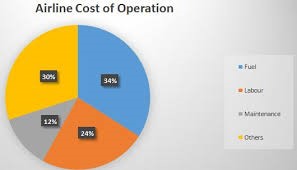

1.Airlines Fuel and Labor Costs Up.

XAL Airline ETF…15% Correction…50day thru 200day to downside.

2.Euro Financials Back Under Pressure.

EUFN Euro Financials ETF—Almost 20% Correction

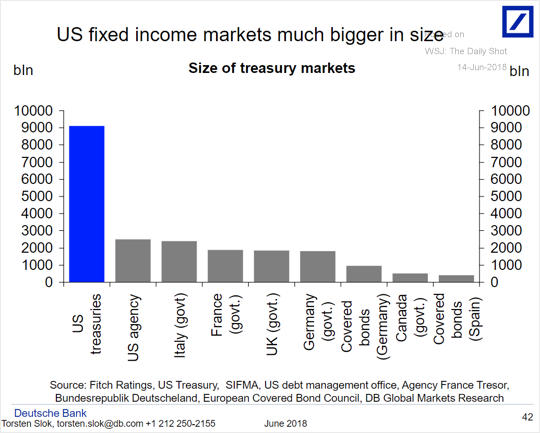

3.U.S. Massive Part of Global Fixed Income.

Rates: This chart shows the size of some of the largest fixed income markets globally.

Source: Deutsche Bank Research

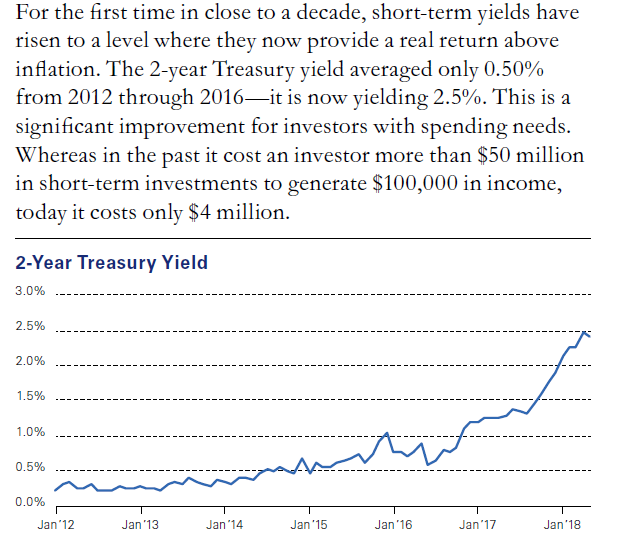

4.Generate $100,000 in Income Went From Needing $50m to $4m…Interesting Look at Rise in Short-Term Rates.

https://haverfordquality.com/wp-content/uploads/2018/06/HAVERFORD-2018-Summer-Outlook.pdf

5.Another Look at FAANG Dominance…700% Over Defensive Sectors.

Widsomtree

It’s been a great run thus far for the five “new economy” dynamos, their performance over the last half-decade nothing short of stellar. We unscientifically compiled a list of non-FAANG industries with the sole purpose of coming up with an off-putting acronym. The “SEPTICS” stocks are the anti-FAANGs—companies that have not taken the same road to riches in recent years. Comprising Specialty Retail, Electric Utilities, Packaged Foods, Tobacco, Insurance, Chemicals and Soft Drinks, this motley crew is the “who’s who” of industries that give little ammunition to braggarts. Between them, they encompass a not insignificant 83 of the S&P 500’s companies and 11.2% of the Index.2

This basket not only didn’t lose money but rallied more than 60% from December 31, 2012, to May 10, 2018. No matter; the FAANG stocks beat it by more than 700 percentage points (figure 1).

