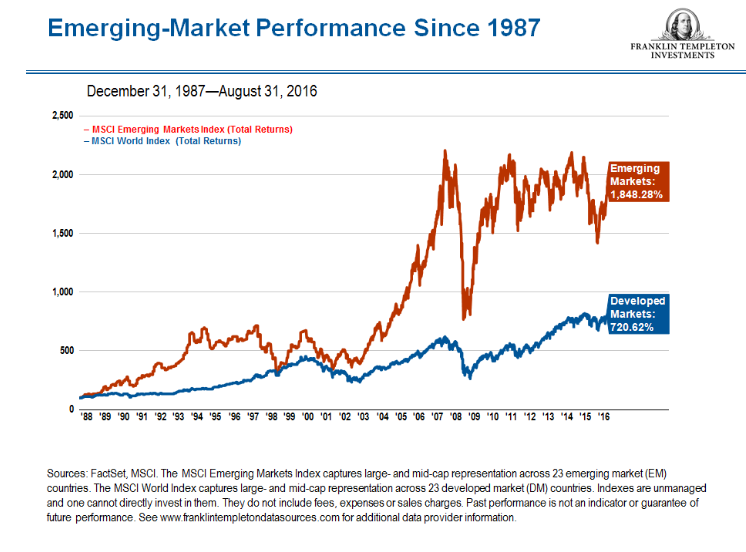

https://www.advisorperspectives.com/commentaries/2016/09/16/emerging-market-resilience

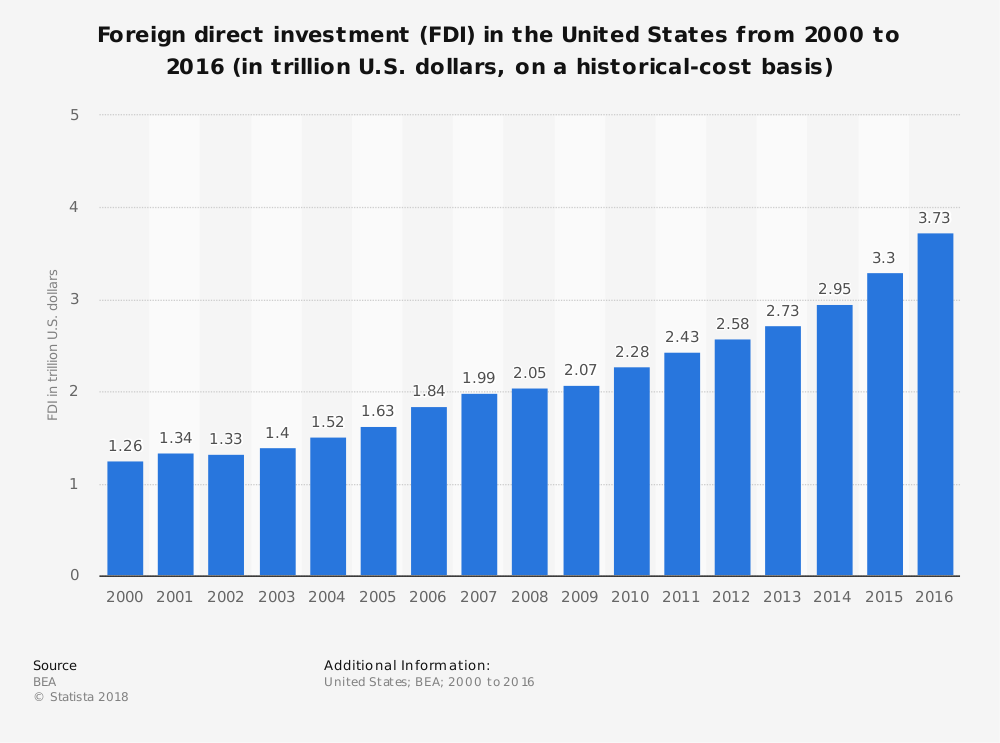

4.Total Foreign Direct Investment in U.S. Has Tripled Since 2000.

This statistic shows the value of foreign direct investment (FDI) in the United States from 2000 to 2016. In 2016, the total foreign direct investments in the United States amounted to approximately 3.73 trillion U.S. dollars.

