1.Spread Between 10 Year and S&P Dividend Yield at 7 Year Highs.

Bloombergs note “The yield spread of bonds over the S&P 500’s dividend yield widens out today to 122 bps, the biggest gap since July of 2011, as a rallying S&P 500 has pushed down on the dividend yield.”

From Dave Lutz at Jones Trading

2.Rates Moving Higher….Watching Financials/Banks.

XLF 50 Day Thru 200day to Upside..Banks under owned by investors rates going higher positive.

3.Real Fed Funds Signal Few More Innings Left

Posted by lplresearch

We dedicated a lot of real estate in our 2018 Midyear Outlook publication to the idea that the business cycle may still have legs, considering indicators such as the ISM Manufacturing Index, the Leading Economic Index, and the yield curve. The strong growth in corporate profits also points to further economic growth ahead: The U.S. economy has never been in recession when corporate profits were growing.

We can also look at the real federal funds rate (the Federal Reserve’s target short-term interest rate minus inflation) as an indicator of whether we are late in the cycle. As shown in the LPL Chart of the Day, the current real fed funds rate is right around zero (2% inflation and ~2% fed funds rate).

For inflation, we use the annual change in the personal consumption expenditures index excluding food and energy (core PCE).

“The near zero level of the fed funds rate, on a real basis adjusted for inflation, suggests the Federal Reserve is not close to over-tightening,” noted LPL Chief Investment Strategist John Lynch. “That is a good sign for continued economic growth.” As the chart also shows, the real fed funds rate was 1.9% or higher ahead of each of the past eight recessions back to 1960.

The Federal Reserve will almost certainly hike rates next week. Market odds favor another hike in December though that is less certain. But it would likely take a string of at least a half dozen more hikes to put the real fed funds rate in the range that has historically preceded recessions. Given benign recent inflation data, including smaller-than-expected increases in producer and consumer prices and soft import and export price data, and contained inflation expectations, we anticipate interest rate stability. That points to a business cycle that may still have a fair amount of room to run.

https://lplresearch.com/2018/09/19/real-fed-funds-signal-few-more-innings-left/

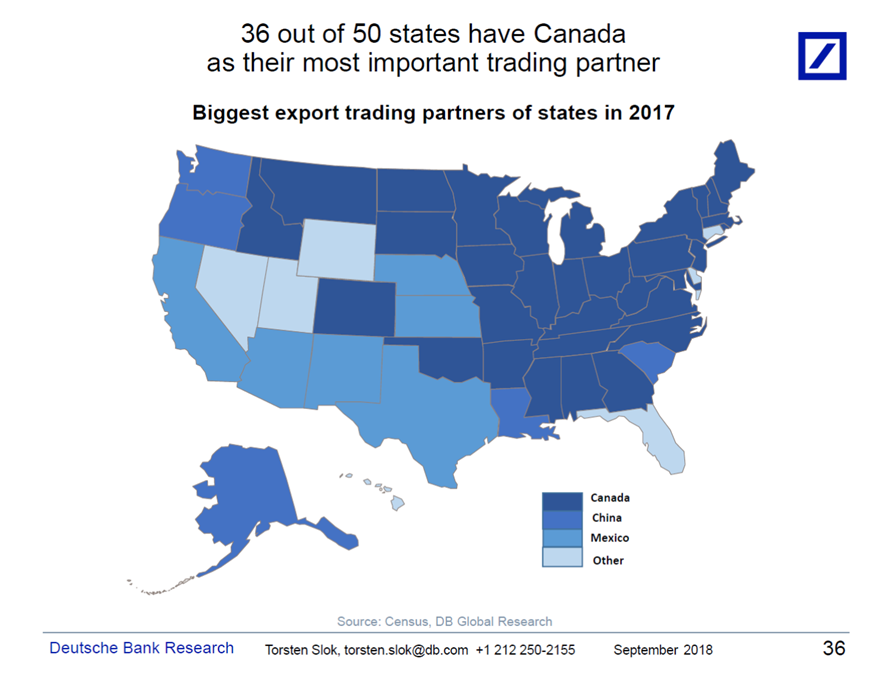

4.36 of 50 States Biggest Trading Partner Canada…Hey

It is difficult to see a meaningful trade deal replacing NAFTA without Canada being involved, see chart below.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

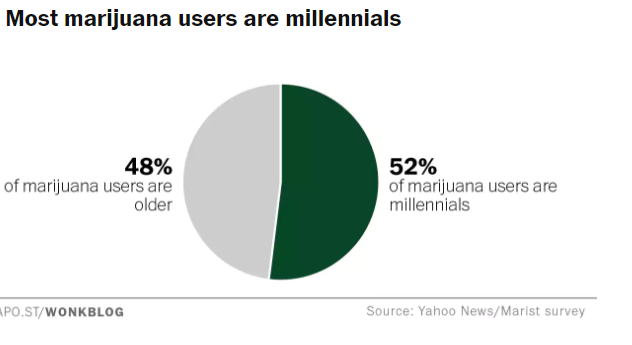

5.Millennials Majority of Weed Users.