Figure 1: Cumulative Return Differential: FAANGs minus SEPTICS

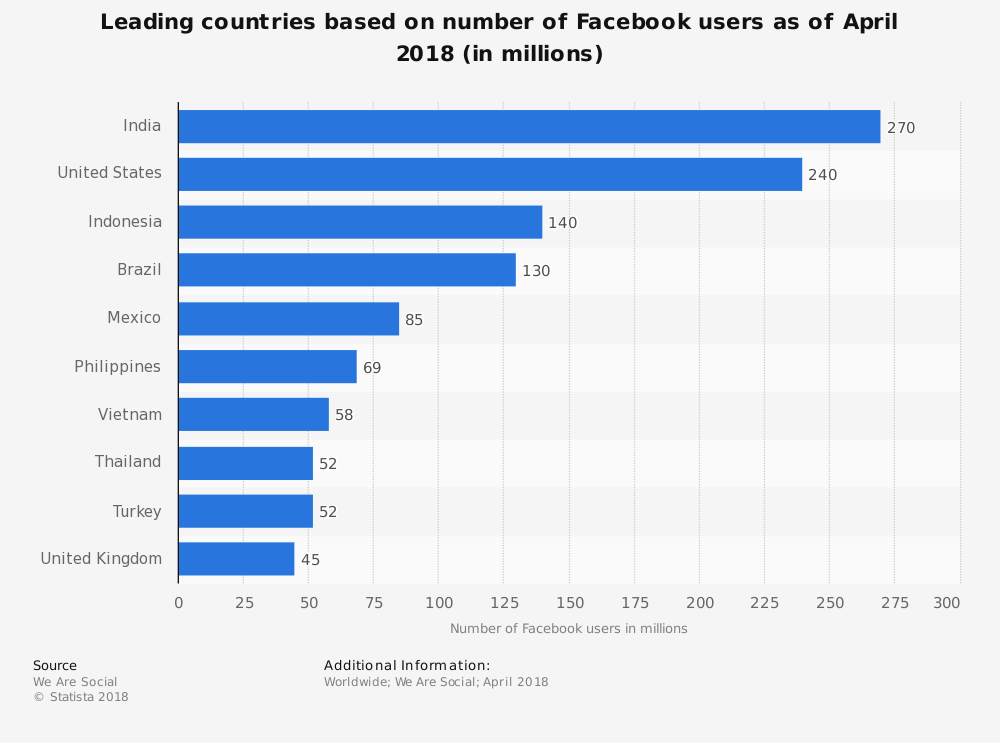

6.Facebook Added An Incredible 70m New Users in First Quarter….India Takes the Lead of U.S. in Number of Users.

https://www.statista.com/statistics/268136/top-15-countries-based-on-number-of-facebook-users/

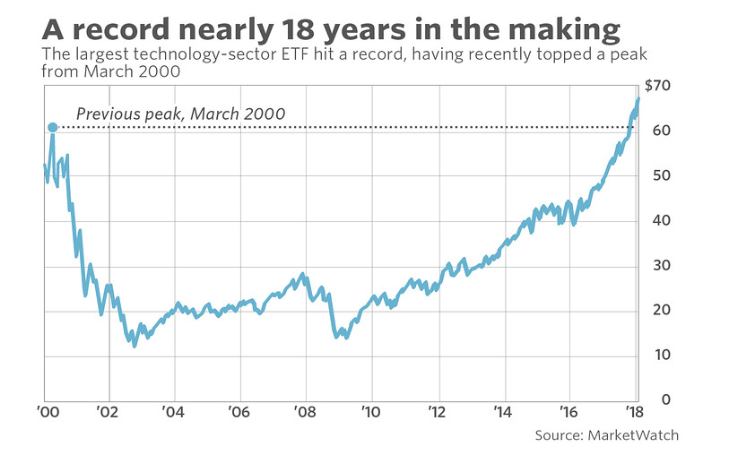

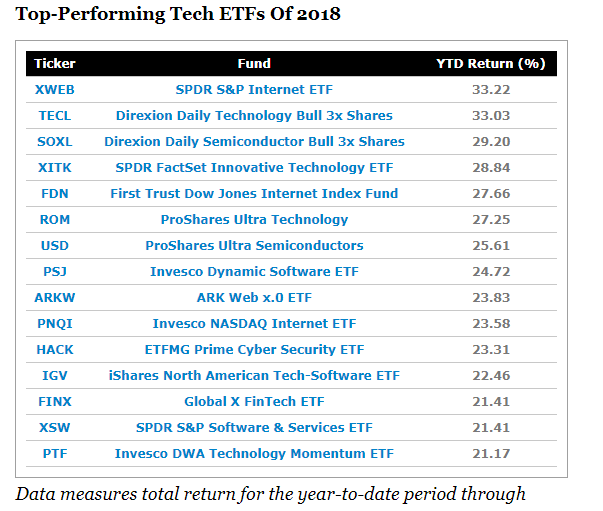

7.The U.S. Now Has 63 Tech ETFs….Just Remember the Biggest One XLK Just Hit New Highs in Jan. This Year.