Foreign Direct Investment (FDI) – additional information

https://www.statista.com/statistics/188870/foreign-direct-investment-in-the-united-states-since-1990/

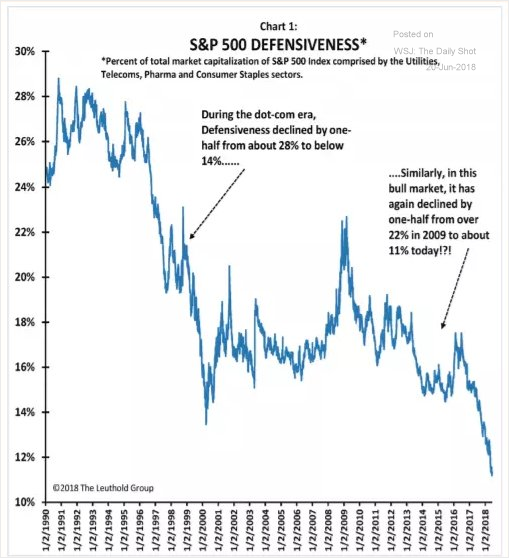

5.As Tech Weightings In Indices Move Higher Defensive Sectors Cut In Half.

5.As Tech Weightings In Indices Move Higher Defensive Sectors Cut In Half.

Equity Markets: The relative weight of defensive stocks (such as utilities) in the S&P 500 continues to trend lower.

Source: @johnauthers, @financialtimes;

Read full articlehttps://blogs.wsj.com/dailyshot/

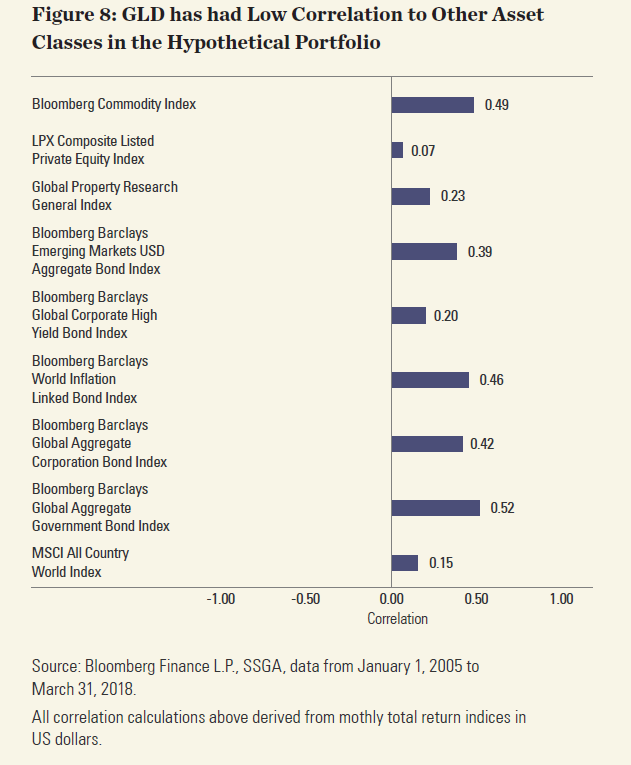

6.Gold Has Real Negative Correlation To Most Asset Classes.

SPDR BLOG

https://global.spdrs.com/blog/

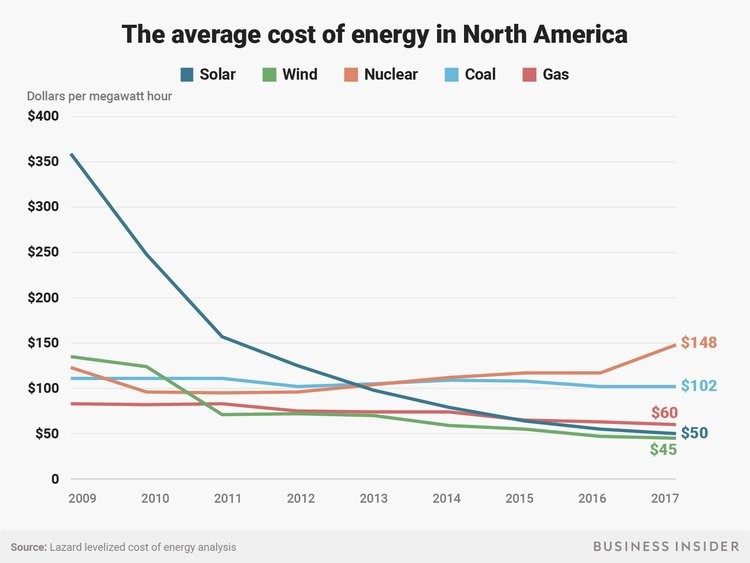

7.The Average Cost of Energy in North America.

