1.Hedge Funds Record Low Exposure to Small Cap Value.

Twits note how much funds hate value

From Dave Lutz at Jones Trading.

Continue reading

Twits note how much funds hate value

From Dave Lutz at Jones Trading.

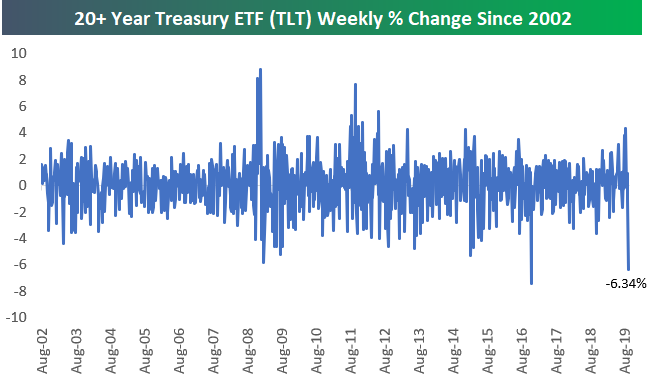

Continue readingOutside of equities, we saw a

massive move higher in Treasury yields this week and a massive drop in Treasury

bond prices. For the 20+ year Treasury ETF (TLT),

this week’s 6.34% drop was its second worst week on record since it began

trading back in 2002.

Below is a look at TLT’s historical weekly

percentage change, and we also show how TLT has performed in the weeks and

months following one-week drops of more than 5% like we saw this week. As

shown in the table, TLT has normally continued lower for a while following big

down weeks. Start a two-week

free trial to one of our three membership levels to

receive Bespoke’s most actionable ideas.

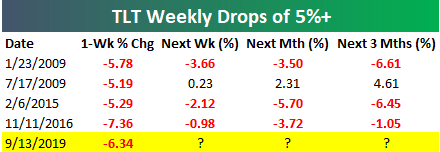

Prior forays into negative territory during this cycle (in 2011, 2012, 2013, and 2016) have accompanied signs of slowing, but have also reflected the broader interest rate environment. Slower global growth, increasingly accommodative central banks, and some flight to safety due to trade uncertainty have all conspired to push rates lower.

The expected inflation rate implied by 10-year TIPS sits at about 1.5%, low historically but still higher than the cycle low and well above the near 0% hit in the heart of the last recession. Slower growth has minimized inflationary pressure, but over the last three months we have seen a modest pickup in inflation and wages.

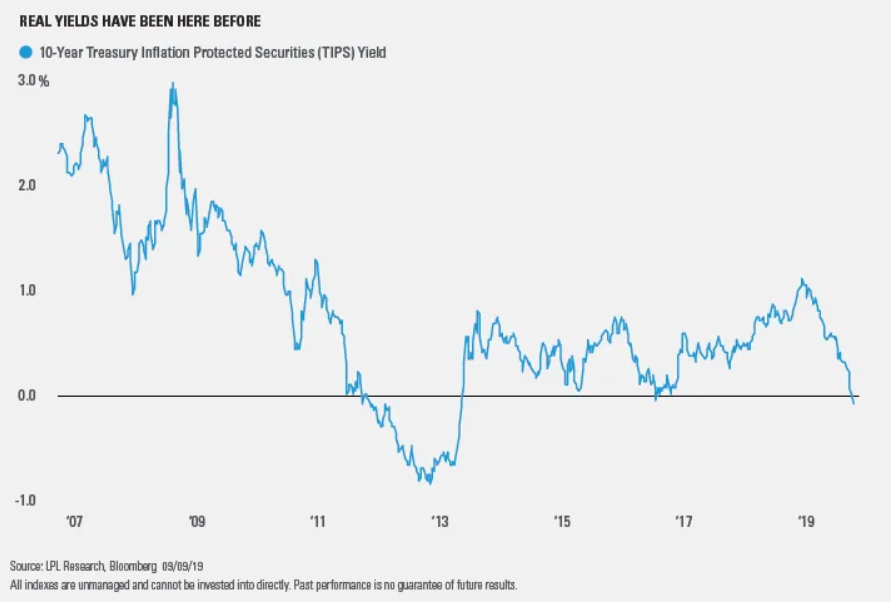

The table below details SPLV’s portfolio characteristics on a year-by-year basis versus SPY. Values in red denote underperformance by the low-vol portfolio. The fund’s lifetime numbers, shown in the gray row at the bottom of the table, are indeed impressive: a higher average annual return, lower volatility and a resultant higher Sharpe ratio, along with a positive alpha coefficient and information ratio.

Within that time span, however, there’s a lot of, um, volatility in the numbers. In those years when SPLV’s standard deviation was higher than SPY’s, there was a cascading and deleterious effect on returns and other portfolio metrics.

So, what’s the point of all this? Simply put, capture of the low-volatility anomaly is path dependent. Just because there’s a low-vol product available doesn’t mean you’ll always derive immediate benefit from its use. Look at the back-to-back underperformance in the 2012-2013 and 2013-2014 spans. Would you have been disappointed by SPLV back then? Would you have bailed from the low-vol strategy?

Many investors, in fact, did just that. Net outflows mounted in the 2013-2014 period and even spilled over into the subsequent period, just ahead of a couple of banner years. And in the 2016-2017 span, SPLV’s net outflows totaled $1.4 billion as the low-vol ETF significantly lagged SPY.

Good Full Read

When Low-Vol Is Not-Strategy may require some time to pay off. Brad Zigler | Sep 09, 2019

Continue reading