http://www.etf.com/sections/features-and-news/top-tech-etfs-year-0

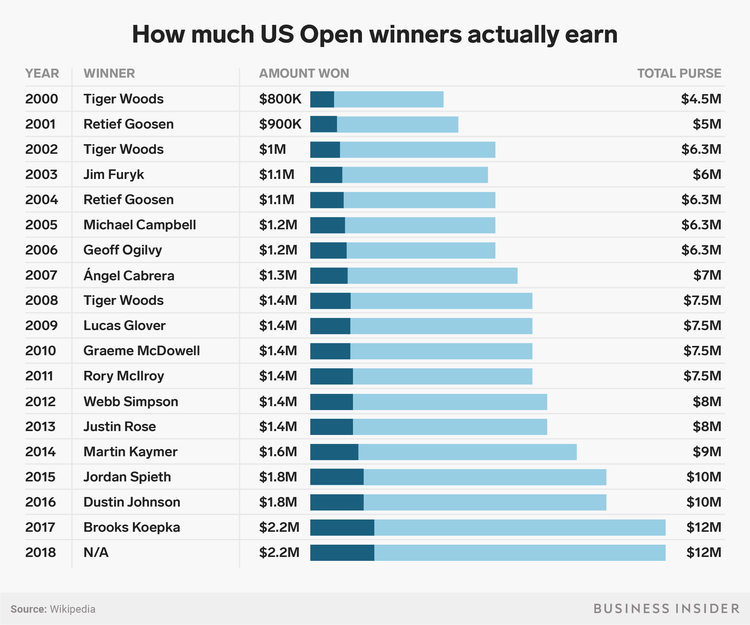

8.The US Open purse is worth $12 million this year — here’s what the winner will take home

Brooks Koepka won $2.2 million last summer after winning the U.S. Open at Erin Hills.Streeter Lecka/Getty Images

- The US Open returns to Shinnecock Hills this weekend for the first time since 2004.

- The last time Shinnecock Hills hosted the tournament, Retief Goosen took home $1.1 million for his win at the notoriously difficult course, with the tournament’s total purse at $6.3 million.

- Since then, both the purse and the winner’s cut for the major have grown significantly.

This weekend the best golfers in the world will meet at Shinnecock Hills to compete for in the US Open.

Shinnecock Hills is a notoriously difficult course, even for the notoriously difficult tournament — the last time the US Open was held there in 2004, just two players finished their four rounds under par, with Retief Goosen winning $1.1 million and a total purse for the tournament of $6.3 million.

As the US Open returns to Shinnecock Hills this year, the player who can best navigate the winds and greens of the course will earn double what Goosen won in 2004, taking home a prize of $2.2 million, along with the honor of winning a major.

The winner’s cut of the purse has changed over the years, with both numbers rising quickly as golf continues to grow and bring in more money. Take a look below to see how much more valuable the tournament has become since 2000, and how much the winner of the tournament has taken home each year.

Both the total purse and winner’s cut of the U.S. Open has risen rapidly since 2000.Jenny Cheng/Business Insider

More: BI Graphics US Open (Golf) Golf

http://www.businessinsider.com/how-much-us-open-winners-actually-earn-2018-6

9.US podcast ad revenues hit record $314 million in 2017

Sarah Perez@sarahintampa / Jun 11, 2018

Comment

The U.S. podcasting industry had a record year in 2017, reaching $314 million in revenue – a figure that’s up 86 percent from the $169 million in 2016, according to new study out this morning from the Interactive Advertising Bureau (IAB) and jointly conducted by IAB and PwC U.S.

The firms are also estimating podcast revenue will see triple-digit 110 percent growth between 2017 and 2020, when revenues will then reach $659 million.

The study also examined what sort of podcasts were benefiting the most from the increased interest in the audio format, as well as what sort of advertisements were preferred.

As you may have guessed (if you spend any time listening to podcasts), host-read ads were the more heavily used ad type, accounting for a whopping two-thirds of all ads in 2017.

Direct response ads transacted on a cost per thousand basis made up the majority of the campaigns, followed by brand awareness ads at 29 percent.

In terms of placement, ads that were inserted or edited into programming accounted for 58 percent of the ad inventory last year, the report also found.

Top advertisers included financial services (18% share of ads), direct-to-consumer retailers (16%), and arts and entertainment (13% of all ads).