A recent report from the investment bank Lazard showed that the cost of producing one megawatt-hour of electricity — a standard way to measure electricity production — fell to around $50 for solar power in 2017. The cost of producing one megawatt-hour of electricity from coal, by comparison, was $102 — more than double the cost of solar, according to Lazard’s math.

Shayanne Gal/ Business Insider

In the first quarter of 2018, solar accounted for 55% of all US electricity added, according to a new report from the Solar Energy Industries Association. That’s more than any other type of electricity.

Batteries are also getting cheaper and more efficient at storing power from renewable sources, which are inherently less regular than the burning of gas or coal.

A new report shows where our energy will come from 30 years from now — and coal is the biggest loser

Jeremy Berke

http://www.businessinsider.com/energy-report-suggests-rise-in-renewables-as-coal-declines-2018-6

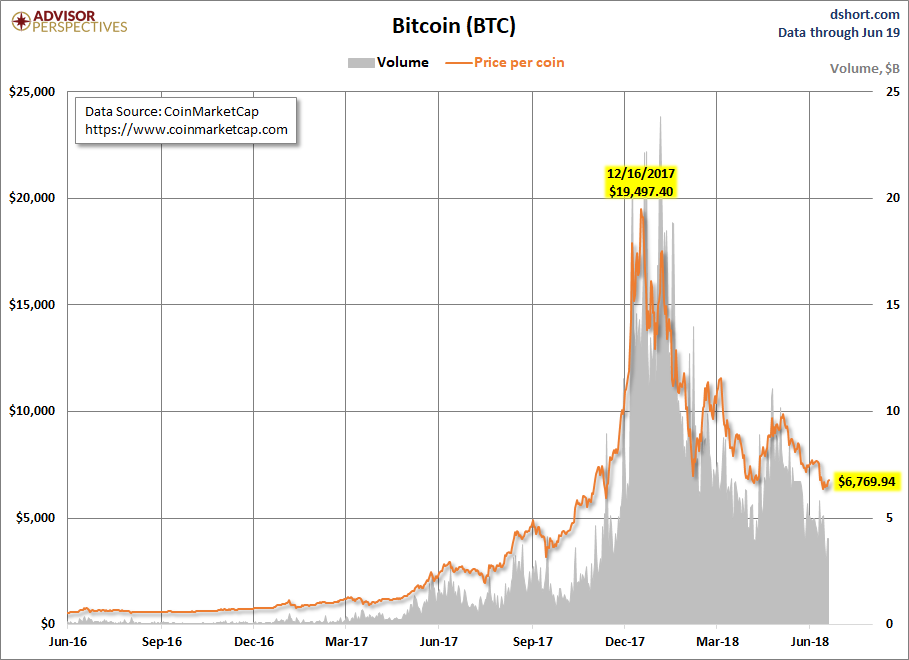

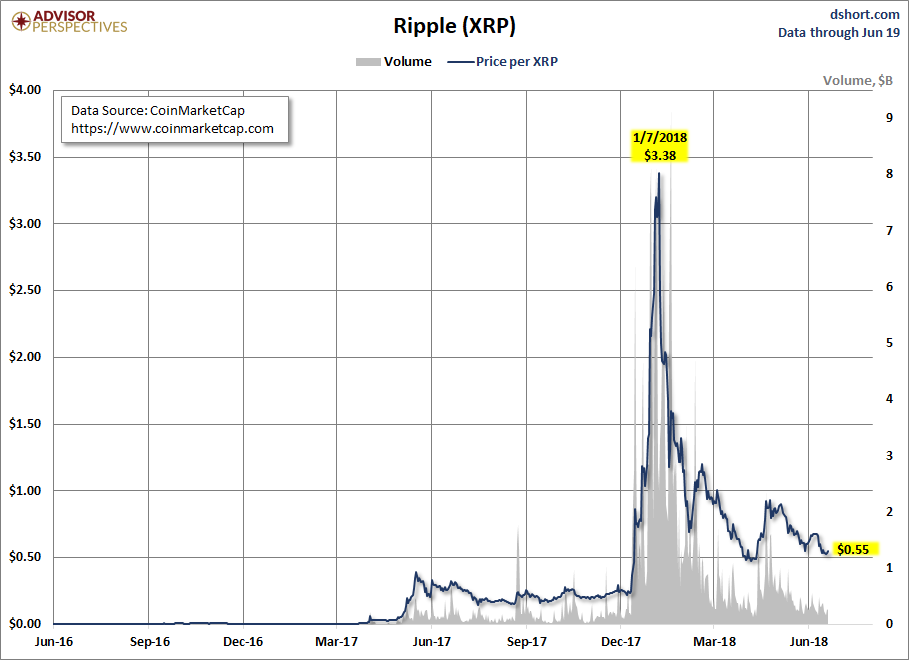

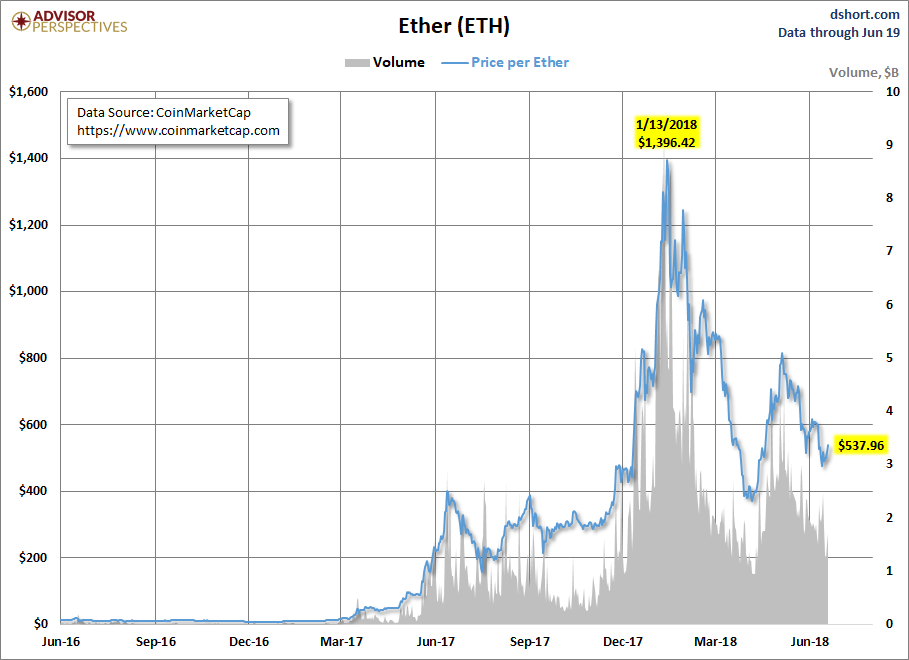

8.The Correction in 3 Largest Crypto Currencies.

https://www.advisorperspectives.com/dshort/updates/2018/06/20/the-three-largest-cryptocurrencies

9.Buffet, Bezos, Dimon New Healthcare Leader-Dr.Gawande.

Berkshire, Amazon, and JPMorgan Announce CEO for Healthcare Initiative

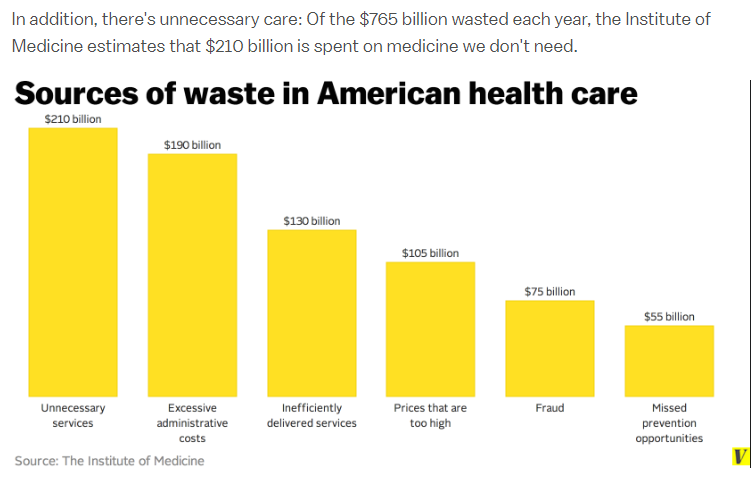

| In January, the real Avengers (Warren Buffett, Jeff Bezos, and Jamie Dimon) slapped on their skin-tight spandex and promised to take down the rising cost of healthcare in America.

