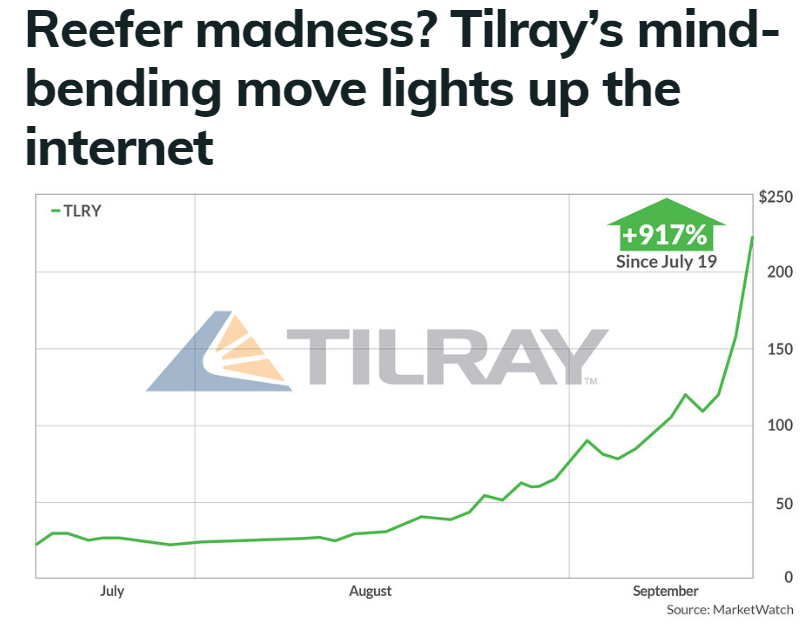

1.Bitcoin Speculators Switch to Weed.

https://www.marketwatch.com/

https://www.marketwatch.com/

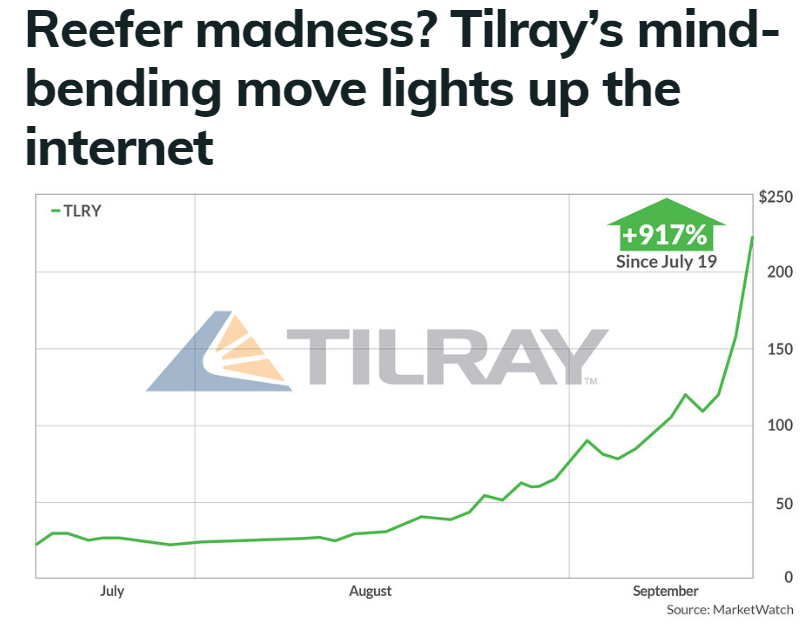

I Started My Trading Career in 1997 So Witnessed the Internet Bubble First Hand….This is Textbook 1999 CEO Interview on Jim Cramer…Stock Spikes 90% and Gets Held 5 x in One Day….Bigger Market Cap than General Mills

Tilray’s Wild, Wild Day

If you didn’t know about Tilray before, you definitely do now.

Earlier this week, the Canadian marijuana producer earned approval from the U.S. government to import medicinal cannabis into the U.S. for clinical trials. On Tuesday night, Tilray CEO Brendan Kennedy gave a chest-thumping interview to Jim Cramer.

Then, all hell broke loose.

Yesterday, shares skyrocketed ~90% before erasing most of those gains and briefly dipping into the red. Couple notes:

- The stock was halted from trading five times by Nasdaq due to volatility.

- It ended up 38% for its best day yet as a public company.

Clearly, Tilray has the munchies

During its mega-surge, Tilray at one point yesterday had gobbled up the market cap of food conglomerate General Mills.

Bottom line: Tilray finished the trading day bigger than American Airlines and Clorox, with a market cap close to $20 billion. Look out, Apple. Someone’s coming for that $1 trillion crown.

https://www.morningbrew.com/

Continue reading →