However, certain types of podcasts are doing better than others when in comes to raking in the ad dollars.

In fact, the top four content genres, out of the 14 measured, generated over half the advertising revenue in 2017. These were: Arts & Entertainment (17%), Technology (15%), News/Politics/Current Events (13%), and Business (11%).

IAB has particular insight into the podcasting market, thanks to member companies like Audioboom, Authentic, ESPN Radio, Gimlet Media, How Stuff Works, Market Enginuity, Midroll Media, National Public Media, Panoply, Podcast One, PMM, Turner Podcast Network, Westwood One, WNYC Studios, and Wondery, who underwrote the industry study.

And in case you’re suspicious that an ad bureau claiming ads are doing great,the numbers here back up other industry reports confirming the podcast explosion. Nielsen, for example, claims that half of U.S. households listen to podcasts now, including big consumer groups – like beer buyers or new parents – who advertisers want to target.

ComScore, meanwhile, claims 1 in 5 Americans aged 18-49 listen to podcasts at least once per month.

And podcast startups are benefitting from the increased consumer interest in the format, as well. Wondery, for instance, raised $5 million earlier this year from Greycroft, Lerer Hippeau Ventures and Shari Redstone’s Advancit Capital. At the time of the raise, IAB was forecasting $220 million in podcast ad revenue.

HowStuffWorks also raised $15 million last year, as did Gimlet Media; radio broadcaster Entercom bought 45 percent of podcast producer and network, Cadence13 (previously Dgital Media), home to “Pod Save America.” Podcast platform Anchor raised $10 million in 2017, podcast platform Art19 raised $7.5 million, and, this spring, Castbox raised $13.5 million for its podcast app.

Investors wouldn’t be throwing money at the business if there wasn’t potential for more money to be made. And to some extent, those increased opportunities to reach consumers via audio are attributed to the changes in how we listen to audio content – that is, on mobile devices instead of radio, and on smart speakers in the home.

PwC also credits smart speakers and mobile as contributing to the opportunity here.

“The growing trend toward ‘anywhere and everywhere’ media engagement has created tremendous opportunity for digital media, of which podcasting is a significant component,” said David Silverman, a Partner at PwC U.S.m in a statement about the new report. “Whether at home on a smart speaker, at work on a PC, or somewhere in between on a mobile device, more and more Americans are listening while they live, providing a robust podcast platform where advertisers can connect with today’s consumers,” he said.

Image Credits: Nick Guy

https://techcrunch.com/2018/06/11/u-s-podcast-ad-revenues-hit-record-314-million-in-2017/

10.These 5 lessons from West Point can make you a better investor — and a better person

Your success is entirely up to you

Getty Images

By

MOOSE

The four years I spent at the United States Military Academy were among the most grueling and challenging years of my life.

There were several times when I thought “I can’t go on anymore, this is my breaking point.” These moments of vulnerability and the ability to persevere beyond them taught me some of the most valuable lessons in life.

Read on to learn five life lessons from West Point that I gained the hard way, and how they apply to your finances.

- Embrace the suck

I didn’t coin the phrase “embrace the suck,” it’s common in the military community. Simply put, it means to put your head down, push and persevere through the “suck” that life has thrown at you at this moment. It could be a screaming meathead in your face or the realization that you’ll never stop working. “Embracing the suck” also means acknowledging that you will emerge from this experience stronger and better than you were before.

Personal finance requires the embracing of a lot of suck. If you’re new to it, the temptations of meandering from paycheck to paycheck and buying whatever trinkets catch your eye that week are a strong pull. Like the sirens luring Odysseus to his death, the habits that can wreck your finances must be resisted at all costs.

Deviating from the norm can be uncomfortable at both a personal and societal level, but take solace in the fact that you will emerge on the other end of this challenge a better version of yourself.

- No excuses

I have a lawyer’s mind. In fact, my parents gently pushed me to pursue that career path. I have a great memory and am adept at finding loopholes. I can argue and negotiate myself out of almost anything.

My excuses didn’t stop at West Point. I’d have an excellent reason for why my boots weren’t shined or why my hair was longer than regulation. I was a terrible cadet and, for the most part, wriggled my way out of everything.

It wasn’t until the final months at the Academy that I began to realize how self-sabotaging this behavior is. Yeah, I wasn’t getting in trouble, but I was holding my development back. I now fully embrace the “no excuse” mentality.

One of the first things we’re taught at West Point is the Four Responses.