Millennial investors are buying weed stocks at a faster clip than Amazon and Netflix

Varada Bhat

- Cannabis stocks are among the most popular with millennials, according to data gathered by Markets Insider from the free-trading app Robinhood.

- Some stocks have more than doubled in popularity over the past month as their prices have soared.

- Canadian cannabis company Cronos is more popular than Amazon, Netflix, and Twitter on Robinhood.

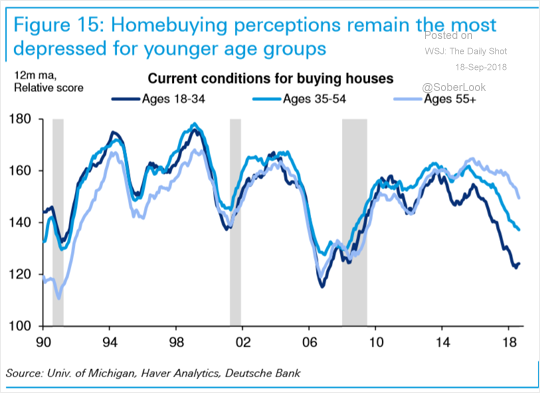

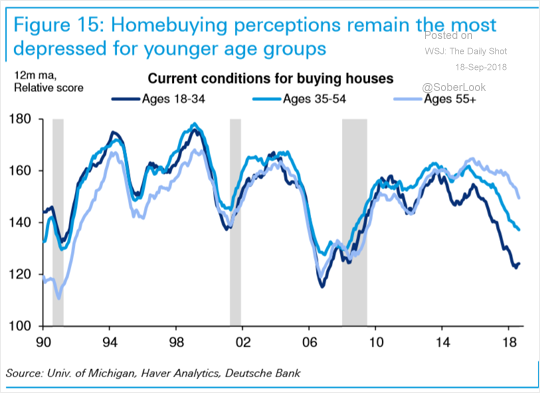

6.Buy Weed not Homes…Millennials Nervous About Buying Homes.

The United States: Younger Americans are much more nervous about buying a home than the older generations. This divergence is a recent phenomenon.

Source: Deutsche Bank Research

https://blogs.wsj.com/dailyshot/

7.Mortgage Rates Head to 6%, 10-Year Yield to 4%, Yield Curve Fails to “Invert,” and Fed Keeps Hiking

by Wolf Richter • Sep 19, 2018 • 72 Comments

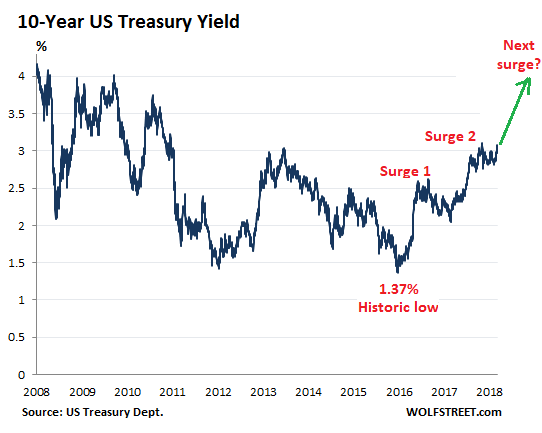

There’s an interesting thing that just happened, which shows that the US Treasury 10-year yield is ready for the next leg up, and that the yield curve might not invert just yet: the 10-year yield climbed over the 3% hurdle again, and there was none of the financial-media excitement about it as there was when that happened last time. It just dabbled with 3% on Monday, climbed over 3% yesterday, and closed at 3.08% today, and it was met with shrugs. In other words, this move is now accepted.

Note how the 10-year yield rose in two big surges since the historic low in June 2016, interspersed by some backtracking. This market might be setting up for the next surge:

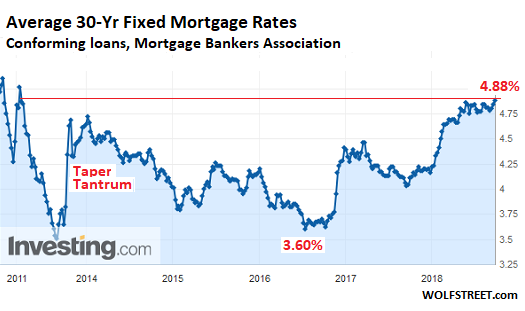

And it’s impacting mortgage rates – which move roughly in parallel with the 10-year Treasury yield. The Mortgage Bankers Association (MBA) reported this morning that the average interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) and a 20% down-payment rose to 4.88% for the week ending September 14, 2018, the highest since April 2011.