What’s the plan? Offer a better health insurance program for their U.S. employees, built from the ground up and “free from profit-making incentives.” The details of what that’ll look like are still foggy, but one thing’s clear: re-imagining healthcare (with its sky-high drug prices and misaligned incentives) is a task for no ordinary CEO. Which is why the Avengers just announced their Super CEO: Dr. Atul Gawande Dr. Gawande is everything we’re not: A general and endocrine surgeon, professor at Harvard Medical School, staff writer for the New Yorker, author of four books (including the best-selling The Checklist Manifesto), and director at the World Health Organization. Besides having little business experience, Dr. Gawande seems to fit the bill to lead this long-term initiative—he’s often highlighted the unnecessary rise of healthcare costs in his work. In one New Yorker piece, he wrote:

He even called out his own clinic for unnecessary spending. Not the hero we want, the hero we need Here’s the deal with misaligned healthcare incentives: Now that more people have insurance under the ACA, there are more doctor visits. The docs can order more tests and treatments because they make more money and insurance will cover the costs. Insurance providers don’t care, because they just raise the premium families pay. And the cycle goes on…and on…

The only question that matters: Can Amazon, Berkshire, JPMorgan, and Dr. Gawande (a world-renowned thought leader in the healthcare space) finally break the cycle? |

https://www.vox.com/2014/9/2/6089693/health-care-facts-whats-wrong-american-insurance

10.Want to Hire Top-Notch Talent? Curiosity Beats Experience Every Time

It’s not what you know. It’s how quickly you can learn.

By Dom PriceWork futurist at Atlassian Software@DomPrice

Once upon a time, “20 years experience” was a good proxy for judging a person’s capabilities. At that time, the business world was quite predictable. Companies who made it into the Fortune 500 tended to stay there for about 30 years. The job you were doing in year 20 closely resembled the job you did in year one.

Today, appearances on the Fortune 500 list are much shorter – less than 20 years. Disruptive companies like Netflix, Airbnb, and Uber prove that the status quo is short-lived no matter what industry you’re in. And in today’s hiring environment, where remote-friendly technologies let us work anywhere anytime, scrappy start-ups can (and will) poach your top talent.

These factors have massive implications for any company looking to scale up.

Tenure matters less than you think

In a recent catch-up with Patty McCord, former Chief Talent Officer at Netflix, we debated the relative merits of hiring for initiative vs. tenure. The punch line? Initiative beats tenure almost every time.

With everything from programming languages to marketing best practices evolving so rapidly, there’s little point in hiring someone with 20 years experience in their role. Those first five (even 10?) years of experience are likely irrelevant today.

Now, before you brand me as ageist, understand that 20 years in the working world is a good thing–so long as those 20 years demonstrate an ability to anticipate and adapt. I once interviewed a candidate who explained “I’ve got 18 years work experience, but each year has been different.” Amazing.

A bit of restlessness and a willingness to start from scratch matter in today’s environment. The best thing about hiring fresh college graduates is that they don’t know what they don’t know, and will plow through barriers that others don’t even think to question.

Hire fully-formed adults

Seems obvious, doesn’t it? We’ve wrongly learned to associate adulthood with age, but it’s more about being resilient, humble, and a life-long learner. (Look around you. I bet you work with plenty of 20-somethings who are fully-formed adults, and a 40-year old who isn’t.)

When you hire adults and embrace cognitive diversity, you start to uncover smarter ways to serve your market. Empower them with the authority to make decisions and take calculated risks. They’re the ones who will demonstrate initiative and find innovative solutions to problems.

Org charts are broken

The traditional notion of “climbing the ladder” by accumulating your years of service is obsolete. Today, career development is more about lateral movement and accumulation of different skills. The ability to adapt quickly and thrive is more important than deep expertise in most cases.

Yet org charts are still vertical and hierarchical at most companies. If you look at highly innovative companies like Netflix and Airbnb, however, they operate on much flatter structures. Their org charts are customer-focused instead of functionally-focused. They understand that networks of teams coming together to serve the customer produce amazing results.

Don’t discount candidates that have worked in six different roles for three years each. The initiative demonstrated by all that lateral movement – and the breadth of experience that comes as a result – will serve your company well.

https://www.inc.com/dom-price/netflix-airbnb-uber-prove-hiring-for-experience-fails.html?cid=hmside3