- Yes, sir/ma’am.

- No, sir/ma’am.

- No excuse, sir/ma’am.

- Sir/ma’am, I don’t understand.

Beyond those four short phrases, the cadre of upperclassmen doesn’t want to hear anything else escape your mouth. Why? It’s likely a complaint or an excuse. Holding us to these four responses begins the long course of discipline that is known as “Beast,” or basic training at West Point.

You can’t succeed if you don’t take ownership of your goals and tasks.

The bigger the goal you have, the more excuses you have not to achieve it. It is said that “religion is the opiate of the masses,” but I say that “being part of the masses is an opiate.” There’s a level of comfort in being just like everyone else.

Becoming financially independent and retiring early are massive goals. Most people cannot and will not achieve them. “No excuse” is your new mantra; repeat it any time you start to justify your failure. Even if you have a good excuse, do you want to imbue it with the power to hold you down?

“I don’t have time for a side hustle!” No excuse, do you watch TV? Then you have time.

Read: Yes, you do have time for a side hustle. Here’s where to find it

“I’m scared to invest money!” No excuse, you don’t need to know much to invest in basic index funds.

Read: If you’re young and think you can’t afford to save for retirement, try this

You have no excuses, step out of your own way and get after it.

- Take ownership

“Step up to my line, not on or over my line.”

“New Cadet, get on my wall!”

It was incredibly odd to hear the upperclassmen refer to a line or a wall as theirs. It’s not normal. Little did I know, these are all signs of taking ownership.

It’s entirely on you whether or not you’re a success.

If you are assigned a task or project at work, take ownership of it. It is YOUR project, and the burden of its success is YOURS to shoulder. If it fails, it’s YOUR failure. It’s the role of the older cadets to whip us into shape, and taking on that responsibility is how the line on the floor or the nondescript wall is theirs.

You can’t succeed if you don’t take ownership of your goals and tasks. If it’s always someone else’s problem, you’re not going to take the requisite amount of interest in the target and invest the time and attention to succeed. It’s as simple as that.

Recently, Jocko Willink (a retired Navy SEAL commander and all-around incredible guy) has popularized the phrase “extreme ownership.” This simple concept caught on for a reason. Most people do not take extreme ownership of life, and it sets them back.

Your finances are highly personal. Hence the term, personal finance. It’s entirely on you whether or not you’re a success which is financially independent and retired decades before most, or if you keep working until the day you die.

- Be decisive

“An OK plan now is better than the perfect plan too late.” — Unknown

In the military, hesitating for a split second in combat can be the difference between life or death. This is why the quote above was beaten into our heads repeatedly. I continued to hear this phrase in the Army, especially during my time as an infantry officer.

You don’t have to read every single personal finance book out there to start down the path to financial independence or early retirement. It isn’t necessary to read all the blogs (thousands and thousands at this point) to retire early. You cannot hesitate to take that first step to financial independence because you don’t know everything.

I don’t know everything. Mr. Money Mustache doesn’t know everything. [Insert name of favorite personal finance blogger] doesn’t know it all. We know SOMETHING, and we act on it. Sticking to one principle of personal finance is better than holding to none.

Do not use the excuse that you don’t know enough (see Lesson 2) to keep you from improving your finances. Start now.

- Habitual assessment

In the Army, we use a powerful habit that I don’t see in civilian life. It’s called an “after action review,” or “AAR.”

During an AAR, you huddle together with your team to assess your latest mission. What went right, what went wrong. The typical format is “Three Up, Three Down.” What were three things that went well? What are three things that didn’t go so well or can be improved?

This habitual assessment is necessary to ensure continued progress. Without it, you’ll keep making the same mistakes or doing the same unproductive things. When you adopt a new plan, give yourself an AAR and keep moving forward.

AARs are especially useful in a group setting. If possible, go over your plans and tactics with a personal finance buddy (in person or online) and make sure you take the time to conduct AARs together. The most useful features of AARs is in creating an open forum where anyone can speak up regardless of rank. I learned the most by hearing perspectives from other people that I hadn’t even considered.

Habitual assessment is your friend. Use it in personal finance and other aspects of your life.

While there are many more invaluable life lessons from my time at West Point, these are five crucial lessons that you can use today.

This column originally appeared on MSO Life. It was adapted and reprinted with permission.

Moose is a West Point graduate, Army veteran, MBA, and investment analyst. He blogs at MSO Life.