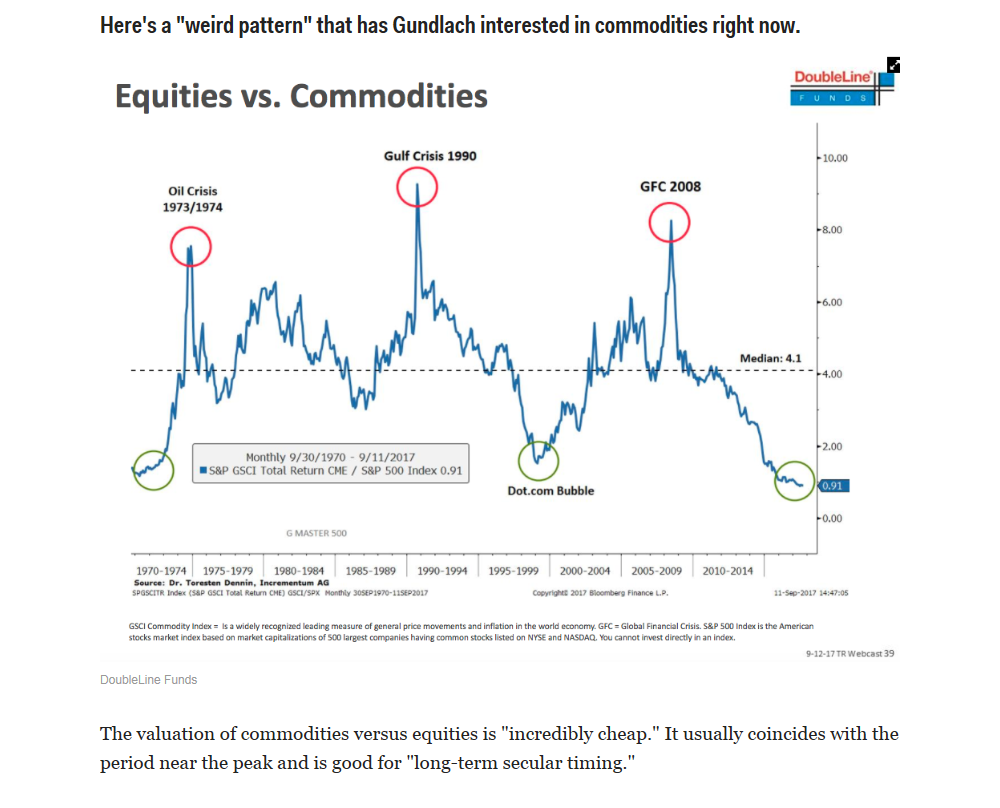

1.Start with Another Gundlach Chart…Equities vs. Commodities.

Sep 11, 2017

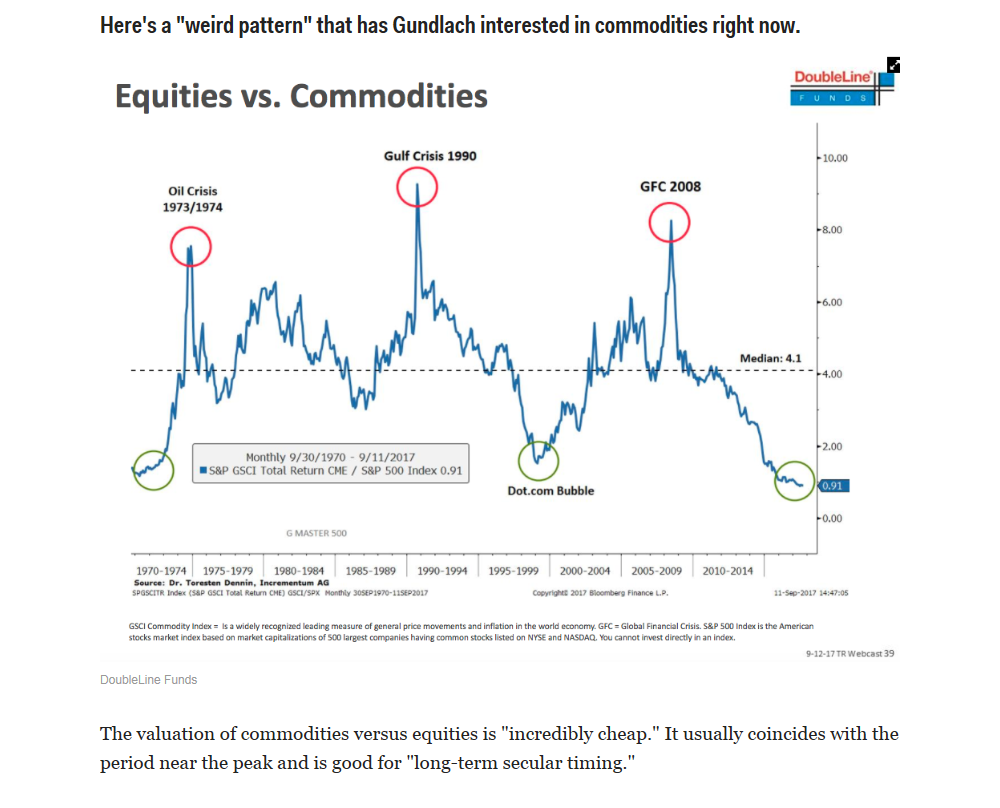

Back in late July we published a Chart of the Day looking at the current rally and how it ranks in terms of length without a significant pullback of any kind. With the S&P 500 closing at a new all-time high today, it has now been 3,108 calendar days since the last 20% decline (the standard bull/bear market distinction). As shown in the table below of the longest bull markets on record, the current bull is the second longest behind the 4,494 days that passed between December 1987 and March 2000 without a 20%+ pullback.

