1.The Big Question..Can Earnings Keep Growing at these Levels?

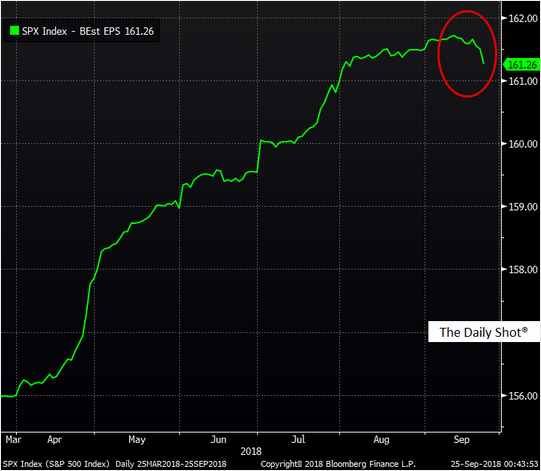

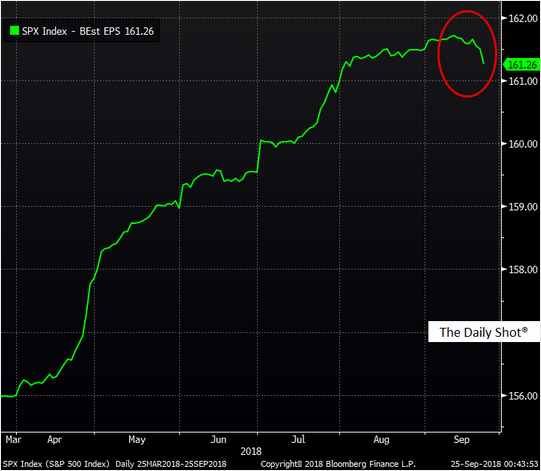

And analysts are turning a bit more cautious on corporate profits. This chart shows Bloomberg’s consensus estimate of the S&P 500 earnings per share for the next twelve months.

And analysts are turning a bit more cautious on corporate profits. This chart shows Bloomberg’s consensus estimate of the S&P 500 earnings per share for the next twelve months.

Sep 26, 2018

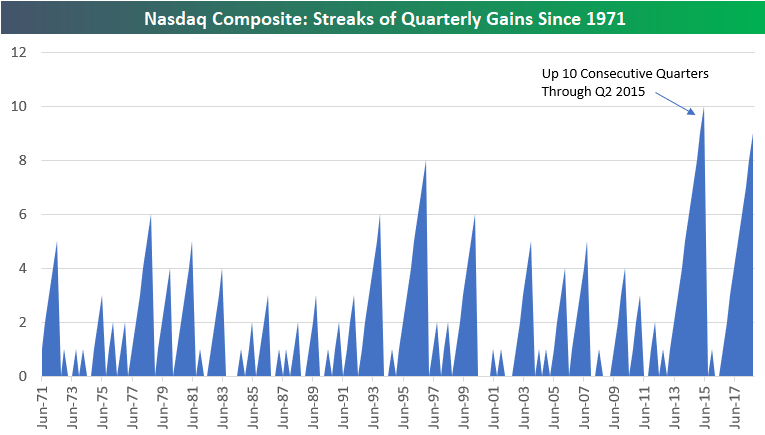

The Nasdaq Composite is set to finish higher for the 9th consecutive quarter when exchanges close this Friday, September 28th. (With a QTD gain of more than 6%, it would take a dramatic plunge over the next two trading days for the quarter to end in the red.)

Below is a chart showing streaks of quarterly gains for the Nasdaq Composite since its inception in 1971.

Nine quarters of gains is not quite the longest streak on record, and it’s not even the longest streak of the last six years! The longest stretch of quarterly gains made it to ten from Q1 2013 through Q2 2015. Prior to that, the record was 8 quarters back in the mid-1990s (Q1 1995 through Q4 1996). Not even during the Dot Com boom of the late 1990s did we see such consistency of gains for the Nasdaq.

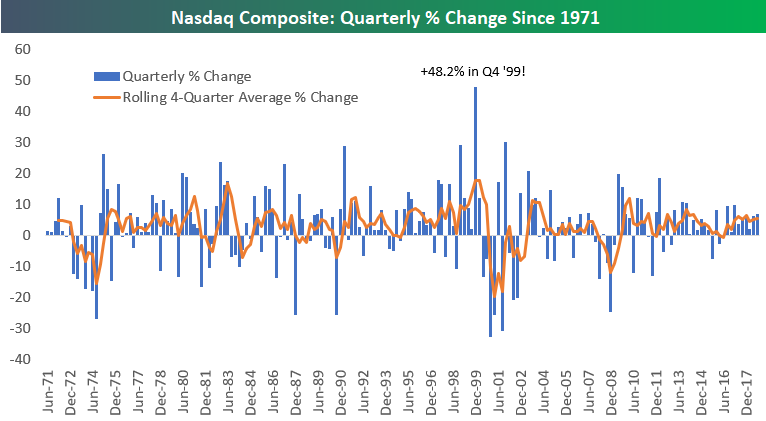

While the Nasdaq has been more consistent to the upside during this bull market than it was during its epic late-1990s rally, the size of the quarterly gains seen this time around don’t come close to matching the rallies seen back then. In the chart below, we show the quarterly price change for the Nasdaq going back to 1971. Yes, we’ve seen very nice quarterly gains of 5-10% many times during the current bull, but from 1997 through Q1 2000, the Nasdaq posted seven double-digit quarterly percentage gains, including a gain of 29.5% in Q4 1998 and a ridiculous 48.2% gain in Q4 1999. This period is nothing like the 1990s.

https://www.bespokepremium.com/think-big-blog/nasdaq-up-9-quarters-in-a-row-again/?utm_source=sumome&utm_medium=linkedin&utm_campaign=sumome_share

Emerging Markets: This chart shows the overall EM trailing price-to-earnings ratio vs. the S&P 500 (LTM = “last 12 months”). EM stocks haven’t been this undervalued relative to the US in quite a while.

Source: Deutsche Bank Research

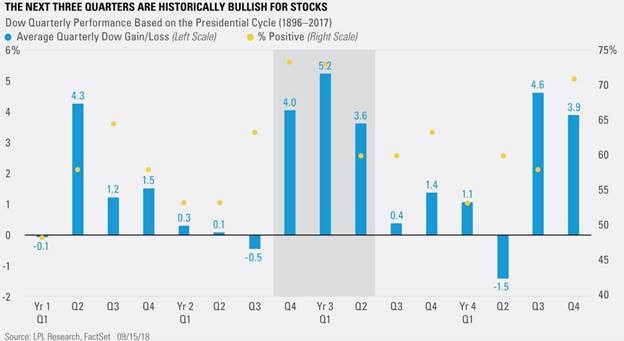

LPL notes the next three quarters are historically some of the strongest out of the entire four-year presidential cycle – “going all the way back to when the Dow started trading in 1896, each of the next two quarters have closed higher 73.3% of the time—no other quarter is up more often. In addition, the average returns over the next three quarters have been 4.0%, 5.2%, and 3.6%—again some of the strongest in the four-year cycle”

From Dave Lutz at Jones.

Bloombergs note “The yield spread of bonds over the S&P 500’s dividend yield widens out today to 122 bps, the biggest gap since July of 2011, as a rallying S&P 500 has pushed down on the dividend yield.”

From Dave Lutz at Jones Trading