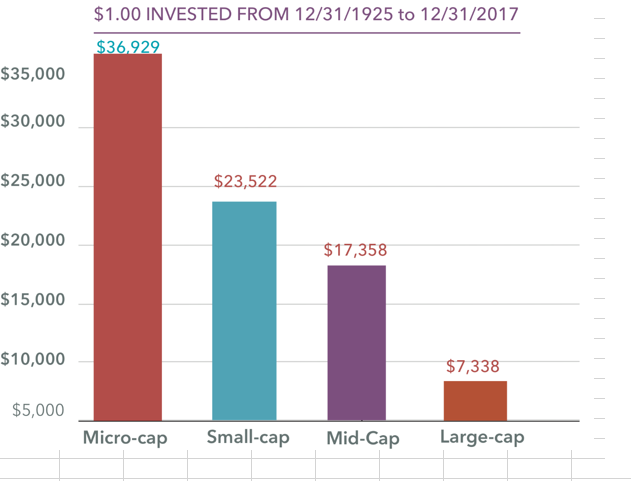

1.This Has Been a Large Cap Growth Led Bull Market But Here Are The Long-Term Stats.

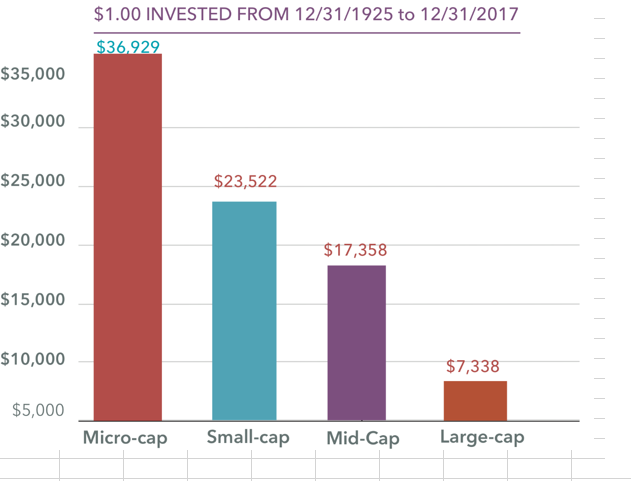

Negative yields are not confined to just Sovereign debt. The chart below shows there is over $1 trillion in corporate debt with negative yields and growing. This will not end well. hashtag#investing hashtag#markets hashtag#economy hashtag#finances hashtag#hedgefunds

https://www.linkedin.com/in/donsteinbrugge/

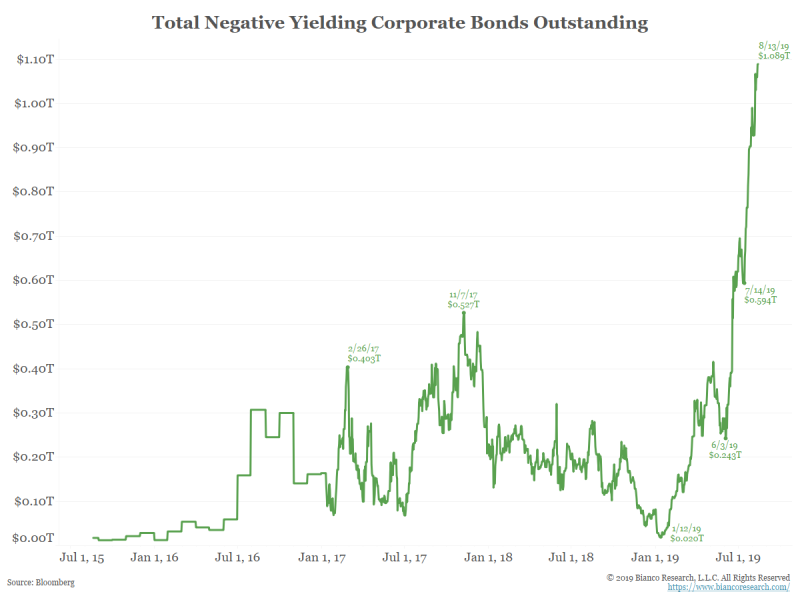

Continue readingIn the U.S., the NFL rules sports—and television. Its games make up 60% of the top 100 most-watched telecasts in a typical year, and over 70% in years when there are no Olympic Games.

Football Season Is Here and It’s a Key Moment for the Future of TV

|

Daniel

Rodriguez Vice President – Private Wealth Director Franklin Templeton |