Today’s close was also a big deal in terms of gains for the current bull market. As shown, the S&P’s gain of 267.61% makes this the second strongest bull market on record as well.

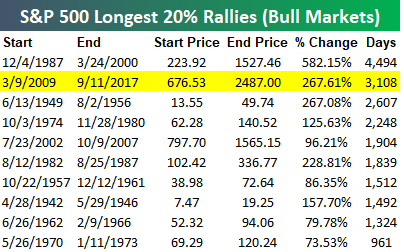

It has also been a long time since the S&P 500 had a 10% correction. As shown, the current streak of 578 days since the last 10%+ correction is the 11th longest on record going back to 1928.

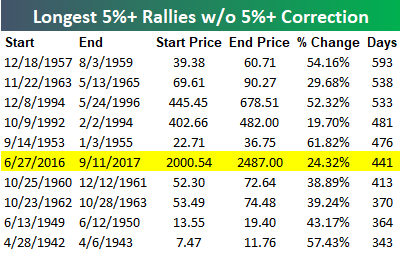

Not only have we not had a 10% correction in more than 18 months, but we also haven’t even had a 5%+ correction since last June. The 441-day streak without a 5%+ correction is the sixth longest on record for the S&P 500.

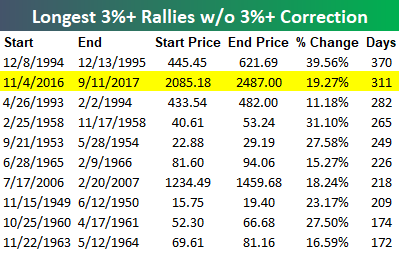

And finally, it has now been 311 days since the S&P 500 last experienced just a 3% pullback. As shown below, this is the 2nd longest streak of all-time without a 3%+ pullback.

To break this record, we’ll need to go another 59 days without declining 3% from today’s close.

Pay just $1 to access any of Bespoke’s premium membership levels for the next month!

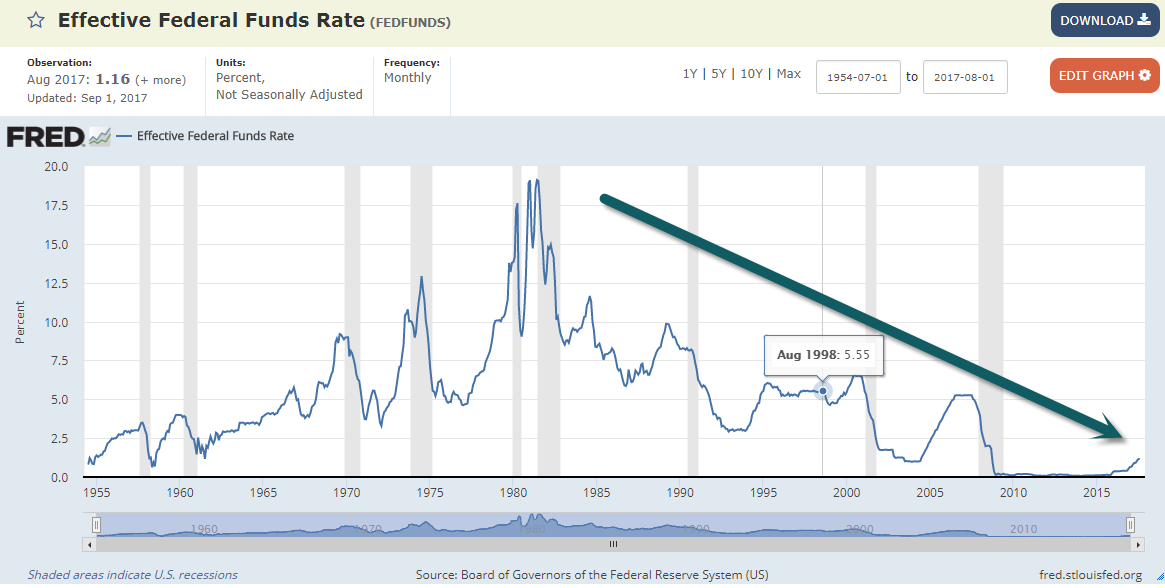

Looking back over six decades, the Wells Fargo team found that the tipping point came when the fed-funds rate exceeded the 10-year Treasury yield’s cyclical low. This has predicted every recession since 1955, with an average lead time of 17 months—producing a significantly earlier warning signal than waiting for the yield curve actually to invert.

What about the current cycle? The 10-year Treasury’s low yield was 1.36%, touched on July 5, 2016. An increase in the fed-funds rate to 1.5%, which the Wells Fargo economists expect at the December FOMC meeting, would trigger the recession early-warning signal. Specifically, their research puts a 69.2% probability of a downturn within 17 months after that.

http://www.barrons.com/articles/trump-and-the-art-of-the-deficit-1504932418

IAT-breaks 200day back to June lows.

IAT-breaks 200day back to June lows.

WSJ-

Shares in U.S. companies with more than half their revenue from outside the country rose by an average of 13%, identical to the gain on MSCI’s (dollar-denominated) index of developed markets excluding the U.S. S&P stocks with less than half their income from abroad gained only 5.9%, according to analysis of FactSet data.

The pattern is even clearer when the market is sliced into five segments from those most exposed to foreign revenues to those least exposed. The most-international fifth of stocks have gained 15% on average this year, while the least-international are up just 2%

https://www.wsj.com/articles/watch-out-the-weak-dollar-gives-shareholders-money-illusion-1504195376