And this doesn’t even include the 9-basis-point uptick of the 10-year Treasury yield since the end of the reporting week on September 14, from 2.99% to 3.08% (chart via Investing.com; red marks added):

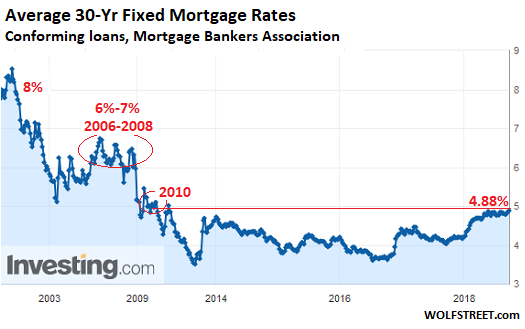

While 5% may sound high for the average 30-year fixed rate mortgage, given the inflated home prices that must be financed at this rate, and while 6% seems impossibly high under current home price conditions, these rates are low when looking back at rates during the Great Recession and before (chart via Investing.com):

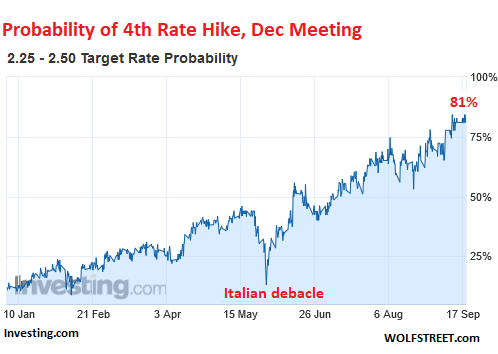

And more rate hikes will continue to drive short-term yields higher, even as long-term yields for now are having trouble keeping up. And these higher rates are getting baked in. Since the end of August, the market has been seeing a 100% chance that the Fed, at its September 25-26 meeting, will raise its target for the federal funds rate by a quarter point to a range between 2.0% and 2.25%, according to CME 30-day fed fund futures prices. It will be the 3rd rate hike in 2018.

And the market now sees an 81% chance that the Fed will announced a 4th rate hike for 2018 after the FOMC meeting in December (chart via Investing.com, red marks added):

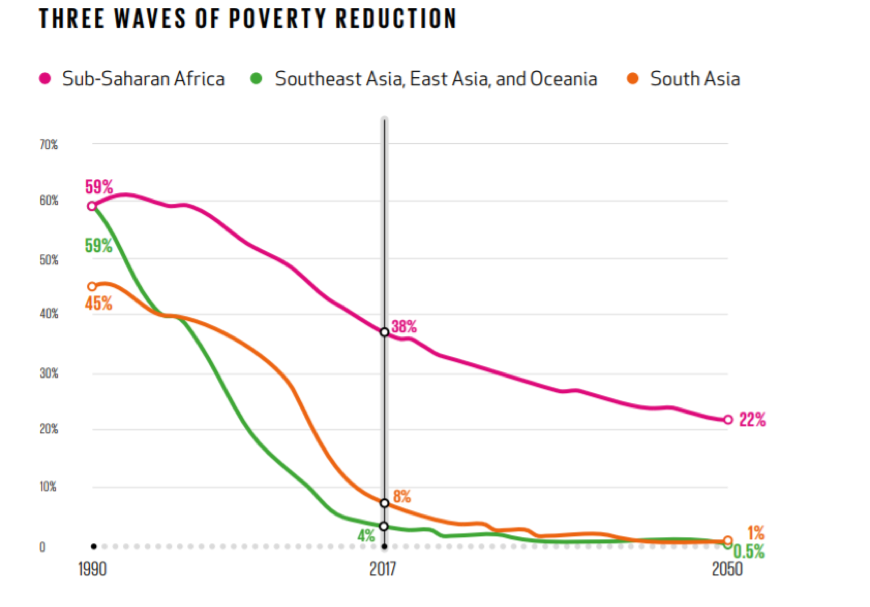

8.By 2050 86% of Extreme Poor Will Be in Sub-Saharan Africa

Another reason why we’re mentioning this: The Bill & Melinda Gates Foundation used the occasion to release its “Goalkeepers Data Report,” which tracks global poverty and demographic trends.

Condensing a 53-page report into 60 words…

- There’s good news: “Since 2000, more than a billion people have lifted themselves out of the extreme poverty…”

- But, extreme poverty is becoming super concentrated: By 2050, 86% of extremely poor people (living on $1.90 a day) will be living in Sub-Saharan Africa.

- The African population is young: ~60% of Africans are under the age of 25. Europeans? Just 27%.

Bottom line, per Bill and Melinda: “Decades of stunning progress in the fight against poverty and disease may be on the verge of stalling. This is because the poorest parts of the world are growing faster than everywhere else…”

+ Bonus chart:

Via Bill & Melinda Gates Foundation

10.3 Surprising Ways to Improve Your Decision Making

Author Steven Johnson offers the counterintuitive advice he learned from studying how people make their most important choices.

By Christine Lagorio-ChafkinSenior writer, Inc.@Lagorio

CREDIT: Shutterstock

When faced with choices, some people are swift and decisive. Others are at the opposite end of the scale, becoming cognitively crippled in the face of a decision. But wherever you fall, chances are you’re not exactly armed with an arsenal of decision making tools. There’s the age-old tactic of making a pros-and-cons list, and that’s the entire stockpile.

Fortunately, in business settings there are often more tools at your disposal than you may be aware of, says Steven Johnson, a media critic who has written nine books incorporating science, business, and technology, including Everything Bad Is Good For You. “If it’s a complex choice with serious ramifications, you don’t want to go into it after just mulling it yourself or having a couple of conversations about it.”

Author Steven Johnson.CREDIT: Courtesy Penguin Random House

In his new book Farsighted: How We Make the Decisions That Matter the Most, Johnson presents case studies and ruminations on some of life’s most significant decisions, from the personal (whether to get married) to the geopolitical (how to take down Osama bin Laden). He surveys the breadth of research into decision making, and examines a few notable historical cases of fraught processes (for example, Charles Darwin’s struggle to publish his research while married to a religious woman whose beliefs it countered.)

In the course of his studies, Johnson has discovered some useful–and surprising–strategies for coming to a decision and boosting the likelihood of a positive outcome. Here are three steps he suggests building into your next big choice.

- Don’t be toodecisive.

Johnson warns that the biggest mistake business leaders make in their decision making is possessing overconfidence. “Decisiveness is fine for simpler choices in life,” he says. “But when you get to a really important crossroads, deliberation is far more important than decisiveness.”

Even if you have a strong gut feeling, take a week to not make the decision. Johnson cites the work of management professor Paul Nutt, who studied the technique (or lack thereof) employed in making hundreds of business decisions. Nutt found there was a significant advantage for folks who took time at the beginning of their process to look at different options, or to actively try to diversify the options available. For most of the subjects, though, “there was no stage at which they said, ‘Are there other choices here?’ and actually made that part of the exercise. Those who did were more likely to be, in the end, pleased with the outcome,” Johnson says.

- Involve other perspectives.

“An important part of this process in a business is diversity in the group of people making the decision,” Johnson says. A multitude of studies support the notion that cognitively diverse groups make both better and more inventive decisions. Even large groups, if they are composed of like-minded individuals, underperform when compared with groups that contain a broad range of viewpoints. “It is the nature of a complex problem that there are angles of it you cannot see from one perspective,” Johnson says. While he notes that reaching a consensus can be more contentious when your workforce is diverse, it yields far better solutions by infusing the process with inherent creativity, and avoiding groupthink.

- Conduct a “pre-mortem.”

Now that you know the goals and a range of strategies for achieving them, you have come to a decision. Next, take that decision and ask: What does the future look like if it completely flops?

It’s a concept psychologist Gary Klein dubbed a “pre-mortem,” and essentially involves asking the question: If the patient dies…what caused that to happen? By visualizing the inverse of what a successful outcome to the decision looks like (“If in two years, this decision turns out to have been a disaster, why would that be?”), individuals and teams also open themselves up to a more creative process where they can see flaws they might have otherwise overlooked.

It sounds odd, but Johnson is convinced the pre-mortem is crucial for the business setting–especially when even the most well-intentioned decisions can have wide-ranging and damaging consequences. “In any business in a disruptive field or social media that’s messing with incumbents or challenging beliefs, it’s incumbent on those companies to run pre-mortems on their concepts,” he says. “Facebook should have taken the time to say, ‘How could this be manipulated with bad actors?’ This should be an ethical imperative for these companies.”

Note: This article contains affiliate links that may earn Inc.com a small fee on purchases originating from them. They do not influence Inc.com’storial decisions to include mention of any products or services in this article.

https://www.inc.com/christine-lagorio/steven-johnson-decision-making.html?cid=hmside4